A 25% tariff is enough to hit risk appetite hard, UBS's "Defensive Three Shields" strategy lays out the stock market

UBS released a research report stating that due to the Trump administration's announcement of a 25% high tariff, U.S. consumer spending is expected to be suppressed, and the risk appetite in financial markets may face significant pressure. UBS warned that risk assets are under withdrawal pressure, especially the MSCI Global Stock Index and the S&P 500. The institution recommends shifting to defensive investments, avoiding high credit risk industries, and favoring companies with robust cash flow. At the same time, it is expected that the U.S. GDP growth rate will be adjusted down to about 1% in 2025

According to the Zhitong Finance APP, international banking giant UBS recently released a research report stating that the institution's outlook for American consumers and the economy is overall cautious. It expects that the "risk appetite" in financial markets may face significant pressure, mainly due to the recently announced broad 25% high tariffs by the Trump administration, which will further suppress consumer spending. The inflation rebound triggered by tariffs and the Federal Reserve's maintenance of high interest rates due to potential tariff pressures will jointly suppress consumption. At the same time, UBS emphasizes that microdata on global consumer finance shows an increase in loan delinquency rates and a weakening willingness to spend, reflecting increased pressure on household balance sheets in a tightening credit environment and rising potential credit risks.

The UBS strategy team believes that risk assets such as stocks may face downward pressure in the short term and throughout the second half of the year—especially the MSCI Global Stock Index and the S&P 500 Index, which have repeatedly set historical highs, may face greater downside pressure. UBS warns that risk assets may face a new round of pullbacks, with high inflation and tariffs jointly suppressing spending, and the market needs to reassess household balance sheets.

In the context of both macro headwinds and micro risk signals, UBS's stock market strategy does not favor aggressive investment strategies that include AI computing leaders and unprofitable popular tech stocks, but rather actively shifts towards defense. The institution increasingly tends to avoid consumer sub-industries that are highly sensitive to credit risk and economic cycles (such as high-end discretionary consumer goods and financing-driven industries), while preferring discretionary consumer giants and high-quality fundamental companies with robust cash flow and inelastic demand.

