China Passenger Car Association: Retail sales of passenger cars in China reached 208.4 thousand units in June, setting a new monthly record, with retail sales of new energy vehicles increasing by 29.7% year-on-year

In June, China's passenger car market performed strongly, with retail, wholesale, production, and export volumes all reaching historical highs. The industry's "anti-involution" effect is significant, with inventories of passenger cars and new energy vehicles both declining in June. The retail penetration rate of domestic new energy vehicles rose to 53.3% in June, thanks to strong support from inclusive policies such as scrapping and updating, trade-in programs, and tax exemptions

In June, China's passenger car market performed strongly, with retail, wholesale, production, and export volumes all reaching historical highs. At the same time, the industry's "anti-involution" effect was significant, with inventories of passenger cars and new energy vehicles both declining in June. The retail penetration rate of domestic new energy vehicles rose to 53.3% in June, thanks to strong support from inclusive policies such as scrapping and updating, trade-ins, and tax exemptions.

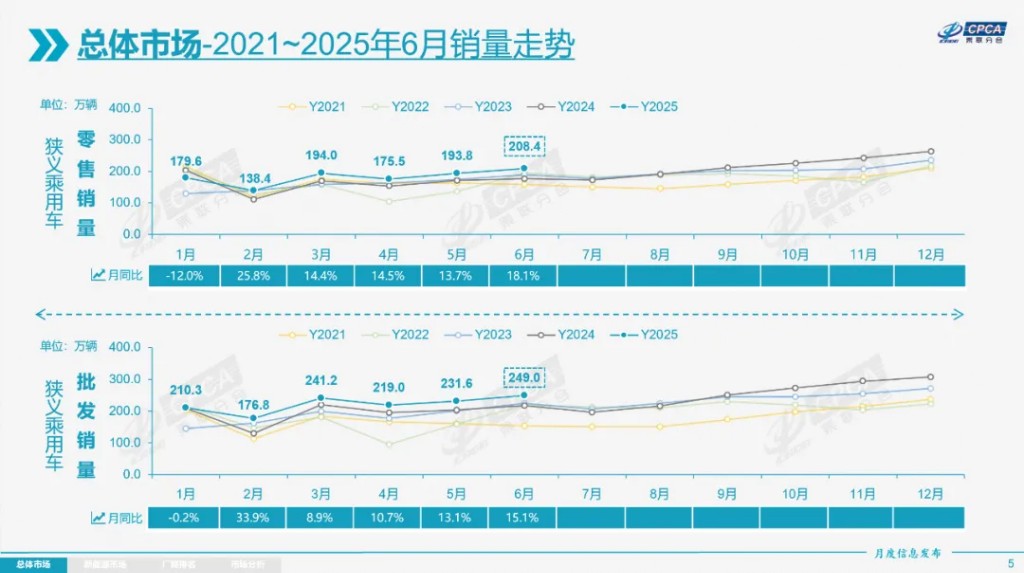

According to data from the Passenger Car Association, in June 2025, the national passenger car market retail reached 2.084 million units, a year-on-year increase of 18.1% and a month-on-month increase of 7.6%. Cumulatively, retail reached 10.901 million units this year, a year-on-year increase of 10.8%. The Passenger Car Association stated:

In previous years, the domestic car market retail showed a "low at the front and high at the back" trend. In June this year, retail grew by 7% compared to the highest level of 1.94 million in June 2022, showing a strong growth trend.

The Passenger Car Association indicated that the characteristics of the passenger car market in June are as follows:

In June, the retail, wholesale, and production of passenger car manufacturers all reached historical highs for the month, and exports reached historical highs for all months.

From January to May 2025, domestic retail of passenger cars achieved a positive growth of 9%, with a growth rate of 18% in June, a net increase of 320,000 units year-on-year, raising the cumulative growth rate by 2 percentage points, achieving an unexpected growth of 10.8% from January to June 2025.

This year's intuitive price war has been somewhat mild, but invisible discount measures such as new model upgrades and adjustments to owner rights have emerged continuously, with new energy promotions decreasing by 0.8% month-on-month to 10.2% in June.

