How to save consumption?

This article discusses the changes in consumption trends in China, pointing out the coexistence of traditional consumption stagnation and new consumption growth. The effectiveness of consumption policies depends on the stability of residents' disposable income and wealth. The article analyzes two main factors affecting consumption: disposable income and wealth effect, emphasizing that consumption tendency is dominated by the wealth effect. Although traditional consumption relies on the economic cycle, new consumption is related to new business formats and new demands, which is worth noting

Core Viewpoints

On one side, traditional consumption represented by Moutai continues to be sluggish; on the other side, new consumption keeps hitting new highs. One side is the awaited consumption stimulus that has not yet arrived, while the other side is the quietly brewing new subsidies for childbirth. How should we understand consumption policies and future consumption trends in China?

First, we note that the experiences of Japan and the United States repeatedly demonstrate one point: the key to consumption stimulus is not the magnitude of the effort; whether consumption stimulus policies are effective depends on whether residents' wages, property income, and wealth can stabilize simultaneously.

Next, let's look at the truth of residents' consumption in China in recent years: income growth has stepped down, and wealth dominated by real estate still faces shrinkage. The market still needs to maintain patience in expecting a rebound in traditional consumption that relies on income expectations and wealth effects.

Unlike traditional consumption, which depends on the economic cycle and income, new consumption, although its total scale is difficult to compare with traditional consumption, is more related to new business formats, new demands, and other new consumption trends, indicating that new consumption deserves more exploration.

Summary

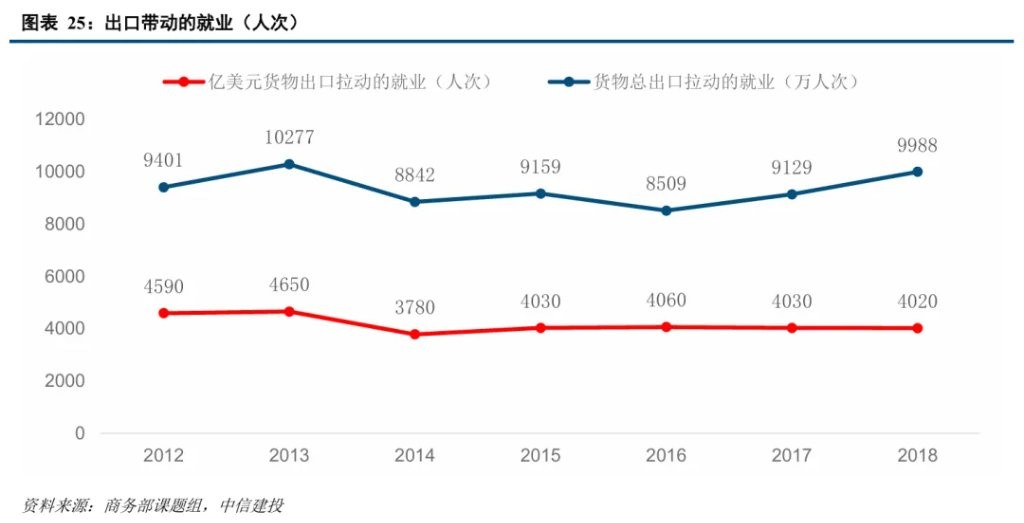

Since the beginning of this year, the tariff game between China and the United States has been repeated, and during the policy window, export grabbing has been in full swing. However, the change in exports alters the time distribution of external demand; the previous strength and resilience imply that the momentum may face insufficiency later, making consumption in the second half of the year even more critical.

What exactly determines consumption? Can conventional consumption stimulus policies promote sustained improvement in consumption? These are the main questions this article aims to answer. Clarifying these issues will provide more confidence in judging future consumption situations.

1. Two Major Factors That Truly Determine Consumption Trends

(1) From both theoretical and actual data perspectives, the core influencing factor of consumption direction is disposable income.

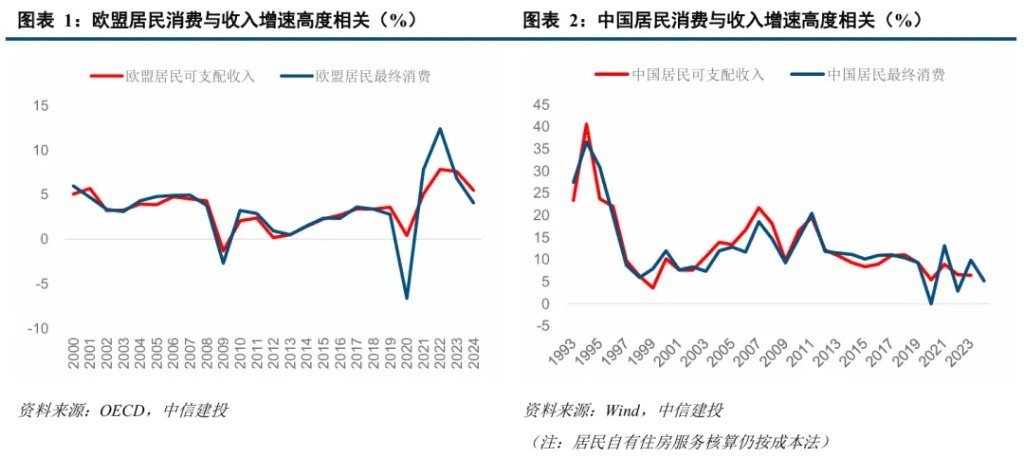

A portion of residents' disposable income is used for consumption, while the remainder is saved; this is a mathematical identity that shows consumption can only come from income (labor income + property income + transfer income). From actual data, the growth rate of residents' consumption in major countries is almost consistent with the growth rate of disposable income, providing empirical evidence.

(2) Another important variable affecting consumption is the wealth effect.

