Moody's credit downgrade shocks the market, will US stocks fall into a new bear market? Perhaps it's just a "minor episode" in the bull market

Moody's has downgraded the U.S. government's credit rating from Aaa to Aa1, causing market turmoil. Although U.S. stocks and global markets may face adjustments in the short term, Wall Street analysts generally believe that the likelihood of U.S. stocks plummeting into a bear market is minimal. Cestrian Capital Research points out that the bullish sentiment in the market remains, and it is expected that U.S. stocks will experience a moderate correction before reaching new highs. This rating downgrade may serve as an excuse for institutional investors to take profits and could prompt the Federal Reserve to accelerate interest rate cuts

Global investors may once again face severe turbulence in the financial markets in the short term starting this week, with the trigger undoubtedly being last Friday's downgrade of the U.S. government's credit rating by Moody's, one of the three major international credit rating agencies, from the highest rating of Aaa to Aa1. This also means that U.S. sovereign debt has been completely removed from the "highest credit rating" category by all three rating agencies. After the Asian market opened on Monday, the pessimistic sentiment of "selling U.S. assets" surged again, reminiscent of the early April announcement of reciprocal tariffs by the Trump administration. Asian stock markets fell across the board on Monday, and the three major U.S. stock index futures, U.S. Treasury bonds, and the U.S. dollar index all declined together.

In the short term, the decline of U.S. stocks and even global stock markets, as well as the global bond market due to the downgrade of the U.S. credit rating from the highest rating, is a foregone conclusion. When the other two major credit rating agencies—Standard & Poor's and Fitch—announced their downgrades of the U.S. rating at that time, it also triggered turmoil in the global financial markets in the short term.

Currently, investors' core focus is on whether Moody's downgrade of the sovereign credit rating will trigger a massive sell-off in U.S. stocks from a medium to long-term perspective, leading to a new bear market for U.S. stocks. From the general viewpoint of Wall Street analysts, whether from a technical analysis perspective or a fundamental perspective, the probability of U.S. stocks plummeting into a bear market is extremely low.

Independent investment research firm Cestrian Capital Research recently stated that the CBOE Volatility Index (VIX) is currently at a recent low, indicating a bullish market sentiment. The firm expects that U.S. stocks will inevitably experience a mild short-term "pullback episode" rather than a significant downward adjustment, and subsequently, U.S. stocks are expected to reach new historical highs.

Moody's downgrade of the U.S. sovereign credit rating may serve more as an excuse or incentive for some institutional investors to "take profits," and they may choose to buy on dips rather than act as a negative catalyst for a bear market decline in U.S. stocks. This rating event could even become a catalyst for the Federal Reserve to accelerate its pace of interest rate cuts, which, after a brief digestion period, may instead drive U.S. stocks higher and set new records.

The ever-excited sentiment is expected to continue after a brief adjustment

On Friday after the market closed, the U.S. lost its last highest sovereign rating—Moody's unexpectedly announced the downgrade of the U.S. sovereign credit rating from Aaa to Aa1 (with the outlook adjusted to "stable"). This news prompted an immediate market reaction: the ETF tracking the S&P 500 index (SPY.US) fell about 1% in after-hours trading on Friday and continued to weaken before the market opened on Monday, with the Nasdaq 100 index ETF (QQQ.US) seeing a drop of 1.3% in after-hours trading. U.S. Treasury futures prices fell, yields rose, and the U.S. dollar index also showed a downward trend on Monday. All of these indicate that investor concerns about the U.S. government's fiscal outlook and potential default have intensified.

However, it should be noted that this downgrade is not an unexpected historical black swan event—Standard & Poor's and Fitch had already downgraded the U.S. credit rating several years ago. Therefore, Moody's downgrade is likely to be fully priced in and digested by the market in the short term, and its impact on the fundamental economic situation in the U.S. is relatively limited compared to the previous downgrades by Standard & Poor's and Fitch What is more noteworthy is the volatility indicators, market technical analysis, and the fundamentals of the U.S. economy. Currently, the VIX volatility index is at a recent low, hovering at a rarely low level for the year, indicating that investors are still immersed in bullish sentiment. Generally speaking, when the VIX is this low, it often means that the market lacks panic selling pressure and protective bets, and this excessive optimism often appears near short-term tops.

