AMD: 'Tied to' Open AI? Not a 'Backup' Lifesaver

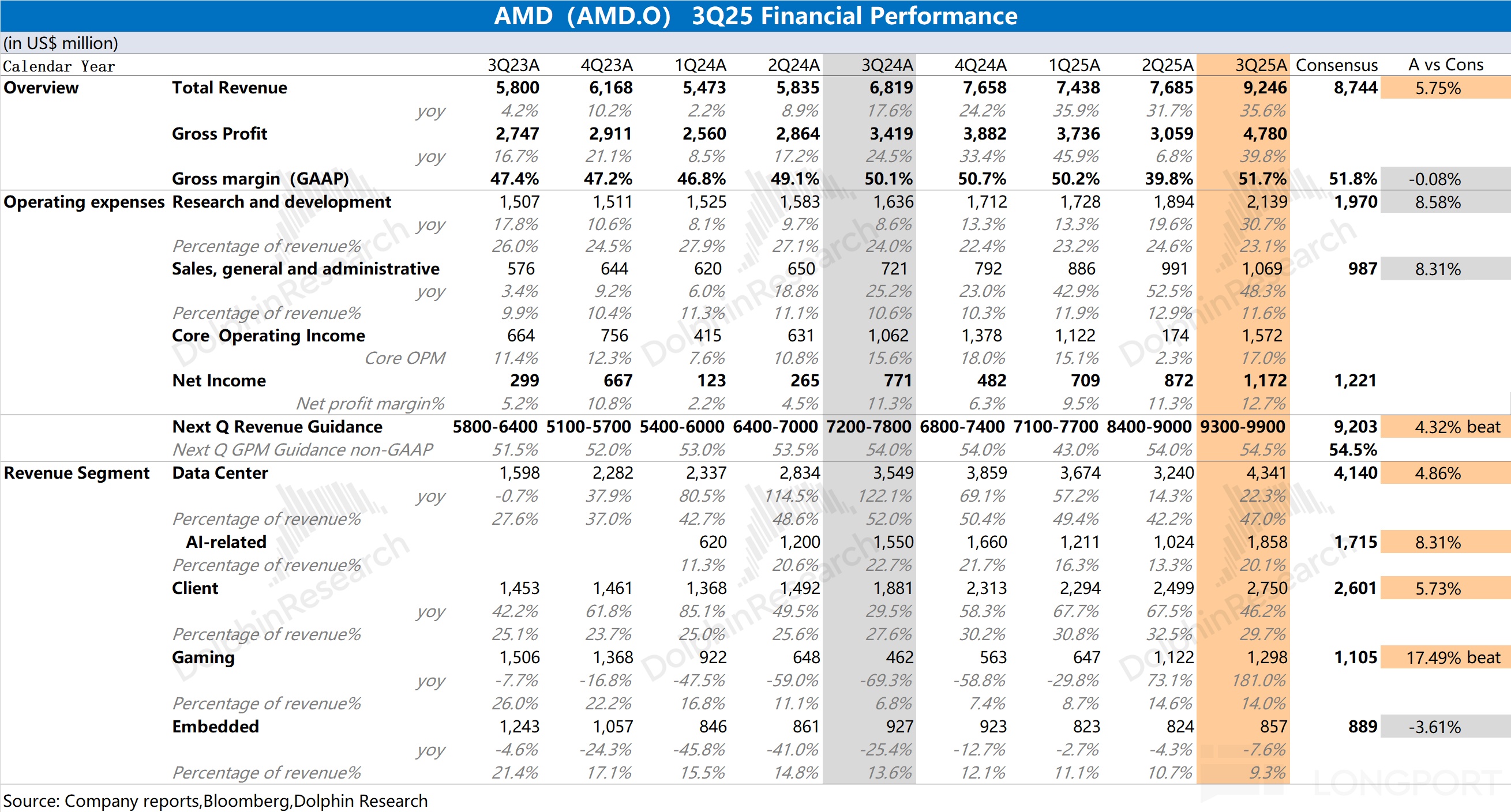

AMD (AMD.O) released its Q3 2025 financial report (ending September 2025) after the U.S. stock market closed on the morning of November 5, 2025, Beijing time. Key points are as follows:

