Consumer Insights | POP MART Mid-Year Report Review: Toys of Time

High growth meets expectations, high valuation needs to be digested

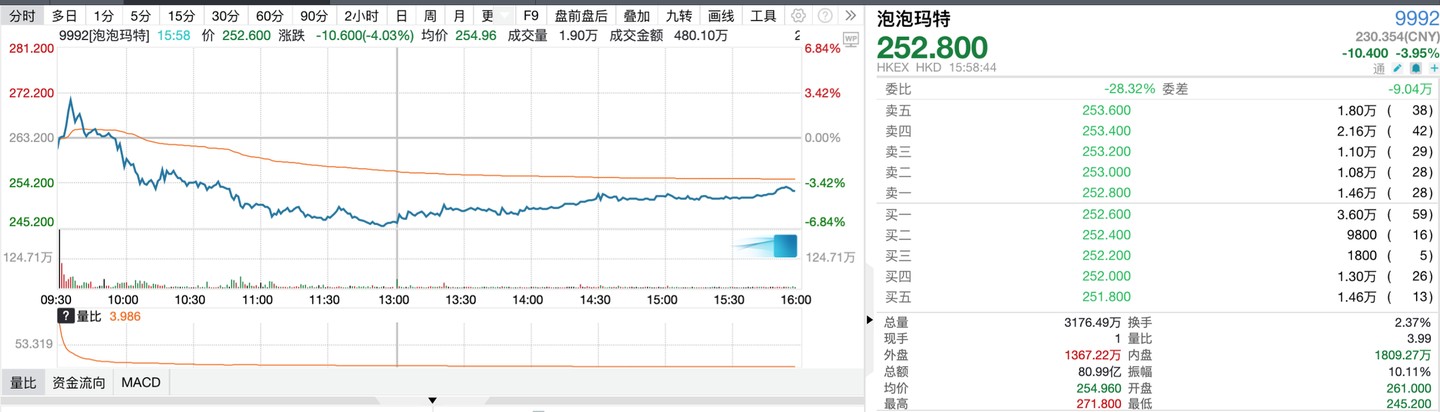

POP MART (9992.HK) announced its interim results, expecting a year-on-year revenue growth of no less than 200% in the first half of 2025 (corresponding revenue of no less than 13.67 billion yuan), and a year-on-year net profit growth (excluding the fair value changes of financial instruments) of no less than 350% (corresponding net profit of no less than 4.34 billion yuan), showing strong performance. The company's results exceeded the consensus expectations of sell-side analysts by 50%, but fell short of the buy-side expectations of a median net profit of 4.5-5.5 billion yuan, leading to a slight adjustment in the stock price.

Data source: WIND, data as of July 16, 2025

Scale Expansion, Rapid Growth

POP MART is still in a rapid expansion phase. The significant year-on-year growth in the company's performance comes from—

① The global recognition of POP MART's IP has increased, with diversified products achieving rapid growth in overseas regions. Since the launch of the LABUBU 3.0 series at the end of April, it has sparked a continuous queue craze worldwide, with the price of hidden products rising from 99 yuan to over 4,000 yuan, indicating a high premium;

② The proportion of overseas revenue continues to rise, positively impacting both gross margin and net margin. The company currently has over 150 overseas stores, with overseas revenue growing year-on-year by 475%-480% in Q1 2025, including a year-on-year growth of 345%-350% in the Asia-Pacific region, 895%-900% in the Americas, and 600%-605% in Europe. The interim report is expected to disclose more detailed regional growth information for Q2.

This year, POP MART has performed strongly in the capital market, primarily due to its rapid revenue and profit growth. According to grassroots research, the company's global GMV from January to June 2025 was 2.1 billion, 1.9 billion, 1.688 billion, 1.512 billion, 3.5 billion, and 3.7 billion yuan, totaling 14.4 billion yuan, a year-on-year increase of 216%. Among these, overseas GMV was 966 million, 665 million, 680 million, 635 million, 1.6 billion, and 1.7 billion yuan, totaling 4.546 billion yuan, a year-on-year increase of 236%. Recently, the trading volume of Star People and CRYBABY in the secondary market has been fluctuating upward, likely forming a new hit series. This further strengthens the company's IP operational capabilities beyond Labubu. The accelerated realization of the globalization strategy is the core driving force behind POP MART's continued outperformance in growth.

High Valuation, Needs Time

Despite POP MART's strong performance growth, even investment banks like Goldman Sachs and JP Morgan have raised their profit forecasts, the biggest enemy for POP MART investors currently is time: how to digest its high valuation through sustained growth requires patient waiting and detailed data tracking.

Goldman Sachs stated in its report that based on the profit warning, it has raised its adjusted net profit forecast for POP MART for 2025-2027 by 15%-22%. For 2025, Goldman Sachs expects revenue and adjusted net profit to reach 32.8 billion yuan and 10 billion yuan, respectively, up from previous estimates of 29.4 billion and 8.2 billion. It maintains a neutral rating, as the target price of 260 HKD is very close to the current price of 252 HKD Based on the strong performance in the first half of the year, JP Morgan has raised its earnings forecast, increasing the 2025 revenue expectation from 28.011 billion yuan to 30.385 billion yuan, and adjusting the earnings per share from 6.10 yuan to 7.15 yuan. JP Morgan has raised the target price for POP MART from HKD 330 to HKD 340, maintaining an "overweight" rating.