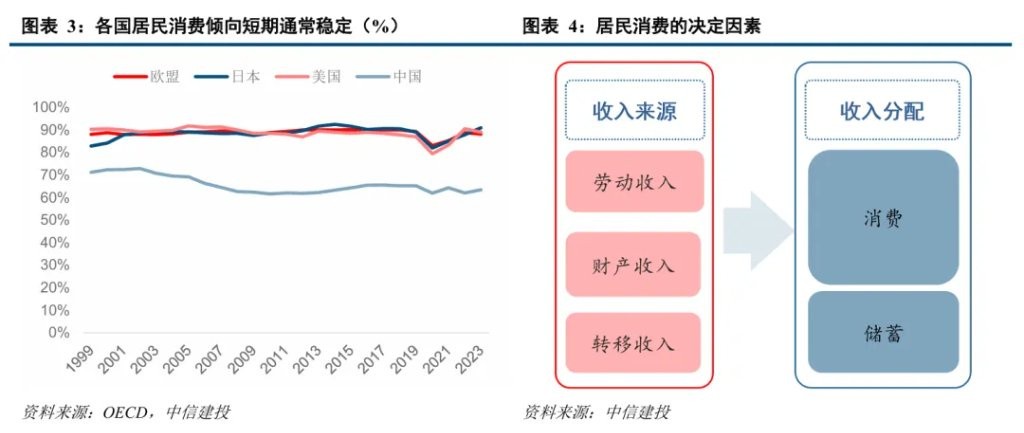

How much residents consume is not only influenced by income but also by how much of their existing income they are willing to spend, which is crucial, i.e., the propensity to consume. However, without other significant macro disturbances, the propensity to consume usually changes little, with its volatility far lower than that of income.

The propensity to consume is mainly dominated by the wealth effect. A significant decline in the value of residents' existing wealth will noticeably affect their willingness to consume, thereby actively reducing the propensity to consume. Additionally, factors such as deteriorating employment income expectations can also exert adverse effects.

2. The Consumption Stimulus Experiences of the U.S. and Japan Provide Super Intuitive Feedback

(1) The effects of Japan's two rounds of consumption stimulus policies were different.

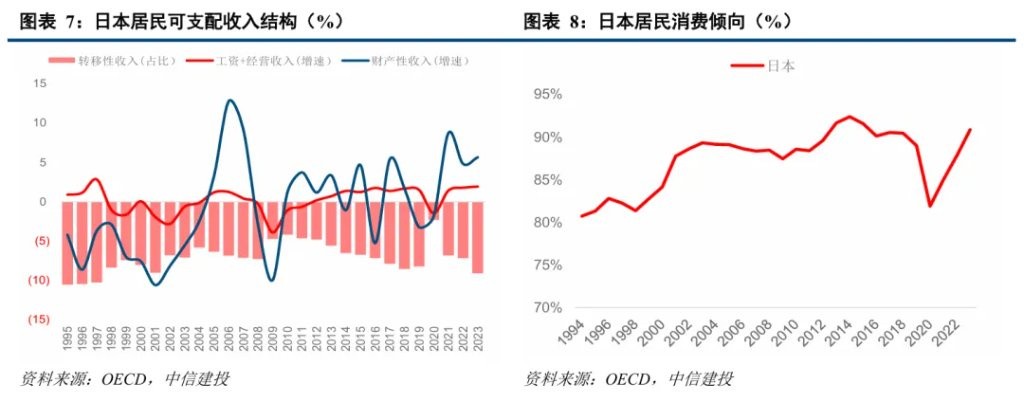

Since Japan's private consumption turned negative year-on-year in 1998, successive cabinets have introduced related policies to stimulate consumption, but the overall effect has been relatively limited. This is mainly because, during this period, Japanese residents' labor income turned negative, and property income continued to decline due to falling stock and real estate prices, leading to a worsening of both types of income, which did not turn positive until 2005. Despite the government's increased transfer payments, residents' overall income continued to shrink during this period, making it naturally difficult for consumption to improve After the pandemic in 2020, Japan's private consumption turned negative year-on-year, but a series of policies achieved good results. The overall center of private consumption is higher than before the pandemic. The main reason is that Japanese residents' labor income quickly recovered after a brief decline, even exceeding pre-pandemic levels, and property income significantly improved due to continuous increases in stock and real estate prices. Residents' disposable income has been continuously improving, and their existing wealth is constantly appreciating, leading to a natural recovery in consumption capacity and willingness, which has driven a noticeable rebound in consumption.

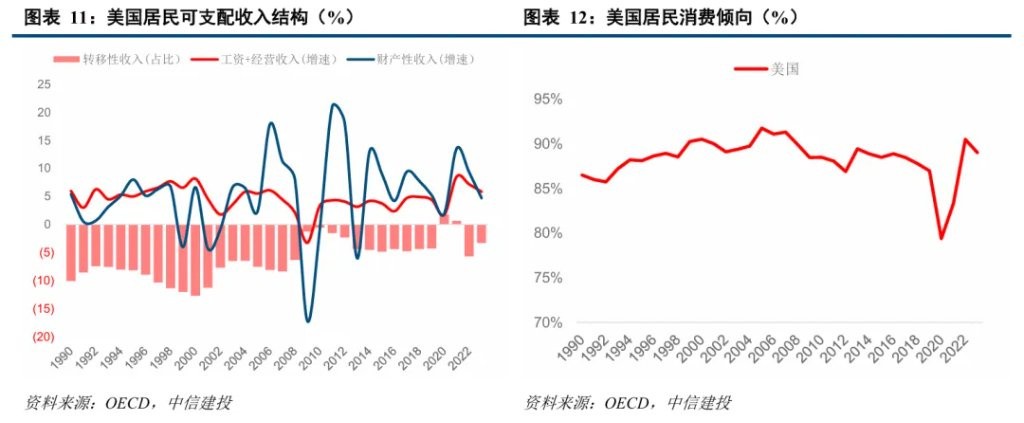

(2) The two rounds of consumption stimulus policies in the United States also show similar performance and conclusions.

After the 2008 financial crisis, stimulus policies moderately improved residents' income, but consumption recovery was limited, and the center remained below pre-crisis levels. During the COVID-19 pandemic, stimulus policies improved residents' income and asset prices, with the center of private consumption significantly higher than before the pandemic.

