Who will be the next Chairman of the Federal Reserve? It is rumored that Trump's confidant Hassett has become the strongest candidate

Kevin Hassett is currently in the lead for the next Chairman of the Federal Reserve, with another popular candidate being former Federal Reserve Governor Kevin Warsh. Trump's dissatisfaction with current Chairman Powell has intensified the political implications of this choice, and investors are concerned about the independence of the Federal Reserve being threatened. Hassett has criticized the Fed's policies, questioning whether it maintains a non-partisan stance

According to informed sources, Kevin Hassett, currently serving as the Director of the National Economic Council (NEC), is in the lead for the next Federal Reserve Chair, with another popular candidate being former Federal Reserve Governor Kevin Warsh. U.S. Treasury Secretary Scott Bessent is involved in the selection process and providing advice, but if others do not prove convincing, he himself may also be considered for the position. Meanwhile, informed sources indicate that Federal Reserve Governor Christopher Waller is still seen as a dark horse.

President Trump has repeatedly expressed dissatisfaction with current Federal Reserve Chair Jerome Powell, accusing high interest rate policies of hindering economic growth and has called for the Federal Reserve to lower interest rates multiple times. Trump has also made it clear that he expects the next Federal Reserve Chair to quickly initiate interest rate cuts, which is a more explicit condition than during his first term.

Trump's statements have heightened the political implications of selecting the successor to the Federal Reserve Chair, raising concerns among investors that the independence of the Federal Reserve is under threat, which is crucial for controlling inflation and maintaining the dollar's status.

Hassett has also echoed Trump's criticisms of the Federal Reserve. In an interview this month, he pointed out that while the Federal Reserve is an independent institution, it lowered interest rates before last year's presidential election and has recently maintained rates unchanged citing inflation risks from tariffs, thus warranting presidential criticism. Hassett stated, "I think this raises the question of whether they have truly maintained a nonpartisan stance and whether they are truly independent."

Serving the President, Not an Ideology

Hassett was once viewed as a moderate right-leaning economist. However, over the past decade, he has gradually entered Trump's inner circle. His handling of the position of Director of the National Economic Council is markedly different from that of his predecessor Gary Cohn, who attempted to curb Trump's impulses on tariffs—resulting in his relatively short tenure. In contrast, Hassett fully embraces the "Make America Great Again" (MAGA) ideology, frequently expressing support for Trump's positions on trade, taxes, inflation, and Federal Reserve policies on television.

Stephen Myrow, head of the Washington research firm Beacon Policy Advisers, stated that this is the way to survive in Trump's world. He said, "Anyone who has been able to stay under Trump for so long is certainly not coming with some sort of ideology. They are not here to serve a particular school of thought; they are here to serve Trump."

It remains unclear how this "serving the president" attitude will affect the role of Federal Reserve Chair, which is supposed to be distanced from executive priorities. However, this is a multi-trillion-dollar question. Economists say that independent central banks are more effective in controlling inflation, so if the Federal Reserve Chair is seen as obedient to the White House, it could trigger turmoil in the U.S. Treasury market. Trump's threat to fire Powell has also exacerbated the financial tensions caused by his trade war.

The Most Suitable Candidate U.S. Treasury Secretary Janet Yellen stated in an interview on Tuesday that the process of selecting Powell's successor has officially begun. In addition to Yellen, the discussions in the small circle also include White House Chief of Staff Susie Wiles—who has been involved in key personnel decisions for Trump and is well aware of how to ensure that the U.S. economy remains strong politically by the midterm elections next year.

Trump's allies indicate that the president himself is highly involved in this selection. One advisor expects the interview process to progress quickly, as once Trump makes a decision, he tends to act immediately.

Hassett has expressed to people both inside and outside the government that he is very eager to take on this position—though he appeared quite low-key during television interviews.

On Tuesday, when asked by reporters if Yellen is the top candidate for the Federal Reserve chair, Trump responded that she "is an option" and praised the Treasury Secretary for "doing a great job."

