Only a few stocks are driving the S&P 500 to new highs! The upward trend in U.S. stocks may be difficult to sustain

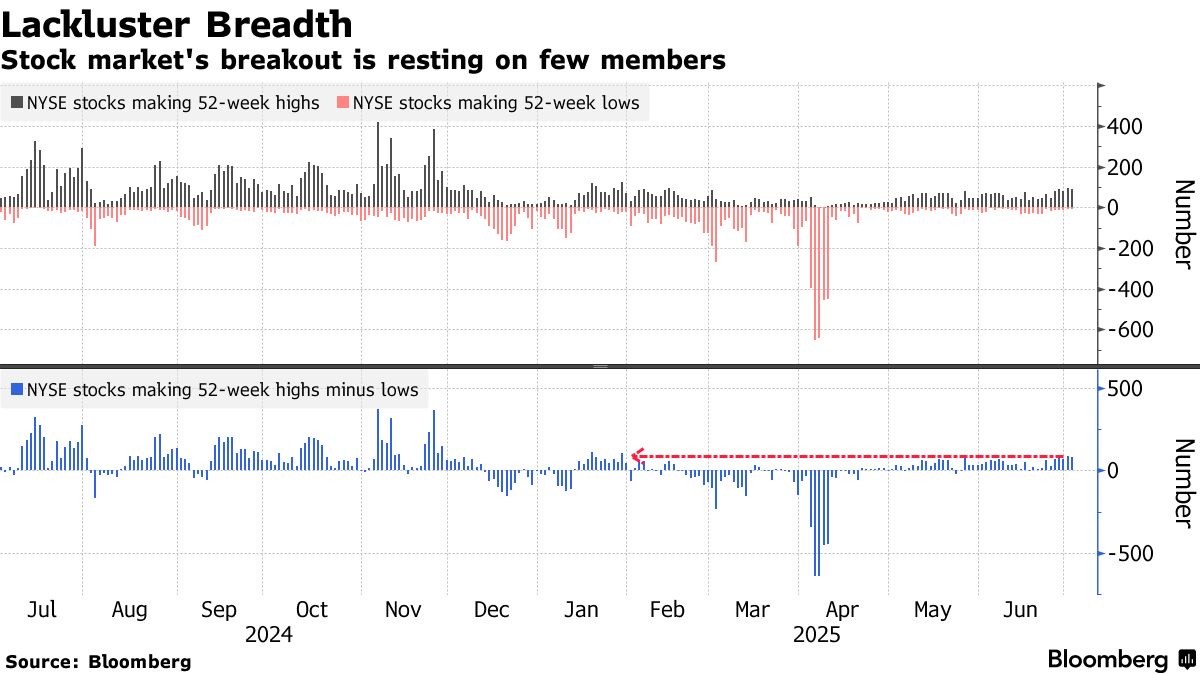

The S&P 500 index has recently reached new highs, but the number of individual stocks hitting new highs is quite low, indicating that the market is concentrated on a few large tech stocks. Oppenheimer's analysis points out that the gap between the number of companies reaching new highs and new lows is not significant, which may signal weak market performance. Large tech stocks have driven the rebound in U.S. stocks, but market participation remains sluggish, and equal-weight indices like the S&P 500 have not reached new highs. Analysts believe that broad market participation is crucial for the sustainability of an upward trend

According to Zhitong Finance APP, as the S&P 500 index continues to hit historical highs recently, the number of individual stocks reaching new highs in the market is few, which is not a good sign for traders worried about the increasing concentration of the market in a few large technology stocks.

Oppenheimer's analysis shows that while the S&P 500 index is repeatedly reaching new highs, the number of companies hitting new highs on the New York Stock Exchange is only 88 more than those hitting new lows. This "narrow market breadth" has historically been seen as a precursor to weak market performance. Historical data indicates that since 1972, when the S&P 500 breaks new highs, if the difference between the number of companies reaching new highs and new lows does not exceed 100, the returns over the following 12 months are often below average.

Technical chart observers have long begun to worry. The current rebound in the U.S. stock market is mainly driven by large technology stocks, indicating that investors are more inclined towards conservative strategies in the face of uncertainties in U.S. trade policy and fiscal concerns. According to analysts Gina Martin Adams and Gillian Wolff, the so-called "seven giants of U.S. stocks" index has risen 36% since the low in April, while the S&P 500 index has only risen 25% during the same period. Meanwhile, currently only 10% of the S&P 500 index constituents are driving the index's rise, far below the average level of 22% from 2010 to 2024.

Oppenheimer senior analyst Ari Wald stated, "Broader market participation is very important. A rally that can gain widespread participation from both large-cap and small-cap stocks is usually more sustainable."

Another sign of low market participation comes from the equal-weighted S&P 500 index, which has not reached a new high since November 29 of last year. Independent market strategist Jim Paulsen pointed out, "I originally thought that after starting from the market low and experiencing such a strong rally, there would be a broader upward trend."

Mixed Signals

After two months of rapid rebound, traders are facing a series of conflicting market signals. On one hand, the U.S. economy continues to perform strongly under tariff uncertainties, inflation remains controllable, and risk-takers have gained returns in both large technology stocks and more speculative market sectors.

However, the shadow of the trade war still looms. U.S. President Trump began announcing new tariff plans on Monday, with the U.S. set to impose tariffs on countries such as Japan, South Korea, and South Africa starting August 1.

The "narrow market breadth" has been a recurring feature in the bull market over the past 32 months, raising concerns that a few stocks may have too much influence on the S&P 500 index. Jim Paulsen believes that if the Federal Reserve does indeed start cutting interest rates in the coming months, it could serve as a catalyst for improving market breadth. He stated, "Many positive forces that should benefit the stock market are currently suppressed by the Fed's unusually tight policies, and I believe they are not far from changing this situation." At the same time, Oppenheimer senior analyst Ari Wald has also seen highlights in the recent performance of small-cap stocks—the Russell 2000 Index has recently regained its 200-day moving average. However, he also added, "If the performance of small-cap stocks weakens again and erases the recent gains, it would indicate that this rally may be running out of momentum and set the stage for seasonal fluctuations in the late third quarter."