In June, the wholesale share of domestic brand passenger cars was 67.1% (up 2.2% year-on-year), and the domestic retail share was 64.2% (up 5.6% year-on-year), showing significant improvement in joint ventures.

With the deepening of anti-involution, the overall inventory of passenger car manufacturers decreased by 150,000 units in June (down 20,000 units year-on-year), and the inventory of new energy vehicles also saw a decline.

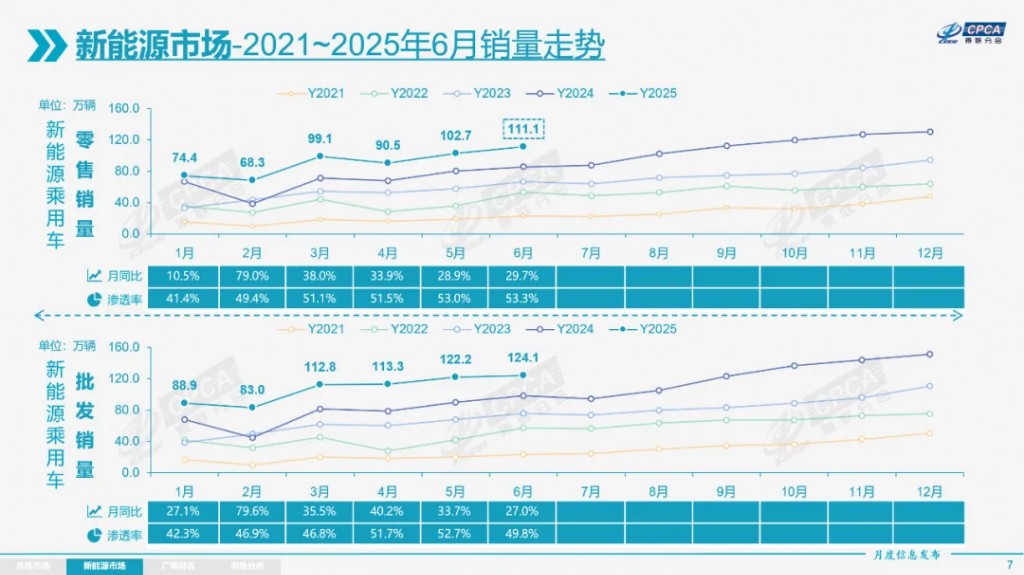

The domestic retail penetration rate of new energy vehicles rose to 53.3% in June, showing strong growth driven by scrapping and updating, trade-ins, and tax exemptions for new energy vehicles under inclusive policies.

From January to June 2025, exports of self-owned fuel passenger cars decreased by 13% to 1.29 million units, while exports of self-owned new energy vehicles increased by 109% to 810,000 units, with new energy accounting for 38.6% of self-owned exports. Although self-owned brands actively reduced inventory in Russia at the beginning of the year, leading to a decline in exports to Russia, the market share of self-owned brands in Russia still maintains a high level of over 55%. Considering the current state of the Russian automotive industry, exports of Chinese cars to Russia will likely recover to a certain level.

The domestic retail share of self-owned brands is 64.2%

In June, retail sales of domestic brands reached 1.34 million units, a year-on-year increase of 30% and a month-on-month increase of 7%. The domestic retail market share of domestic brands in the same month was 64.2%, an increase of 5.6 percentage points year-on-year. From January to June, the market share of domestic brands was 64%, an increase of 7.5 percentage points compared to the same period last year, with significant growth in the new energy market and export market for domestic brands. Leading traditional automakers performed excellently in their transformation and upgrading, with significant increases in market share for brands such as BYD, Geely, Chery, and Changan.

In June, mainstream joint venture brands had retail sales of 510,000 units, a year-on-year increase of 5% and a month-on-month increase of 6%. In June, the retail market share of German brands was 16.1%, a decrease of 2.4 percentage points year-on-year, while Japanese brands had a retail market share of 12.0%, a decrease of 2.3 percentage points year-on-year. The market retail share of American brands was 5.8%, a decrease of 0.5 percentage points year-on-year.

In June, luxury car retail sales were 230,000 units, a year-on-year decrease of 7% and a month-on-month increase of 18%. The retail market share of luxury brands in June was 11.0%, a decrease of 3 percentage points year-on-year, while the traditional luxury car market performed relatively well.

