"The King of Retail" AIC license implemented, bank-affiliated equity investment welcomes a small climax

China Merchants Bank's wholly-owned subsidiary, China Merchants Jinfu Asset Investment Company (China Merchants Investment), has obtained the AIC license, becoming the third joint-stock bank to hold this license. With the expansion of the AIC equity investment pilot scope, equity investment activities in the banking sector are gradually heating up. China Merchants Investment's registered capital has reached 15 billion yuan, demonstrating China Merchants Bank's emphasis on the AIC license. Support from regulatory policies will enhance banks' capabilities in equity investment and the integration of investment and lending businesses

From policy adjustments to market feedback, the core proposition of financial asset investment companies (AIC) under the banking industry may shift from resolving non-performing assets of parent banks to equity investment.

Recently, China Merchants Bank announced that its planned establishment of China Merchants Financial Asset Investment Company (hereinafter referred to as "CM Investment") has received regulatory approval for preparation.

As a wholly-owned subsidiary, CM Investment's license approval makes China Merchants Bank the third joint-stock bank to hold an AIC license, following Industrial Bank and China CITIC Bank.

The entry of more joint-stock banks corresponds to a subtle change in the positioning of AIC since 2024.

In September 2024, the Financial Regulatory Administration expanded the pilot scope of AIC equity investment from Shanghai to 18 cities;

In March of this year, the pilot scope extended from cities to their respective provinces, with regulators clearly supporting banks and insurance funds in establishing AICs, and increasing the equity investment limit of AIC on-balance-sheet funds from 4% of total assets to 10%.

In just 4 months since its implementation, the largest joint-stock banks, China Merchants Bank, China CITIC Bank, and Industrial Bank, have all obtained AIC licenses.

According to statistics from Jifeng, the number of funds issued by five major state-owned banks under AIC since 2025 has surpassed the annual levels since 2018.

These changes confirm that AIC, as a stepping stone for the banking industry to open up mixed business paths such as equity investment, is gradually stepping onto a larger stage.

"King of Retail" Expands Territory

Although the license has come late, the substantial registered capital still reflects China Merchants Bank's emphasis on this AIC license.

CM Investment will become a first-level subsidiary of China Merchants Bank, with registered capital of 15 billion yuan, which not only exceeds that of its peers, Industrial Investment and CITIC Investment, but is also comparable to the AICs of the five major banks, second only to the "universe bank" Industrial and Commercial Bank of China.

At the beginning of the year, when regulators supported commercial banks in establishing AICs, China Merchants Bank President Wang Liang stated that the expansion policy is beneficial for enhancing banks' comprehensive service capabilities in direct equity investment and investment-loan linkage businesses.

The Commercial Banking Law imposes strict restrictions on banks' direct equity investments;

However, in actual business operations, banks do have a demand for equity investment. After all, becoming a shareholder not only provides dividends and returns upon exit but may also bring in income from business operations such as supply chain settlements and employee payroll services, enhancing their middle-income revenue.

Without an AIC license, banks can only engage in equity investment indirectly by having their wealth management subsidiaries issue private wealth management products to raise funds for indirect investments in unlisted company equities or funds; alternatively, they may invest in domestic assets through licensed subsidiaries abroad.

China Merchants Bank's previous attempts at equity investment were conducted indirectly through the private asset management business of its Hong Kong subsidiary, CM International.

In 2024, CM International had a total of 4 investment projects in its overseas private equity products successfully listed and exited; there were also 4 projects that successfully went public domestically.

Wang Liang admitted that the bank has accumulated rich experience in equity investment through CM International.

China Merchants Bank now states that the establishment of AIC will help to specialize in market-oriented debt-to-equity swaps and equity investment pilots, providing comprehensive and multi-level financing support for enterprises, and enhancing comprehensive operational capabilities It can be seen that although AIC also has the function of debt conversion, the purpose of China Merchants Bank applying for the license may be more about enhancing equity investment capabilities, enriching investment banking services, and thereby leveraging the synergistic effect of the parent bank's credit resources.