III. Recent Re-evaluation of Chinese Residents' Consumption and Policy Effects

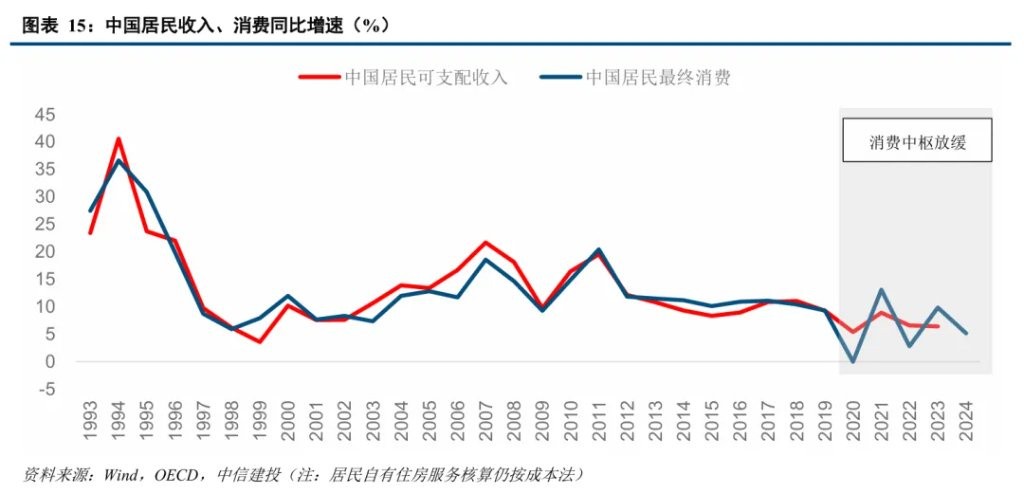

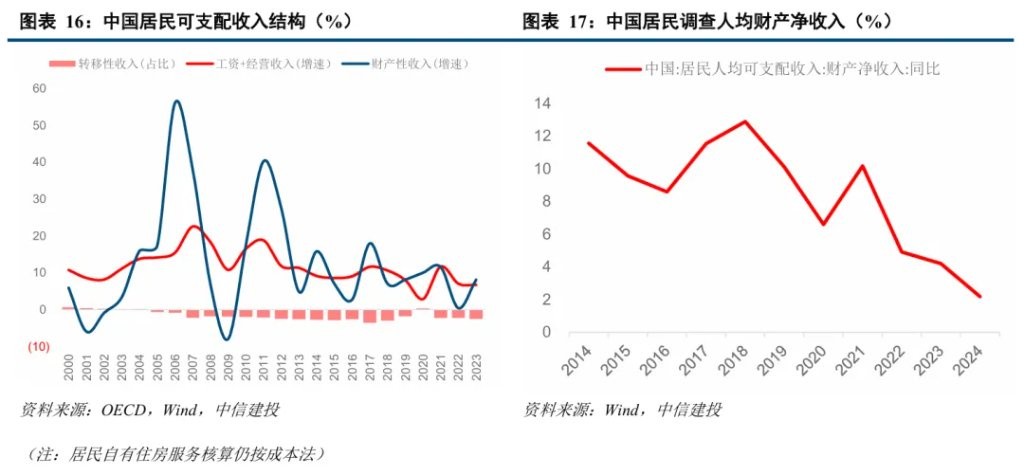

(1) Post-pandemic growth rate of residents' disposable income and wealth value has not yet recovered to pre-pandemic levels.

In the years following the pandemic, the growth rate of residents' disposable income has consistently been below pre-pandemic levels. According to macro financial flow statement data, the growth rate of labor income has been continuously slowing in 2022 and 2023, while property income saw a significant decline mainly in 2022. Household survey data shows that net household property income has been significantly declining since 2022.

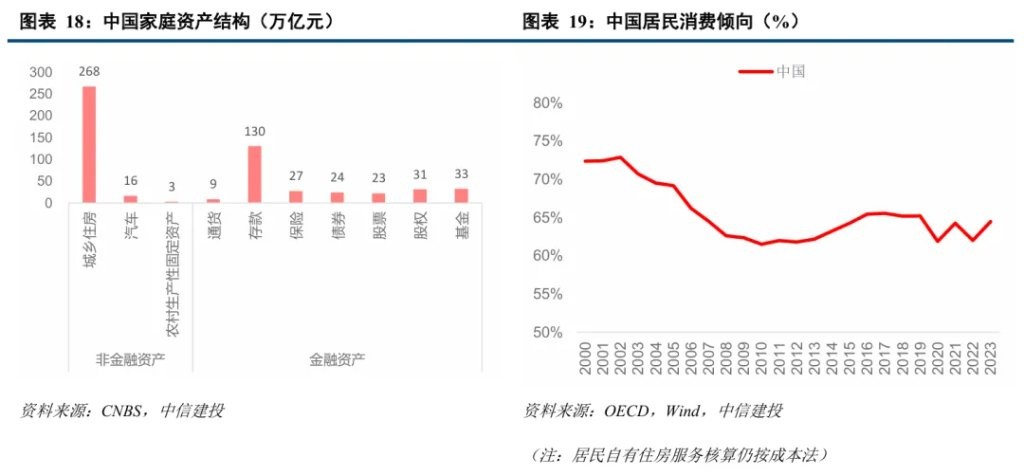

Negative wealth effects impact residents' willingness to consume. The price adjustments of the 268 trillion yuan real estate assets and 56 trillion yuan stock market assets held by households are the dominant factors dragging down consumption willingness. Additionally, multiple shocks to employment during the pandemic and the continuous contraction of the real estate industry chain have led to weak expectations for residents' employment and income, resulting in cautious consumption.

Correspondingly, the growth rate of consumption post-pandemic has also shown a weak and fluctuating trend, and after smoothing out the low base disturbances, the overall center of consumption growth has slowed.

(2) Existing consumption stimulus policies in China: the direction is correct, but there should not be excessive concern about the intensity.

In August 2024, the state raised 150 billion yuan in subsidies for consumption specifically through national debt for the first time. In 2025, the consumption subsidy fund will double to 300 billion yuan.

The government work report lists "expanding domestic demand" as a top priority, and the "Special Action Plan to Boost Consumption" further introduces 30 specific measures. The intensity of the policies should not be overly scrutinized; after all, the fact that policies are beginning to focus on consumption is a significant shift and is heading in the right direction.

IV. Traditional consumption expansion still requires patience, exploring new consumption opportunities.

(1) In the short term, traditional consumption may still be constrained by income and wealth.

The momentum for employment and labor income growth may slow. First, after experiencing a rush to export in the fourth quarter of last year and the first quarter of this year, the distribution of exports for the whole year has been front-loaded, and export growth in the second half may not reach the level of the first half. Second, real estate investment has seen a monthly increase in the decline since the beginning of this year, and real estate prices are still in a downward trend, which may remain pessimistic in the second half. With weakened momentum in exports and real estate, residents' employment and labor income still face pressure.

Before the negative wealth effect completely ends, it will be difficult to boost consumption willingness. From the second-hand housing price index of 70 large and medium-sized cities, since turning negative month-on-month in September 2021, there have only been signs of turning positive in February and March 2023, while the remaining 42 months have all shown negative month-on-month values. It will take time for real estate prices to stabilize, and correspondingly, residents' willingness to consume may be difficult to change in the short term In the medium term, deepening reforms to enhance residents' income through multiple channels and improving secondary distribution will gradually release consumption potential, but it remains a gradual process.

