The U.S. June CPI confirms tariff transmission, commodity inflation rises again after 4 months, and core PCE may be even more "ferocious"?

The U.S. June CPI data shows that the tariff transmission effect has begun to manifest, with core commodity prices rising for the first time since February, and significant increases in prices for affected categories such as household goods and clothing. Although the core CPI rose only 0.2% month-on-month, investment banks expect the core PCE to significantly outperform the core CPI, potentially reaching a month-on-month increase of 0.29%-0.34%. This will weaken the rationale for the Federal Reserve to cut interest rates and strengthen its determination to maintain current policies

The tariff transmission effect has begun to manifest, and the U.S. June CPI data hides key structural changes behind its apparent weakness.

Although the core CPI in June rose only 0.2% month-on-month (lower than expected), core commodity prices saw a significant increase for the first time since February, with prices of categories affected by tariffs, such as household goods and clothing, rising sharply. Major investment banks currently expect core PCE to significantly outperform core CPI, potentially reaching a month-on-month increase of 0.29%-0.34%, which would weaken the rationale for the Federal Reserve to cut interest rates this year and strengthen its determination to maintain its current policy stance.

Apparent Weakness Hides Structural Changes

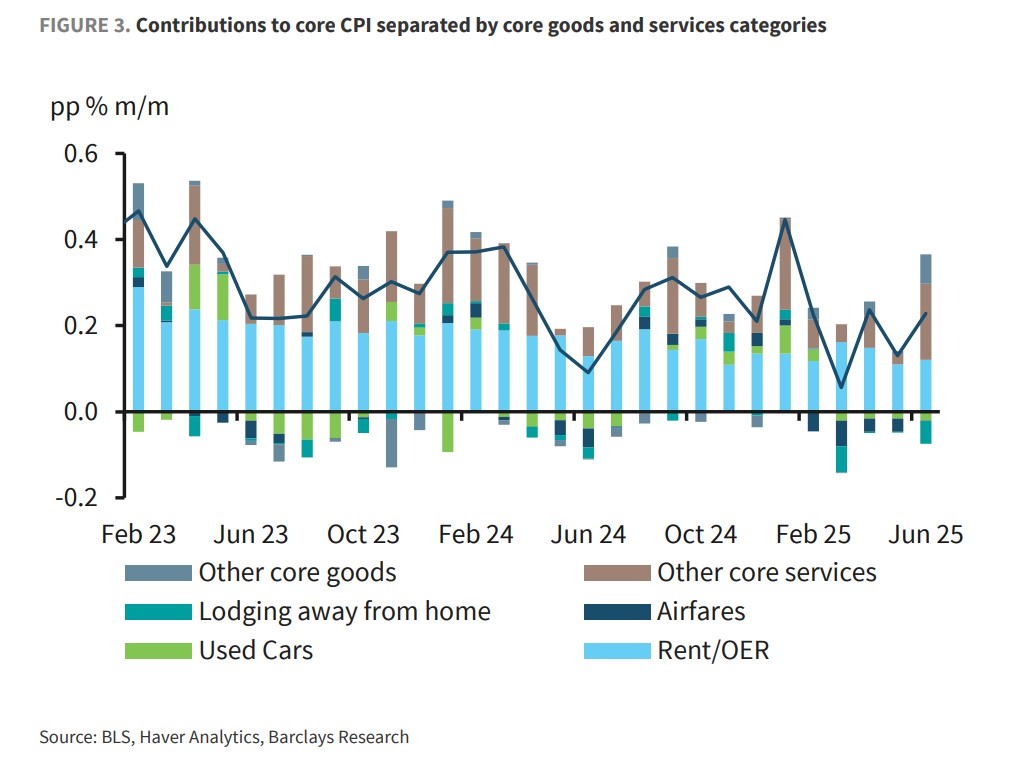

The June CPI data initially appears mild: the core CPI rose 0.23% month-on-month, slightly below the market expectation of 0.25%-0.30%, and the year-on-year rate increased from 2.8% to 2.9%. However, this apparent weakness conceals important structural changes.

According to news from the Chasing Wind Trading Desk, Bank of America reported on July 16 that core commodity prices rose 0.2% in June, and excluding used cars, they rose 0.3%, marking the first increase since February and the strongest performance since February 2023.

The long-awaited evidence of tariff transmission has finally appeared. Core commodity prices (such as appliances, clothing, entertainment products, etc.) rose in June, marking the first increase since February. Bank of America emphasized that Tuesday's report provided ample evidence that tariffs are being passed on to consumers:

Prices of household goods rose 0.98% month-on-month, the largest increase since January 2022;

Clothing prices rose 0.43%;

Prices of entertainment products rose 0.77%;

While core commodities rose, core services (such as accommodation and airfares) saw price declines. Notably, hotel accommodation prices have fallen for four consecutive months, and airfare prices have decreased for five consecutive months. Bank of America stated that demand is slowing based on the bank's consumer data and airport security check numbers.

Barclays estimates that the U.S. trade-weighted effective tariff rate is 14-15%, significantly higher than last year's 2.5%. It is expected that about 50% of the tariff costs will be passed on to prices, a hypothesis consistent with the Federal Reserve's survey.

Core PCE May Be More "Aggressive"

Currently, investment banks generally expect that the core PCE, which the Federal Reserve pays more attention to, may be more "aggressive."

Bank of America predicts that the core PCE in June may rise 0.34% month-on-month, primarily driven by the stock market rebound and increased investment-related services (such as financial advisory fees). Regarding the Federal Reserve, the CPI data reinforces the rationale for the Fed to maintain its current policy.

Bank of America pointed out that if the PCE forecast is correct, the reasons for the Fed to remain unchanged this year will be strengthened. Tariffs are beginning to affect the data, and a 0.3% increase in core PCE will bring it to a year-on-year level of 3.0% in the third quarter.

For investors, the key is that there is still uncertainty regarding the timing and magnitude of tariff transmission. Barclays expects prices to gradually rise in the coming months, peaking in early autumn. Bank of America recommends continuing to go long on inflation and downplaying market expectations for interest rate cuts before the end of 2025.

The above exciting content comes from the Wind Trading Platform.

For more detailed interpretations, including real-time interpretations and frontline research, please join the【 **Wind Trading Platform ▪ Annual Membership**】

Risk Warning and Disclaimer

The market has risks, and investment should be cautious. This article does not constitute personal investment advice and does not take into account the specific investment objectives, financial situation, or needs of individual users. Users should consider whether any opinions, views, or conclusions in this article are suitable for their specific circumstances. Investing based on this is at your own risk