The demand for GPU packaging substrates surges as NVIDIA Blackwell embarks on a path of aggressive expansion

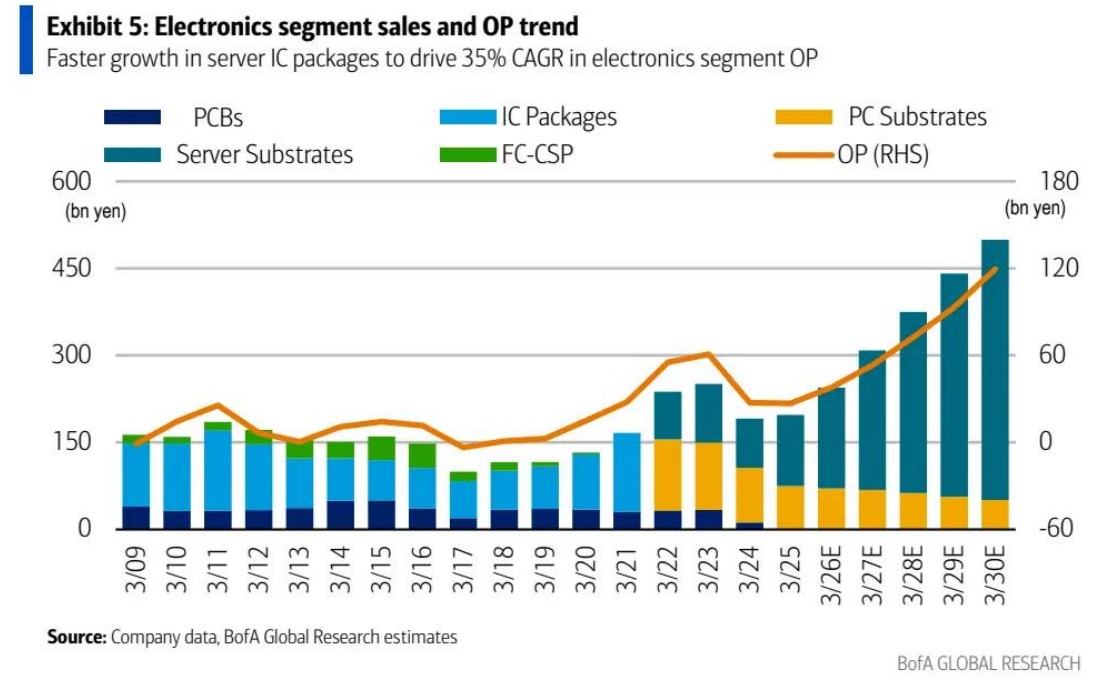

Wall Street investment giant Bank of America released a research report stating that Japan's semiconductor packaging equipment leader Ibiden's electronic components business is expected to achieve a compound annual growth rate of 35% in operating profit over the next five years. This is mainly due to the surge in demand for AI chips, and Ibiden plans to significantly increase production by 60-70% from 2024 to 2026. It is expected to supply ABF substrates to clients such as Google, Microsoft, and Meta by 2026, driving NVIDIA's Blackwell series AI chips into a "super growth cycle."

According to the Zhitong Finance APP, a recent research report released by Wall Street investment giant Bank of America shows that the operating profit compound annual growth rate (CAGR) of the electronic components business under Ibiden, a leading semiconductor packaging equipment company headquartered in Japan, could reach 35% over the next five years. Additionally, the EPS forecast for the fiscal year ending 2028 has been significantly raised. The main logic behind this is the explosive demand for GPU packaging substrates (i.e., ABF advanced packaging substrates) provided by Ibiden for the massive expansion of AI chip production capacity, driving a substantial increase in both volume and price of ABF.

Bank of America’s research data indicates that packaging equipment leader Ibiden is significantly expanding production (with an unprecedented expected increase of 60-70% in capacity from 2024 to 2026) and is poised to seize the historical opportunity for accelerated expansion of ASICs. It is expected that starting in 2026, Ibiden will supply ABF substrates in volume for AI ASIC super customers, such as Google, Microsoft, and Meta's self-developed AI ASIC chips.

The extremely optimistic expectations of Bank of America’s analyst team regarding Ibiden's valuation and the fundamental expansion of demand imply that the shipment volume of NVIDIA's Blackwell series AI chips/AI server rack products will enter a so-called "super growth cycle" in the second half of the year. The Blackwell series AI chips include Blackwell architecture AI GPUs and AI GPUs based on NVIDIA's most advanced architecture, Blackwell Ultra. For example, the Blackwell architecture dual-die + 8-HBM3E or the next-generation HBM system—12-HBM4 CoWoS advanced packaging—requires at least 14 layers of ABF and a very large effective area.

