Zuckerberg's post "huge amount of information," the AI "burning money war" is far from over

Zuckerberg posted to announce that Meta is ready to invest hundreds of billions of dollars to build large data centers. Bank of America Merrill Lynch interpreted this statement as a demonstration of confidence in mid-term revenue growth, as well as a strong signal that the AI capital expenditure cycle is far from over, while also extending an olive branch to AI talent. The bank raised its revenue forecast for Meta but slightly lowered its earnings per share forecast for 2026 due to the surge in AI-related expenditures

A social media post about AI investment has analysts recalculating Meta's future.

According to an article from Wall Street Insight, Meta Platforms CEO Mark Zuckerberg stated on Monday that the company will invest hundreds of billions of dollars to build several large data centers to support its artificial intelligence development, aiming to achieve Artificial General Intelligence (AGI), with the first data center expected to be operational next year. He posted on the social platform Threads:

We have named the first data center Prometheus, which is expected to go live in 2026. We are also building more giant clusters... The company will invest "hundreds of billions of dollars" in data center capacity construction to create superintelligence. We have funds from the business to support this plan.

Bank of America Merrill Lynch analyst Justin Post and others believe that the post is "information-rich," as this statement reflects confidence in Meta's mid-term revenue trajectory and sends a signal to the market that the AI capital expenditure cycle is far from over, while also extending an olive branch to AI talent.

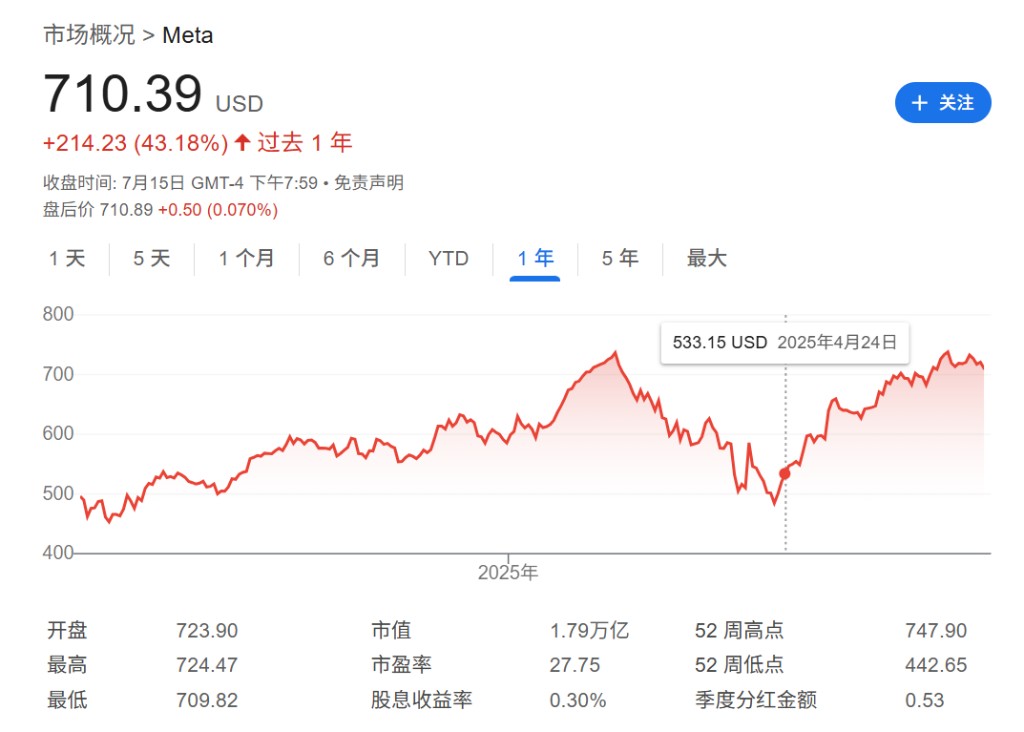

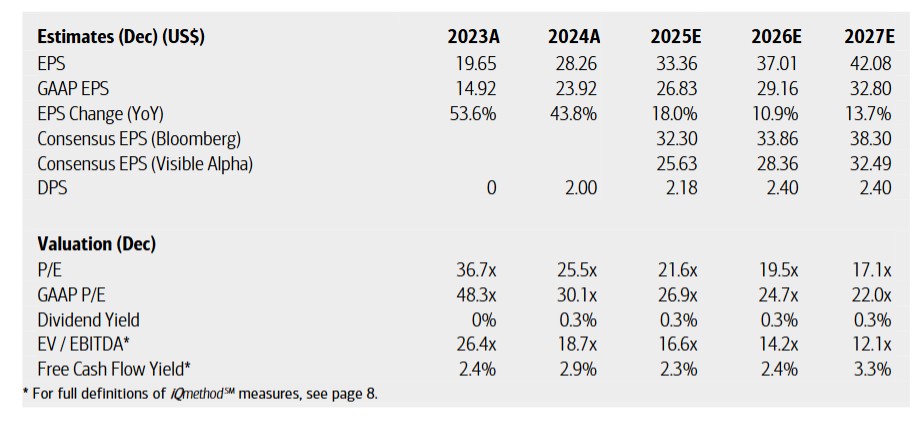

We believe these comments demonstrate confidence in Meta's revenue growth trajectory, and the scale of investment implies higher capital and operating expenditures in the future. We also view this post as an olive branch to AI talent, indicating that Meta is an ideal place for AI innovation. We expect AI investment to be a key focus in the upcoming earnings call. Meta may need to prove that its AI can deliver strong returns to drive valuation multiples expansion (the stock is currently trading at 25 times our expected earnings per share (EPS) for 2026).

As a result, Bank of America Merrill Lynch raised its revenue expectations for Meta but lowered its 2026 earnings per share forecast to reflect higher AI-related spending. They maintained a "Buy" rating on Meta, raising the target price from $765 to $775.

The cash burn is far from over: Bank of America explains five key signals from the post

According to Bank of America Merrill Lynch's analysis, Zuckerberg's post, combined with Meta's recent acquisitions of Scale AI and Play AI, as well as reports of large-scale AI talent recruitment, conveys five important signals to investors.

First, this statement shows Meta's confidence in its mid-term revenue outlook. Bank of America Merrill Lynch raised its second-quarter revenue expectations to near the upper limit of the guidance range, with third-quarter and 2026 revenue expectations both above Wall Street consensus.

Second, this clearly indicates to Wall Street that the AI capital expenditure cycle is far from over, with a high likelihood of future capital expenditure growth. Bank of America Merrill Lynch raised its 2026 capital expenditure expectations by $6 billion, expecting Meta's total capital expenditures from 2025 to 2027 to reach $229 billion Third, this post is also seen as a recruitment signal for AI talent, further highlighting Meta's image as a company focused on AI innovation and committed to providing resources for it.

Fourth, Meta is increasingly likely to add AI service components to its business, including marketing services around messaging, consumer/business subscriptions, and licensing deals for Llama.

Finally, Bank of America believes this post further emphasizes the importance of the potential return on AI investments as a focus for long-term investors. Meta may need to demonstrate strong AI returns to drive valuation multiple expansion, with the current stock price equivalent to 25 times the expected earnings per share in 2026.

The AI investment race continues to heat up, raising Meta's revenue expectations but lowering profit forecasts

Based on improved macro conditions, favorable exchange rates, and advancements in AI advertising technology stacks, Bank of America Merrill Lynch has raised its revenue expectations for Meta, while slightly lowering its earnings per share forecast for 2026 to reflect higher AI-related costs.

The firm predicts that Meta's revenue will reach $190 billion in 2025, a 15% year-over-year increase, with earnings per share of $26.83.

The revenue expectation for 2026 is $217 billion, higher than Wall Street's consensus expectation of $213 billion, but the earnings per share expectation has been lowered by 1% to $29.16.

It has also raised the 2025 capital expenditure expectation by $1.7 billion to $66.5 billion, and the 2026 capital expenditure expectation by $5.8 billion to $78.7 billion.

Bank of America Merrill Lynch warns that the AI investment race among tech giants is intensifying, stating, "CEOs of internet companies see the growing AI opportunities and the greater risks of missing out."

Analysts believe that the industry's capital expenditure expectations for 2026 are "more likely to be raised than lowered." Among the companies covered by Bank of America Merrill Lynch, Google is considered "the most likely to see an upward revision in capital expenditure expectations for 2026."