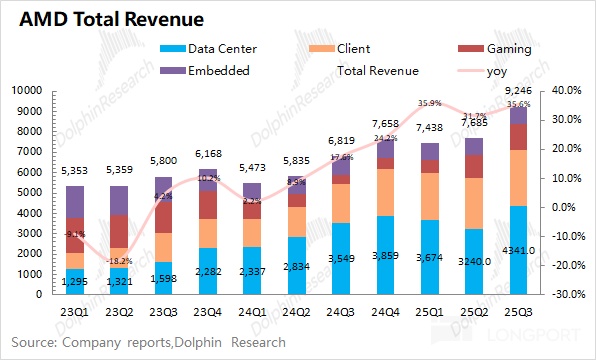

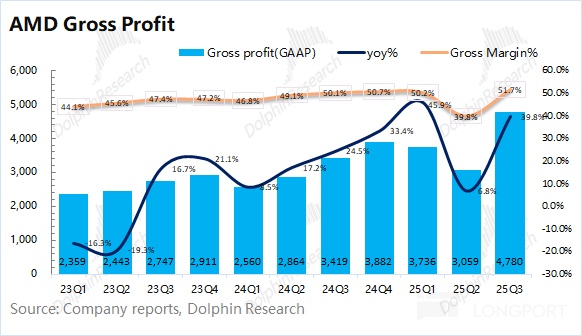

1. Overall Performance: AMD achieved revenue of $9.25 billion in Q3 2025, a year-on-year increase of 35.6%, exceeding market expectations ($8.74 billion). The year-on-year growth in revenue was mainly driven by client and gaming business, as well as data center business. The company's gross margin (GAAP) for the quarter was 51.7%, an increase of 1.6 percentage points year-on-year. Last quarter's gross margin was affected by inventory impairment related to MI308; excluding this impact, the actual gross margin last quarter was 50.2%, with a sequential increase of 1.5%, mainly due to improved profitability in the client business and product optimization.

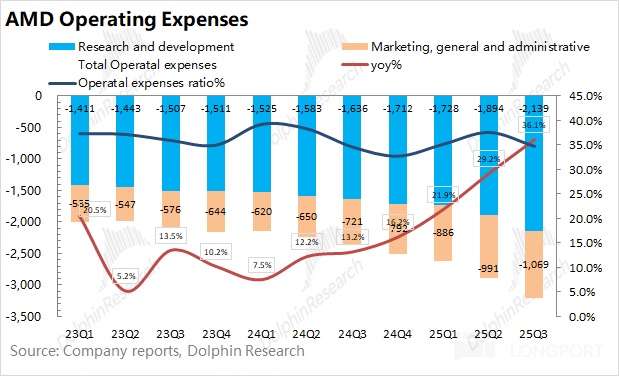

2. Operating Expenses: $AMD(AMD.US) R&D expenses for the quarter were $2.14 billion, a year-on-year increase of 30.7%; sales and administrative expenses were $1.07 billion, a year-on-year increase of 48.3%. While revenue maintained high growth, the company's core operating expenses also increased. The core operating expense ratio for the quarter reached 34.7%, an increase of 0.1 percentage points year-on-year.

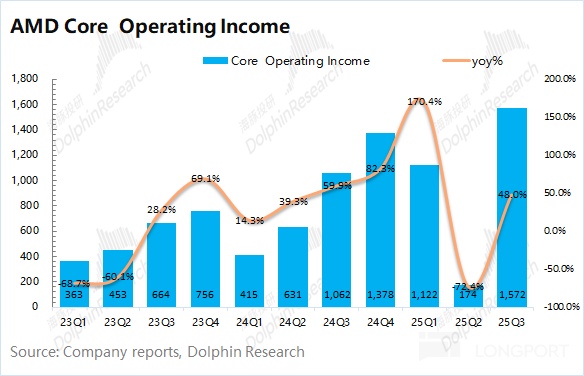

AMD achieved a net profit of $1.17 billion for the quarter, mainly influenced by non-recurring items. From an operational perspective, the company's core operating profit for the quarter was $1.57 billion, showing growth again, with a core operating profit margin of 17%.

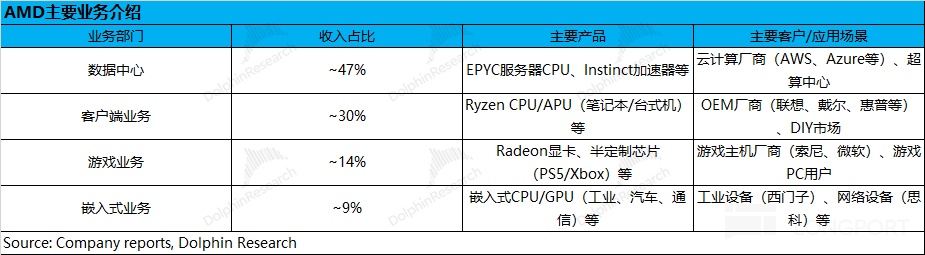

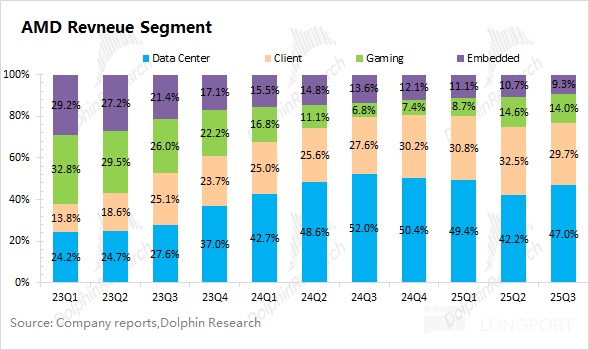

3. Business Segments: Driven by growth in data center and client business, the combined revenue of these two segments accounted for over 70%.

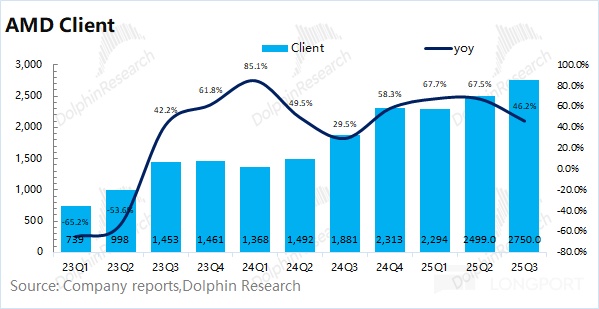

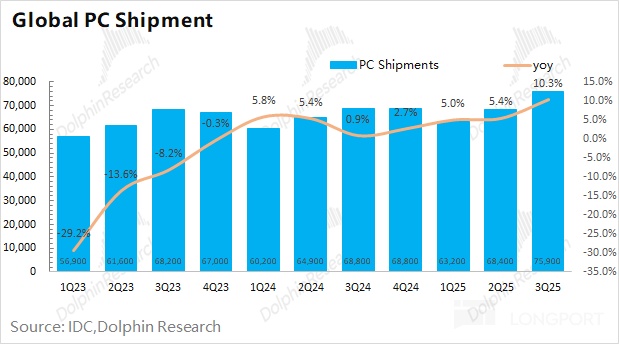

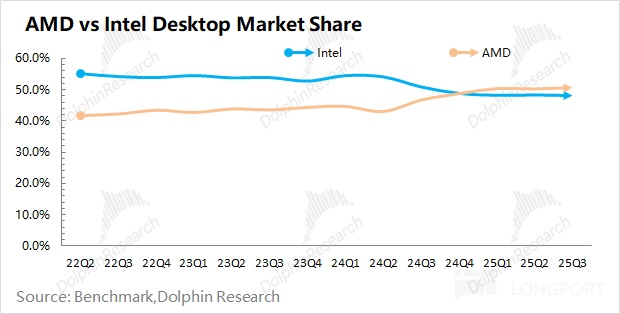

1) Client Business Gains Market Share: Revenue for the quarter grew to $2.75 billion, a year-on-year increase of 46.2%. The global PC market shipment increased by 10% year-on-year, while the company's client business saw significant growth, mainly due to AMD's continued market share gain in the PC market.