Exports: According to data from the Passenger Car Association, in June, passenger car exports (including complete vehicles and CKD) reached 480,000 units, a year-on-year increase of 23.8% and a month-on-month increase of 7.3%. From January to June, passenger car manufacturers exported 2.479 million units, a year-on-year increase of 6.8%. In June, new energy vehicles accounted for 41.1% of total exports, an increase of 17 percentage points compared to the same period last year. Exports of domestic brands reached 410,000 units in June, a year-on-year increase of 28% and a month-on-month increase of 10%; exports of joint venture and luxury brands were 62,000 units, a year-on-year decrease of 9%.

Production: In June, passenger car production reached 2.419 million units, a year-on-year increase of 13.3% and a month-on-month increase of 6.1%. From January to June, passenger car production totaled 13.246 million units, with a cumulative year-on-year increase of 13.5%. In June, passenger car production was 200,000 units higher than the historical peak of 2.21 million units in June 2022, contributing to local economic stability. In June, luxury brand production decreased by 15% year-on-year and increased by 2% month-on-month; joint venture brand production increased by 9% year-on-year and 12% month-on-month; domestic brand production increased by 20% year-on-year and 4% month-on-month.

Wholesale: In June, national passenger car manufacturers achieved wholesale sales of 2.490 million units, setting a historical record for the month, with a year-on-year increase of 15.1% and a month-on-month increase of 7.5%; from January to June, national passenger car manufacturers' wholesale totaled 13.279 million units, a year-on-year increase of 12.2%. Driven by strong retail performance, the year-on-year growth rate of passenger car wholesale in June was 3.0 percentage points lower than that of retail. In June, wholesale sales of domestic automakers reached 1.67 million units, a year-on-year increase of 19% and a month-on-month increase of 4%. Mainstream joint venture automakers had wholesale sales of 553,000 units, a year-on-year increase of 11% and a month-on-month increase of 17%. Luxury car wholesale was 256,000 units, a year-on-year decrease of 3% and a month-on-month increase of 8% In June, the overall wholesale pattern of major passenger car manufacturers continued to change, with some small enterprises showing signs of gradual rise. Leading automakers such as Geely Automobile, FAW Toyota, and SAIC-GM-Wuling performed strongly on a month-on-month basis. Compared to May, there were only 5 passenger car manufacturers with sales exceeding 100,000 units in June (5 in May, 5 in the same period last year), accounting for 45% of the overall market share (46% last month, 45% in the same period last year). The share of passenger car manufacturers with wholesale volumes of 50,000 to 100,000 units accounted for 25% (25% last month, 27% in the same period last year), while those with wholesale volumes of 10,000 to 50,000 units accounted for 28% (27% last month, 24% in the same period last year).

Inventory: Due to good production conditions for manufacturers in June, wholesale in June was 70,000 units higher than production, while monthly domestic wholesale was 80,000 units lower than retail. The overall inventory in the passenger car industry decreased by 150,000 units in June (a decrease of 20,000 units in the same period last year). From January to June this year, the overall inventory in the industry increased by 380,000 units compared to the same period last year (a decrease of 510,000 units from January to June last year, a decrease of 200,000 units in 2023, an increase of 110,000 units in 2022, a decrease of 1.01 million units in 2021, and a decrease of 500,000 units in 2020). This year has changed the trend of continuous inventory reduction from January to June in previous years, also bringing good growth in manufacturer sales.

New Energy Vehicle Manufacturer Wholesale Penetration Rate 49.8%

In June, the production of new energy passenger vehicles reached 1.2 million units, a year-on-year increase of 28.3% and a month-on-month increase of 2.0%; the cumulative production from January to June was 6.457 million units, an increase of 38.7%.

In June, the wholesale sales of new energy passenger vehicles reached 1.241 million units, a year-on-year increase of 27.0% and a month-on-month increase of 1.6%; the cumulative wholesale from January to June was 6.447 million units, an increase of 37.4%.

In June, the retail sales of new energy passenger vehicles reached 1.111 million units, a year-on-year increase of 29.7% and a month-on-month increase of 8.2%; the cumulative retail from January to June was 5.468 million units, an increase of 33.3%.