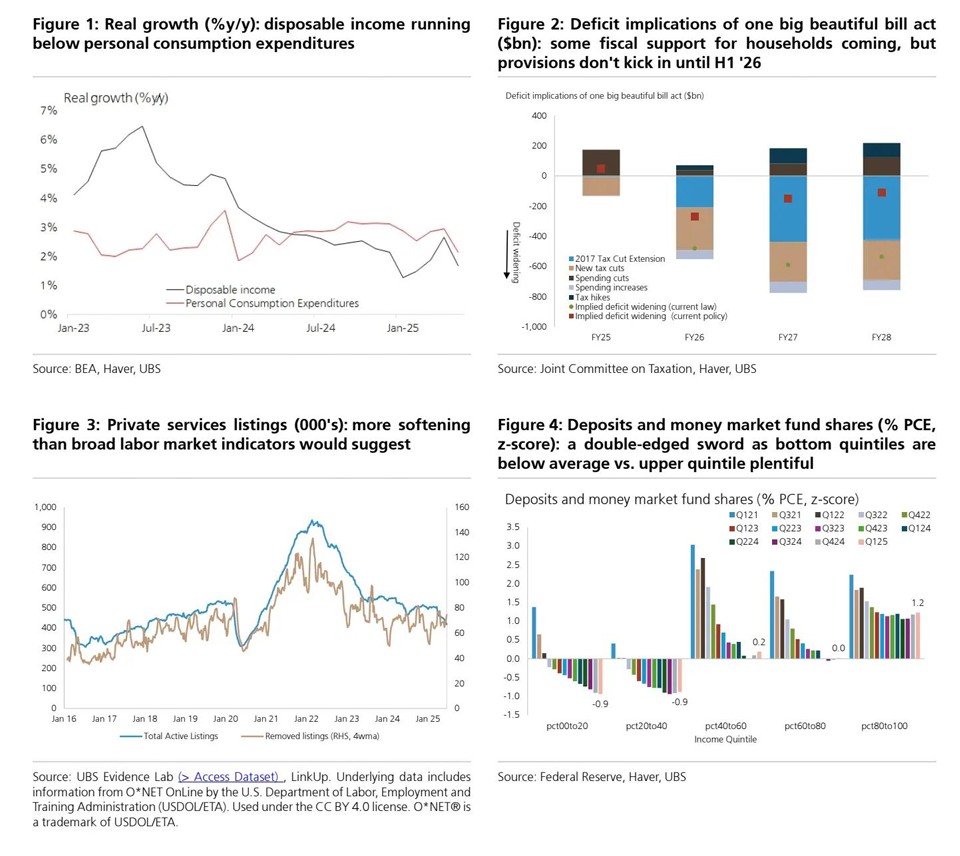

Additionally, UBS's global equity strategy team stated that fiscal stimulus from the U.S. government is expected to be delayed until 2026, leading to disposable income growth not keeping pace with consumption growth. As a result, UBS has lowered its 2025 U.S. GDP growth forecast to about 1%. Therefore, due to factors such as strong financial buffers for high-income households and existing employment resilience, the long-term structural outlook for U.S. consumption remains relatively positive, with the real recovery momentum likely to emerge after 2026.

The UBS strategy team indicated that as consumers become more cautious, the market may experience a downward adjustment for risk assets, and it is advisable to prepare in advance by shifting towards defense and prioritizing high-quality fundamentals. Only when inflationary pressures ease, trade uncertainties diminish, and new fiscal dividends are realized will the "tightening spell" on American consumers be lifted, allowing risk assets to potentially enjoy a more robust upward foundation.

Macroeconomic and Consumer Background: Rising Caution

Overall, the UBS equity strategy team believes that risk assets such as stocks and high-yield corporate bonds may face significant pullback pressure in the short term and throughout the second half of the year, and the market may need to reassess the sustainability of American household balance sheets and consumption.

UBS's research report shows that the current macro environment has increasing unfavorable factors for consumers. First, the economic growth rates in the U.S. and globally are slowing: as previous fiscal stimulus wanes and the effects of tightening monetary policy become apparent, UBS expects U.S. real GDP growth to drop to about 1% in 2025, significantly lower than the level in 2024. UBS predicts that the unemployment rate will rise to about 4.6% in 2025, and the U.S. household sector may enter a fragile phase of "slowing income growth—spending supported by credit." Secondly, the momentum of the U.S. labor market is weakening, with slower job growth in the private sector. The job vacancy data in the service industry shows greater signs of downward softening compared to traditional labor indicators, indicating a cooling employment and income outlook. Additionally, the year-on-year growth rate of disposable income for residents has fallen below that of personal consumption expenditure, creating the largest gap in over a decade. Some consumption may rely on previously accumulated savings or borrowing for support.

Meanwhile, high-income households in the U.S. still have ample financial buffers—this polarization means that overall consumption resilience largely depends on the continued spending of the affluent group. Looking ahead, if the economy slows further, the largest middle- and low-income households in the U.S. may be forced to cut back on consumption due to depleted savings and limited credit.

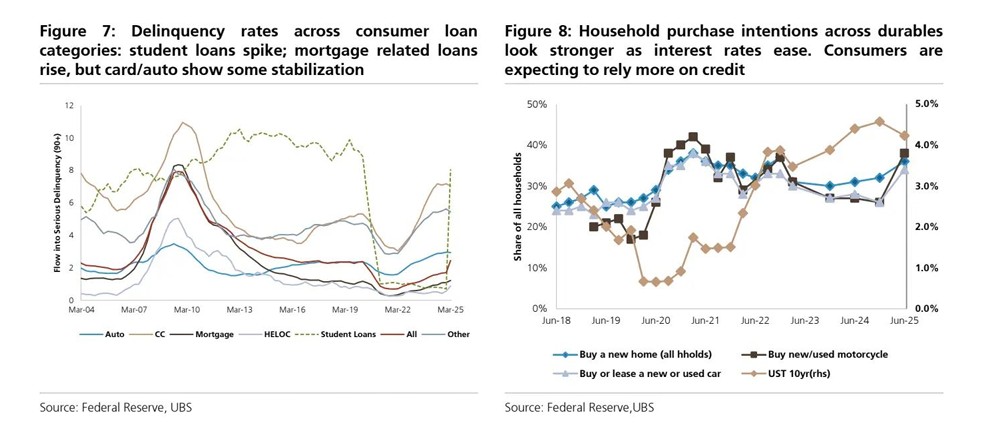

UBS stated that inflation and interest rate factors continue to exert pressure on U.S. consumer spending. UBS predicts that the core personal consumption expenditure (core PCE) inflation rate will still be around 3.4% by the end of 2025. It is expected that, in the context of high inflation, the Federal Reserve may continue to maintain high policy interest rates in the second half of the year, driving up mortgage and consumer credit rates, increasing the burden of household debt repayment, and suppressing demand for durable goods.

