Market worries about the ruling coalition's election defeat, Japan's long-term bond storm resurfaces

As the Japanese Senate elections approach, the ruling coalition may lose its majority seats, leading investors to sell off ultra-long-term government bonds. The yield on 30-year government bonds has risen to 3.09%, while the 40-year yield is nearing historical highs. The market anticipates that if the ruling party loses, it will drive up long-term government bond yields and increase the burden of public debt. The uncertainty of the election results is intensifying, which may affect the Bank of Japan's policy path

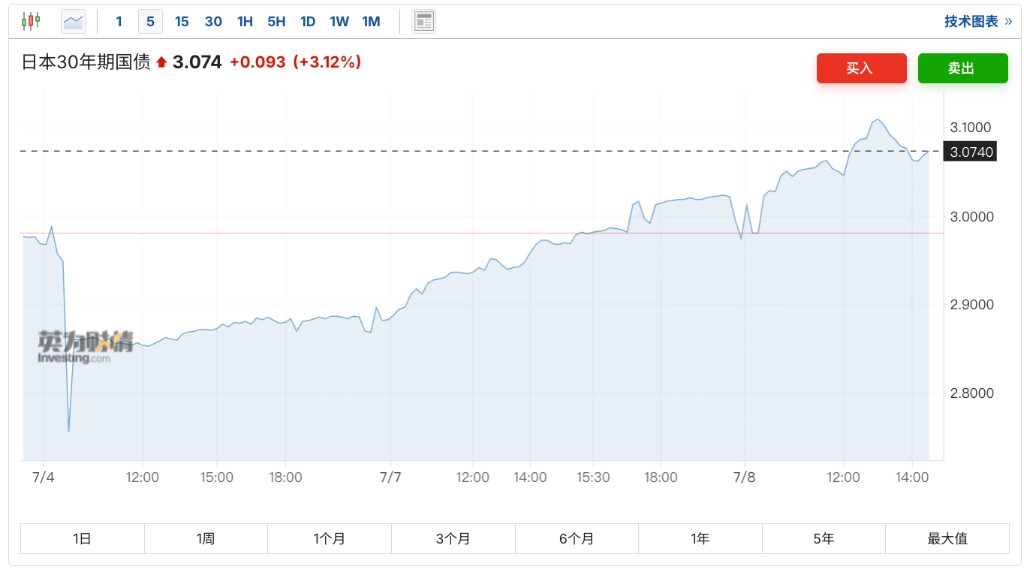

Ahead of the Japanese Senate elections, the yield on Japan's ultra-long-term government bonds has soared to record highs.

As the July 20 Senate elections approach, the key suspense is whether the ruling coalition can maintain a majority. Local media opinion polls over the weekend indicated that the Liberal Democratic Party and its coalition partner Komeito may lose their majority in the July 20 elections, triggering a massive sell-off of Japan's ultra-long-term bonds by investors on Monday.

On Tuesday, the yield on Japan's 30-year government bonds rose sharply by 12.5 basis points to 3.09%, while the yield on 40-year government bonds also approached historical highs.

Previously, the ruling coalition had already lost its majority in the House of Representatives, failing to even reach half.

Wall Street Journal previously mentioned that Morgan Stanley warned in its research report that if the ruling party loses in the Senate this time, the market would expect more aggressive fiscal stimulus, which could push up Japan's long-term government bond yields.

Poll results from multiple media outlets show that there is still uncertainty about whether the ruling coalition can retain its majority, with some surveys even predicting potential losses. Nomura Securities warned that if the ruling coalition loses power in the Senate, market volatility will significantly increase, and Japanese stocks may face downward pressure.

Poll Divergence Intensifies Election Uncertainty

The Japanese ruling coalition needs to win at least 50 of the 125 seats to maintain its majority. Currently, the campaign focus revolves around economic stimulus plans, with the ruling party advocating cash subsidies, while the opposition proposes tax cuts and other measures.

According to informed sources, if the ruling coalition loses, the new government may lean towards larger-scale fiscal stimulus measures to boost the economy, which will further increase Japan's already high public debt burden.

Morgan Stanley's analysis pointed out that concerns about Japan's fiscal situation are more reflected in steepening the yield curve of Japanese government bonds. This is because the proportion of foreign capital in the ultra-long bond market has increased, with insufficient local buyers, and foreign investors may demand higher risk premiums.

Currently, media poll results are highly divergent. Nomura emphasized that the uniqueness of this election lies in the fact that the ruling coalition has already lost its majority in the House of Representatives, and if it loses the Senate as well, the market will tend to price in a more fluid political situation, which could even trigger the risk of Prime Minister Shigeru Ishiba resigning.

Bank of Japan's Policy Dilemma, Normalization Path Obstructed

The Bank of Japan is at a critical juncture in exiting its long-term ultra-loose policy, but the severe volatility in the bond market and election uncertainty complicate its policy path.

In recent years, the Bank of Japan has suppressed long-term interest rates through massive bond purchases, but as inflation gradually approaches the 2% target, the market expects the central bank to gradually reduce its bond purchases.

However, analysts pointed out that if the election results lead to a deterioration in the political environment, the Bank of Japan may be forced to maintain its loose policy to stabilize the market, thereby delaying the timeline for monetary policy normalization.

Risk Warning and Disclaimer The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk