The 10 most challenging issues in the global market today, this is UBS Group AG's response

UBS stated that U.S. tariffs are equivalent to imposing a 1.5% GDP tax, causing global growth to fall to a historical low of 1.3% annualized growth rate; the dollar is experiencing cyclical depreciation but not a long-term trend; the inflation impact of tariffs will be reflected in the July CPI; European stock markets have a clear valuation advantage over U.S. stocks, with a price-to-earnings ratio discount of 25%; central banks in various countries are generally shifting to accommodative policies to respond to tariff shocks; it is expected that China will further cut policy interest rates by 20-30 basis points in the second half of the year

UBS answered the top 10 global economic questions that investors are most concerned about in its latest research report, covering core market worries from tariff impacts to dollar depreciation.

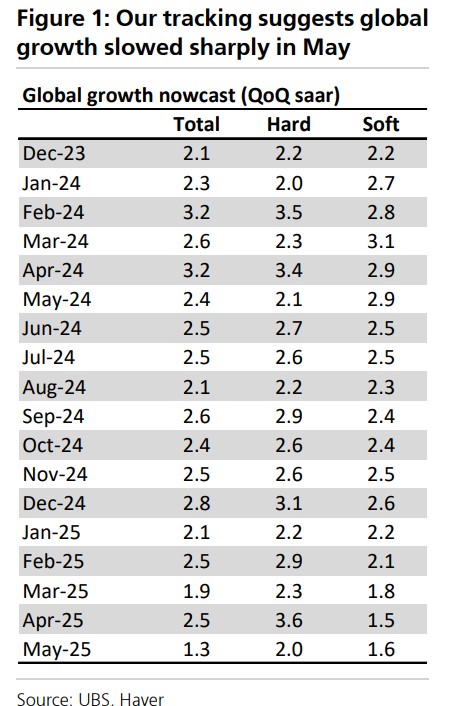

On July 8th, according to news from the Chasing Wind Trading Desk, UBS's research team released a significant report that provides an in-depth analysis of the top ten concerns for investors. The report indicates that the current global economy faces a complex web of challenges, with U.S. tariffs equivalent to a 1.5% GDP tax on importers, and global growth tracking valuations showing only a 1.3% annualized growth rate, which is at the 8th percentile historically.

UBS also stated in the report that the depreciation of the dollar and adjustments in central bank policies have become the current market focus. Although UBS holds a cyclical bearish view on the dollar, it does not expect this to mark the beginning of a long-term depreciation trend. The impact of tariffs on inflation is expected to be reflected in the July CPI data, while the Federal Reserve faces dual pressures from inflation and employment.

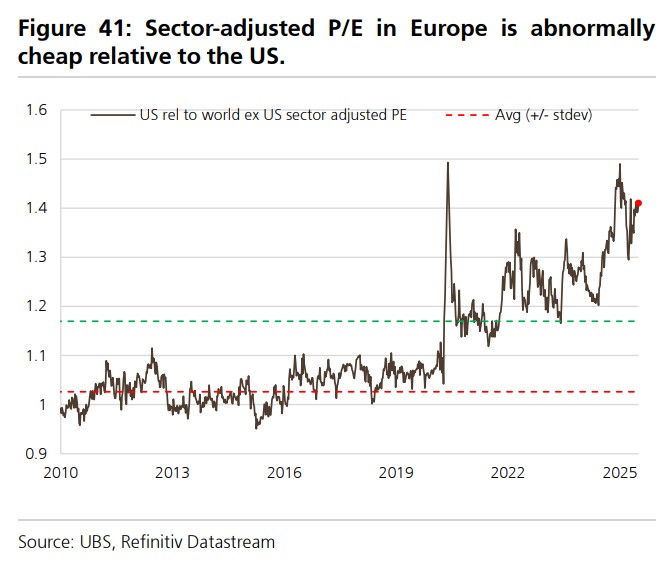

UBS pointed out that European stock markets have a valuation advantage relative to U.S. stocks, with European stock market valuations showing an unusual discount compared to U.S. stocks, with industry-adjusted price-to-earnings ratios 25% lower than those in the U.S., far exceeding the normal historical level of 7%. The firm maintains a benchmark allocation strategy of overweighting European stocks while underweighting U.S. stocks.

