The S&P and Nasdaq are both approaching historical highs, and the earnings reports of the "Seven Giants" will set the tone for the direction of the U.S. stock market

The S&P 500 and Nasdaq indices are nearing historical highs, despite facing challenges from tariffs and monetary policy. In the coming week, 112 S&P 500 constituent stocks will release their earnings reports, with the market focusing on tech giants such as Alphabet and Tesla. Expectations for a Federal Reserve rate cut have cooled, with CME data showing the probability of a rate cut in July dropping to 5%. The earnings season indicates that the overall earnings of S&P 500 constituent stocks are expected to grow by 5.6% year-on-year. Some stocks have reacted mildly after earnings reports, with analysts noting that excellent earnings reports struggle to exceed high expectations

The Zhitong Finance APP noted that the S&P 500 Index and the Nasdaq Composite Index are both hovering near historical highs, despite escalating tariff disputes and intensifying debates over monetary policy, the market remains steadfast. Last week, the Nasdaq led with a 1.6% increase, the S&P 500 climbed 0.7%, while the Dow Jones Industrial Average remained basically flat.

In the coming week, 112 S&P 500 constituent stocks will announce their quarterly reports, with market focus concentrated on tech giants such as Alphabet (GOOGL.US), Tesla (TSLA.US), and Chipotle Mexican Grill (CMG.US).

Meanwhile, economic data will include indicators of manufacturing and service sector activity, while the Federal Reserve has entered a quiet period ahead of its policy meeting on July 29-30.

Interest Rate Game Intensifies

Federal Reserve Governor Christopher Waller explicitly called for a rate cut in July during a speech in New York on Thursday, stating that the federal funds rate is more than 1 percentage point above a reasonable level. "Inflation is close to target and the upside risks are limited; we should not wait for the labor market to deteriorate before taking action."

However, market expectations for a rate cut have continued to cool—CME FedWatch tools show that the probability of a rate cut in July has dropped from 13% a month ago to 5%.

Citi's chief economist, Nathaniel Karp, believes that as the job market further loosens and tariffs do not trigger widespread inflation, the Federal Reserve may reach a consensus on a rate cut in September.

Earnings Season Report Card

The second-quarter earnings season kicked off with large banks exceeding expectations, followed by impressive results from streaming giant Netflix, both indicating strong resilience in U.S. consumer spending.

FactSet data shows that overall earnings for S&P 500 constituents are expected to grow by 5.6% year-over-year, up from last week's expectation of 4.8%. However, some stocks that surged in advance reacted tepidly after earnings reports, such as Netflix, which despite raising its full-year revenue guidance, saw its stock price drop by 5%.

William Blair analysts pointed out: "Excellent earnings are hard to surpass when expectations are overly inflated."

Evercore ISI's head of equity derivatives strategy, Julian Emanuel, warned that after the index rebounded 30% from its April low, the S&P 500's price-to-earnings ratio has reached 24.7 times, meaning that even strong performance can only maintain current high levels, and any slight miss in expectations could trigger a significant pullback.

"Seven Giants" and Market Expansion Expectations

"Seven Giants" and Market Expansion Expectations

Alphabet and Tesla will kick off the quarterly earnings releases for the "Seven Giants" tech stocks. This batch of stocks is expected to once again lead the S&P 500's earnings growth this quarter.