In other words, from the perspective of volatility indicators, the market may have accumulated some pullback pressure. Although Moody's downgrade seems to be a significant negative news event, the U.S. stock market fell after the news was announced, but in conjunction with volatility and sentiment indicators, the current pullback is more likely a normal process of profit-taking by bulls and short-term digestion of strong rebound gains, rather than evolving into a major sell-off similar to last year and early April.

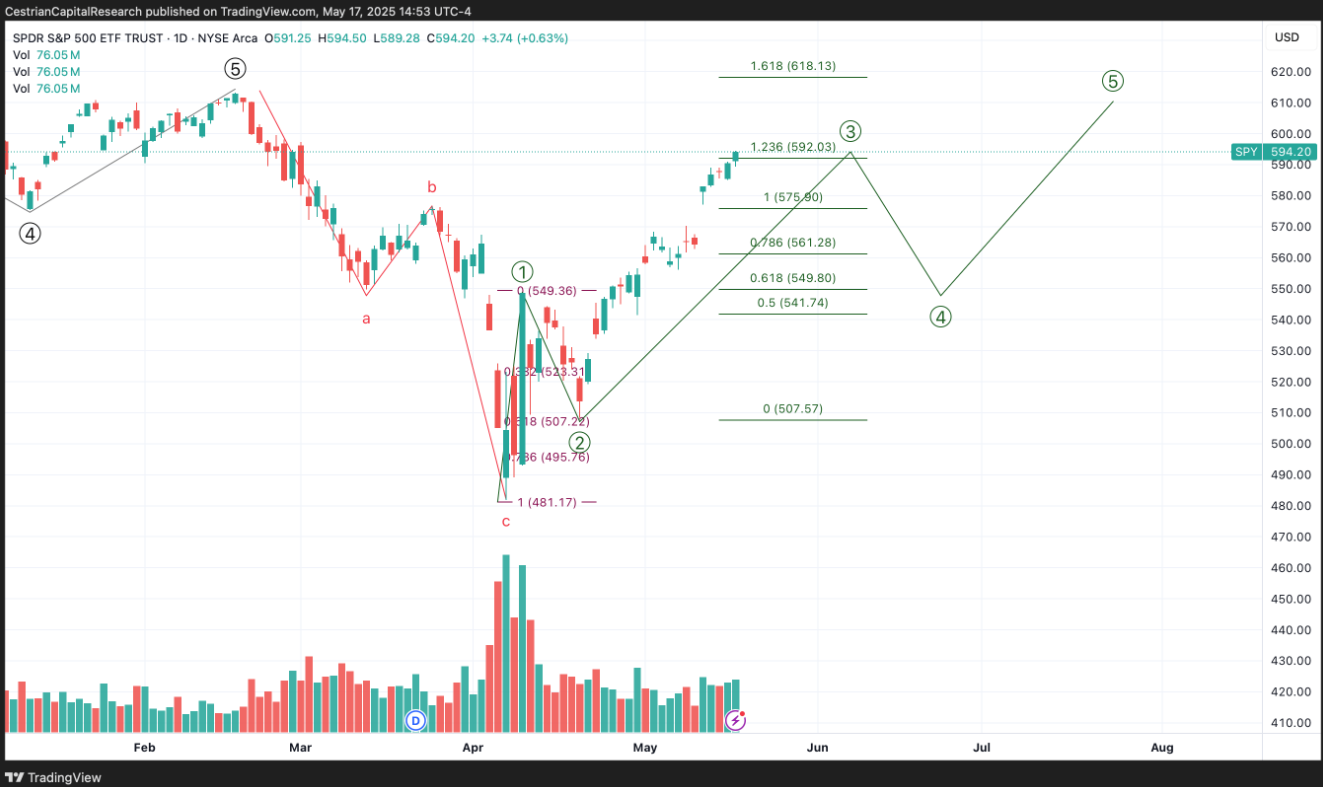

From the perspective of major technical analysis, the technical charts of key ETFs tracking U.S. stock valuations, such as SPY, QQQ, and SOXX, show that the market is at a local top, and it is currently likely in a small fourth wave pullback phase within the fifth wave upward momentum. This adjustment is a normal correction within a bull market trend, rather than the beginning of a new bear market.