The report also mentioned the impact of Trump's "Big Beautiful Plan" on the U.S. economy, the general shift of global central banks towards easing policies in response to the growth slowdown caused by tariff impacts, and the outlook for economic stimulus policies in China for the second half of the year.

Question 1: The Impact of Tariffs on Global Growth Has Already Emerged

The report states that the tariffs currently implemented by the U.S. are equivalent to a tax of about 1.5% of GDP on U.S. importers, and even with trade agreements, there is no significant downward trend in tariffs.

Data from the U.S. Treasury shows that based on June's tariff revenue, over $300 billion in tariff revenue is collected annually. According to news from the Chasing Wind Trading Desk, Morgan Stanley previously stated in a report that U.S. tariff revenue has annualized to $327 billion, accounting for 1.1% of GDP.

UBS indicated that in April, following the announcement of tariffs, there was a sharp divergence between global hard data and soft data (reaching the highest gap in 27 years), with hard data showing an annualized growth of 3.6%, while soft data only indicated 1.3%. However, starting in May, the two began to converge, as the deterioration of hard data was faster than the improvement of soft data.

UBS stated that its global growth tracking composite data shows that global growth is only at a 1.3% annualized growth rate, which is at the 8th percentile historically.

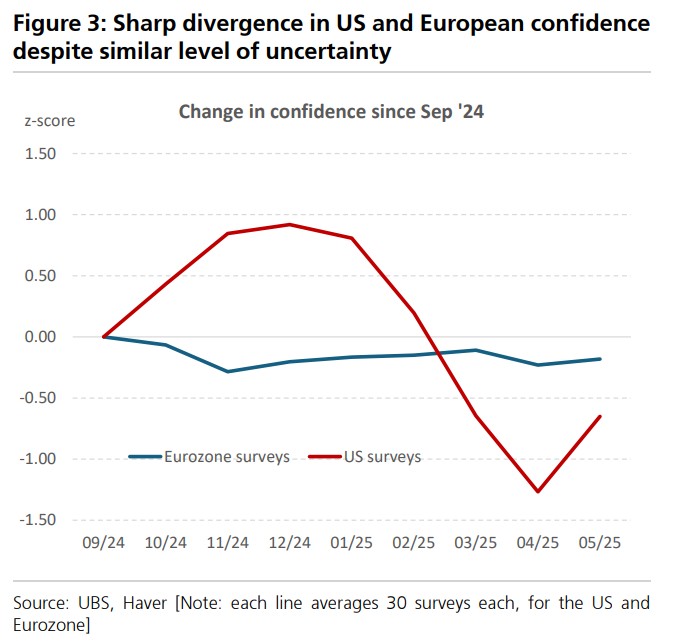

It is noteworthy that the decline in the U.S. confidence index has exceeded that of other regions, while European survey data has remained relatively stable, despite both regions facing similar levels of policy uncertainty. In the U.S., survey data is now 1.5 standard deviations lower than the levels in December

Question 2: How is this dollar sell-off different from previous ones?

UBS holds a cyclical bearish view on the dollar but does not believe this marks the beginning of a long-term depreciation trend.

UBS analysts believe that the dollar's depreciation is primarily driven by three factors: increased demand for hedging against dollar downside, a cyclical slowdown in the U.S. economy, and improving trend growth in other parts of the world. Currently, the first factor is already at play, and the second factor is about to manifest.

Foreign investors hold $31.3 trillion in U.S. long-term securities, of which $6.3 trillion is held by official accounts. UBS estimates that if the foreign exchange hedging ratio increases by 5 percentage points, it would generate $1.25 trillion in dollar sell-off flow, far exceeding the U.S. annual external deficit.

However, UBS emphasizes that the current dollar sell-off does not possess the necessary conditions for a long-term dollar downcycle seen in the past—improving growth in other regions and a reduction in risk premiums. This will limit the scope and duration of the current dollar depreciation cycle.

Question 3: The lagging impact of tariffs on inflation

Although the U.S. has implemented large-scale tariffs, equivalent to a 1.1% increase in PCE prices, there has not yet been a significant reflection in the official CPI and PCE data.

