Japan's "House of Councillors Election": A referendum on "inflationary debt and financial repression," serves as a model for the United States

The Japanese House of Councillors election will be held this weekend. Deutsche Bank believes this is not only a political event but also a policy barometer. The election is seen as a referendum on the "financial repression" policy, with the public reacting strongly to the ongoing negative real interest rates and high inflation, focusing on "price control measures." Japanese government bond yields have soared to their highest levels in over a decade, providing important references for countries like the United States. Market tensions have intensified, with the 10-year government bond yield reaching its highest level since 2008

This weekend, Japan's House of Councillors will hold elections, and Deutsche Bank believes this will not only be a political event but also a key policy barometer.

According to the Wind Trading Desk, on July 15, Deutsche Bank strategist Mallika Sachdeva pointed out in a report that the upcoming House of Councillors election on Sunday can essentially be viewed as a referendum on the "financial repression" policy.

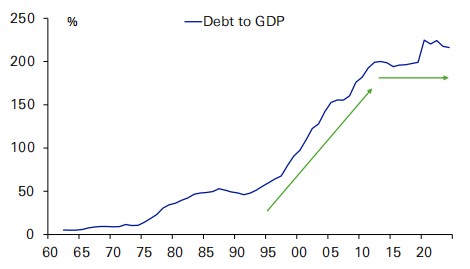

The research report explains that financial repression refers to high-debt countries maintaining negative real interest rates to transfer wealth from the household sector to the government sector, thereby achieving debt sustainability. Over the past 12 years, Japan has successfully stabilized its massive government debt through this method.

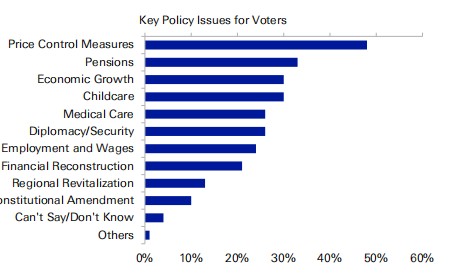

However, the ongoing negative real interest rates combined with recent high inflation are making this policy increasingly unpopular among the public. According to a Nikkei News opinion poll, "price control measures" have become the most concerning policy issue for voters, far surpassing other topics such as pensions and economic growth.

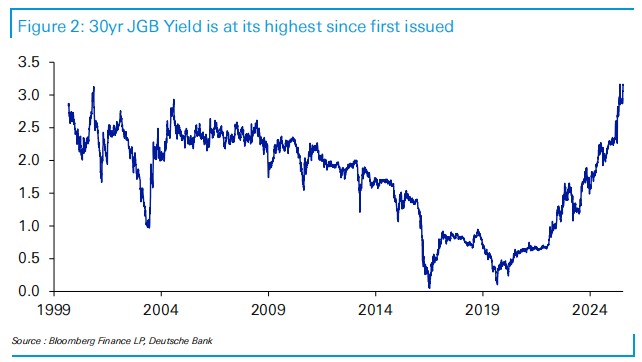

Deutsche Bank believes that voters are effectively "retrieving" fiscal space from the government by demanding tax cuts and cash subsidies. This game of cat and mouse has not only led to Japanese government bond yields soaring to their highest levels in over a decade but also provides a vivid example for countries like the United States that are also on an unsustainable debt path.

The report points out that the U.S. government is attempting to implement a combination of measures to improve its fiscal situation, including suppressing trade partners (tariffs) and suppressing real interest rates (pressuring the Federal Reserve). The strong backlash from the Japanese public against financial repression policies offers important insights into the political and social pressures the U.S. may face in the future.

Record Government Bond Yields and Fiscal Expansion Commitments

Market tensions have become evident in the lead-up to the elections.

On Tuesday, the yield on Japan's 10-year government bonds reached its highest level since 2008 during intraday trading, while the yield on 30-year government bonds hit a historic high since the issuance of bonds of that maturity in 1999.

For market participants accustomed to Japan's ultra-low government bond yields, the current market conditions can be described as entering a new unknown territory.

Data shows that the current decade is one of the worst-performing periods for Japan's 10-year government bonds in over 150 years of recorded history. This historic trend is solely due to the yield rising from about 0.4% in July 2015 to currently just below 1.6% The research report points out that in an environment where coupon rates are almost negligible, even a slight increase in interest rates can lead to significant capital losses—this is the severe reality currently facing many bond markets in Japan and globally.

This drastic market change occurs just before the upcoming Japanese House of Councillors election on Sunday. Notably, various political factions are actively promoting expansionary fiscal policies as part of their campaign platforms.

The ruling Liberal Democratic Party - Komeito coalition promises to provide one-time cash subsidies, while the opposition proposes a more radical consumption tax reduction plan, which could have a more significant impact on government fiscal revenue. The market's reaction is essentially a pre-pricing of the potential further loosening of fiscal discipline in the future.

The above exciting content comes from the Wind Trading Platform.

For more detailed interpretations, including real-time analysis and frontline research, please join the【Wind Trading Platform ▪ Annual Membership】.

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investment based on this is at one's own risk