New Stock Outlook | Two-Year Loss Exceeds 800 Million Yuan, Domestic First Oral COVID-19 Drug Faces Growth Challenges, Genuine Biotech in Financial Dilemma

Genuine Biotech Limited is facing financial difficulties, with losses exceeding 800 million yuan over the past two years. The company submitted its listing application to the Hong Kong Stock Exchange on February 18, with China International Capital Corporation as the exclusive sponsor. Its core product Azvudine is the first domestically produced oral COVID-19 medication, having sold over 10 million bottles, but its revenue mainly relies on Fosun Pharma, with sales of 344 million yuan and 236 million yuan expected in 2023 and 2024, respectively, indicating a downward trend in revenue

On February 18, the Hong Kong Stock Exchange disclosed that Genuine Biotech Limited (hereinafter referred to as: Genuine Biotech) has officially submitted its application, with China International Capital Corporation (CICC) serving as its exclusive sponsor. According to Zhitong Finance APP, this is not the first time Genuine Biotech has knocked on the door of the Hong Kong Stock Exchange; as early as August 4, 2022, Genuine Biotech submitted listing application materials to the Hong Kong Stock Exchange, aiming for a Hong Kong IPO.

Single commercialized product COVID-19 oral drug has lost over 800 million yuan in two years

The prospectus shows that Genuine Biotech is a biotechnology company driven by innovative research and development, focusing on the development, manufacturing, and commercialization of innovative drugs for viral infections, tumors, and cardiovascular and cerebrovascular diseases.

According to Zhitong Finance APP, Genuine Biotech's core product, Azvudine, is the first domestically produced oral drug for COVID-19.

It is reported that Azvudine, as a Class 1 innovative drug, received conditional approval from the National Medical Products Administration (NMPA) for the treatment of HIV infection in July 2021, and in July 2022, it received conditional approval from the NMPA for the treatment of COVID-19, becoming the first oral antiviral drug developed by a Chinese company approved by the NMPA for the treatment of COVID-19. It is expected to complete Phase III clinical trials after listing in the second half of 2025. According to Frost & Sullivan data, Azvudine is the only dual-target oral nucleoside drug in the world for the treatment of HIV.

Currently, Azvudine has sold over 10 million bottles. The company has established its own production facilities with an annual capacity of approximately 3 billion tablets of Azvudine, and these facilities have passed GMP certification, fully meeting existing commercialization needs.

In terms of performance, over the past two years, nearly all of Genuine Biotech's revenue has come from sales of Azvudine to Fosun Pharma. The prospectus shows that in 2023, Genuine Biotech had only one customer, Fosun Pharma, with total sales of 344 million yuan; in 2024, Fosun Pharma accounted for 99.2% of total revenue, with total sales of 236 million yuan.

In 2023 and 2024 (hereinafter referred to as: the reporting period), Genuine Biotech recorded operating revenues of 344 million yuan and 238 million yuan, respectively, a year-on-year decline of 30.89%. Genuine Biotech has not yet achieved profitability, with losses of 784 million yuan and 40.042 million yuan in 2023 and 2024, respectively, totaling a loss of 820 million yuan over the two years.

Genuine Biotech stated that the continued losses are mainly due to the COVID-19 situation, considering the product's expiration date and marketability, resulting in significant inventory write-downs, leading to gross losses; at the same time, significant research and development expenses for core products and other candidate drugs, as well as administrative expenses and fair value losses on convertible redeemable preferred shares, have also impacted this. In addition, the decrease in losses compared to the previous year is due to a reduction in the amount of inventory write-downs, resulting in recorded gross profit.

It can be seen that the market growth endpoint for the first domestically produced oral drug for COVID-19 is approaching, and although losses in 2024 have decreased, profitability has still not been achieved. If the profitability situation cannot be improved in the short term, it may affect investor confidence and stock price performance after listing

In the field of tumor treatment, Genuine Biotech has discovered that its core product Azvudine possesses broad-spectrum anti-tumor activity, making it the only nucleoside anti-tumor drug with dual mechanisms and high selectivity in the past 30 years. It exerts dual anti-tumor effects by inhibiting DNA synthesis in tumor cells and regulating immune system functions.

Additionally, the TOPO1 inhibitor platform developed under the Genuine Biotech ZS-1003 project employs an innovative non-camptothecin core structure, demonstrating broad-spectrum anti-tumor activity. This drug has unique advantages in overcoming common anti-tumor drug resistance. Preclinical studies indicate that its inhibitory effect on irinotecan-resistant tumor cells is 400 times that of irinotecan; it is also expected to be widely used as a novel toxin in various XDC (such as ADC, PDC, SMDC, etc.) conjugated drug projects, providing effective solutions to combat resistance in various tumors.

Notably, from 2021 to 2022, Genuine Biotech conducted two rounds of financing, raising a total of 712 million yuan, with investors including Jinbailin Investment, Yifeng Capital, Yingke Capital, Yashang Capital, Fuqiang Financial, and Shanghai Diseno Pharmaceutical Co., Ltd. After completing the Series B financing in 2022, the company's post-investment valuation reached 3.56 billion yuan.