In June, the export of new energy passenger vehicles reached 198,000 units, a year-on-year increase of 116.6% and a month-on-month decrease of 1.0%; the cumulative export from January to June was 987,000 units, an increase of 48.0%.

1) Wholesale: In June, the wholesale penetration rate of new energy vehicle manufacturers was 49.8%, an increase of 4.6 percentage points compared to June 2024. In June, the penetration rate of domestic brand new energy vehicles was 66.7%; the penetration rate of new energy vehicles among luxury cars was 33%; while the penetration rate of new energy vehicles among mainstream joint venture brands was only 6.6%.

In June, the wholesale sales of pure electric vehicles reached 771,000 units, a year-on-year increase of 39.2% and a month-on-month increase of 1.5%; the sales of narrow-sense plug-in hybrids reached 348,000 units, a year-on-year increase of 10.1% and a month-on-month increase of 2.2%; the wholesale of range-extended vehicles was 122,000 units, a year-on-year increase of 13.6% and a month-on-month increase of 0.3%. In June, the wholesale structure of new energy vehicles was: pure electric 62.1% (year-on-year +5.1%, month-on-month -0.1%), narrow-sense plug-in hybrid 28.0% (year-on-year -4.0%, month-on-month +0.1%) Extended range 9.8% (year-on-year -1.1%, month-on-month -0.1%). In the wholesale structure of new energy from January to June 2025: pure electric 61.4% (year-on-year +3.2%), narrow plug-in hybrid 29.8% (year-on-year -2.4%), extended range 8.8% (year-on-year -0.8%).

In June, the wholesale of B-class electric vehicles reached 230,000 units, a year-on-year increase of 7% and a month-on-month increase of 3%, accounting for 30% of the pure electric share, a decrease of 9 percentage points compared to the same period last year. The A00+A0 level economy electric vehicle market in the pure electric market performed well, with A00 level wholesale sales of 153,000 units, a year-on-year increase of 61% and a month-on-month decrease of 6%, accounting for 20% of pure electric, an increase of 3 percentage points compared to the same period last year; A0 level wholesale sales of 171,000 units, accounting for 22% of pure electric, year-on-year flat; A-class electric vehicles 185,000 units, accounting for 24% of pure electric, a year-on-year increase of 6 percentage points; the growth of economy electric vehicles is sustainable, and only the popularization of economy electric vehicles can truly drive the incremental growth of the auto market.

In June, there were 23 models with wholesale sales exceeding 20,000 units (15 models last month), including BYD Song (59,026 units), Haiou (51,295 units), Model Y (51,253 units), Geely Xingyuan (41,046 units), Haibao 06 (29,346 units), Hongguang MINI (27,735 units), Ruiqi 8 (25,705 units), Xiaomi SU7 (23,225 units), Hongqi H5 (23,126 units), Xingyue (23,116 units), Lavida (23,016 units), BYD Dolphin (22,924 units), Boyue (22,644 units), Aito M8 (22,327 units), Qin L (22,195 units), Sagitar (22,036 units), BYD Qin (21,847 units), Ruiqi 5X (21,819 units), Ruiqi 7 (21,433 units), Sylphy (21,023 units), RAV4 (20,786 units), Emgrand (20,598 units), Model 3 (20,346 units). Among them, 13 are new energy models, and recent fuel vehicle models such as Sylphy, Lavida, Xingyue, Ruiqi 8, and Ruiqi 7 have performed strongly in the domestic market.

2) Retail: In June, the retail penetration rate of new energy vehicles in the overall domestic passenger car market was 53.3%, an increase of 4.8 percentage points compared to the same period last year. In June's domestic retail, the penetration rate of new energy vehicles among independent brands was 75.4%; the penetration rate of new energy vehicles among luxury cars was 30.3%; while the penetration rate of new energy vehicles among mainstream joint venture brands was only 5.3%. From the monthly retail share of new energy vehicles in the domestic market, the retail share of independent brand new energy vehicles in June was 71%, a year-on-year decrease of 0.2 percentage points; the share of mainstream joint venture brand new energy vehicles was 3.1%, a year-on-year decrease of 1 percentage point; the share of new forces was 19.5%, with brands such as XPeng, Leapmotor, and Xiaomi driving a year-on-year increase of 0.2 percentage points in the share of new forces; Tesla's share was 5.5%, a year-on-year decrease of 1.4 percentage points.

