The "rule of thumb" has failed, and the dollar's plunge has caught Wall Street forex experts off guard

Affected by Trump's policies, the US dollar unexpectedly fell by more than 10%, breaking the effectiveness of traditional trading signals such as interest rate differentials and risk aversion. Previously reliable models and correlations have failed, leading to a money market fund's return expected to record the worst annual performance since 2017. Traders are struggling to adapt to this "new normal."

Some of Wall Street's most time-tested currency strategies are failing, leaving even the most seasoned forex traders perplexed.

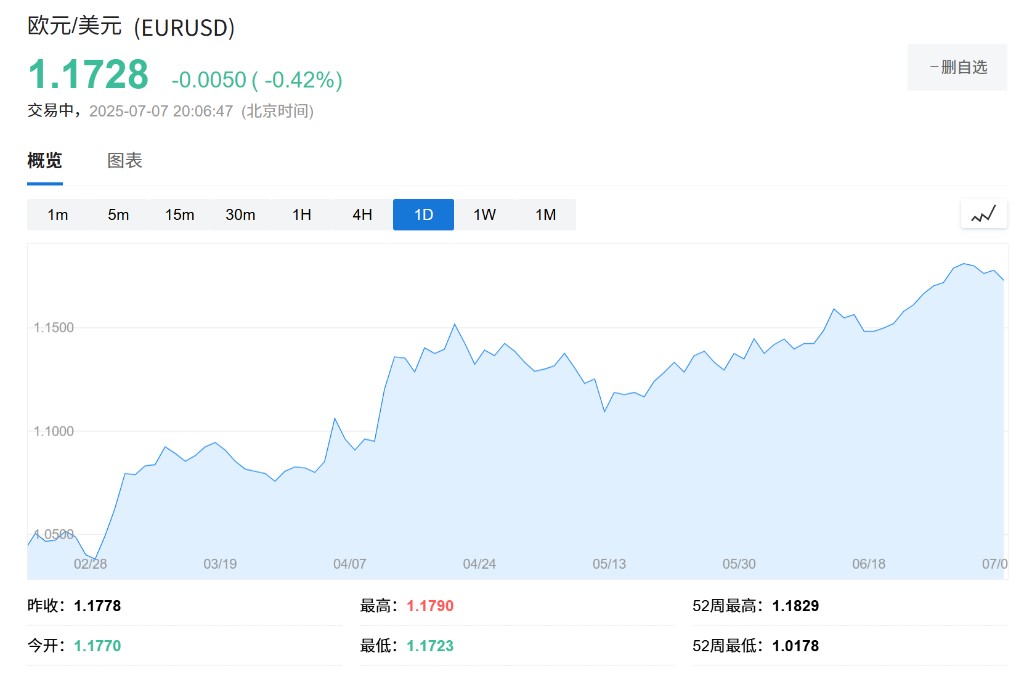

This year, influenced by Trump's tax and tariff policies, the dollar unexpectedly plummeted, falling more than 10% against the euro and the Swiss franc, catching many forex experts off guard. Previously reliable trading signals—such as selling euros when Europe cuts interest rates or buying dollars when market risk aversion rises—are now frequently failing.

This shift has caused real losses for investors, with an index tracking currency funds returning only 0.6% this year, potentially marking the worst annual performance since 2017.

Traders say that while clear reasons can be found for currency fluctuations in hindsight, the speed and severity of this year's market changes have caught them off guard. Traders from UBS and Mizuho candidly admit that the models they relied on to make accurate judgments are now frequently failing.

Model Failures and the "New Normal" of Interest Rate Logic Breakdown

At Mizuho, this confusion has become a persistent topic in the trading room. Trader Jordan Rochester revealed that his colleague, options trader Nikhil Kochhar, often shouts "Why!" in the face of perplexing market fluctuations, prompting Rochester to gift him a custom baseball cap emblazoned with the phrase.

"A month or two later, someone will pat us on the shoulder and say, 'Why didn't you short more dollars? Isn't it obvious?'" Rochester stated:

"But the fact is, it's not obvious."

This sentiment is widespread on Wall Street. Many long-tested strategies, such as judging currency trends based on interest rate differentials or geopolitical risks, have now failed. Traders find that the strategies they once relied on are giving false signals, making them hesitant to establish positions.

What confounds traders the most is the failure of the interest rate differential, traditionally the most reliable indicator. Theoretically, the U.S. Federal Reserve has maintained interest rates in the range of 4.25% to 4.5%, while the European Central Bank cut its deposit rate to 2% in June, marking the eighth rate cut of this cycle. Such a significant interest rate differential should support a strong dollar.

However, the reality is quite the opposite. The euro has surged 13% against the dollar this year, reaching a four-year high.

Idanna Appio from First Eagle Investments is one of those investors who are cautious about the models. Her model currently signals to maintain a neutral stance on the dollar, partly because the U.S. has higher interest rates. But her intuition tells her this is the wrong judgment, so she chooses to continue shorting the dollar, opting instead to hold euros and yen "The interest rate differential has worked well for a long time," she said, "but now, there are other factors at play."

Brad Bechtel, head of global foreign exchange sales and trading at Jefferies, also believes that the dollar will eventually experience a sharp rebound to realign with interest rate trends:

"Whatever the driving factors are, they are pushing things to extremes because they are not affecting central bank policies or growth expectations; something is going wrong."

Old Correlations Are Breaking Down

In addition to interest rate logic, the correlations between other asset prices have changed in unusual ways. For example, the dollar has typically been viewed as a safe-haven asset, rising during market panic. However, now, the dollar sometimes moves inversely to the VIX fear index, meaning that the dollar may fall when investors are fearful.

This breakdown of correlation is particularly evident in the market reactions triggered by conflicts in the Middle East. In the past, traders could expect that tensions in the Middle East would lead to a surge in both oil and dollar prices. But now, this predictability has diminished significantly. For instance, after Iran attacked a U.S. military base in Qatar on June 23, Brent crude oil prices briefly soared above $81 per barrel but then fell sharply as the attack was deemed symbolic. In contrast, the dollar's fluctuations that day were much smaller than expected.

"When correlations break down, trading becomes very, very difficult," said Nikhil Kochhar, a trader at Mizuho:

"In events like the outbreak of the Israel-Hamas war, you now question whether this will lead to a rise or fall in the dollar."

Traders believe that new forces are driving the market, such as capital flowing widely out of the U.S. and foreign investors purchasing dollar-hedged products. However, due to the scarcity of relevant data, these new forces are difficult to track effectively, making it challenging for professionals to adjust their trading systems accordingly.

The result is that traders generally choose to reduce risk, executing simpler, smaller-scale trades. Lu Xin, a currency derivatives trader at UBS, stated that he is becoming more cautious regarding risk, and trading strategies are becoming stricter:

"People are more afraid to hold short options positions before the weekend; the 'rule of thumb' is outdated, and everyone is starting to accept that more uncertainty is the new normal."