How much room is there left in this round of the real estate market?

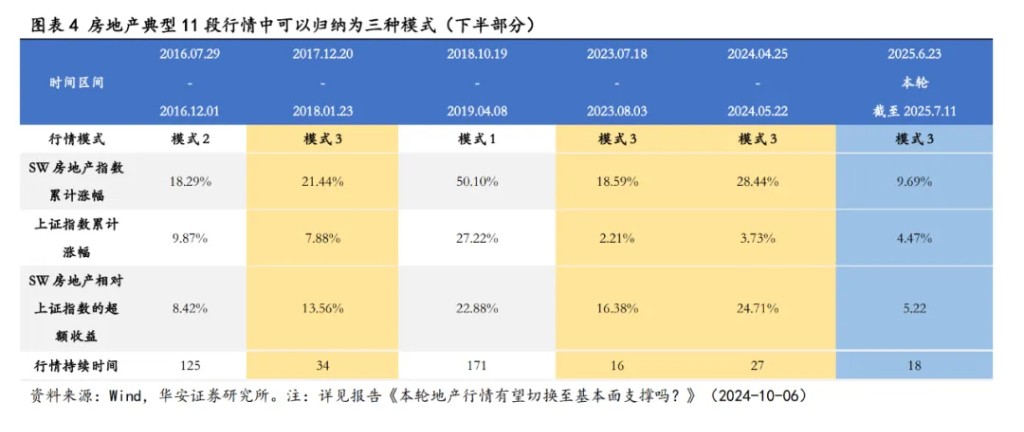

This round of the real estate market has experienced a phase of valuation recovery influenced by expectations of policy easing. Although real estate price data weakened in May and the market still faces downward pressure, it is expected that real estate stocks have an upside potential of 5-15% in the next half month. Since June 23, the Real Estate Index has risen by 9.69%, with an excess return of 5.22% relative to the Shanghai Composite Index. Recently, under the catalyst of policy, the real estate sector has performed strongly, leading the industry in terms of growth

Real estate regulation policies are expected to further loosen, driving a phase of valuation recovery, and the market is unfolding. In May, real estate price data weakened significantly, facing a new round of downward pressure. Under the policy demand for "stabilizing and stopping the decline," and with the Central Political Bureau meeting approaching at the end of July, there are expectations for further loosening of real estate regulation policies, hence real estate stocks are experiencing a phase of valuation recovery opportunity.

This round of real estate market belongs to a typical phase of valuation recovery opportunity brought about by policy shifts or significant policy easing during a downturn cycle or at the bottom. Historically, under this model, the duration of the real estate market generally lasts about 1 month, with index gains of 15-25%, and excess returns relative to the Shanghai Composite Index of 10-25%. Since June 23, this round of real estate market has seen the real estate index rise by 9.69%, with excess returns of 5.22% relative to the Shanghai Composite, lasting 18 calendar days. According to historical patterns, the real estate sector still has an upside potential of 5-15%, with excess returns relative to the Shanghai Composite also having a space of 5-20%, and is expected to continue rising in the next half month. Considering the current active market trading and increased risk appetite, the performance of this round of real estate market is expected to approach the upper limit of the range.

In our July monthly report, we were the first to indicate that the Political Bureau meeting was approaching, and real estate was likely to see a phase of market driven by policy catalysts. This week (July 7 - July 11), the real estate sector ranked first among the Shenwan primary industries, with a weekly increase of 6.1%. Among the secondary sub-industries, real estate services and real estate development rose by 6.2% and 6.1%, respectively, both ranking relatively high.

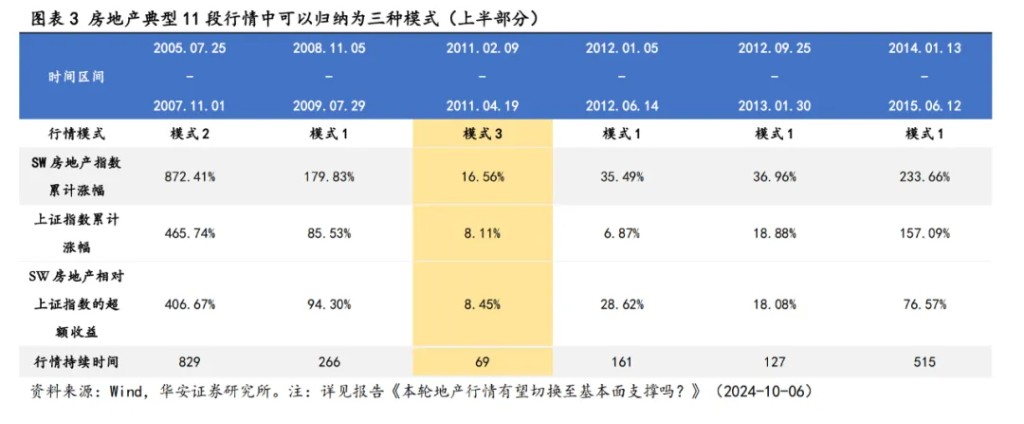

The recent real estate market belongs to a typical phase of valuation recovery opportunity driven by policy shifts or significant policy easing expectations during a downturn cycle or at the bottom. Generally, there are three models for the rise of the real estate market:

The first model is high prosperity + initial policy tightening, where real estate benefits from strong fundamental support and rises; the second model is continuous policy efforts + marginal improvement in real estate prosperity, where the Davis double-click boosts the real estate market, depending on when the real estate prosperity shows improvement trends; the third model is during a downturn cycle or at the bottom, where policy shifts or significant policy easing occur, leading to phase valuation recovery opportunities for real estate, which usually have certain regularity in terms of time and magnitude.

Since July 2021, several phases of the real estate market have followed this model, where the duration of the market generally lasts about 1 month, with index gains typically between 15-25%, and excess returns relative to the Shanghai Composite Index generally between 10%-25%.

The rise of the real estate sector from the end of June to now belongs to the third model, namely the phase of valuation recovery driven by expectations of policy easing. From June 23, 2025, to now, the Shenwan real estate sector has risen by 9.69%, while the Shanghai Composite Index has risen by 4.47%, with excess returns of 5.22% for real estate relative to the Shanghai Composite, lasting 18 calendar days. Referring to the gains and duration of historical model 3, the current absolute return of the real estate sector still has an upward space of about 5%-15%, and the excess return relative to the Shanghai Composite also has a space of about 5%-20%, and is still expected to continue rising in the next half month or so Considering the current market trading sentiment is improving and risk appetite is increasing, we expect the returns, relative returns, and duration of this round of real estate market to lean towards the upper limit of the range.

Authors of this article: Zheng Xiaoxia, Liu Chao, Zhang Yunzhi, Ren Siyu, Chen Bo, Source: Huashan Securities, Original title: "How Much Space is Left in This Round of Real Estate Market?" This article has been abridged.

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account the specific investment goals, financial conditions, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk