Robinhood missed out again! Digital technology company Block was included in the S&P 500, with its stock price rising by as much as 14%

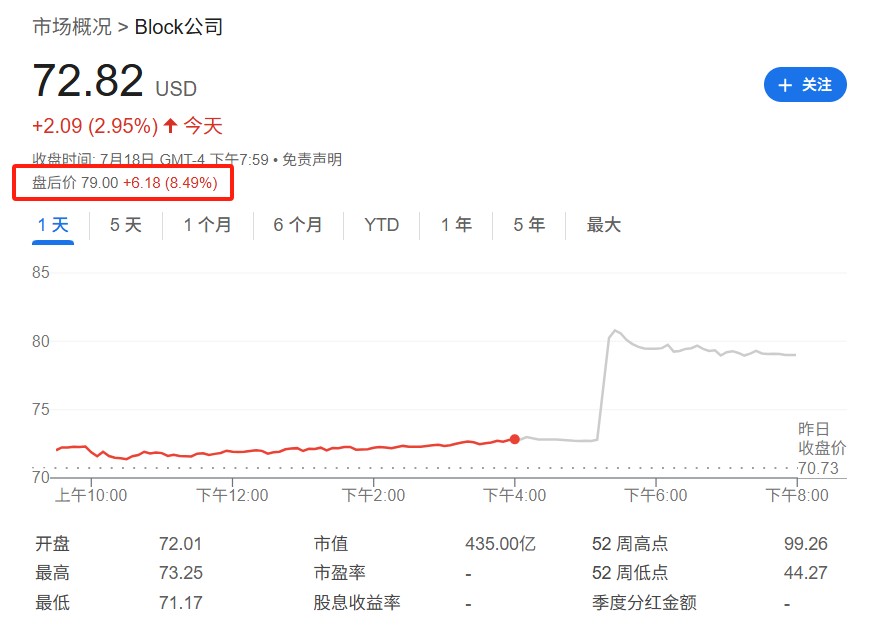

Jack Dorsey's fintech company Block will join the S&P 500 index on July 23, highlighting the increasing influence of digital payments and cryptocurrencies in mainstream finance. For Robinhood, this marks its third consecutive failure to be included, with Block's market capitalization at $43.5 billion, significantly lower than Robinhood's nearly $100 billion market cap. Following the announcement, Block's stock price surged 14% in after-hours trading, before the increase settled at 8.49%

Financial technology company Block, led by Jack Dorsey, will be included in the S&P 500 index, a milestone event that highlights the growing influence of digital payments and cryptocurrencies in mainstream finance.

On Friday, S&P Dow Jones Indices announced that traditional energy company Hess will soon be removed from the benchmark index, with fintech firm Block taking its place. This change will take effect before the market opens on July 23. Meanwhile, Robinhood, which has garnered much attention, has once again missed out on inclusion in this benchmark index.

According to reports, Chevron's acquisition of Hess for $53 billion created an opportunity for Block's inclusion. Following the announcement, Block's stock price surged 14% in after-hours trading, before settling at an increase of 8.49%.

This marks the third consecutive time Robinhood has been overlooked. Wall Street Insight previously mentioned that during the routine quarterly adjustment of the S&P 500 index in June and the removal of Ansys, Robinhood was not included in the constituent stocks.

As a publicly traded fintech company, Block has a market capitalization of $43.5 billion, significantly lower than Robinhood's nearly $100 billion market cap. The latter's stock price has soared 178% this year and is widely regarded as a strong candidate for index expansion.

(Robinhood's stock price has risen 178.25% year-to-date)

(Robinhood's stock price has risen 178.25% year-to-date)

From Payment Tool to Financial Platform

Jack Dorsey, as the founder of Twitter, was criticized for spending too much time on Square and other projects during his tenure as CEO of Twitter.

Now, Square has been renamed Block and has gradually evolved from a simple payment processor into a broader financial technology participant. The company's business scope currently includes peer-to-peer transfers, merchant services, and is increasingly delving into consumer lending.

Reports indicate that Block is working to transform its Cash App into a comprehensive banking and lending product, although the company is still grappling with unstable profitability.

Earlier this year, Block's industrial bank subsidiary received approval from the Federal Deposit Insurance Corporation (FDIC) to offer loans directly to consumers through Cash App. Additionally, the company is integrating Bitcoin payment functionality into its terminal devices.

Analysts believe that for Block, entering the S&P 500 index is a significant positive development. With the rise of passive investing, funds tracking the S&P 500 index will need to purchase Block's stock to match the latest composition of the index, which will bring sustained capital inflows to its stock price