The supply and demand pattern is tight, Citigroup is bullish on silver, reiterating that gold prices may have peaked!

Citigroup raised its three-month target price for silver from $38 to $40, and increased the six to twelve-month target price to $43. The rise in silver prices is not merely a catch-up trade with gold, but more a reflection of silver's strong fundamentals. Citigroup reiterated that the peak in gold prices may have already occurred and maintained its expectation that gold prices will fall below $3,000 next year

Citigroup's latest research report significantly raises its silver price forecast, expecting silver to break through $40 per ounce in the coming months, driven by tightening physical supply and increasing investment demand.

Citigroup has raised its three-month target price for silver from $38 to $40, and its six to twelve-month target price to $43. Analysts Max Layton and others stated in the report that they expect silver supply to further tighten against the backdrop of several years of supply deficits.

In stark contrast to silver, Citigroup maintains its unchanged forecast for gold, reiterating that a peak may have already occurred and insisting that gold prices will fall below $3,000 next year. Precious metals have performed strongly this year, with gold reaching an all-time high and rising over a quarter, while silver's gains have been even more impressive.

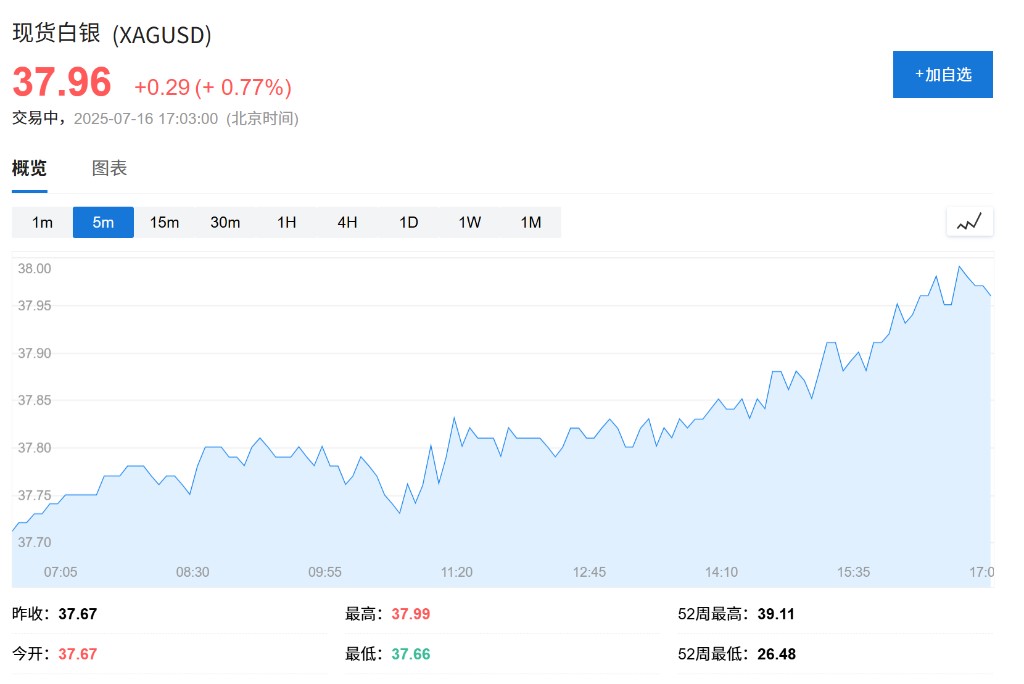

As of the time of writing, spot silver is trading below $38 per ounce, having risen 31% this year.

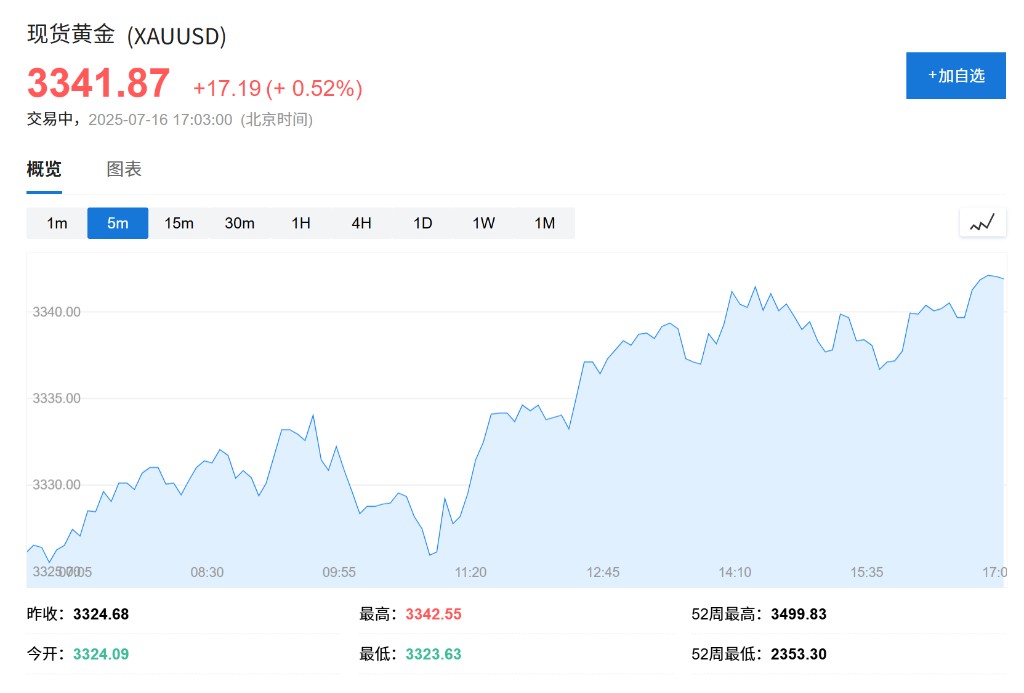

Gold prices are around $3,347 per ounce.

Supply and Demand Fundamentals Support Silver Price Increase Expectations

Citigroup analysts believe that the rise in silver prices is not merely a catch-up trade with gold, but more a reflection of silver's strong fundamentals:

"We expect silver supply to tighten due to several years of supply deficits, holders needing higher prices to sell, and strong investment demand."

Silver possesses both industrial raw material and financial asset attributes, making it more attractive in the current market environment. Precious metals have become one of the strongest performing commodities this year, driven by central bank purchases and inflows into exchange-traded funds.

Citigroup analysts stated that the anticipated monetary policy easing by the Federal Reserve will provide additional upward momentum for silver. "Silver will also rise under the impetus of the Fed's interest rate cuts."

Meanwhile, uncertainty over U.S. tariffs has stimulated demand for safe-haven assets, further supporting precious metal prices.

Despite the overall strong performance of precious metals, Citigroup maintains a relatively cautious stance on gold. The bank keeps its previous forecast unchanged, believing that gold may have already peaked and expects gold prices to fall below $3,000 next year.

"We continue to emphasize our view that gold prices may have already peaked."