(2) Actively explore new consumption investment opportunities with the potential to break through boundaries

New consumption is not limited to a specific industry; it includes innovative forms of traditional consumption as well as entirely new consumption content brought about by technological advancements and model innovations. The consumer group is becoming younger, represented by the post-90s and Generation Z, pursuing emotional value in the consumption process, including self-pleasure, healing, curiosity, experience, companionship, and social interaction, rather than pure pragmatism.

New consumption is a structural prosperity track, with strong growth and anti-cyclical attributes. From international experience, it is essentially counter-cyclical, becoming particularly prominent during economic downturns. Currently, apart from the already popular categories, new consumption investment opportunities with the potential to break through boundaries can be actively explored based on characteristics such as product strength, brand strength, innovation, and emotional value.

Main Text

Since the beginning of this year, the tariff game between China and the United States has been repeated, and during the policy window, the rush to export has been in full swing.

Amid overseas uncertainties, the market is paying attention to the direction of domestic demand, especially the future path of consumption. Recently, whether in the macroeconomic or capital market, the trend of consumption has begun to show new signs—new consumption, which accounts for a small proportion, is significantly outperforming the more cyclical traditional consumption.

In the face of the consumption trend, the market is also concerned about a topic: when will traditional consumption rebound, and what useful measures can policies provide in the traditional consumption sector? In other words, how should consumption policies be effectively stimulated?

This article reviews international experiences in consumption stimulus policies to answer a question: what drives the growth momentum of traditional consumption, and what is the future outlook for traditional consumption in China?

1 Two key factors that truly determine consumption trends

(1) The core influencing factor of consumption direction is disposable income

From both theoretical and practical data perspectives, the core influencing factor of consumption direction is disposable income.

Theoretically, residents' consumption entirely comes from the use of disposable income. In national economic statistics, a portion of residents' disposable income is used for consumption, while the remaining part is savings, which is a mathematical identity.

From practical data, the growth rate of residents' consumption in major countries is almost consistent with the growth rate of disposable income, whether in large operational trends or small phase fluctuations, providing empirical evidence.

Residents' disposable income consists of labor income (wages + operating income), property income, and transfer income. Any significant change in any of these income sources will ultimately affect consumption.

(2) Another factor influencing consumption is the wealth effect

How much residents consume is not only influenced by income but also crucially depends on how much of their existing income they are willing to spend, which is known as the propensity to consume. However, in the absence of other significant macro events, residents' consumption propensity usually changes very little, with its volatility being much lower than that of income Consumer inclination is mainly dominated by the wealth effect. A significant decline in the value of residents' stock wealth will noticeably affect their willingness to consume, thereby actively reducing consumption inclination. Additionally, factors such as deteriorating income expectations will also exert influence.

2 The consumption stimulus experiences of the U.S. and Japan provide super intuitive feedback

We reviewed the consumption stimulus policies in the history of the United States and Japan and found that the core factor determining whether consumption can significantly improve is residents' disposable income.

Against the backdrop of weakening employment, stock market, and real estate asset prices, relying solely on fiscal policy subsidies is insufficient to completely reverse residents' income or boost their consumption inclination. These experiences tell us that without considering the sustainability of income and the improvement of the wealth effect, relying solely on a single consumption stimulus policy may yield limited results.

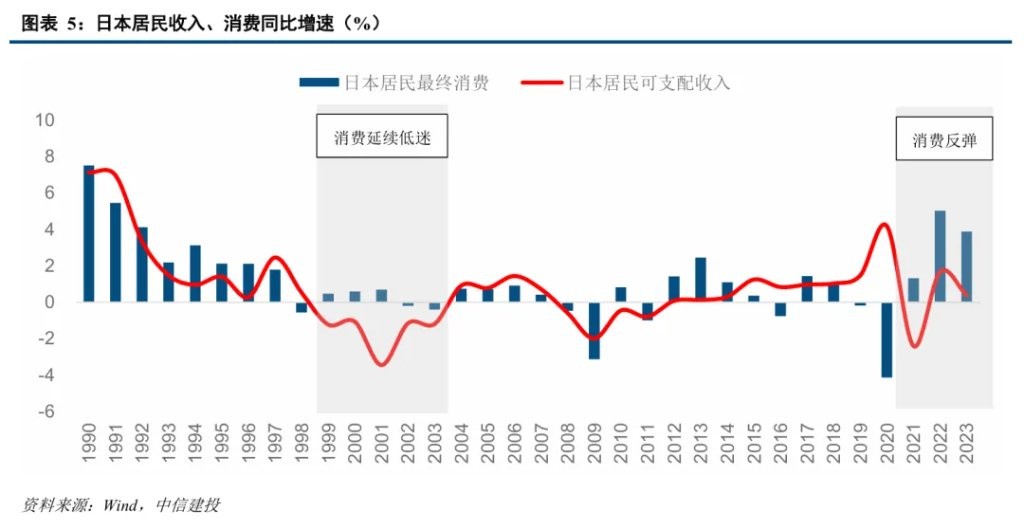

(1) Different effects of Japan's two rounds of consumption stimulus policies

Firstly, the stimulus policies around 2000 did not improve residents' income, and consumption continued to be sluggish, with a lower central tendency.

Since Japan's private consumption turned negative year-on-year in 1998, successive cabinets have introduced related policies to stimulate consumption. The early Hashimoto and Obuchi cabinets implemented a 4 trillion yen income tax reduction (accounting for 0.75% of GDP) and issued 700 billion yen in consumption vouchers (accounting for 0.13% of GDP), along with employment promotion policies. Later, the Mori and Koizumi cabinets, constrained by fiscal limitations, did not implement further tax reductions and consumption voucher policies, and the scale of financial support for employment promotion was also reduced, although they modified holiday laws to create conditions for consumption.

Overall effects were relatively limited. Although private consumption showed some recovery from 1999 to 2001, there was a low base effect from the previous period, and the operating central tendency remained significantly lower than before 1997.

Secondly, during the COVID-19 pandemic, stimulus policies improved residents' income and asset prices, leading to a rebound in consumption and an increase in the central tendency.

After Japan's private consumption turned negative year-on-year in 2020 due to the COVID-19 pandemic, a series of measures were introduced, including universal cash subsidies, targeted subsidies, and measures to stabilize enterprises and employment. For instance, over 14 trillion yen (accounting for 2.5% of GDP) in cash subsidies, 1.7 trillion yen in the "Go To Campaign" comprehensive subsidy policy targeted at supporting the recovery of consumption industries such as travel, dining, and accommodation, interest-free loans for enterprises, employment stabilization subsidies, and various local government special subsidies.