The price patterns of representative indices such as SPY (S&P 500 ETF), QQQ (Nasdaq 100 ETF), and SOXX (Philadelphia Semiconductor Index ETF) have shown signs of a short-term top from a technical perspective. According to the wave structure classification of Elliott Wave Theory, this round of upward movement since spring this year can be divided into five waves, and the market is likely nearing the end of the third wave and about to enter the fourth wave adjustment phase. The technical charts of the aforementioned ETFs indicate that the indices have shown signs of weakness after a recent surge—this is likely a signal of a local top. The fourth wave adjustment typically appears in the form of a mild pullback, with a relatively limited range, helping to digest previous gains.

From the perspective of technical analysts, it is crucial to note that the fourth wave is a normal correction within an upward trend, rather than a trend reversal. As long as the pullback of the fourth wave does not break below key technical support levels (such as the top area of the previous wave), the larger upward pattern will be maintained, and the subsequent fifth wave is expected to push the indices to higher highs. This means that the decline we are currently seeing is more like a pause in the U.S. stock bull market process, rather than the beginning of a new bear market. Technical indicators also support this view: some overbought indicators have retreated, but the overall technical situation remains in a key area controlled by bulls; there are no signs of panic in trading volume. All of this indicates that the market is undergoing a healthy adjustment rather than a trend reversal.

In this context, investors already have the willingness to take profits and reduce risk exposure, and Moody's rating downgrade just provides such an opportunity or "excuse." In other words, the selling pressure triggered by this news is more a direct reflection of the market's inherent technical adjustment needs and short-term profit-taking—investors temporarily withdraw some funds under the pretext, rather than a significant deterioration in fundamental expectations. For this reason, independent investment research firm Cestrian Capital Research believes that this downgrade has limited destructive power on the medium to long-term trend of the market Not only that, but this rating turmoil may also bring unexpected positive consequences. From a policy perspective, if the market's short-term volatility intensifies due to the rating downgrade and the selling of U.S. Treasuries escalates, tightening U.S. financial conditions, the Federal Reserve may be forced to reassess its monetary policy path. It cannot be ruled out that it will consider early interest rate cuts and targeted balance sheet expansion in the second half of the year to stabilize market expectations.

Although Federal Reserve officials have not yet made a clear statement regarding the rating event, historical experience shows that when financial markets are impacted, monetary policy tends to lean towards being more accommodative. This means that Moody's downgrade could actually accelerate the timeline for a policy shift, becoming a potential significant catalyst for strengthening the U.S. stock market bull run. After all, once investors begin to anticipate that the Federal Reserve may ease its policies, the decline in long-term interest rates and improvement in liquidity will support stock valuations, allowing the three major stock indices to continue climbing after a brief consolidation.

Based on the above analysis, Cestrian Capital Research has adopted a relatively cautious but still bullish strategy in its specific operations. Currently, the institution holds only a small amount of short positions as insurance, aimed at hedging against potential short-term volatility risks—this is just a small position, equivalent to buying an "insurance policy." Overall, Cestrian Capital Research maintains an optimistic view on the mid-term outlook for the market and has not turned bearish due to Moody's downgrade.

Many analysts believe that after the strong rebound in April, the market, especially the high-valued large tech giants, needed a moderate profit-taking technical correction; Moody's downgrade may just provide an opportunity for this correction, and after the adjustment, it is expected to become a driving force for U.S. stocks to reach new highs.

In other words, Moody's downgrade did not "kill" the bull market of the S&P 500 index and the Nasdaq 100 index; rather, after a short-term downward adjustment, it may inadvertently ignite a new round of strong bull market momentum for the bulls. In the view of bullish forces like Cestrian Capital Research, after a slight fourth wave consolidation, the U.S. stock market is expected to regain its upward momentum, and the S&P 500 index will challenge and surpass its previous historical high