3) Exports: In June, the export of new energy passenger vehicles reached 198,000 units, a year-on-year increase of 116.6% and a month-on-month decrease of 1.0%. This accounted for 41.1% of passenger car exports, an increase of 17.6 percentage points compared to the same period last year; Among them, pure electric vehicles account for 63% of new energy exports (compared to 76% in the same period last year), with the core focus on A00 and A0 level pure electric vehicle exports accounting for 49% of new energy exports (compared to 31% in the same period last year). As the scale advantages of China's new energy vehicles become apparent and market expansion demands grow, more and more new energy brand products made in China are going abroad, with increasing recognition overseas. Among them, plug-in hybrids account for 33% of new energy exports (compared to 23% in the same period last year). Although recently affected by some external countries, the export of domestic plug-in hybrids to developing countries is growing rapidly, with a bright outlook.

In June, the outstanding companies in new energy exports were: BYD (85,957 units), Chery Automobile (26,569 units), Tesla China (10,115 units), SAIC Passenger Vehicle (9,831 units), SAIC-GM-Wuling (8,436 units), Geely Automobile (7,569 units), Changan Automobile (6,805 units), BeamO (4,600 units), Polestar (4,173 units), Dongfeng Motor (3,837 units), XPeng (3,779 units), Great Wall Motors (3,383 units), Leapmotor (3,085 units), Changan Mazda (2,532 units), FAW Hongqi (2,519 units), GAC Aion (1,277 units), Zhima Automobile (1,078 units), Seres Automobile Hubei (1,075 units), SAIC-GM (958 units), SAIC Maxus (819 units), Jiangsu Yueda Kia (785 units). Other car companies also have a certain scale of new energy exports.

From the perspective of overseas system construction, some domestic brands have a high proportion of CKD exports, with Great Wall Motors' CKD export ratio at 34.2% and BYD's CKD export ratio at 12%. The shift from complete vehicle exports to CKD exports and the establishment of overseas localized production systems has been excellently demonstrated by companies like Great Wall Motors and BYD.

4) Car Companies: In June, the overall trend of new energy passenger vehicle companies was relatively strong, with BYD's pure electric and plug-in hybrid dual-drive solidifying the leading position of domestic brands in new energy; narrow plug-in hybrids represented by BYD, Geely, and Chery continued to perform strongly. In terms of product launches, as domestic car companies implement a "multi-line parallel" strategy in the new energy sector, the market base continues to expand, with 18 manufacturers achieving monthly wholesale sales of new energy vehicles exceeding 10,000 units (one less than the same period last year, unchanged from the previous month), accounting for 91.8% of the total new energy passenger vehicles (last month 91.2%, same period last year 90.4%). Among them, BYD (377,628 units), Geely Automobile (122,367 units), Changan Automobile (87,458 units), Tesla China (71,599 units), Chery Automobile (66,368 units), SAIC-GM-Wuling (61,810 units), Leapmotor (48,006 units), Seres Automobile (43,354 units), Great Wall Motors (36,375 units), Li Auto (36,279 units), XPeng (34,611 units), Dongfeng Motor (28,802 units), Xiaomi Automobile (25,459 units), Nio (24,925 units), GAC Aion (19,886 units), FAW Bestune (16,771 units), SAIC Passenger Vehicle (16,202 units), FAW Hongqi (14,756 units) The domestic retail sales of new energy passenger vehicles that exceeded 20,000 units are: BYD (352,081 units), Geely (114,798 units), Changan (76,346 units), Tesla China (61,484 units), Hongmeng Zhixing (52,585 units), SAIC-GM-Wuling (51,258 units), Leapmotor (44,921 units), Chery (39,919 units), Li Auto (36,279 units), Great Wall Motors (32,992 units), XPeng (30,832 units), Dongfeng (28,375 units), GAC Aion (25,901 units), Xiaomi Auto (25,459 units), Nio (24,925 units), FAW Bestune (15,635 units), and FAW Hongqi (13,462 units). The new energy performance of mainstream domestic automakers is increasingly strong, with BYD, Geely, Changan, and others performing well in domestic new energy retail.

5) New Forces: In June, the retail share of new forces was 19.5%, an increase of 0.2 percentage points year-on-year. The trend among new forces is polarized, with some new forces undergoing adjustments. The independent new energy brands of traditional domestic automakers, as the second generation of innovation, performed strongly, with a share of 11.7%, remaining flat year-on-year. New energy brands from large domestic groups such as Deep Blue Auto, Avita, Fangcheng Leopard, and Jihe Auto performed excellently.

6) Regular Hybrid: In June, the wholesale of regular hybrid passenger vehicles was 86,000 units, a year-on-year decrease of 13%, but a month-on-month increase of 19%. Among them, GAC Toyota (31,283 units), FAW Toyota (29,444 units), Changan Ford (4,422 units), Dongfeng Honda (2,718 units), GAC Honda (1,704 units), Dongfeng (1,517 units), GAC Trumpchi (577 units), Geely (373 units), Jiangsu Yueda Kia (147 units), and Beijing Hyundai (70 units). The sales of hybrid vehicles from independent brands are gradually increasing.

July National Passenger Car Market Outlook

July 2025 will have 23 working days, providing relatively ample production and sales time. With the structural differentiation in the growth of the car market, some companies have ample production capacity for traditional fuel vehicles, and the characteristics of destocking under the pressure of a shrinking fuel vehicle market are evident. It is expected that the high-temperature holiday will be relatively long, and the car market will enter a consolidation period in July.

In recent years, the characteristic of the summer car market being less sluggish has become increasingly evident. From 2014 to 2019, the retail sales in July accounted for an average of 6.9% of the total annual volume, while from 2020 to 2024, the retail sales in July accounted for an average of 8.4% of the total annual volume, with 2024 still reaching a 7.5% share. The monthly patterns of the car market are increasingly aligning with the characteristics of aging markets in Europe and the United States, with the characteristics of popularization weakening.

Due to the abnormal subtropical high pressure in our country this year and its early northward jump, the southern plum rain belt has unusually moved northward, the northern weather has been hot, and sudden thunderstorms have increased, resulting in strong rigid demand for vehicles in summer under the trend of climate warming.

Since the old-for-new policy will be launched in July 2024, the sales base in July this year will be relatively high. Given the high production enthusiasm of manufacturers at the beginning of this year, the industry did not exhibit the destocking characteristics seen in previous years, with inventory reaching 3.45 million units by the end of May and inventory days at 57 days, leading to significant destocking pressure for both fuel and new energy vehicles. Therefore, the production and sales in July will still show a relatively fast growth rate, gradually slowing down

With the continuous deepening of anti-involution efforts, automakers are striving to maintain relative stability in market prices, and the production pace will show a further steady trend. Due to the decline in the interest rate spread between bank deposits and loans, high-interest and high-return car loan policies are being controlled. The original high returns given to dealers by banks will partially subsidize car prices, and the significant reduction in car loan rebates has further increased the profit pressure on dealers, indirectly deepening conflicts with manufacturers. With inventory at relatively high levels, the growth of manufacturers' sales is slowing down.

Currently, housing market price data is declining, and local fiscal pressure is becoming more apparent, leading to a more stable pace of consumption promotion in the automotive market. In the second quarter, China's automobile export situation is improving, with some overseas markets showing good growth. In May, the overseas market share of domestic new energy vehicles increased to 14.7%, and there is still potential for continuous improvement in the future.

According to data from the National Bureau of Statistics, in 2024, there will be 290 million migrant workers in China, accounting for 21.3% of the population. Recent policies promoting new energy vehicles in rural areas are beneficial for tapping into some of the consumption potential for new energy vehicles in rural areas. The support from manufacturers and local subsidies for middle-aged and elderly migrant workers to purchase new energy vehicles is significant and will undoubtedly add new momentum to the automotive market.

This article is excerpted from: “【Monthly Analysis】June 2025 National Passenger Car Market Analysis”, Author: Passenger Car Association