Morgan Stanley's July list of analysts' focus on U.S. stocks is out: Energy Transfer has been removed

JP Morgan updated its list of U.S. stock analysts' focus, removing Energy Transfer. Although the stock is considered undervalued, it is no longer included in the focus list. The new list includes growth strategies focusing on Amazon, Broadcom, etc., income strategies focusing on real estate investment trusts, value strategies focusing on AT&T, McDonald's, etc., and short strategies focusing on Sirius XM

According to Zhitong Finance APP, JP Morgan recently updated its Analyst Focus List (AFL) for U.S. stocks. The bank updates its "Analyst Focus List" monthly, which features a selection of representative stocks under its four main investment strategies: growth, income, value, and short selling. Notably, the latest list no longer includes the energy stock Energy Transfer (ET.US). The bank stated that although it still believes the stock is undervalued, it does not see the necessity to include it in the list.

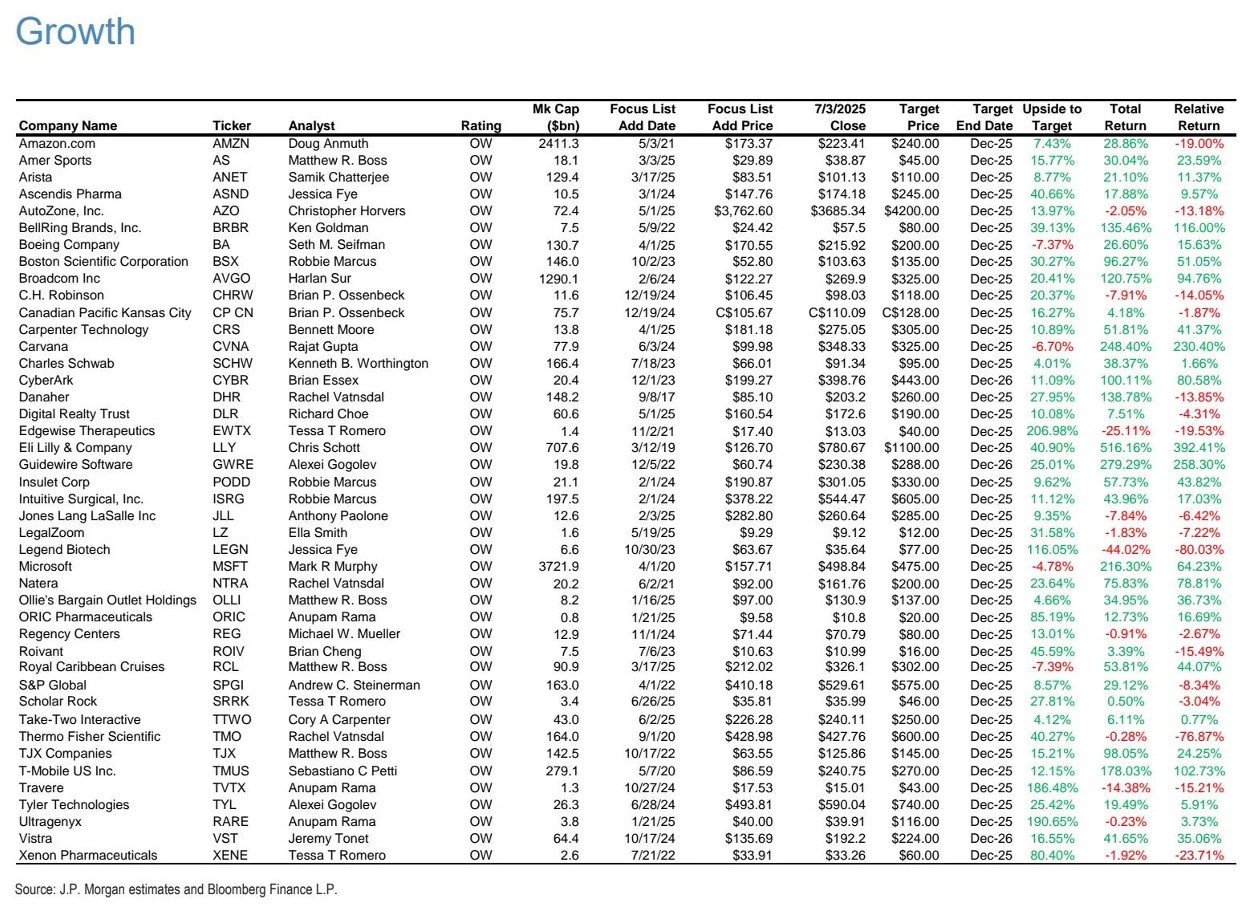

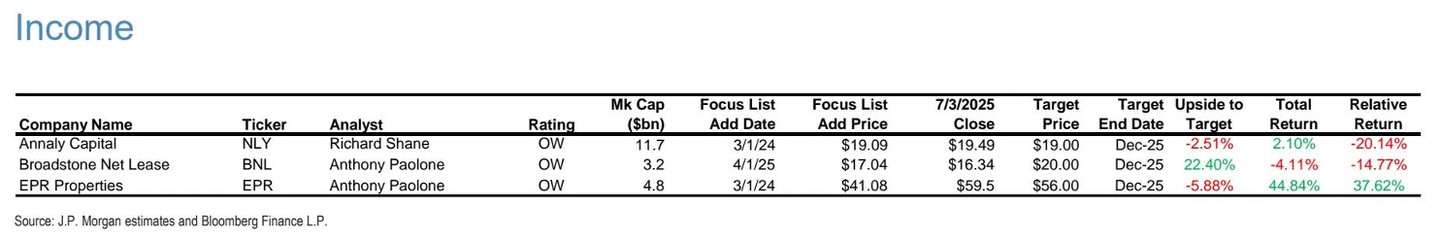

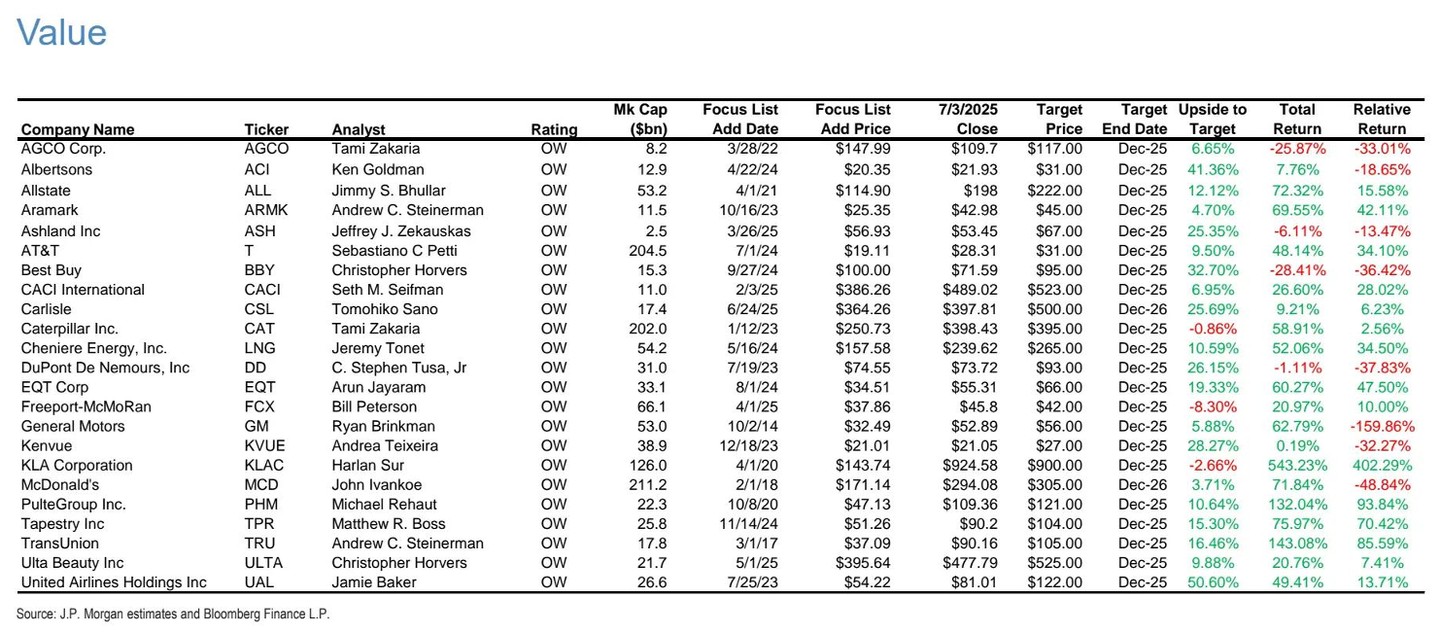

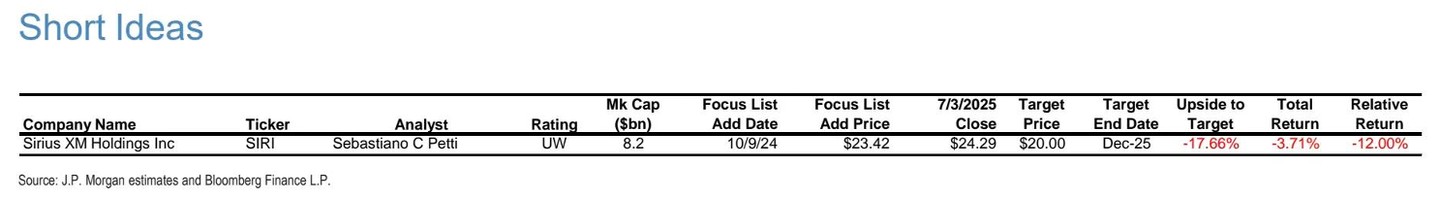

Here are the U.S. stocks on JP Morgan's Analyst Focus List for July.

Under the growth strategy, JP Morgan analysts focus on U.S. stocks including: Amazon (AMZN.US), Broadcom (AVGO.US), Eli Lilly (LLY.US), Legend Biotech (LEGN.US), Microsoft (MSFT.US), T-Mobile US (TMUS.US), among others.

Under the income strategy, JP Morgan analysts focus on U.S. stocks including: Annaly Capital Management (NLY.US), Broadstone Net Lease (BNL.US), EPR Properties (EPR.US), all of which are real estate investment trusts.

Under the value strategy, JP Morgan analysts focus on U.S. stocks including: AT&T (T.US), Best Buy (BBY.US), McDonald's (MCD.US), General Motors (GM.US), Ulta Beauty (ULTA.US), United Airlines (UAL.US), among others.

Under the short selling strategy, JP Morgan analysts focus on the U.S. stock Sirius XM (SIRI.US).