In short, Genuine Biotech's financial data is lackluster, with the company's biggest highlight being the COVID-19 oral drug Azvudine tablets. Amid ongoing losses, Genuine Biotech has reduced its R&D investment, with R&D expenses projected at 238 million yuan and 151 million yuan for 2023 and 2024, respectively.

From a purely R&D perspective, most of Genuine Biotech's product pipeline is in the early clinical stage, transitioning candidate drugs to later clinical trials, advancing preclinical programs to clinical trials, and continuing to expand the clinical development of candidate drugs to treat more indications. It can be anticipated that it will continue to incur significant R&D expenditures in the future.

At this point, tightening R&D expenses indicates that Genuine Biotech is caught in a financial dilemma: on one hand, there have been substantial losses over the past two years, and on the other hand, the company's funds are running low. As of the end of 2024, the company's cash and cash equivalents amount to only 321 million yuan, which, at the previous "burn rate," will not last long.

Building Three Major Pipelines Centered on Azvudine: HIV, Anti-tumor, and Central Nervous System

Genuine Biotech has established an HIV drug pipeline and an anti-tumor drug pipeline centered on Azvudine, while also venturing into the central nervous system field.

For instance, in terms of HIV drugs, Genuine Biotech expects to complete the Phase III clinical trial of Azvudine for the treatment of HIV infection by 2025. There is also a developing novel oral HIV candidate drug CL-197, which is expected to complete Phase I trials by 2025, with plans to submit an IND application for CL-197 overseas. The combination of Azvudine/CL-197 compound tablets has the potential to become the world's first fully oral long-acting HIV treatment drug, taken once a week According to Frost & Sullivan data, HIV is a virus that primarily attacks and destroys the immune system's CD4 + T cells, making patients more susceptible to infections and other diseases. The HIV infection process is divided into four stages: acute infection, latent period, pre-AIDS, and late-stage AIDS, which is also known as acquired immunodeficiency syndrome (AIDS). Based on genetic differences, HIV can be classified into two main virus types: HIV-1 and HIV-2. HIV-1 is the most common type, accounting for over 90% of global HIV infections. Currently, there is no cure for HIV infection, but it can be suppressed or slowed down through drug treatment.

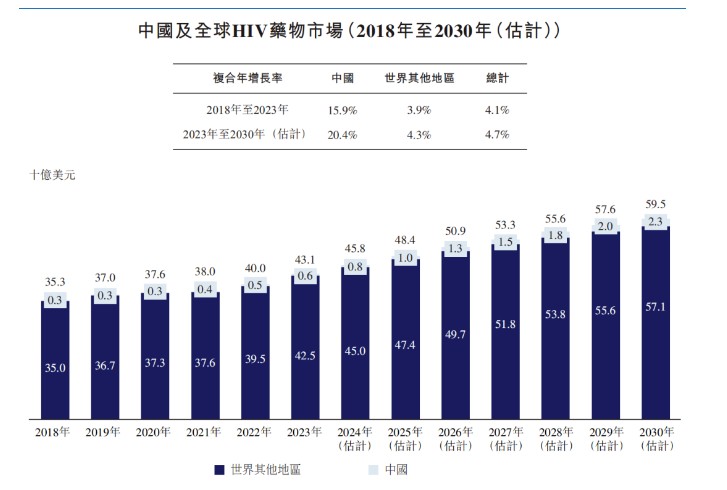

The market size for HIV drugs in China and globally continues to grow, increasing from $35.3 billion in 2018 to $43.1 billion in 2023, with a compound annual growth rate of 4.1%. It is expected to grow at a rate of 4.7% to reach $59.5 billion by 2030.

In recent years, newly approved cART drugs with increased efficacy and safety have become the most widely used HIV drugs globally. However, most HIV drugs in the Chinese market are single-agent antiretroviral drugs, rather than combination drugs containing multiple ART formulations that are more readily available in developed markets.

As an NRTI (a class of antiretroviral drugs widely used as backbone drugs in first-line cART regimens), Adefovir may work in combination with drugs of different mechanisms to form various cART regimens. Therefore, different categories of single-agent antiretroviral drugs (such as NNRTI or INSTI) are not considered substitutes or competing products for Adefovir. Thus, as the market size for HIV drugs grows, the market demand for Adefovir is expected to continue to increase.

However, as Genuine Biotech has stated, most of the company's drug combinations are currently in preclinical or clinical development stages, and its business relies on the successful development of drugs and candidates for treating viral infections, tumors, and cardiovascular diseases. In other words, if Genuine Biotech can successfully launch its products, its stock price will depend on Adefovir for "feeding" in the coming years.

In summary, at the tail end of the COVID-19 "dividend" and holding COVID-19 oral drugs in 2022, Genuine Biotech still stumbled in its Hong Kong IPO. Having missed the best listing period, the "single bet" risk for Genuine Biotech cannot be ignored