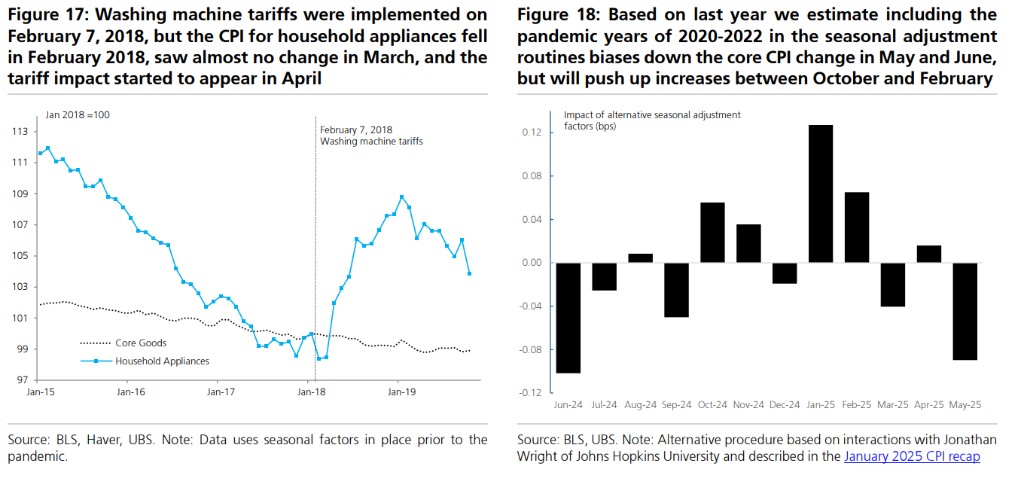

UBS believes this lag is primarily caused by four factors: shipping date exemptions, corporate inventory buffers, slow price transmission of intermediate and capital goods, and the bi-monthly sampling method of CPI.

UBS expects to see a significant impact of tariffs on major inflation indicators only by the July CPI data (released in August).

The bank noted that during the Trump 1.0 era, the experience of a 20% tariff on general washing machines in 2018-2019 indicated that it takes 2-3 months for the effects of tariffs to manifest clearly in the CPI. The currently implemented 10% general tariff is expected to have the most inflationary impact, with a similar timing effect.

Question 4: How are exporters (globally) responding to U.S. tariffs?

The report states that the potential pre-tariff effects observed in the first quarter and in April/May indicate that a stable state due to price increases and quantity adjustments has not yet been reached.

There is a persistent gap in trade data reported by the U.S. and China, and discrepancies exist between container shipping data and official trade data.