It is understood that research data from Wall Street institutions such as Bank of America and Morgan Stanley shows that since the second quarter of this year, the shipment volume of Blackwell architecture AI GPU products and GB200 NVL72 AI server racks has entered an unexpectedly accelerated growth trajectory. With the mass production of Blackwell Ultra architecture products, the Blackwell series AI GPU products/AI server rack products are expected to embark on a more aggressive path of "global shipment volume and AI computing power demand surging" starting in the second half of the year.

Why is the ABF packaging substrate firmly bound to AI chip packaging?

NVIDIA's Blackwell series dual-die AI GPUs and Google's TPUs, among other AI ASICs, are striving to securely "bundle" more high-power chips, higher HBM stacking numbers, and thousands of high-speed I/Os together through TSMC's CoWoS advanced packaging. This cannot be achieved without the high-layer property of ABF packaging substrates—this advanced packaging substrate must simultaneously achieve ultra-fine lines, low dielectric, high heat resistance, and low warpage. Currently, the only material system that meets these stringent criteria and has been validated for mass production is the ABF advanced packaging substrate For example, the Blackwell-B200 needs to connect two large GPU dies with up to 12-high HBM4 stacked onto a silicon interposer, increasing the number of I/Os by more than 145% compared to Hopper. It must rely on the ABF advanced packaging substrate with 10-14 layers of arbitrary interconnect (mSAP process) to meet impedance and crosstalk requirements. The high-speed SerDes spacing of the Blackwell-B200 is much smaller than 35µm, with more than 14 layers of wiring. The ABF advanced packaging substrate can stably achieve 8/8 µm or even 5/5 µm line width/spacing through mSAP/SAP processes, while traditional BT substrates can only achieve a best of 15/15 µm.

Electrical and thermal performance also determine that the advanced packaging system for high-performance AI chips cannot do without ABF packaging substrates. ABF resin has a low dielectric constant (Dk≈3.5), low loss, and a thermal resistance Tg greater than 200 °C, supporting packaging heat dissipation greater than 1kW. The high-layer stacked Blackwell-HBM module must rely on these material properties to ensure high efficiency, integrity, and reliability of data transmission.

ABF Packaging Substrate and AI Computing Power Demand

Ibiden is at the top of the advanced packaging equipment tier with a dual oligopoly in technology and customers, and the ramp-up of Blackwell's production capacity is strongly coupled with its large-scale expansion progress. The manufacturing and shipment of Blackwell/AI ASICs are highly dependent on ABF. According to a report from Bank of America, due to the extremely strong demand for AI computing power, the mass shipment pace of the Blackwell series AI GPUs and AI server racks has been significantly advanced, and the demand for AI ASIC chips led by Google TPU has unexpectedly surged, resulting in a large-scale "land grab" for global ABF packaging substrate capacity.

The generative AI leader Anthropic, known as the "OpenAI rival," predicts that by 2027, AI large models will be capable of automating almost all white-collar jobs, thus the AI computing power demand brought by inference is described as "starry sea," expected to drive the artificial intelligence computing power infrastructure market to continue showing exponential growth. The "AI inference system" is also considered by Jensen Huang to be the largest source of revenue for NVIDIA in the future.

With the global popularity of ChatGPT and the heavyweight launch of the Sora text-to-video large model, combined with NVIDIA's unparalleled performance over several consecutive quarters in the AI field, it signifies that human society has entered the AI era. At NVIDIA's earnings conference at the end of May, Jensen Huang optimistically predicted that the Blackwell series would set the strongest sales record for AI chips in history, driving the artificial intelligence computing power infrastructure market to "exhibit exponential growth."