In the future, the main team of China Merchants Investment may come from China Merchants International; multiple head office departments, including the Investment Banking Department, Strategic Client Department (Private Equity Team), and Asset-Liability Department (Investment Management Team), will also participate directly.

There is also a high enthusiasm within China Merchants Bank for attracting investment, and the team building may adopt an internal competition format.

From Risk Mitigation to Investment

The initial setting of AIC was purely as a large bank's debt-to-equity conversion tool, with the original intention of resolving the asset quality risks accumulated by large banks after the subprime mortgage crisis.

At the end of 2015, the Central Economic Work Conference first included deleveraging as a key task; a year later, AIC, as a debt-to-equity conversion entity, was born to take over the parent bank's non-performing loans and achieve risk isolation.

Although it has been nearly ten years since AIC institutions entered the financial market, before 2024, their business has always been limited to debt-to-equity conversion and equity investments aimed at debt-to-equity conversion, with pure equity investment pilots only allowed in Shanghai;

The total number of AIC licenses in the industry is only five, corresponding to the five major state-owned banks: Industrial and Commercial Bank of China, Agricultural Bank of China, Bank of China, China Construction Bank, and Bank of Communications.

For state-owned enterprises with high debt levels at that time, AIC's risk mitigation role was significant.

For example, a certain steel state-owned enterprise reduced its debt ratio from 80% to 60% through debt-to-equity conversion operations by ICBC Investment, saving tens of millions in interest expenses annually.

For a long time, AIC's business scope has been strictly limited to debt-to-equity conversion and its supporting measures;

Until 2020, regulators approved five AICs to conduct "equity investments in technology enterprises not aimed at debt-to-equity conversion" in Shanghai;

and emphasized that AICs should focus on participating in corporate restructuring, equity investment, and direct investment related to economic structural adjustment, industrial optimization and upgrading, and coordinated development in the Yangtze River Delta.

However, at that time, AIC's equity investments still had obvious trial characteristics:

First, the pilot areas were limited to Shanghai, and there were only five AICs;

Second, it was clearly stated that the amount of equity investment from on-balance-sheet funds should not exceed 4% of total assets, and window guidance was provided to prompt AIC institutions to review the use of funds.

The Bank of China Research Institute pointed out that 70-80% of AIC funds are composed of targeted reserve requirement reduction funds from the parent bank, and can also come from bond issuance, interbank borrowing, and other on-balance-sheet financing.

However, the targeted reserve requirement reduction funds and the proceeds from debt-to-equity conversion bond financing have clear usage restrictions and cannot be used for pure equity investments.

This means that the funding source for AIC's pure equity investments mainly comes from the parent bank's own funds and operational accumulation.

This determines that debt-to-equity conversion is the absolute main business of AIC during this period.

For example, the 9.198 billion yuan investment income of ICBC Investment in 2023 mainly came from dividends from debt-to-equity conversion; by the end of the year, its pure equity investment fund had only five investment projects, with a cumulative amount of less than 600 million yuan.

A more critical turning point occurred in 2024. In June of that year, the General Office of the State Council proposed to expand the pilot scope of direct equity investment by financial asset investment companies, supporting asset management institutions to increase their investment in venture capital;

Three months later, the Financial Regulatory Administration stated that it would "appropriately relax the restrictions on the amount and proportion of equity investment by financial asset investment companies," expanding the pilot cities from Shanghai to 18 large and medium-sized cities including Beijing and Tianjin;

At the same time, the upper limit of the proportion of on-balance-sheet investments was raised from 4% to 10%, and the proportion of investment in a single private equity fund was increased from 20% to 30%.