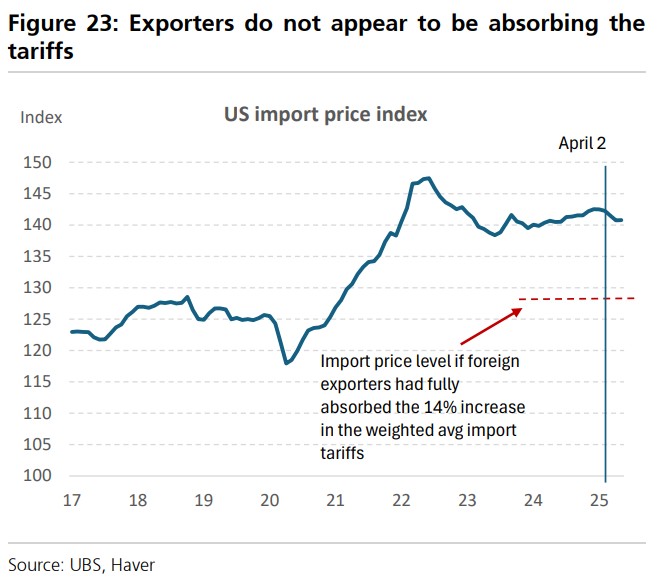

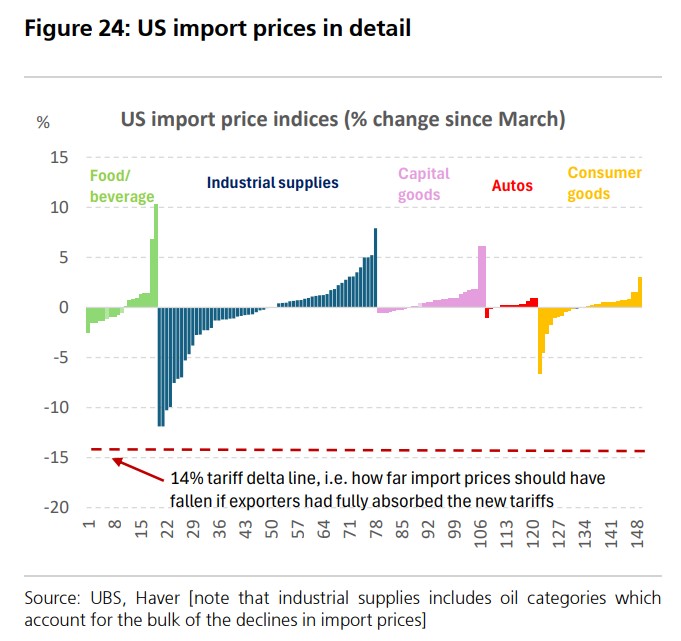

However, there is almost no evidence that foreign exporters absorb tariffs by lowering export prices. In April, U.S. import prices fell by only 0.5%, and remained flat in May, indicating that foreign exporters have hardly absorbed tariffs by lowering export prices.

However, there is almost no evidence that foreign exporters absorb tariffs by lowering export prices. In April, U.S. import prices fell by only 0.5%, and remained flat in May, indicating that foreign exporters have hardly absorbed tariffs by lowering export prices.

UBS believes that foreign exporters may indeed have absorbed the impact of the U.S. dollar depreciation on their profits, while U.S. importers bear the majority of the tariff costs. Currently, there are no clear signs of transshipment, but it is still too early to tell.

Question 5: Has the U.S. fiscal outlook pushed up global yields?

Currently, the vast majority of changes in the U.S. budget deficit stem from the extension of the 2017 tax cuts, which had been anticipated after the elections.

UBS is very concerned about the long-term supply of U.S. Treasuries, but historically, demand fluctuations often far exceed supply fluctuations.

If concerns about an economic slowdown continue to rise, domestic demand for U.S. Treasuries should increase to a level sufficient to easily absorb this supply.

UBS believes that the bottom for the 10-year Treasury yield should be at 2.75%, even in an extremely tight environment.

Question 6: What evidence is there of capital outflows from the U.S.?

The view that foreign investors are reducing their exposure to U.S. assets has spread widely among market participants.

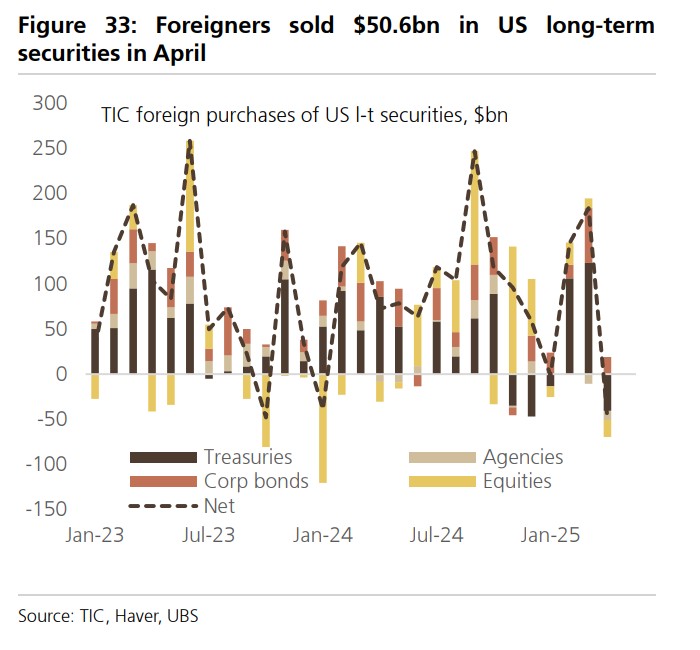

UBS stated that the U.S. TIC data for April provided evidence of a sell-off of U.S. assets, but it is unclear whether this rotation continued beyond April. The data showed that foreign investors net sold $50.6 billion in U.S. long-term securities, including $18.8 billion in stocks and $40.8 billion in government bonds.

