Contrary to Goldman Sachs! Deutsche Bank: The strong fundamentals of platinum will continue until next year

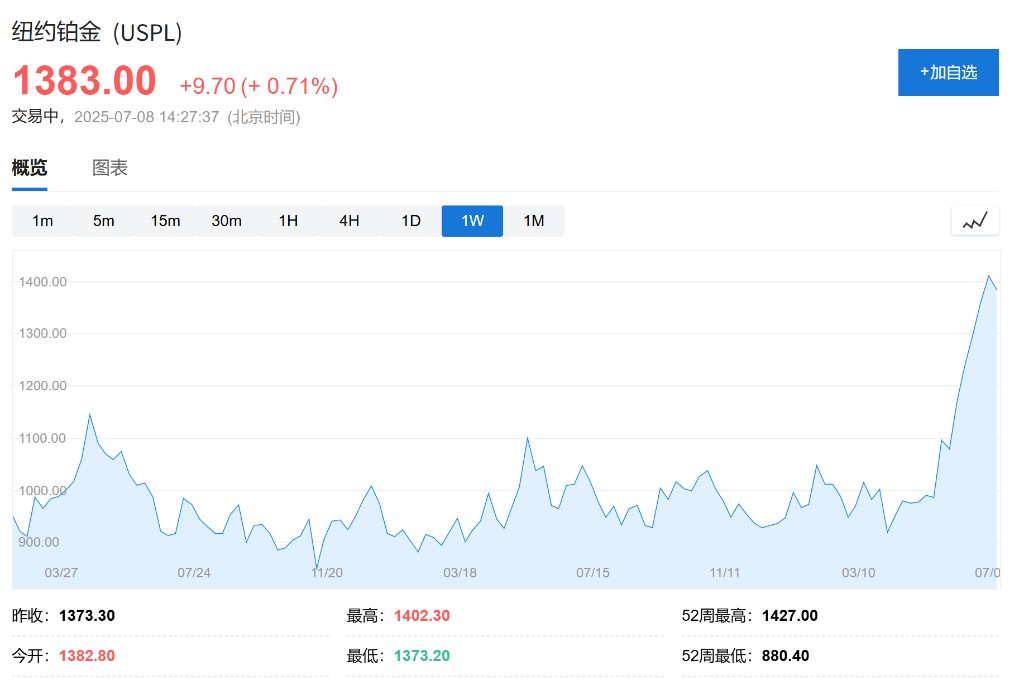

Unlike Goldman Sachs' pessimistic expectations, Deutsche Bank believes that the strong fundamentals of platinum will continue until 2026, supported by four consecutive years of supply deficits and structural demand. The trend of gold shifting to platinum as an alternative and industrial restocking both underpin the strong fundamentals of platinum. Based on the above optimistic expectations, Deutsche Bank believes that platinum prices could reach USD 1,550 per ounce in 2026, which has room for growth compared to its base forecast of USD 1,400 per ounce

Deutsche Bank believes that considering the continuous supply deficit for four years and structural demand support, the fundamentals of platinum will remain strong until 2026.

According to news from the Chasing Wind Trading Desk, Deutsche Bank analysts stated in a report on July 7 that since 2023, there has been a significant shortage of platinum. By next year, the fundamental shortage of platinum will enter its fourth year, with four consecutive years of supply deficit providing solid support for prices.

Continuous fundamental shortage will eventually reflect in prices

Deutsche Bank analysts stated that the continuous fundamental shortage of platinum will eventually reflect in prices, although the specific timing is indeed difficult to determine.

Compared to the levels from 2018 to 2022, the demand for platinum in the automotive catalyst (autocat) sector remains strong. Moreover, the sales performance of plug-in hybrid electric vehicles (PHEVs) is stronger than that of battery electric vehicles (BEVs), which may slow down the decline in demand for platinum group metal catalysts, far below previous expectations for a decline in demand in the coming years.

Deutsche Bank noted that the situation for platinum has changed over the past two months, mainly due to:

(a) The trend of gold turning to platinum as a substitute in jewelry manufacturing is supported;

(b) The rise in platinum leasing rates is seen as a sign of physical shortage;

(c) Several years of deficits may have eroded industrial inventories, leading to a need for some replenishment.

Based on the above optimistic expectations, Deutsche Bank believes that platinum prices could reach $1550 per ounce by 2026, which has room for growth compared to its base forecast of $1400 per ounce.

Goldman Sachs warns: Speculative bubble will eventually burst

In contrast to Deutsche Bank's optimistic outlook, Goldman Sachs analysts Lina Thomas and Daan Struyven bluntly pointed out in their report that the main driving force pushing platinum to $1280 per ounce is speculation and ETF demand, rather than fundamental improvements. Goldman Sachs believes that once speculative enthusiasm wanes, a price correction will be inevitable.

Goldman Sachs believes that the price sensitivity of Chinese buyers constitutes a natural ceiling. The Chinese market accounts for about 60% of the world's new platinum production, and its buyers exhibit a "buy low, sell high" pattern. Data shows that nearly 50% of China's platinum imports are driven by price-sensitive jewelry and investment demand. The price rebound that began in mid-May has already suppressed jewelry and investment demand in China, validating the price sensitivity of Chinese buyers.

Discrepancies in automotive industry demand are key

The two investment banks have significant differences in their outlook for automotive industry demand. Goldman Sachs emphasizes that the automotive industry demand is facing structural decline, as the rapid adoption of electric vehicles is eroding the long-term demand for platinum in fuel vehicle catalysts. Goldman Sachs automotive analysts expect that the scale of fuel vehicles in China has peaked, which will exert structural pressure on the demand for platinum in automotive catalysts Deutsche Bank holds a relatively optimistic view, believing that the demand for platinum automotive catalysts remains at high levels seen from 2018 to 2022. More importantly, the excellent performance of plug-in hybrid vehicles compared to pure electric vehicles may slow the expected loss of demand for platinum group metal automotive catalysts in the coming years.

In terms of supply-side analysis, the two investment banks also show different risk assessments. Goldman Sachs expects that global platinum supply will remain stable or grow moderately, unless power restrictions in South Africa re-emerge. South Africa accounts for about 70% of global platinum production, and guidance from major platinum group metal miners indicates that supply will grow moderately by 12% by 2025.

Deutsche Bank acknowledges seasonal factors on the supply side, noting that the weak performance in the first quarter may be temporary. Heavy rainfall in February was cited by Anglo American and the South African Statistics Bureau as a factor affecting output, but miners maintained their guidance for the year, with the industry's profit-to-cost ratio expected to rise from 10% to 15%