Trade conflict escalates again, U.S. stock futures and European stocks both decline, while the Japanese yen, Swiss franc, and gold see slight increases

The threat of tariffs from Trump intensifies, causing risk assets such as U.S. stock futures, European stocks to decline, and Asian stock markets to fall. Safe-haven assets like the yen, Swiss franc, and gold have seen slight increases

On July 9th, ahead of the negotiation deadline, Trump intensified tariff threats, escalating market tensions, leading to declines in U.S. stock futures, European stocks, and a volatile drop in Asian markets before closing flat, while the U.S. dollar index weakened. Safe-haven assets such as the yen, Swiss franc, and gold saw slight increases. In other assets, the U.S. bond market was closed due to a holiday on Friday. OPEC+ is expected to significantly increase production, causing oil prices to dip slightly.

The following are the movements of core assets:

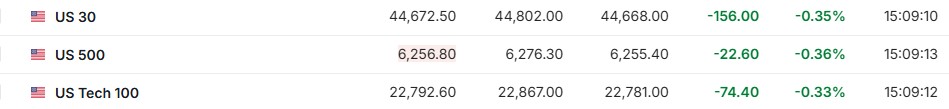

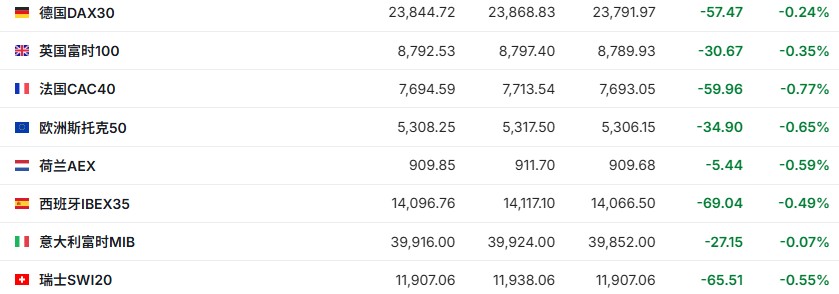

U.S. stock index futures all fell over 0.3%.

European stocks broadly declined, with German and British stocks both down over 0.2%, and French stocks down over 0.7%.

The Nikkei 225 index closed up 0.1%. The Tokyo Stock Exchange index closed down 0.04%. The Seoul Composite Index closed down 2%.

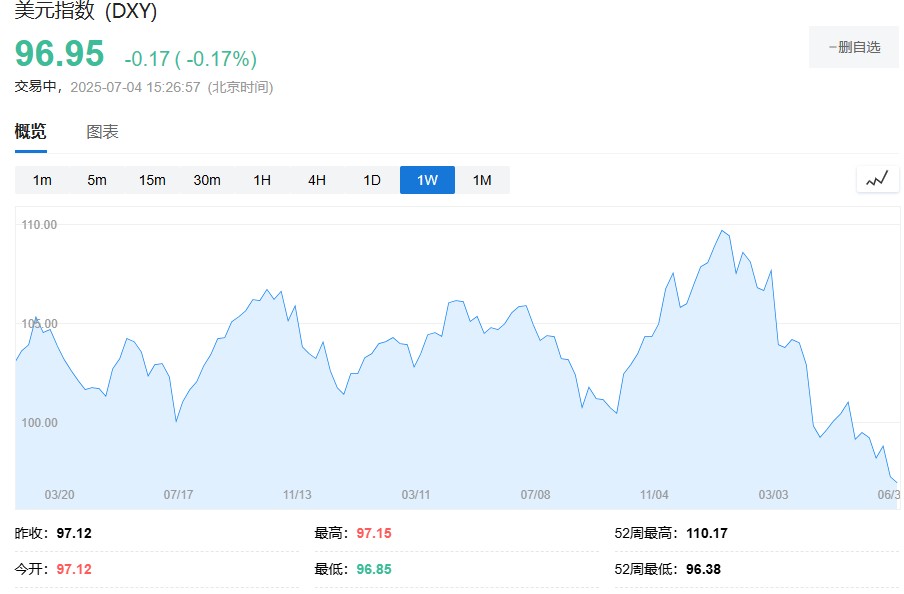

The U.S. dollar index fell 0.2%, while the British pound and euro rose over 0.1%, the South Korean won rose over 0.4%, and the New Taiwan dollar remained basically flat. The yen appreciated about 0.4%, and the Swiss franc rose over 0.2%.

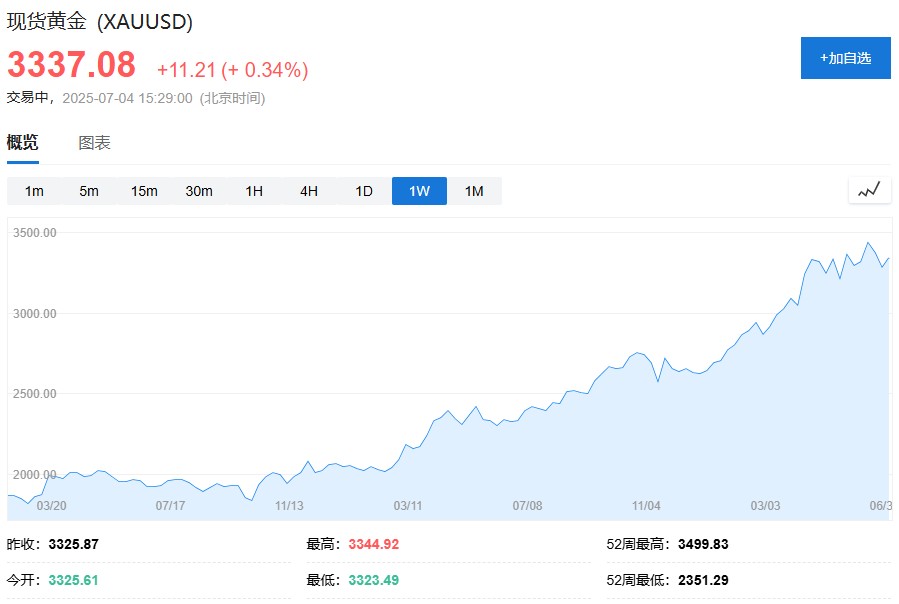

Spot gold rose about 0.3%, while spot silver fell about 0.2%.

U.S. oil fell over 0.3%, and Brent oil fell over 0.5%.

Bitcoin fell about 0.4%, and Ethereum fell about 1.5%.

U.S. stock futures and European stocks slightly down

Some investors are holding cash to observe how the market will move on Monday.

For example, Jung In Yun, CEO of Singapore's Fibonacci Asset Management, stated that there is more cash in their portfolio than usual. Seeing other fund managers too optimistic makes him uneasy, so he has reduced some stock positions to guard against a market downturn.

U.S. stock index futures all fell over 0.3%.

Major European stock indices opened slightly lower, with the German DAX30 index down 0.28% at the open. The UK FTSE 100 index opened down 0.36%. The Euro Stoxx 50 index opened down 0.60%. The French CAC40 index opened down 0.54%.

U.S. dollar index weakens, safe-haven currencies yen and Swiss franc rise

The U.S. dollar index fell about 0.2%.

The yen appreciated about 0.4%, and the Swiss franc rose over 0.2%.

Spot gold rises, spot silver falls

Spot gold is up about 0.3%, while spot silver is down about 0.2%.