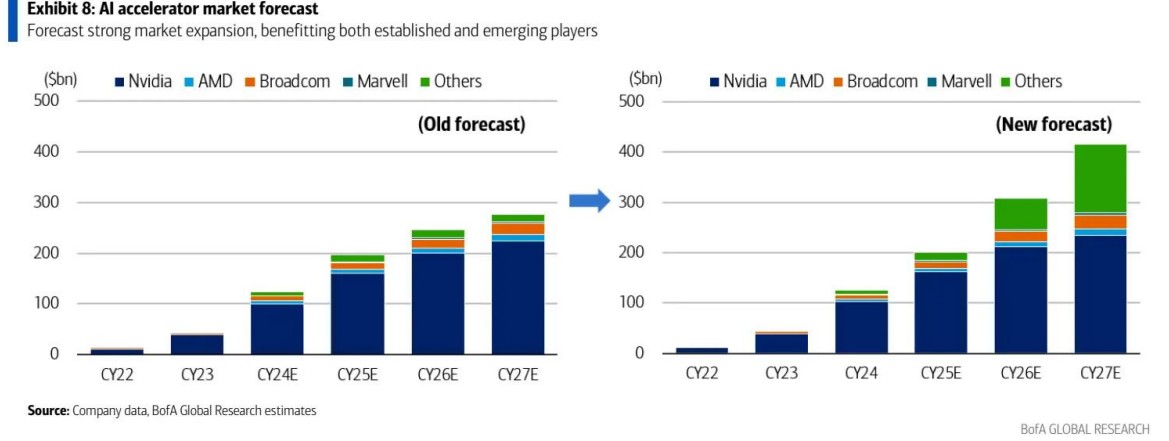

The Bank of America analysis team has significantly raised the profit expectations and 12-month target stock price for core supplier Ibiden of ABF packaging substrates in its latest report. Bank of America stated that NVIDIA's AI GPUs still account for about 80%+ of Ibiden's ABF packaging substrate share, but the share of AI ASICs (mainly from major cloud computing giants) is expected to approach 20% by 2030 Bank of America stated that NVIDIA, along with ASIC leaders such as Broadcom, has secured advanced packaging production lines from Ibiden and a few Taiwanese packaging equipment manufacturers. Notably, Ibiden is set to significantly expand production starting from the end of 2024, which underscores NVIDIA's strong confidence in the explosive growth of shipments for the Blackwell series products and provides the supply chain with clear long-term quantitative orders.

The strong demand for GPU substrates also indirectly confirms that shipments of NVIDIA's Blackwell series GPUs (B200/GB200 and the upcoming mass-produced Blackwell Ultra B300) and the installation of NVIDIA's Blackwell AI server clusters are rapidly increasing, forcing substrate manufacturers to expand high-end ABF capacity in advance to match the shipping pace.

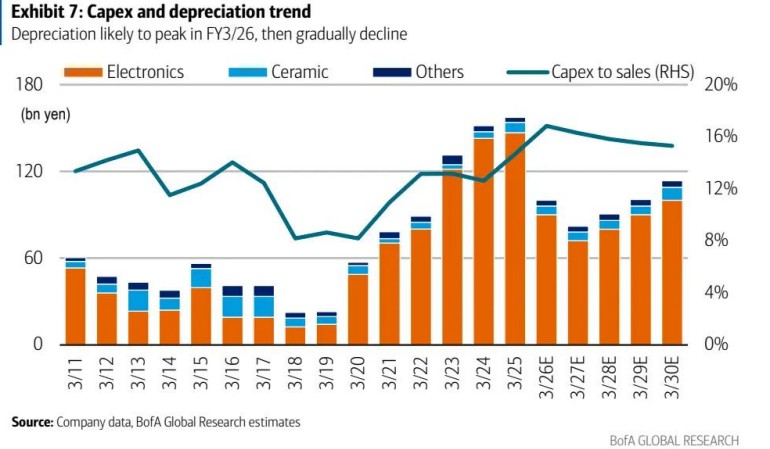

The Bank of America analysis team indicated that AI ASICs aimed at large-scale AI data centers (such as Google's TPU and Amazon AWS's Trainium) are expected to enter a phase of significant growth in ABF packaging substrates, comparable to NVIDIA's Blackwell series products, starting in 2026. The report shows that Ibiden has unprecedentedly laid out 60-70% of new ABF packaging substrate capacity in its two new factories in Gifu and Oono, Japan, to meet the strong growth demand for high-end substrates for both GPUs and ASICs.

The predictive data from the Bank of America analysis team indicates that the sales of AI chips, including GPUs, ASICs, and other XPUs, will grow from just $126 billion in 2024 to over $400 billion by 2027, and will reach at least $650 billion by 2030. Although NVIDIA's AI GPUs dominate the market with nearly 80% market share, Bank of America predicts that by 2030, the customized, high-performance, and low-cost characteristics of the ASIC ecosystem will account for nearly 20% of the market share