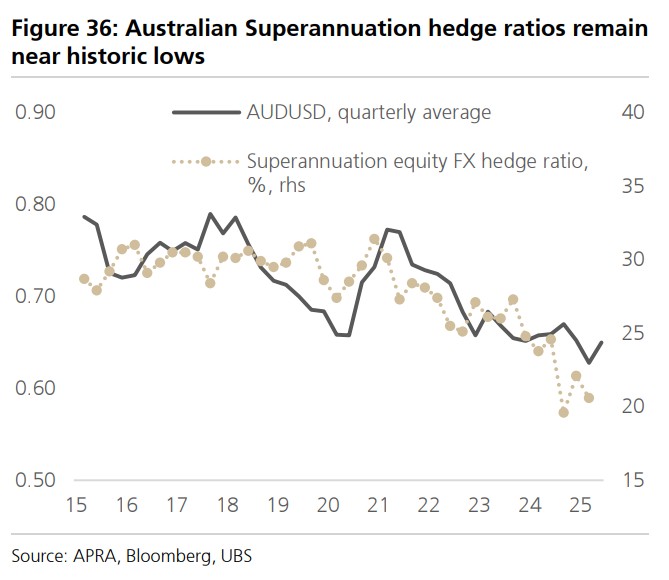

UBS believes that the continued depreciation of the dollar may reflect that global investors have increased their foreign exchange hedging ratio for U.S. assets. The foreign exchange hedging data from Australian and Canadian pension funds shows that the current hedging ratio remains at historically low levels, with room for further increases.

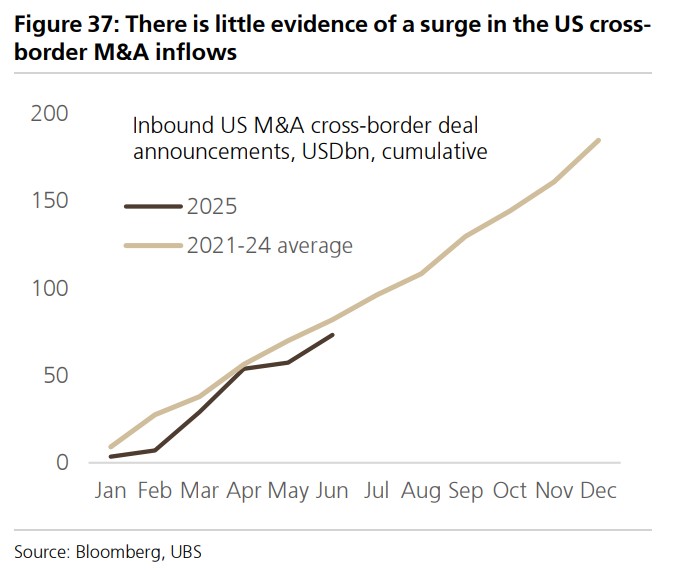

UBS stated that so far, there has been no clear evidence in merger and acquisition announcement data to verify the federal government's claim of over $10 trillion in FDI investment commitments flowing into the U.S.

Question 7: How "exceptional" is the U.S. stock market compared to Europe?

When global GDP slows down, the U.S. usually performs well, but this time the GDP slowdown is centered around the U.S., and the Eurozone has unexpectedly performed much better than the U.S., although this has not been fully reflected in market trends.

The aspects in which the U.S. is performing exceptionally poorly relative to the Eurozone include: valuation (exceptionally expensive relative to the EU), fiscal conditions, and household excess savings, as detailed below:

The U.S. stock market's price-to-earnings ratio adjusted for sectors is 25% higher than that of Europe, while the historical average is only 7%.

