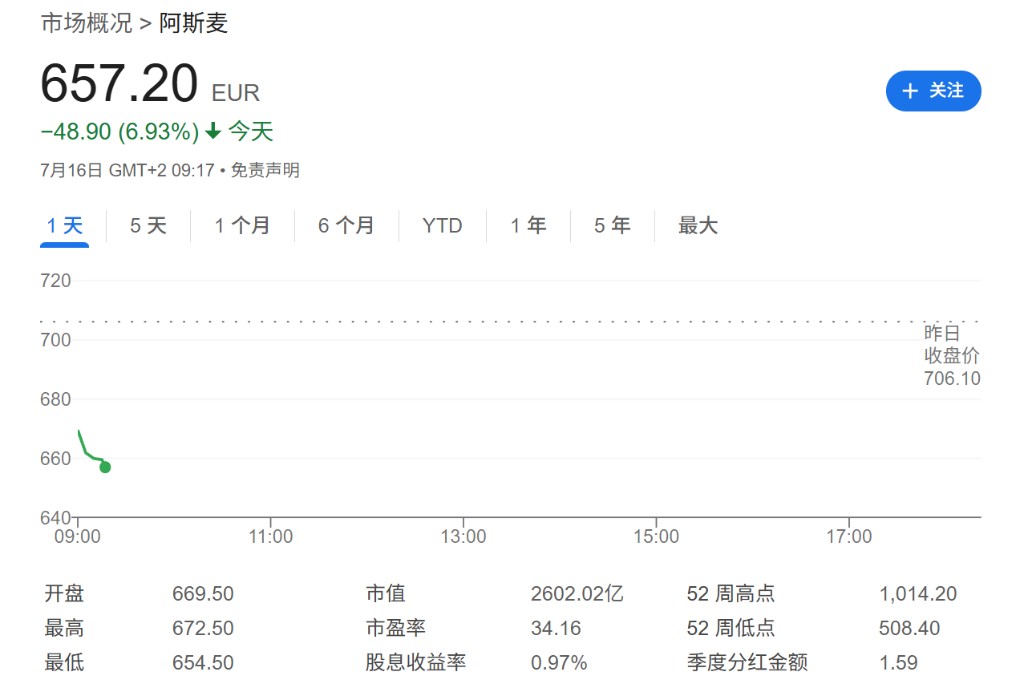

Inflation concerns weaken interest rate cut expectations, U.S. stock futures decline, European stocks open lower collectively, ASML plummets 6% after earnings

Affected by persistent inflationary pressures and tariff threats, S&P 500 index futures fell 0.3%, indicating that U.S. stocks may close lower for the second consecutive trading day. Long-term U.S. Treasury yields remain high. European stocks opened lower collectively, with ASML dropping nearly 6% after its earnings report

U.S. stock index futures fell as persistent inflation pressures and potential new tariff threats prompted traders to significantly lower expectations for a Federal Reserve rate cut this year, shifting market sentiment to a cautious stance.

After the latest U.S. inflation data showed that companies have begun to pass some tariff-related costs onto consumers, bets on a Federal Reserve rate cut quickly weakened. S&P 500 futures fell 0.3%, indicating that U.S. stocks may close lower for the second consecutive trading day. Long-term U.S. Treasury yields remained high. European stocks opened lower collectively, with ASML dropping nearly 6% after earnings.

- European stocks opened lower collectively, with the Euro Stoxx 50 index down 0.53%, the German DAX index down 0.33%, and the UK FTSE 100 index down 0.05%. ASML shares fell nearly 6%. Richemont shares rose 1.2% in Europe, as the company's sales exceeded expectations. Stellantis shares fell as much as 5% in Europe after the company decided to cancel its hydrogen fuel cell vehicle project.

- U.S. stock index futures extended their losses, with S&P 500 futures down 0.3% and Nasdaq 100 futures down 0.5%.

- The U.S. dollar spot index fell 0.1%. The euro rose 0.2% against the dollar to $1.1623.

- The yen rose 0.1% against the dollar to 148.70.

- The euro rose 0.1% against the Norwegian krone to 11.9162, the highest since April 24.

- The yield on the 10-year U.S. Treasury fell 1 basis point to 4.47%, while the 30-year Treasury yield remained around 5%.

- Brent crude oil rose 0.2% to $68.86 per barrel.

- Spot gold rose 0.5% to $3341.14 per ounce.

- Bitcoin rose 1.4% to $118121.3.

U.S. stock futures decline as inflation concerns weaken Fed rate cut expectations

Expectations for a Federal Reserve rate cut have narrowed significantly this month. Strong June employment data released on July 3 first dispelled market expectations for a rate cut after the July 30 meeting, and subsequently weakened bets on a rate cut in September—whereas in late June, a September rate cut had been fully priced in by the market.

Dallas Fed President Lorie Logan stated that while policymakers may need to keep rates at current levels for a longer time to fully cool inflation, they may also need to pivot to rate cuts if inflation and the labor market soften.

Analysts generally believe that the Federal Reserve will remain on hold in the short term. Tim Waterer, Chief Market Analyst at KCM Trade in Sydney, wrote in a report:

“The latest data may prevent the Fed from adjusting rates at least for the next few months.” In addition, concerns about inflation triggered by tariffs, as well as the risk of increased government spending in major global economies, are bringing a bearish tone to the U.S. Treasury market. European stock index futures are declining, partly due to chip equipment manufacturer ASML Holding NV warning that the uncertainty surrounding tariffs is casting a shadow over its outlook.