White House spokesperson Kush Desai stated, "With Joe Biden's inflation crisis now completely behind us, President Trump has made it clear that the Federal Reserve's monetary policy should align with his economic agenda that supports growth. He will continue to nominate the most suitable candidates to best serve the American people."

As the Director of the National Economic Council, Hassett has daily access to the president. In contrast, Waller tends to travel between the Hoover Institution in California and New York. In 2017, Trump interviewed this former Federal Reserve governor for the chair position but ultimately deemed Waller's views too hawkish and her appearance too young, opting instead for Powell.

Hassett served as the Chairman of the Council of Economic Advisers during Trump's first term. Prior to that, he worked at the Federal Reserve and also served as the research director at the American Enterprise Institute (AEI). He is an expert in taxation and has authored many works. However, he is perhaps best known for his book "Dow 36,000," which predicted a significant rise in the U.S. stock market, shortly before the tech bubble burst. The Dow Jones Industrial Average ultimately took over twenty years to reach the level predicted in the book.

"Confusing"

After the end of Trump's first presidential term, Hassett provided consulting services for Trump's son-in-law Jared Kushner's investment fund, Affinity Partners, and frequently met with Trump to discuss economic issues. A longtime friend of Hassett stated that the two share similar views of the world and tend to harbor resentment due to feeling undervalued.

In fact, Trump has been vocal in his complaints about Powell since appointing him as Federal Reserve chair. This dissatisfaction has evolved into open anger this year, even giving Powell the nickname "Mr. Too Late" and often using sharper language to criticize him.

After a one percentage point rate cut in the last few months of 2024, the Federal Reserve under Powell has not cut rates again this year. Federal Reserve officials have stated that there is currently no need for further rate cuts, citing robust economic growth and a strong job market, and emphasizing the need for time to observe whether tariffs will drive inflation as most economists expect.

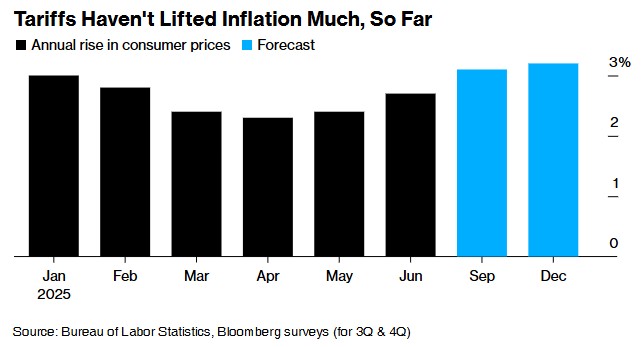

So far, there have been no significant signs of tariff-driven price increases in consumer prices. However, the June data released on Tuesday showed signs that businesses are beginning to pass on trade-related costs to consumers This further exacerbates market expectations that the Federal Reserve will again maintain interest rates at its meeting on July 29-30. The market still anticipates one to two rate cuts within the year.

Hassett echoed Trump's criticism of being "too late" in an interview, stating that the Federal Reserve is "behind the curve" and appears lagging compared to the actions of other central banks. He also expressed concerns, along with other Trump advisors and Republican lawmakers, about the rising costs of renovating the Federal Reserve headquarters—this has become the latest excuse for Trump to criticize Powell.

One of the goals of the Trump administration may be to pressure Powell to voluntarily resign from his position as a Federal Reserve governor when his term as chairman ends in May next year—rather than continuing until 2028. The fundamental position of the Trump administration is that the new chairman nominated by Trump—whether Hassett or someone else—should have a clear and unobstructed path to taking office.

Bessent stated on Tuesday: "Typically, the Federal Reserve chairman also resigns from the board at the same time." "There is currently a lot of discussion about the 'shadow Federal Reserve chairman,' which could cause confusion before they are nominated. I can say that if a former chairman remains on the board, it would be very confusing for the market."