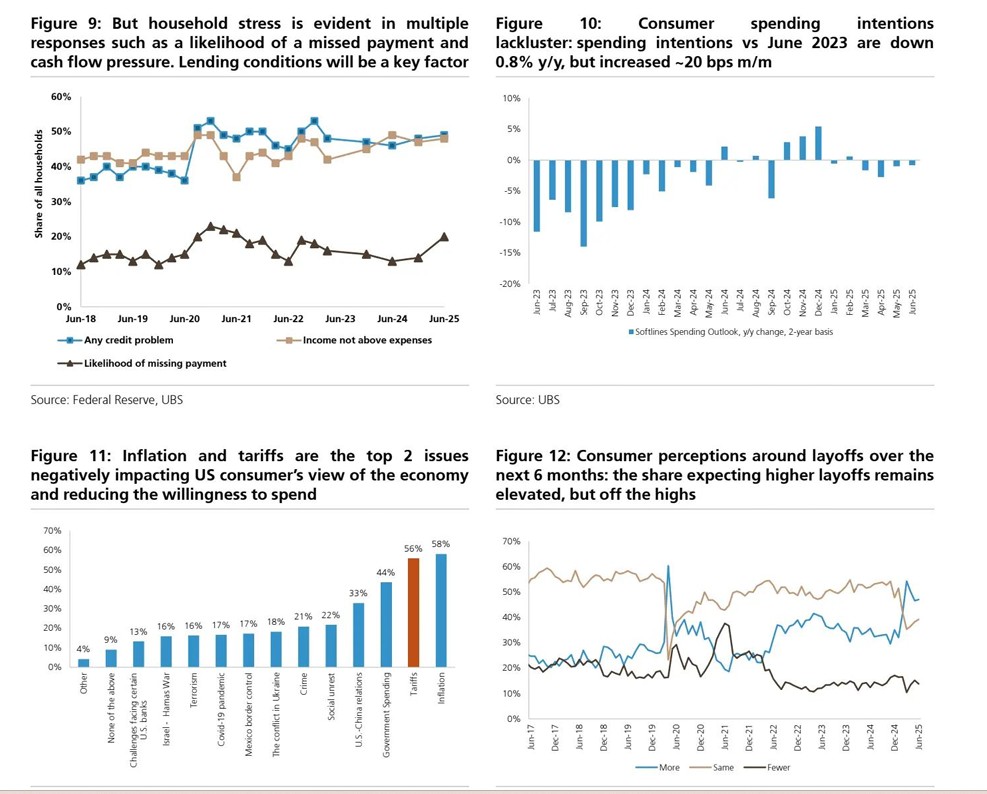

In addition, the impact of Trump's trade policy may further highlight the situation, as the U.S. government significantly raised and expanded import tariffs on goods in the second half of 2025, with the weighted average tariff rate potentially soaring to about 20% (compared to only about 2% in 2024). UBS stated that high tariffs covering 25% or more of most countries will directly erode residents' real purchasing power by pushing up consumer goods prices. UBS's survey shows that as many as 68% of respondents believe inflation is negatively affecting their views on the economy, and 42% see tariffs as a major drag factor—surprisingly, the impact of Trump's tariff policy as a single factor exceeds concerns about geopolitical situations or employment prospects.

The UBS report pointed out that the increase in tariff policy particularly affects some U.S. holiday shopping season goods, such as Halloween costumes in the second half of the year, which face higher tariff costs that may squeeze related consumption. Moreover, trade uncertainty itself has become a new pressure point on consumer psychology. UBS's survey found that tariffs have risen to become the second-largest concern for U.S. consumers, just after inflation, which was unexpected by the market. This phenomenon indicates that the uncertainty of trade policy is suppressing consumption willingness through psychological expectation channels. If tariffs ease in the future, they may instead become one of the upward driving factors for consumption prospects The delay in fiscal support is also a significant disadvantage for the macro environment in the United States. As mentioned above, although the U.S. government has introduced a series of fiscal transfers and tax reduction policies aimed at residents in recent years (such as tax credits and new deductions in the "BBB Act"), most of these benefits will not truly benefit the household sector until 2026. Therefore, for more than a year to come, American households cannot expect new fiscal handouts to cushion the impacts of inflation and interest rates, and will have to rely more on their own assets and credit to balance their income and expenses. UBS points out that new tariff shocks in the second half of 2025 will misalign with fiscal benefits in the first half of 2026, increasing the pressure for consumption to slow down throughout the year.