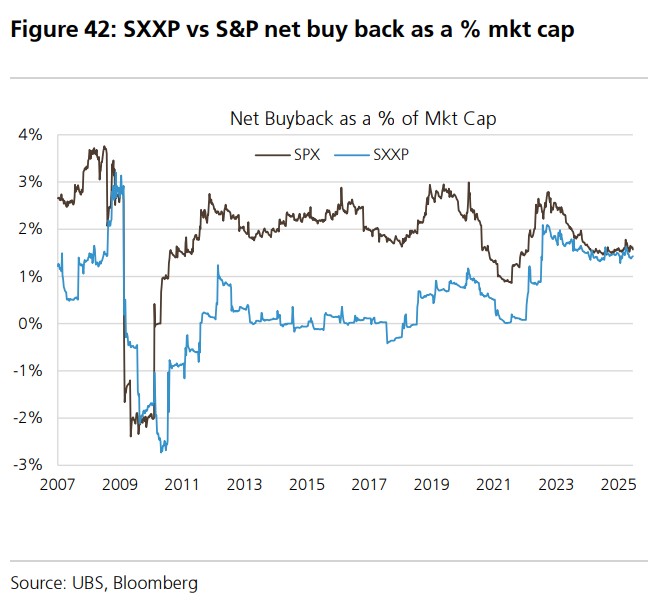

The total return in Europe (dividends plus buybacks) is now 4.4%, while in the U.S. it is 2.8%.

Europe's fiscal conditions and household excess savings are significantly better than those in the U.S., with Europe's excess savings at about 10% of GDP, while the U.S. is only 2%.

UBS states that the areas where the U.S. is no longer "exceptional" compared to the Eurozone include: buybacks (as a percentage of market value) and GDP growth (slightly lower than the EU in 2026).

Question 8: Is the "Big Beautiful Act" helpful or harmful to U.S. growth?

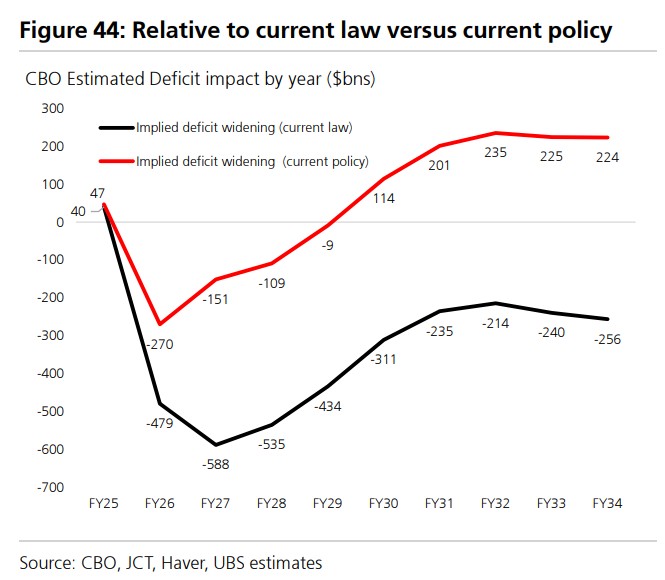

UBS indicates that the act increases the deficit before 2026 and then shifts to narrowing, with a total reduction of the deficit by $400 billion over ten years.

The bank expects that the "Big Beautiful Act" will contribute about 45 basis points to growth before 2026, after which the fiscal drag will begin to show.

The act expands the business provisions of the 2017 tax reform, including full expensing, R&D tax credits, and changes in deductions, with student loan reductions being an important recent source of funding.

Question 9: How are central banks responding to the global tariff escalation?

The actual impact of tariff shocks differs significantly from expectations, primarily manifested in the depreciation of the dollar and a lack of retaliatory measures. This fundamentally changes economic outcomes, including central bank policy orientations.

For central banks outside of the Federal Reserve, the current situation is much simpler than the previously feared stagflation scenario. Tariff shocks clearly constitute a negative growth shock, and may also be a deflationary shock. Since April 2, the average one-year interest rate in developed markets has fallen by 30 basis points, while in emerging markets it has decreased by about 50 basis points.