The policies achieved good results. The overall central tendency of private consumption was higher than before the pandemic, maintaining a strong level of consumer spending in both 2022 and 2023.

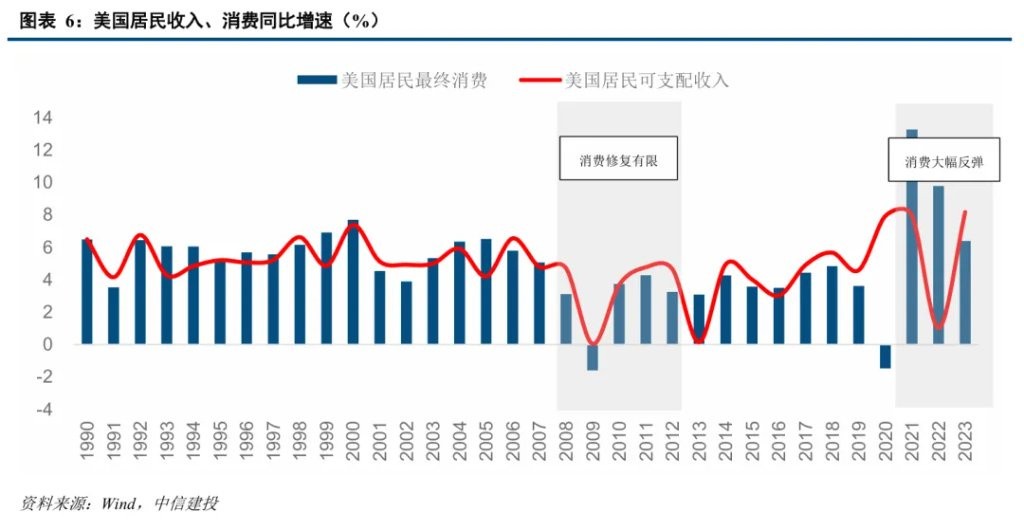

(2) Different effects of the two rounds of consumption stimulus policies in the United States Firstly, the stimulus policies after the 2008 financial crisis moderately improved residents' income, but consumption recovery was limited, with the central tendency still below pre-crisis levels.

After the outbreak of the financial crisis, the U.S. government successively introduced stimulus measures such as the "Economic Stimulus Act" and the "American Recovery and Reinvestment Act." In 2008, the Bush administration implemented a fiscal stimulus of $168 billion, and in February 2009, the Obama administration launched a $787 billion recovery plan, which included household tax cuts, unemployment benefits, and investment promotion. In February, a $275 billion "Homeowner Affordability and Stability Plan" was also introduced, and from July to August, a $3 billion subsidy program for trading in old cars for new ones was implemented.

The policy effects were limited. Private consumption continued to decline and turned negative in 2008 and 2009, starting to recover in 2010, but the central tendency remained significantly below that of 2007.

Secondly, during the COVID-19 pandemic, stimulus policies improved residents' income and asset prices, leading to a rebound in consumption, with the central tendency higher than before the pandemic.

After private consumption in the U.S. turned negative year-on-year due to the COVID-19 pandemic in 2020, a series of large-scale stimulus policies were introduced. Both the Trump and Biden administrations launched multiple rounds of economic relief plans, totaling $6 trillion, with direct cash subsidies to households amounting to as much as $870 billion, along with unemployment assistance, tax cuts, measures to stabilize businesses and employment, and various investment promotion policies.

The policy effects were significant. The central tendency of private consumption was significantly higher than before the pandemic, maintaining strong consumer spending from 2021 to 2023.

(3) The differences in consumption stimulus effects are not due to the intensity of the policies.

Historically, there have been significant differences in the effects of stimulus policies in Japan, primarily due to the stark differences in residents' income during the two periods.

After 1998, Japan's residents' labor income turned negative, and property income declined significantly due to continuous drops in stock and real estate prices, leading to a deterioration in both types of income, which did not turn positive until 2005.

Although the government provided transfer payments averaging about 3% of residents' disposable income each year, overall income in the resident sector continued to shrink during this period, making it naturally difficult for consumption to improve.

After the COVID-19 pandemic in 2020, Japan's residents' labor income experienced a brief decline but quickly recovered, with growth rates gradually exceeding those before the pandemic. Property income significantly improved due to continuous increases in stock and real estate prices.

Additionally, from 2020 to 2022, transfer payments averaging about 2.8% of residents' disposable income were provided each year. Residents' disposable income continued to improve, existing wealth kept appreciating, and both consumption capacity and willingness to consume continued to recover, leading to a noticeable rebound in consumption.

Comparing the fiscal stimulus in Japan during these two periods, it can be said that the fiscal transfer payments to residents in 1998 were stronger than during the pandemic, yet the consumption stimulus effects were more pronounced during the pandemic. This proves that the elasticity of consumption is not solely dependent on fiscal stimulus

(4) The key to stimulating consumption lies in whether residents' income and wealth can stabilize and rebound

There are significant differences in the effects of the two stimulus policies in the United States, also due to the large differences in household income during the two periods.

During the two crises, the government's transfer payments did not differ much in intensity.

First, let’s present a data point that challenges intuition: the fiscal transfer payments to residents' income after the pandemic were not much stronger than those in 2008.

From 2008 to 2012, the government provided transfer payments averaging about 5.6% of residents' disposable income each year; during the period of 2020-2021, this figure was 5.7%. In other words, fiscal subsidies are not the fundamental reason for the strong consumption in the U.S. later on.

If a 5.7% fiscal transfer payment could stimulate final consumption, we should have seen strong U.S. household consumption in the later stages of the 2008 financial crisis. However, as we all know, household consumption in the U.S. continued to be weak after the financial crisis.

One significant difference is in the performance of labor income and property income.

From 2008 to 2012, although residents' labor income rebounded after a deep decline, it did not reach pre-financial crisis levels, and residents' property income also experienced significant negative growth, only starting to improve significantly around 2011. The impact of the financial crisis on residents' balance sheets was not truly repaired until around 2011.

After the COVID-19 pandemic, residents' labor income quickly recovered and exceeded pre-pandemic levels, and property income also saw a significant improvement after a brief slowdown (mainly due to the rebound in real estate and stock markets).

Another factor with significant differences is the consumption tendency dominated by the wealth effect.