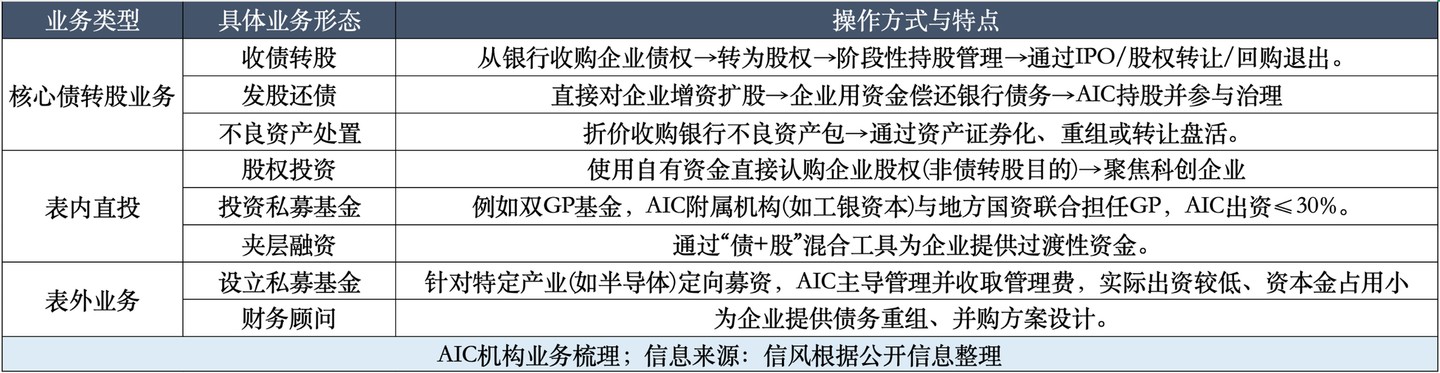

Thus, the business model of AIC gradually developed into three categories: core debt-to-equity swaps, on-balance-sheet direct investments, and off-balance-sheet businesses; on-balance-sheet direct investment, which occupies a high amount of capital, often appears in the form of subscribing to private equity fund shares.

In March 2025, regulators further supported national banks in establishing AICs, expanding the pilot scope from cities to provinces, allowing joint-stock banks to officially enter the market.

This became a turning point for the enthusiasm of various AICs for equity investment to rise sharply.

According to incomplete statistics from Xinfeng, as of July 7, the five major banks' AICs had issued a total of 185 funds (including pure equity investments and equity investments for the purpose of debt-to-equity swaps);

In the 7 months of 2025, the number of funds issued reached 34, surpassing the total for any full year since 2018.

Xinfeng learned from an AIC of a state-owned large bank that the current AIC business includes both debt-to-equity swaps and pure equity investments, especially after the policy was implemented, pure equity investments have continued to develop and have a wide coverage, many of which appear in the form of private equity funds.

However, the use of funds and the scale of business development are still limited, and the accompanying problem of excessive capital consumption still exists.

To enhance the effectiveness of limited funds, more AICs are beginning to seek more partners to increase allowable leverage.

For example, in some AIC equity investments, many local industrial guidance funds, insurance funds, and industrial capital have already joined; the dual GP structure is particularly common in cooperation with local state-owned assets.

ICBC Investment, for instance, co-invested with four local entities, including the Shandong New Industrialization Fund and the Shandong State-Owned Enterprise Reform Fund, to establish the Jinan Gongrong Guohui Equity Investment Fund in March of this year;

This fund, with a scale of 1 billion yuan, has two GPs: ICBC Capital and Shandong Guohui Fund Management, with a clear investment focus on high-end manufacturing, integrated circuits, new energy, new materials, and other industries within Shandong Province.

Future Vision

From policy to market, the positioning of AIC is no longer just about debt resolution;

The market needs more capital to flow into "early investment, small investment, long-term investment, and hard technology" for long-term capital operations. Commercial banks need equity investment to form a linkage between investment and loans, further tapping into the value of corporate resources.