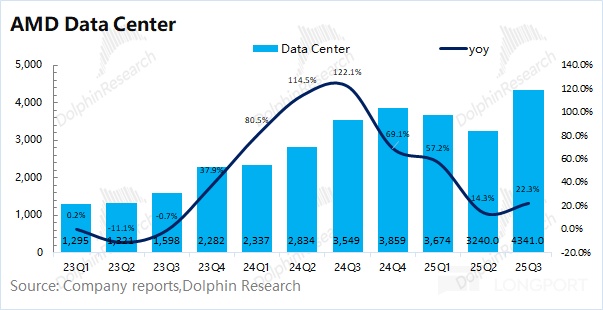

2) Data Center Awaits New Product Boost: Revenue for the quarter was $4.34 billion, a year-on-year increase of 22.3%. The growth in data center business this quarter was mainly driven by increased production of MI355 series products and enhanced competitiveness in the server CPU market.

① Server GPU: The current growth in the company's data center business is mainly driven by the MI355 series. With increased production of the MI355 series, the company's AI GPU revenue in the second half of the year will be significantly better than the first half. With the signing of orders from Open AI, the market is more focused on the progress of MI450, which will drive growth for the company in the next 2-3 years.

② Server CPU: The server CPU business contributed the main increment to the data center business in the first half of the year, mainly due to the company's increased market share in the server CPU market. According to third-party data, the company's market share in the server CPU market has increased from 10% to around 20%.

4. AMD Performance Guidance: Q4 2025 expected revenue is $9.3-9.9 billion (market expectation $9.2 billion), with a midpoint of $9.6 billion, a sequential increase of 3.8%, excluding MI308 revenue. The company expects a non-GAAP gross margin of around 54.5% (market expectation 54.5%).

Dolphin Research's Overall View: Compared to guidance, the market is more anticipating new orders.

AMD's revenue and gross margin for the quarter exceeded previous guidance expectations, mainly driven by growth in data center business, client, and gaming business. In addition to the growth in data center business driven by the MI355 series, the company's gaming business has also clearly rebounded from the bottom.

Regarding the data center business that the market is concerned about, this quarter contributed the largest sequential increase in revenue, benefiting from increased production of the MI355 series and enhanced competitiveness in server CPUs. The data center business saw a sequential increase of $1.1 billion, with Dolphin Research estimating that AI GPUs contributed approximately $800 million of the increment, and server CPUs also saw growth.

Combining the company's guidance for the next quarter, Dolphin Research expects growth in client and embedded business, while gaming business will decline due to seasonal factors. The revenue increment for the next quarter will still mainly come from data center and increased production of MI355, with Dolphin Research estimating AI GPU revenue to reach around $2.4 billion, a sequential increase of only $600 million, showing a slowdown, and barely exceeding market expectations ($2.2-2.3 billion), not considered a "surprise."

With the impact of continuously increasing AI Capex, the market's focus on AMD has shifted from gaining market share in the PC market to growth prospects in data center and AI fields:

a) Cloud Giants Increase Capital Expenditure, Continuing AI Capex Heat

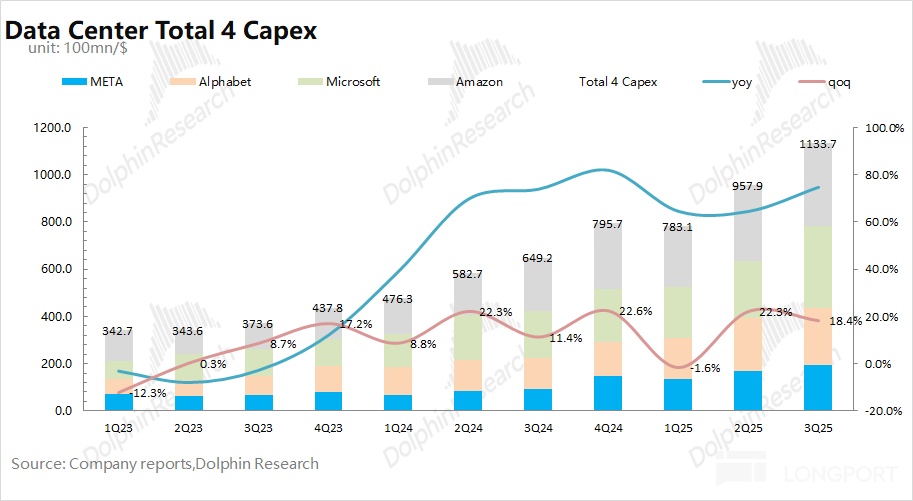

With the mass production of AMD's MI350 series and NVIDIA's GB series, the four major manufacturers have increased their capital investment in AI servers in the second half of the year. Based on the capital expenditure guidance from major manufacturers, Dolphin Research estimates that the combined capital expenditure of the four companies (Meta, Google, Microsoft, and Amazon) will be raised to over $410 billion in 2025, with a year-on-year growth rate of 65%.

The current AI Capex remains hot, providing the biggest industry support for the growth of the company's data center business. However, the capital expenditure of major manufacturers for the third quarter has been announced, and the guidance for the fourth quarter is even more enthusiastic, with the latest expectations from buyers likely to be higher. AMD's sequential growth of only $600 million between the third and fourth quarters appears particularly quiet, indicating that MI355 lacks a system-level solution, and cloud manufacturers are still not buying in.

b) Securing Major Customers and Orders: Open AI's Order Support.

Before October, Open AI had already reached agreements with NVIDIA and Oracle; NVIDIA also began strategic cooperation with Intel in the CPU field. Under the "dual" influence of NVIDIA GPUs and Broadcom's custom ASICs, AMD seems to be gradually becoming a marginal player in the AI chip market, with the company's stock price performing flat.

Subsequently, Open AI also reached a 6GW cooperation agreement with AMD, directly bringing a 20%+ increase in the company's stock price. Actually, Dolphin Research believes AMD is still a "backup" option for Open AI, which is both a "fallback" for NVIDIA and a way to alleviate the tight inference situation.

Estimating based on a deployment cost of approximately $50 billion per 1GW, this 6GW agreement corresponds to a deployment cost of about $300 billion, expected to bring AMD nearly $100 billion in revenue increment, providing favorable assurance for the company's growth over the next five years (2026-2030).

Open AI's large order has already driven the company's stock price up. For this financial report and conference call, the market also expects the company to provide more customer and order information to further boost confidence.

c) MI355 Shipments and MI450 Progress:

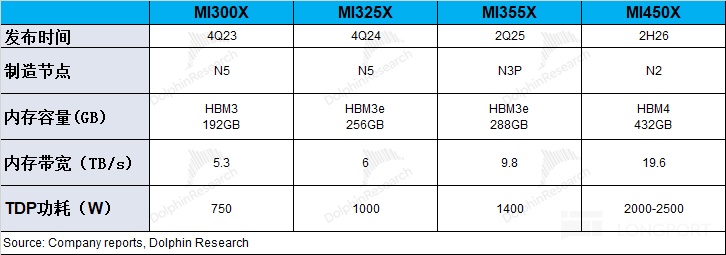

The recent growth in the company's data center business is mainly driven by increased production of MI355. With Open AI placing a large order for MI450, the market is more focused on the progress of MI450.

Recently, AMD CEO Lisa Su clarified in an interview that MI450 will use TSMC's 2nm process, equipped with 432GB of HBM4 memory, and is expected to challenge NVIDIA with next year's new products.

Overall (a+b+c), the company's current data center business enjoys "industry heat + major customer orders + clear iteration of MI series core products" triple support. AMD's stock price has climbed from "100->150->200+", gradually digesting expectations in these three areas (AMD's stock price breaking through $200 is brought by Open AI orders).

With the impact of Open AI's large order and MI450's mass production in the second half of 2026, the market expects the company to experience sustained high growth in the next two years. Therefore, for PE valuation selection, the current estimate is based on the situation in 2027.