During the period from 2008 to 2012, residents' consumption tendency continued to decline, possibly due to continuous wealth losses, overall sluggish and consolidating real estate prices, and a slow recovery in the stock market, which only returned to pre-financial crisis levels in 2013 for the S&P 500.

After the COVID-19 pandemic, stock and real estate prices rose rapidly, significantly enhancing residents' wealth effect, leading to an increase in consumption tendency, even surpassing pre-pandemic levels.

3 Recent Re-evaluation of Chinese Residents' Consumption and Policy Effects (1) First, it is necessary to see that post-epidemic growth in residents' income and wealth remains weak

The growth rate of residents' disposable income has not yet recovered to pre-epidemic levels.

From the macro funds flow statement accounting data, in 2019, the growth rate of residents' disposable income was 9.3%, while from 2020 to 2023, it was 5.4%, 8.9%, 6.6%, and 6.5%, consistently below pre-epidemic levels.

From a structural perspective, labor income growth has continuously slowed down in 2022 and 2023, while property income saw a significant decline in growth mainly in 2022. Household survey data also shows that net household property income has significantly declined since 2022.

Correspondingly, post-epidemic consumption growth has also shown a fluctuating and weak trend. After smoothing out the low base disturbances, the overall consumption growth rate has slowed down.

Adjustments in stock and real estate prices, along with negative wealth effects, impact residents' willingness to consume.

In 2022, the total housing assets of households in China amounted to 268 trillion yuan, while the total assets in stocks and funds were 56 trillion yuan. Since the second half of 2021, real estate prices have been adjusting, and the CSI 300 index has been fluctuating downward from February 2021 to September 2024, with a decline of nearly 45%. Moreover, 2020 and 2021 were significant years for fund issuance, leading to substantial losses for investors. The contraction of household wealth has reduced the willingness to spend on consumption.

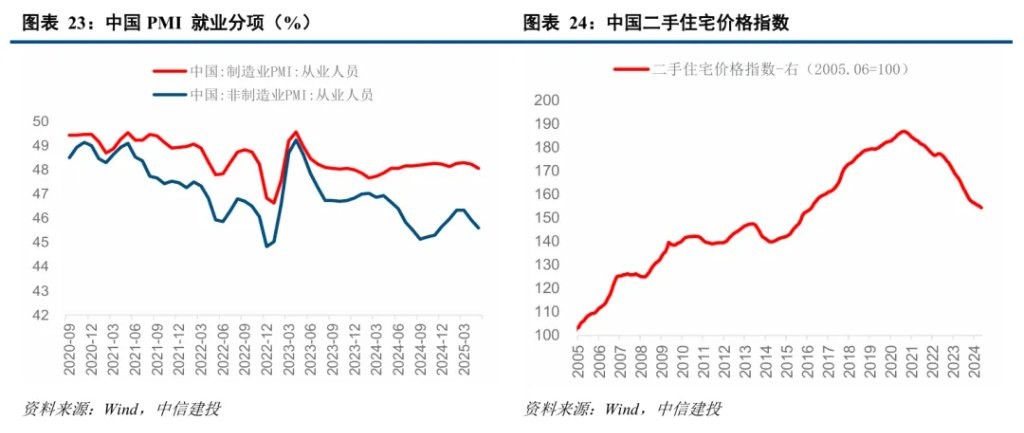

Additionally, multiple shocks from the epidemic have impacted employment, and the contraction of the real estate industry chain has weakened residents' employment and income expectations, making consumption more cautious.

(2) China has existing consumption stimulus policies: the direction is correct, but there should not be excessive concern about the intensity.

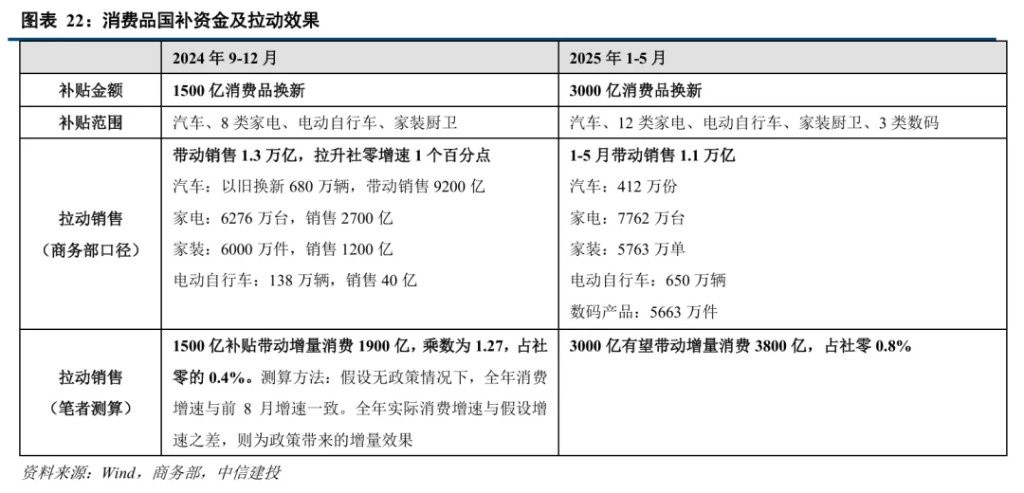

In August 2024, the state raised 150 billion yuan in subsidies for consumption specifically through national debt funds for the first time.

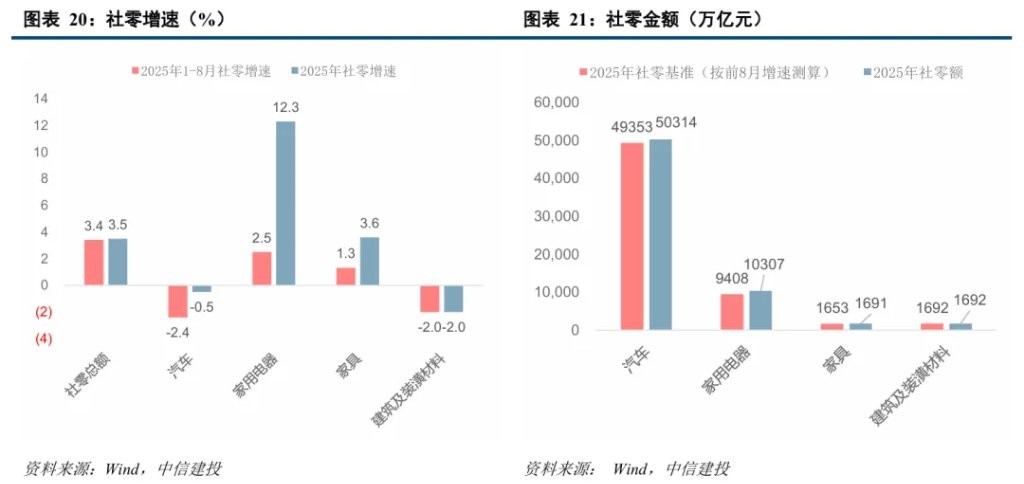

In early August 2024, 150 billion yuan in national debt funds for the replacement of old consumer goods began to be fully allocated to localities. According to data from the Ministry of Commerce, this has driven sales of 1.3 trillion yuan, boosting retail sales growth by over 1 percentage point. The replacement of old goods has driven automobile sales of 920 billion yuan and sales of eight major categories of household appliances by 240 billion yuan, while home decoration and kitchen and bathroom "upgrades" have driven related product sales of about 120 billion yuan.