For large industries, AIC is still just a corner of many businesses, with an employee scale that even does not match that of local branches;

However, whether it is the initial paid-in threshold of 10 billion yuan or the subsequent business resource docking, AIC is indeed highly dependent on the parent bank.

This determines that the players currently keen on establishing AIC are still veritable large banks.

Apart from the five major state-owned banks, this year, China Merchants Bank, CITIC Bank, and Industrial Bank, which have newly obtained AIC licenses, rank among the top three in scale and profit among joint-stock banks in 2024;

Currently, no other joint-stock banks have expressed intentions to establish AIC, while city commercial banks like Bank of Ningbo and Suzhou Bank have publicly stated that they have no plans to establish AIC.

From the existing achievements, the profit feedback from each AIC to the parent bank is not significant, with the total profit of the five major banks' AICs in 2024 amounting to a net profit of 18.354 billion yuan, constituting only 1.4% of the total profit of the parent banks;

The role of AIC still lies more in risk mitigation and leveraging comprehensive benefits, achieving low-cost deposit accumulation and increasing space for fee income.

In terms of growth rates, the profit growth rates of Bank of China Asset, ICBC Asset, and Agricultural Bank Asset are 35.74%, 7.24%, and 3.98%, respectively, all significantly ahead of the profit growth rates of their parent banks;

The compound annual growth rate of profits for the five AIC institutions from 2018 to 2024 is as high as 57.93%.

It has been less than a year since AIC's pure equity investment was promoted from Shanghai to 18 provinces and cities;

In the current context of narrowing bank net interest margins and weak wealth management, the further relaxation of equity investment business by AIC is still expected to achieve greater profits and feedback to the parent banks.

However, under the long-term debt-oriented thinking of commercial banks, more breakthroughs and changes are needed in everything from the top-level design of regulation to the organizational structure and personnel allocation of institutions.

Li Yunze stated at a press conference in September 2024 that future regulations should guide commercial banks to optimize assessment mechanisms and appropriately grant equity investment businesses a certain degree of risk tolerance to avoid excessive risk aversion behavior.

Transitioning from traditional debt-to-equity business to pure equity investment, AIC institutions still face many challenges.

One is the issue of high capital consumption.

In the "Capital Management Measures for Commercial Banks" effective in 2024, the risk weight for equity investments in industrial and commercial enterprises participating in market-oriented debt-to-equity swaps has been reduced from 400% to 250%;

However, the risk weight for other equity investments corresponding to pure equity investments remains as high as 1250%.

This also means that the expansion of equity investment by AIC institutions may directly impact the capital consumption of the parent banks, thereby lowering ROE (Return on Equity) Second, the difficulty of exit after the slowdown of IPO rhythm.

Currently, the exit paths for equity investment in China still heavily rely on IPOs, so when the IPO rhythm slows down, AIC returns may face significant impacts;

For example, the profit decline of up to 22.27% year-on-year for Bank of Communications Investment in 2024 was caused by the lack of investment projects going public during the reporting period.

This also requires AIC institutions to actively expand diversified exit paths such as mergers and acquisitions, equity transfers, while increasing equity investment business to ensure capital recovery and returns.

Third, the shortcomings in professional capabilities under long-term debt-oriented thinking.

AIC institutions dominated by banks often have teams that come from the banking system, while early-stage investments in the technology industry carry high risks, which naturally contradicts the banks' low tolerance for non-performing assets;

The assessment mechanism that leans towards short-term performance may also make investment teams reluctant to engage with early-stage companies.

Therefore, although policies direct AIC equity investments towards "investing early, investing small, and investing in hard technology," actual cases of equity investment still concentrate on the later stages of corporate development.

Accordingly, AIC institutions may still need to strengthen the requirements for investment research capabilities in talent development, introduce external talents; at the same time, they need to establish long-term assessment mechanisms, implement due diligence exemption systems, and prevent the risk of benefit transfer.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investing based on this is at one's own risk