Combining the company's current market value ($405.8 billion), it corresponds to approximately 30 times PE for the company's core operating profit after tax in 2027 (assuming a compound annual growth rate of +38% in revenue, non-GAAP gross margin of 56%, tax rate of 13%). Compared to NVIDIA's current market value corresponding to slightly over 20 times PE in 2026, AMD's valuation is relatively high, reflecting the market's expectation for the company's MI450 new product to capture market share and sustain high growth.

Overall, AMD's short-term performance will still be mainly affected by CPU business and MI355 shipments, but the current market focus has already shifted to the future growth prospects of the data center, including new customers, new orders, and MI450's mass production progress.

It is worth noting that the company's current high valuation already includes expectations for high growth in the next 2-3 years and good performance of MI450, directly pricing MI450 ahead of MI355.

MI450 is still essentially a future product, and unlike its predecessors, it is more inclined towards system-level solution delivery. In this field, it lacks historical experience and can only hope to learn from others to improve delivery success, by learning from the delivery of NVIDIA's GB series.

In the current environment of tight liquidity, this kind of chip stock based on "option" valuation expectations and marginal market position, releasing such mediocre but slightly better performance, coupled with no new major order cooperation announcements to boost, is likely to struggle to boost capital sentiment.

Below is Dolphin Research's specific analysis of AMD's financial report:

I. Overall Performance: Revenue and Gross Margin, Both Better Than Guidance Expectations

1.1 Revenue Side

AMD achieved revenue of $9.25 billion in Q3 2025, a year-on-year increase of 35.6%, exceeding market expectations ($8.74 billion). The year-on-year growth in the company's revenue was mainly driven by client and gaming business, as well as data center business, with increased production of MI355 being the main source of growth for the quarter.

1.2 Gross Margin Side

AMD achieved a gross profit of $4.78 billion in Q3 2025, a year-on-year increase of 39.8%. The gross margin for the quarter was 51.7%, showing a significant rebound.

Last quarter's gross margin was affected by inventory impairment related to MI308; excluding the impact of inventory impairment, the actual gross margin last quarter was 50.2%. The company's gross margin for the quarter still showed improvement, mainly driven by improved profitability in client business and the recovery of gaming business.

1.3 Operating Expenses

AMD's operating expenses for Q3 2025 were $3.208 billion, a year-on-year increase of 36%. Both R&D expenses and sales and administrative expenses saw varying degrees of increase.

Breaking down the specific expenses:

1) R&D Expenses: The company's R&D expenses for the quarter were $2.14 billion, a year-on-year increase of 30.7%. Although the company's revenue growth rate is fast, R&D expenses have also consistently grown. The current R&D expense ratio is 23.1%, showing a decrease;

2) Sales and Administrative Expenses: The company's sales and administrative expenses for the quarter were $1.07 billion, a year-on-year increase of 48.3%. The situation of sales expenses is highly correlated with revenue growth rate, and as revenue growth accelerates, the company's sales investment also increases.

1.4 Profit Side

Due to the significant deferred expenses generated by AMD's acquisition of Xilinx, it will continue to erode profits for some time. For the actual operating situation this quarter, Dolphin Research believes "core operating profit" is more relevant.

Core Operating Profit = Gross Profit - R&D Expenses - Sales and Administrative Expenses

After excluding the impact of acquisition expenses, Dolphin Research estimates AMD's core operating profit for the quarter was $1.57 billion, continuing to rebound. The "sudden decline" in the company's profit side last quarter was mainly due to the impact of MI308 inventory impairment, approximately $800 million. Even after adding back $800 million, the company's core operating profit for the quarter still showed improvement, benefiting from increased production of MI355, client, and gaming business recovery.

II. Business Segments: MI355 is the Main Driving Force

From the company's business segmentation, data center and client business are the company's main businesses, accounting for 75%. With the growth in demand for AI GPUs and increased market share in server CPUs, the proportion of data center business has increased significantly. In the second half of the year, with increased production of the MI350 series, the share of data center has risen again.