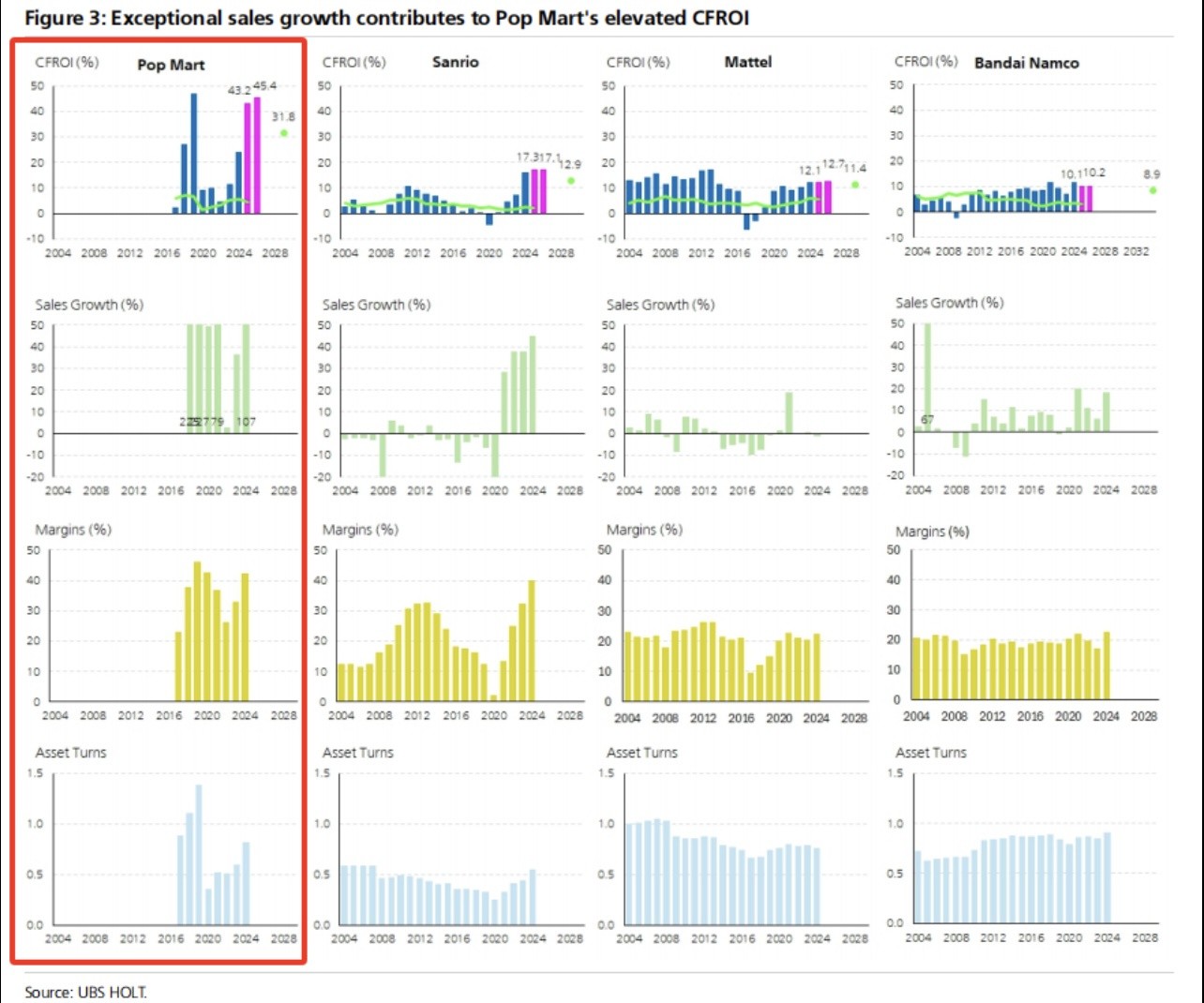

JP Morgan estimates that POP MART's implied valuation for 2026 is at 33 times PE, close to the 35 times valuation of the Japanese IP company Sanrio, and higher than Disney's 20 times valuation.

Source: Huatai Securities

Another reason for POP MART's high valuation is its profitability, which exceeds the industry average. The company's cash flow return on investment (CFROI) for 2024 has risen to 24%. The profit margin for 2024 is as high as 42%, more than double the industry average of 20%. This may indicate that in the medium to long term, its valuation will be difficult to fall below the industry level, making it a "toy of time."

Source: UBS Securities

Innovative Products Drive Growth

POP MART's IP operation capability has become its strong moat. In the near future, we can expect more catalytic events as follows—

① Founder Wang Ning appeared at Shanghai Xuhui Port Huai Henglong to cut the ribbon for the newly opened "POPOP" jewelry store, which will sell more Labubu series jewelry products, as well as series accessories like SkullPanda, Molly, and Dimoo, further enhancing the monetization ability of the IP. The scale of the stores is expected to continue to expand;

② The first season of the "Labubu & Friends" animation is expected to premiere in the summer, featuring 20 episodes of 2-minute videos spread across social networks, still focusing on enhancing IP recognition and strengthening operations in conjunction with potential new product launches;

③ A collaboration with Uniqlo, Labubu x Uniqlo T-shirts will be launched in August;

④ The preview/release of Labubu 4.0 is expected to be launched before the Christmas/Spring Festival holidays, preparing for sales in 2026;

⑤ Labubu is potentially launching interactive emotional toys with AI features, and with the gradual maturity of the domestic AI toy supply chain, POP MART has a complete opportunity to launch products with new technologies in 2025-2026.

Considering the company's IP operation capability and global expansion process, we believe that POP MART still has high growth potential in its business, and the current market pricing is fully reasonable. The current stock price reflects the market's expectation that the company's sales growth will slightly slow to 24% in 2028-29, and the EBITDA profit margin will return from a high of 42% to the company's own five-year median of 35% Assuming POP MART makes breakthrough progress in overseas markets, new technology toys, or IP dissemination, and maintains a profit margin of 40% in the long term, the company's prospects remain promising