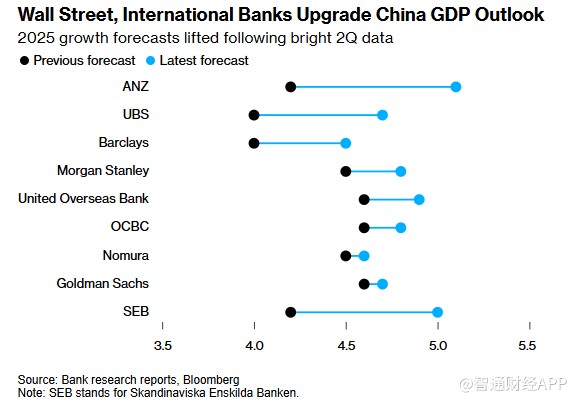

Second quarter GDP data exceeded expectations, and international major banks have raised their forecasts for China's economic growth

Due to better-than-expected GDP data in the second quarter, at least nine U.S. and international banks have raised their forecasts for China's economic growth this year. Banks such as Morgan Stanley, Goldman Sachs, and Barclays have adjusted their 2025 GDP growth expectations for China to nearly 5%, while ANZ expects a growth rate of 5.1%. The upward revision of China's economic growth expectations by several major banks comes as the Chinese economy has performed surprisingly well despite U.S. tariffs, thanks to the resilience of exports and policy support for consumption and investment. According to the National Bureau of Statistics of China, preliminary calculations show that GDP grew by 5.2% year-on-year in the second quarter of this year. Goldman Sachs economists stated that given the favorable economic situation so far this year, policymakers are unlikely to rush to introduce large-scale or significant stimulus measures in the short term. In a report on Tuesday, they said, "We expect gradual and targeted easing policies to help curb the downturn in the real estate market and alleviate pressures in the labor market."

According to the Zhitong Finance APP, at least nine American and international banks have raised their forecasts for China's economic growth this year due to better-than-expected GDP data for the second quarter. Banks such as Morgan Stanley, Goldman Sachs, and Barclays have adjusted their 2025 GDP growth expectations for China to nearly 5%, while ANZ expects a growth rate of 5.1%.

Several major banks have raised their expectations for China's economic growth.

Despite the imposition of tariffs by the United States, China's economy has performed surprisingly well, thanks to resilient exports and policy support for consumption and investment. According to data from the National Bureau of Statistics of China, preliminary calculations show that GDP grew by 5.2% year-on-year in the second quarter of this year.

Goldman Sachs economists stated that given the favorable economic situation so far this year, policymakers are unlikely to rush to implement large-scale or significant stimulus measures in the short term.

In a report on Tuesday, they said: "We expect gradual and targeted easing policies to help curb the downturn in the real estate market and alleviate pressures in the labor market."