From a purely incremental perspective, we estimate that the 150 billion yuan in consumption subsidy funds has driven incremental consumption of 190 billion yuan, with a multiplier of 1.27, accounting for 0.4% of retail sales. The estimation method assumes that without policy intervention, the annual retail growth rates for automobiles, home appliances, home furnishings, and decoration would remain consistent with the growth rates of the first eight months, and the difference between the actual annual growth rate and the assumed growth rate represents the incremental effect brought about by the policy In 2025, consumer subsidy funds will double to 300 billion, and we expect to drive incremental consumption of 380 billion, accounting for 0.8% of social retail.

The 2025 government work report lists "expanding domestic demand" as a top priority, and the "Special Action Plan to Boost Consumption" further introduces 30 specific measures. The extent of policy strength should not be overly entangled; after all, the policy's increasing focus on consumption marks a significant shift and is heading in the right direction.

4 Traditional consumption expansion still requires patience, exploring new consumption opportunities

(1) In the short term, traditional consumption may still be constrained by income and wealth limitations

The momentum for employment and labor income growth may slow down. First, after experiencing a rush to export in the fourth quarter of last year and the first quarter of this year, the annual export distribution has been brought forward, and export growth in the second half of the year may not reach the level of the first half. Second, real estate investment has seen a widening decline month by month this year, and real estate prices remain in a downward trend, with the second half of the year likely still not optimistic. With weakened momentum in exports and real estate, residents' employment and labor income still face pressure.

Before the negative wealth effect is completely ended, it will be difficult to boost consumption willingness. From the second-hand housing price index of 70 large and medium-sized cities, since turning negative month-on-month in September 2021, there have only been signs of turning positive in February and March 2023, while the remaining 42 months have all shown negative month-on-month values. It will take time for real estate prices to stabilize, and correspondingly, residents' willingness to consume may be difficult to change in the short term.

(2) In the medium term, traditional consumption expansion has great potential but still requires patience

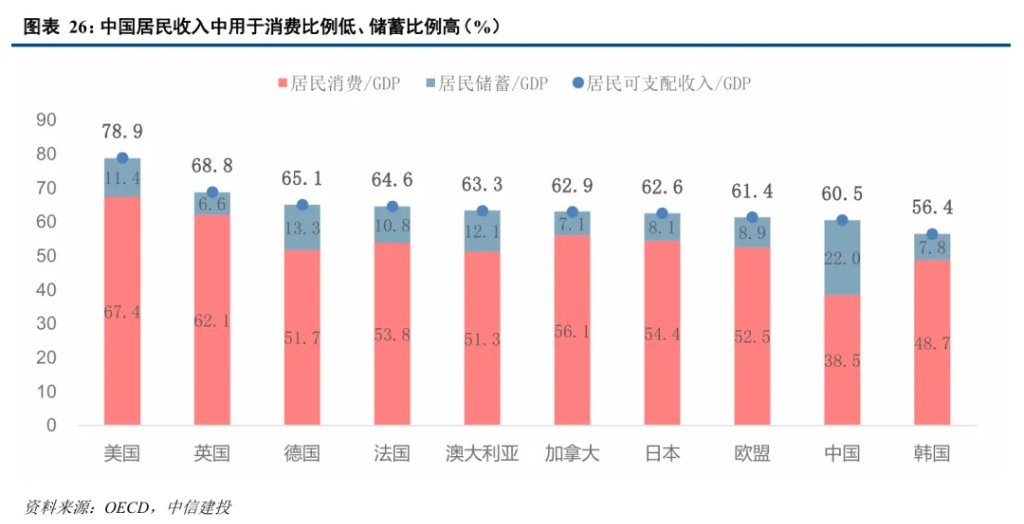

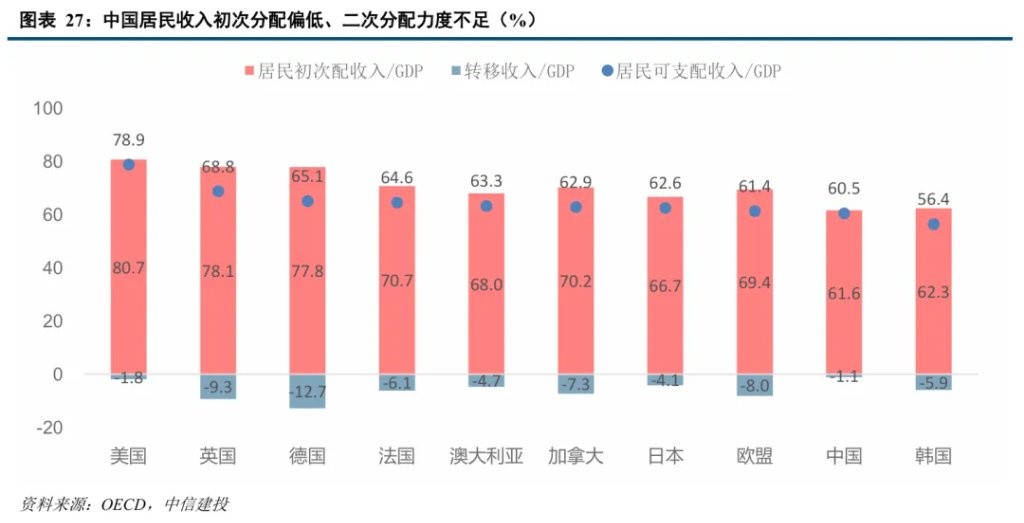

There is significant room for improvement in the share of residents' income in national income distribution. From the five-year average data from 2018 to 2022, the share of initial distribution income of residents in national income in China is 61.6%, which is relatively low compared to other developed countries. There is a 5 percentage point improvement space compared to Japan, about 8 percentage points compared to Australia, Canada, and France, and a 15 percentage point improvement space compared to Germany and the UK.