2.1 Data Center Business

AMD's data center business achieved revenue of $4.34 billion in Q3 2025, a year-on-year increase of 22.3%, exceeding market expectations ($4.14 billion). The year-on-year growth for the quarter was driven by increased production of MI355 and growth in AMD EPYC CPU shipments.

Combining company and market expectations, breaking down specifically: Dolphin Research estimates AI GPU revenue for the quarter was approximately $1.85 billion, with related revenue from data center CPUs around $2.5 billion.

Both AMD's CPUs and GPUs contribute increments to the company's data center business:

a) Data Center CPU: In the context of Intel's weak CPU products, AMD, leveraging the "CPU+GPU" combination, has continuously increased its market share in the data center CPU market, rising from 10% to 20%. Although Intel's x86 CPU has recently established cooperation with NVIDIA, AMD, with the iterative upgrade of the MI series, is still expected to drive growth in the company's data center CPU shipments;

b) AI GPU: The main increment in the company's data center this quarter came from increased production of the MI355 series. After the product transition period in the first half of the year, capital expenditure from major cloud manufacturers and the company's AI GPU shipments have significantly increased. With the large order from Open AI, the MI450 series to be released next year has become the main focus of the market.

Combining market and company conditions, Dolphin Research estimates the company's AI GPU for the next quarter is expected to reach around $2.4 billion, with little consideration for MI308-related revenue.

Combining the recent increase in capital expenditure from the four major cloud manufacturers, each manufacturer has increased their procurement of AI servers and related chips in the second half of the year. Dolphin Research estimates the combined capital expenditure of the four cloud manufacturers (Meta, Google, Microsoft, and Amazon) will be raised to over $410 billion in 2025, with a year-on-year growth rate of 65%, indicating the current hot demand in the AI market.

Regarding the data center business:

Short-term perspective: Increased production of MI355 will continue to drive growth in the company's AI GPU and data center business. With increased GPU shipments, leveraging the "GPU+CPU" combination, the company is also expected to strengthen its competitiveness in the data center CPU market. The current hot AI Capex also creates a favorable market environment for the company's growth;

Medium to long-term perspective: Open AI's large order will start mass production in the second half of 2026, providing assurance for the company's growth over the next 2-3 years. As major cloud manufacturers compete to increase capital expenditure, the compute chip market will still be in a "tight supply and demand" situation next year. The company currently expects MI450 to start mass production in the second half of 2026, and if the MI450 series progresses smoothly, it is expected to secure more orders for the company.

2.2 Client Business

AMD's client business achieved revenue of $2.75 billion in Q3 2025, a year-on-year increase of 46.2%, exceeding market expectations ($2.6 billion). The growth in client business was mainly due to the recovery of the PC market and the erosion of Intel's market share.

Combining industry data, global PC shipments in Q3 2025 were 75.9 million units, a year-on-year increase of 10.3%. Meanwhile, AMD's client business achieved 46% year-on-year growth. In comparison, Intel's client business only grew by 4.6% year-on-year.

Comparing the growth rates of the three, Dolphin Research believes the overall PC market has warmed up, with AMD gaining significant market share in the PC market. From the desktop market perspective, AMD's market share has already caught up with Intel.

2.3 Other Business

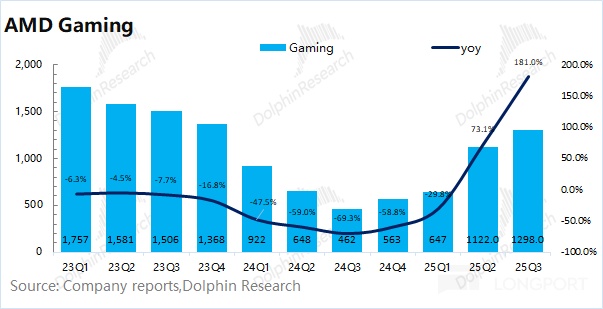

1) Gaming Business: The company's gaming business achieved revenue of $1.3 billion in Q3 2025, a year-on-year increase of 181%.

