BlackRock prefers European government bonds: yields are more attractive compared to U.S. Treasuries

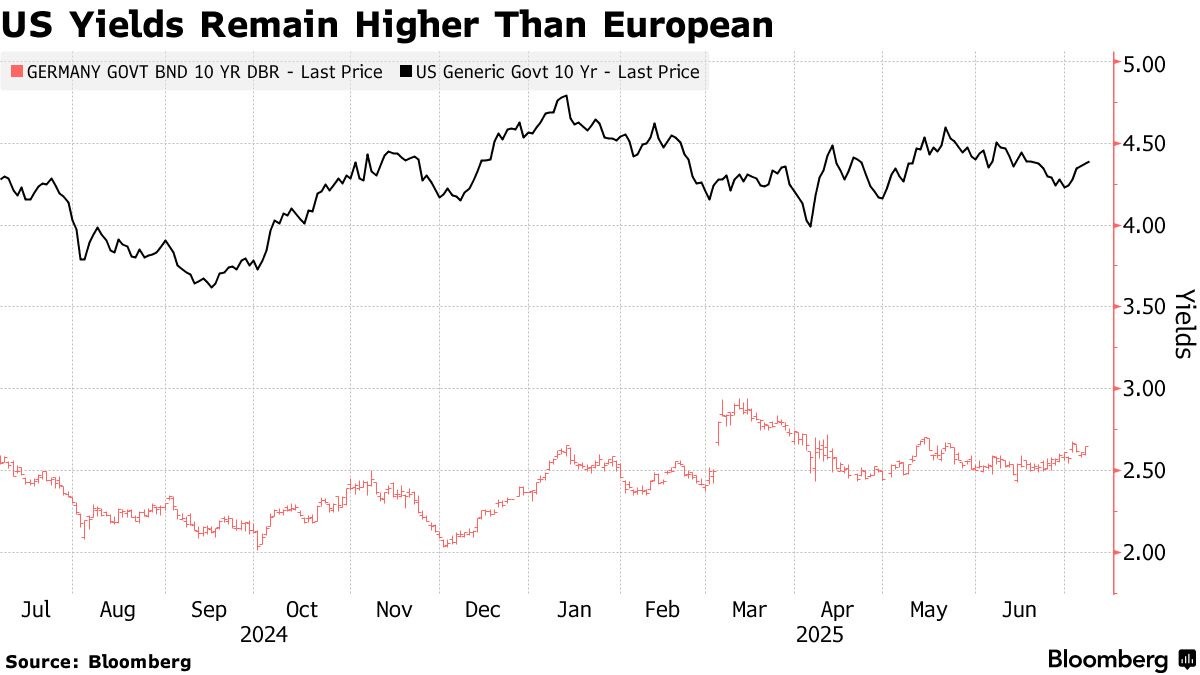

BlackRock Investment Institute has adjusted its stance on European government bonds from "slightly underweight" to "neutral," citing their yields as more attractive compared to U.S. Treasuries. Strategists Jean Boivin and Wei Li stated in a report: "We prefer Eurozone government bonds and credit products over U.S. bonds." "Their yields are attractive, and the term premium is also closer to our expectations compared to U.S. Treasuries." Additionally, within the Eurozone, BlackRock indicated a preference for government bonds from peripheral countries such as Italy and Spain. U.S. Treasuries achieved their best monthly performance since February last month, but were sold off again in the past week as traders lowered expectations for a Federal Reserve rate cut in July following strong U.S. non-farm payroll data for June. Strategists believe that stubborn inflation will prevent the Federal Reserve from making significant rate cuts. They also believe that the high U.S. government fiscal deficit may prompt investors to seek more compensation when holding long-term U.S. Treasuries

According to Zhitong Finance APP, BlackRock Investment Institute has adjusted its stance on European government bonds from "slightly underweight" to "neutral," citing their yields as more attractive compared to U.S. Treasuries. Strategists Jean Boivin and Wei Li stated in a report: "We prefer Eurozone government bonds and credit products over U.S. bonds." "Their yields are attractive, and the term premium is also closer to our expectations compared to U.S. Treasuries." Additionally, within the Eurozone, BlackRock indicated a preference for government bonds from peripheral countries such as Italy and Spain.

U.S. Treasuries achieved their best monthly performance since February last month, but were once again sold off in the past week as traders lowered their expectations for a Federal Reserve rate cut in July following strong U.S. non-farm payroll data for June. Strategists believe that stubborn inflation will prevent the Federal Reserve from making significant rate cuts. They also believe that the high U.S. government fiscal deficit may prompt investors to seek more compensation when holding long-term U.S. Treasuries.