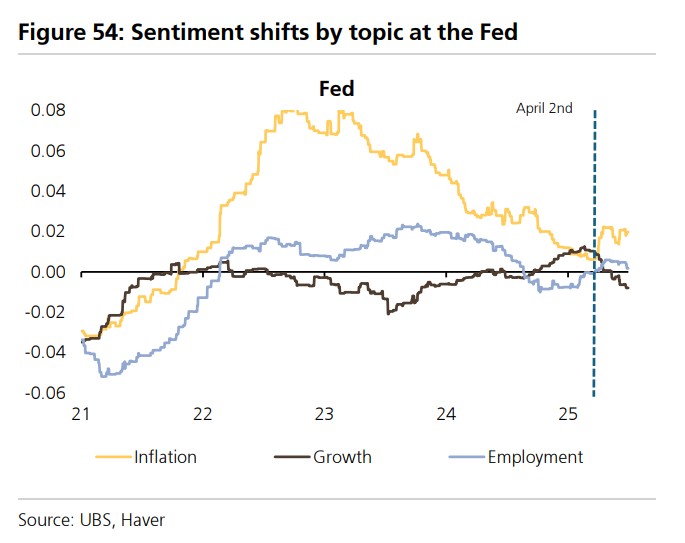

UBS's in-depth analysis model shows that among the G3 central banks, the European Central Bank has turned the most dovish, while the Bank of Japan is beginning to worry about growth. The Federal Reserve, on the other hand, faces a dilemma.

If the rise in inflation exceeds the unemployment rate, the Federal Reserve's policy rule suggests raising interest rates. However, if tariffs are primarily a one-time price level shock, the Federal Reserve may choose to prioritize addressing higher unemployment rates. Current signs indicate that the Federal Reserve tends to support the labor market.

If the rise in inflation exceeds the unemployment rate, the Federal Reserve's policy rule suggests raising interest rates. However, if tariffs are primarily a one-time price level shock, the Federal Reserve may choose to prioritize addressing higher unemployment rates. Current signs indicate that the Federal Reserve tends to support the labor market.

Question 10: How many stimulus measures has China implemented, and how many are yet to be introduced?

China set a GDP growth target of "around 5%" at the National People's Congress meeting in March and announced moderate policy stimulus measures. The broad fiscal deficit expanded to 1.5-2% of GDP, with monetary and credit policies set to "moderately loose." UBS expects the policy interest rate to be cut by 30-40 basis points.

In terms of policy implementation, the central bank lowered the policy interest rate by 10 basis points in May, reduced the reserve requirement ratio by 50 basis points, and announced new relending tools to support consumption and innovation. The net issuance of government bonds was strong in the first half of the year, driving credit growth in June to a year-on-year increase of 8.8%.

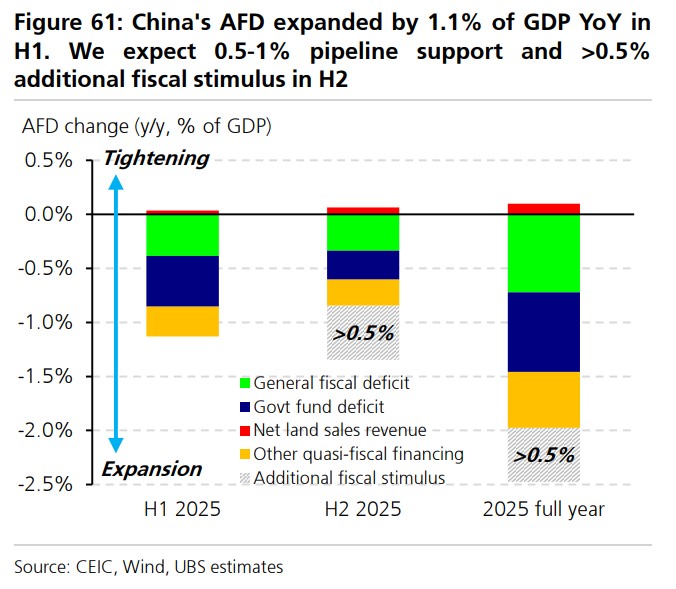

UBS estimates that China's broad fiscal deficit expanded to 1.1% of GDP year-on-year in the first half of the year. It is expected that the remaining planned fiscal stimulus (0.5-1% of GDP) will be delivered in the second half of the year, and additional fiscal stimulus exceeding 0.5% of GDP may be introduced, potentially at the end of the third quarter.

Additionally, UBS expects a further reduction of 20-30 basis points in the policy interest rate.