The company's semi-custom business revenue increased this quarter, benefiting from Sony and Microsoft stocking up for the upcoming holiday sales season. In the gaming graphics card sector, driven by the cost-performance advantage of the Radeon 9000 series graphics cards, both revenue and channel shipments achieved significant growth.

Due to seasonal factors, the company's gaming business will decline sequentially next quarter, but it has already shown significant recovery from the previous low state.

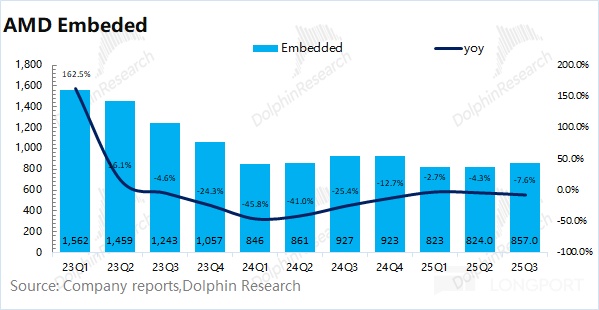

2) Embedded Business: The company's embedded business achieved revenue of $860 million in Q3 2025, a year-on-year decline of 7.6%. Although the embedded business remains relatively sluggish, it has started to recover sequentially, mainly due to improvements in testing and simulation, aerospace and defense, industrial vision, and healthcare sectors.

<End of Article>

Dolphin Research's Related Research on AMD

AMD Earnings Season

August 6, 2025 Conference Call "AMD (Minutes): Even without MI308, AI GPU will grow year-on-year next quarter"

August 6, 2025 Earnings Review "AMD: CPU Strongly Competes with Intel, When Can AI GPU Compete with NVIDIA?"

May 7, 2025 Conference Call "AMD (Minutes): AI GPU will achieve double-digit growth for the year"

May 7, 2025 Earnings Review "AMD: "Handling" Intel, and Giving NVIDIA "Intensity"?"

February 5, 2025 Conference Call "AMD (Minutes): 1H25 Data Center Business Will Not Grow Sequentially"

February 5, 2025 Earnings Review "AMD: Deepseek Fuels, GPU "Backup" Dream Breaks ASIC"

October 30, 2024 Conference Call "AMD: Next Year MI350 Can Catch Up with NVIDIA's Blackwell (24Q3 Conference Call Minutes)"

October 30, 2024 Earnings Review "AMD: "Timid" Guidance, AI Landing Equals AI Downhill?"

July 31, 2024 Conference Call "AMD: MI350 Will Compete with Blackwell (24Q2 Conference Call Minutes)"

July 31, 2024 Earnings Review "AMD: Major Manufacturers Stock Up Crazy, AI Guidance Moves Up Again"

May 1, 2024 Earnings Review "AMD: "Chicken Rib" Guidance, Pouring Cold Water on AI"

January 31, 2024 Earnings Review "AMD: PC Has Bowed, AI Only Has Three Points of Heat?"

November 1, 2023 Earnings Review "Without NVIDIA's Explosive Power, AMD's Recovery is Too "Snail-like""

November 1, 2023 Conference Call "AI PC, A New Wave of Productivity (AMD23Q3 Conference Call)"

August 2, 2023 Earnings Review "AMD: Climbing Out of the Valley, PC First to Warm Up"

August 2, 2023 Conference Call "Data Center Continues to Grow, Gross Margin Rises Again (AMD2Q23 Conference Call)"

AMDIn-depth

March 8, 2024 "Continuous Surge of NVIDIA and AMD, Is There a Bubble?"

June 21, 2023 "AMD's AI Dream: Can MI300 Sniper NVIDIA?"

May 19, 2023 "AMD: Millennium "Second", Can It Reverse?"

Risk Disclosure and Statement of This Article:Dolphin Research Disclaimer and General Disclosure

The copyright of this article belongs to the original author/organization.

The views expressed herein are solely those of the author and do not reflect the stance of the platform. The content is intended for investment reference purposes only and shall not be considered as investment advice. Please contact us if you have any questions or suggestions regarding the content services provided by the platform.