There is substantial room for adjustment in internal income distribution among residents. The proportion of residents' income used for transfer payments in GDP is relatively low in China, with a five-year average of 1.1% from 2018 to 2022, while Japan and Australia are above 4%, the UK, France, and Canada are between 6%-9%, and the average level in the European Union is around 8% High resident transfer payment adjustments often mean imposing more income and property taxes on high-income groups to subsidize the entire population, especially low-income families. This will increase the income of low-income groups, who have a higher propensity to consume, while improving the social security system.

Deepening reforms to enhance residents' income through multiple channels and improving secondary distribution will release consumption potential in the medium term, but it remains a gradual process.

In July 2024, the 20th Central Committee's Third Plenary Session clearly proposed to improve the income distribution system, increase the proportion of residents' income in national income distribution, raise the proportion of labor remuneration in primary distribution, and increase property income for urban and rural residents through multiple channels. This will provide a foundation for consumption expansion. It proposed to improve the redistribution adjustment mechanisms such as taxation, social security, and transfer payments, standardize the income distribution order, and regulate the wealth accumulation mechanism, which will enhance the overall consumption propensity of the resident sector, reduce excessively high resident savings rates, and release consumption potential.

(3) Actively explore new consumption investment opportunities with the potential to break through existing boundaries

From a conceptual perspective, familiar consumption belongs to traditional consumption, while new consumption is emerging and trendy.

The definition of traditional consumption is self-evident; it refers to consumption that consumers are already familiar with, including both goods and services.

Currently, there is no authoritative definition of new consumption; it is not confined to a specific industry and is not distinguished by price levels. Its main characteristics are being emerging, fresh, and trendy.

First, there are innovative forms of traditional consumption content, such as IP toys and blind boxes in the toy industry, new tea drinks, bulk snacks, light meal replacements, and functional beverages in the food and beverage industry, ancient luxury gold in jewelry, national trend clothing in the apparel industry, emerging brands in the maternal and infant products industry, and ice and snow tourism and "IP tourism" combined with film and television dramas and games in the cultural tourism industry.

Second, there are entirely new consumption contents brought about by technological advancements and model innovations. These have a strong "try-it-out" attribute, such as AI glasses, smart wearables, new technology products, digital consumer goods like virtual clothing, and script killing.

From a driving force perspective, traditional consumption is dominated by residents' income, while new consumption is often driven by product strength to "break through."

Traditional consumption has a large volume and is mainly influenced by economic conditions and residents' income, making it cyclical.

New consumption is a structural prosperity track, less sensitive to economic fluctuations, with strong growth and anti-cyclical attributes. The supply side is mainly driven by product strength, brand strength, and innovation, while the demand side is driven by consumer emotional recognition and can easily "break through" and become popular during phases of traffic dividends.

In terms of scale, traditional consumption has a large volume, while new consumption is smaller in scale. In 2024, China's final consumption expenditure will reach 54 trillion yuan, the vast majority of which should belong to traditional consumption.

New consumption covers a wide range of industries and fields, with no accurate scale, but representative companies such as POP MART, Mixue Ice City, and Laopu Gold are expected to have a combined revenue of 46.3 billion yuan in 2024. iiMedia Consulting estimates that the market size of China's millet economy will reach 168.9 billion yuan in 2024. If moderately expanded, it may still fall short of a trillion market scale. Regardless, compared to the total resident consumption of 54 trillion yuan, new consumption is concentrated in specific circles and categories, accounting for a very small proportion, but with broad growth potential.

From the perspective of consumer groups, traditional consumption covers a wide range, while new consumption groups tend to be younger.

Traditional consumer groups cover all age groups, with consumption goals primarily focused on "survival" and "development," but also including "enjoyment."

The consumer group of new consumption is younger, represented by those born in the 1990s and Generation Z, with consumption goals primarily focused on "enjoyment." Their core pursuit is the emotional value during the consumption process, including self-pleasure, healing, curiosity, experience, companionship, and social interaction, rather than pure pragmatism.

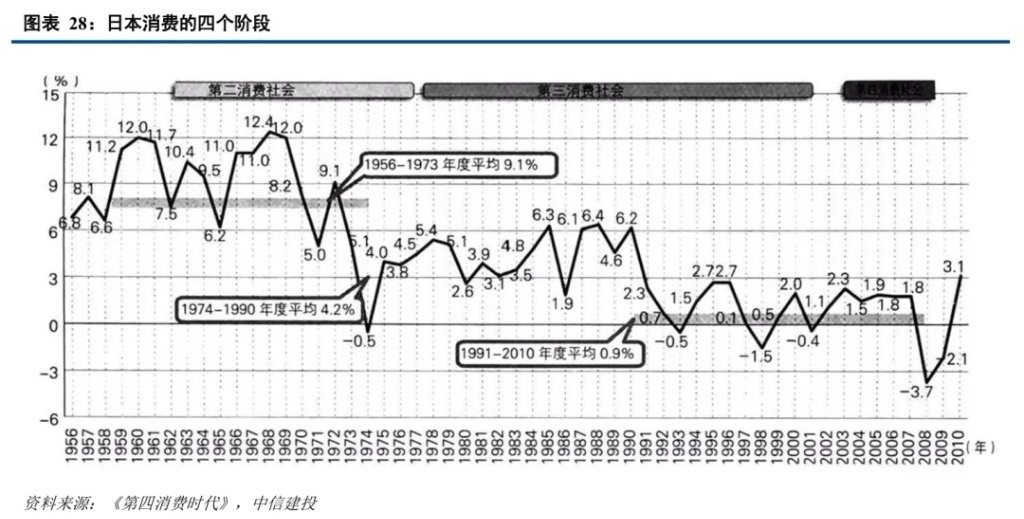

From international experience, new consumption is essentially counter-cyclical.

Japanese writer Miura Noboru divides Japanese consumption into four stages in his book "The Fourth Consumption Era." In the third consumption stage, consumption orientation begins to shift towards personalization, diversification, and differentiation, with the economic background being a low-growth phase.

The current boost and expansion of traditional consumption in our country still require time. New consumption, due to its growth potential and counter-cyclical attributes, stands out with its scarcity value and remains a key allocation direction. In addition to categories that have already gained popularity, new consumption investment opportunities with the potential to break through can be actively explored based on characteristics such as product strength, brand strength, innovation, and emotional value.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at their own risk