From a financial indicator perspective, the credit cycle for American consumers and businesses has entered its later stages, with debt repayment pressures and default risks beginning to surface. In the corporate sector, UBS's credit model shows that the U.S. credit cycle indicators are already showing signs of fatigue. Although corporate profits have not yet experienced a cliff-like deterioration, since June, the number of U.S. leveraged loan defaults and "fallen angels" (bonds downgraded to junk status or close to junk status) has significantly increased. Fortunately, the default rate for small and medium-sized enterprises (SMEs) has not yet shown a significant rise, and the number of bankruptcy filings across society, when employment-weighted, remains near historical medians. UBS warns to pay attention to changes in corporate profitability—under the trends of economic slowdown and productivity automation, companies may no longer be as reluctant to lay off employees as they were in the past. If profit pressures increase, they will be more inclined to cut costs through layoffs, which will in turn exacerbate consumption downturns and credit default risks.

The credit pressure in the household sector is also rising. With the end of the federal student loan grace period, the delinquency rate for student loans in the U.S. has significantly jumped, and the default rate related to mortgages has also begun to rise from extremely low levels. In contrast, the delinquency rates for U.S. credit cards and auto loans are currently relatively stable, with no new spikes (indicating that the asset quality of these two types of consumer credit has not yet deteriorated significantly). Overall, the overall delinquency rate for consumers is on an upward trend but remains at historical median levels, necessitating vigilance against the "spillover effect" into other credit areas. UBS will closely monitor the delinquency situation for credit cards and auto loans as leading indicators for assessing the spread of consumer financial pressure.

UBS proposes a "defensive three-shield" strategy for the stock market: primarily defensive style, waiting for counterattack opportunities

In the context of coexisting macro headwinds and micro risk signals, UBS's cross-asset strategy encompassing the stock and bond markets has shifted to a defensive stance. Specifically, UBS's defensive strategy "First Shield"—that is, credit market defense, holds a "neutral to cautious" view on the U.S. credit market: it is expected that U.S. corporate bond spreads will have moderate widening space in the short term (i.e., risk premiums will rise), thus a cautious approach is needed strategically, with a preference for upgrading credit quality (increasing the average credit rating of the portfolio) In other words, UBS recommends increasing holdings in high-quality bonds and defensive non-cyclical industry credit products under the expectation of declining risk appetite, while reducing exposure to high-yield, highly leveraged corporate bonds. Given that the current credit spread levels have significantly compressed compared to 2022, UBS believes that the space for further excess returns is limited, and tactically favors defensive relative value trades, such as going long on bonds of financially sound leading companies within the same industry, shorting bonds of financially weak small companies, or conducting hedged portfolios across different sectors to reduce beta risk.

UBS's defensive strategy "Second Shield" — favoring essential consumption over discretionary consumption. In the stock market, UBS's strategy team similarly advocates maintaining caution and balance in consumer-related sectors. Due to the slowdown in U.S. consumption trends and tightening credit, which first impacts the discretionary consumption sector, the strategy should focus on defensive consumption and essential consumer goods companies. UBS states that large retail giants with warehouse and discount models benefit from the consumer "trade-down" trend, with Walmart, Costco, and Target accounting for about 50% of total retail spending in the U.S.; conversely, some leading second- and third-tier discretionary retailers may face inventory buildup and financial deterioration due to declining foot traffic and sales.

UBS's defensive strategy "Third Shield" — favoring companies with robust cash flow and inelastic demand, while avoiding high-debt, highly elastic sub-sectors. These companies overlap slightly with the aforementioned essential consumption, focusing on supermarket chains, discount retail, leading consumer staples, and fundamentally strong companies like Amazon that have healthy balance sheets and can weather economic cycles. For example, leaders in the essential consumer goods sector, such as Coca-Cola and other food and beverage giants, demonstrate relatively stable performance; although costs rise under inflation, leading companies possess some pricing power to pass on costs, ensuring reliable cash flow. UBS indicates that such a comprehensive allocation is expected to provide relative returns during a consumption slowdown cycle, while waiting to increase aggressive strategic exposure when economic recovery occurs