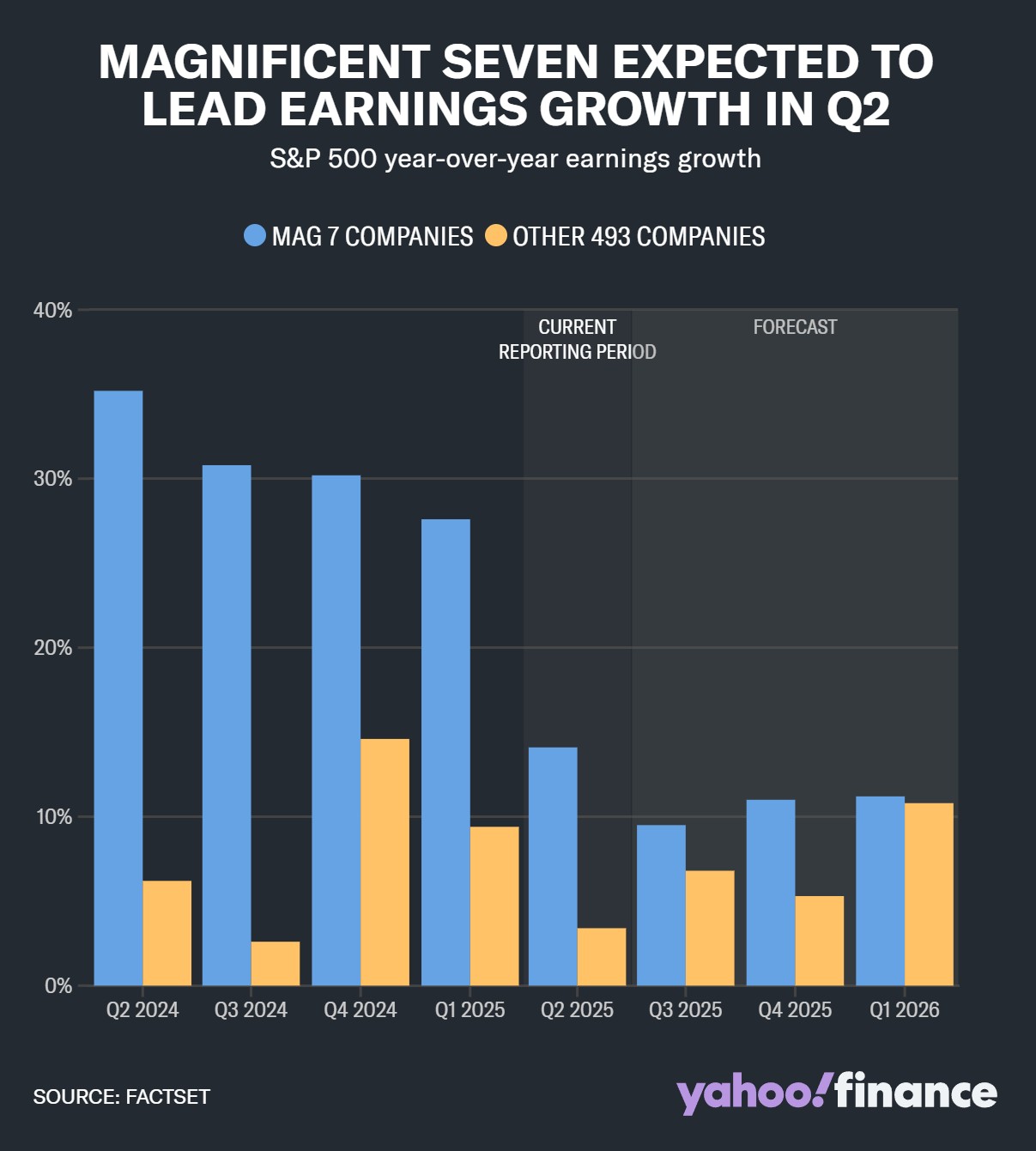

The "Seven Giants" are expected to see a year-over-year earnings growth of 14.1% in the second quarter, while the earnings of the remaining 493 stocks in the index are expected to grow by only 3.4% year-over-year. This means that the likelihood of S&P 500 earnings exceeding expectations largely depends on the performance of large tech companies However, as shown in the figure below, the market generally expects that the remaining 493 stocks will begin to contribute a larger proportion of earnings growth in the coming quarters—this is a key signal that Wall Street strategists are looking for, as they hope to see the stock market rally, which has only sporadically appeared in recent years, expand.

"It’s time to realize profits," wrote Citigroup strategist Scott Chronert in a report to clients. "If we want to see further room for correction, corporate commentary will be crucial, while hoping for a turning point in the growth of cyclical industries to ultimately drive the rally."

He added: "The issue lies in the current market environment. It feels like the market is pricing in positive developments ahead of time. As we have emphasized, market sentiment is high, and implied growth expectations are also very high."