Rumors of Trump firing Powell shake the market, investors position for "steepening trades" to hedge risks

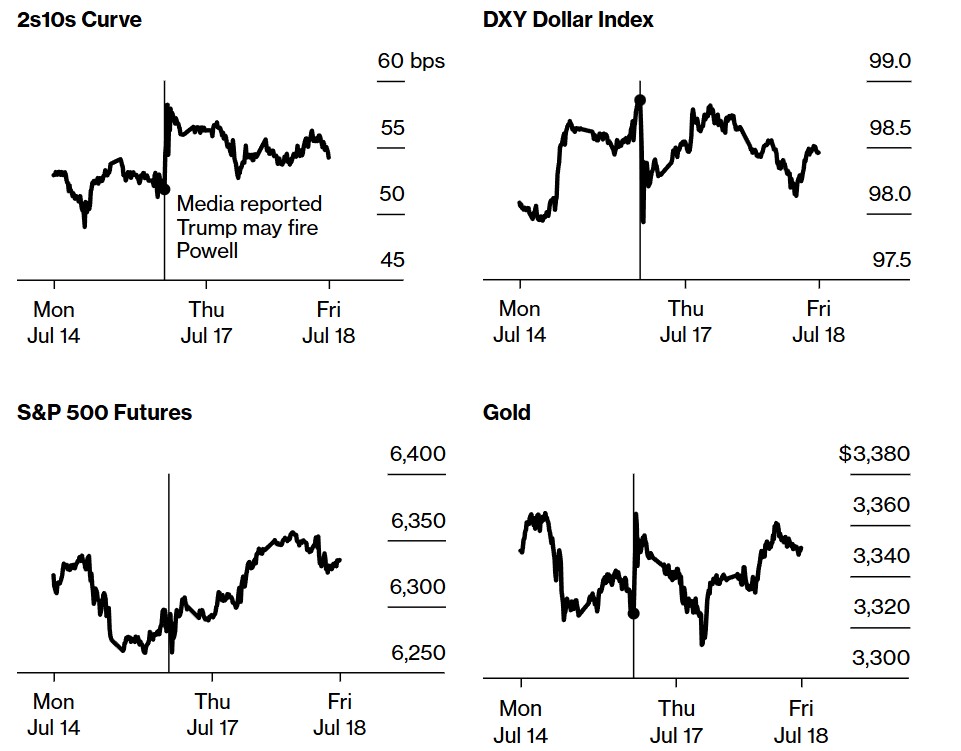

Rumors of Trump firing Federal Reserve Chairman Powell have caused market turbulence, with investors adopting a "steepening trade" strategy to hedge risks. Although Trump denied the firing plans and the market's reaction has somewhat reversed, analyst Van Gelderen still adheres to the original strategy, believing that the political pressure faced by Powell may influence Federal Reserve policy. Investors' positioning strategies have implicitly considered "Powell hedging," reflecting heightened concerns about the independence of the Federal Reserve

According to Zhitong Finance APP, last week a piece of news stating that "U.S. President Trump may fire Federal Reserve Chairman Powell" caused a stir in global markets. At this critical moment, Citrini Research analyst James Van Gelderen quickly issued a "macro trading" alert to about 50,000 clients, proposing a simple strategy: buy two-year U.S. Treasury bonds while selling ten-year U.S. Treasury bonds.

The logic behind this operation is that if the new Federal Reserve chairman is more inclined to align with Trump's interest rate cut demands, short-term bond yields may decline due to expectations of policy easing; meanwhile, concerns about weakened central bank independence could raise long-term inflation expectations, thereby increasing long-term bond yields.

It is noteworthy that this expectation was quickly validated after Powell's subsequent speech, with market fluctuations even exceeding initial predictions. Although Trump later denied the related plans, causing some market reactions to reverse, investors like Van Gelderen still adhered to their original strategy, believing that this risk, once deemed "unimaginable," is gradually becoming a real threat.

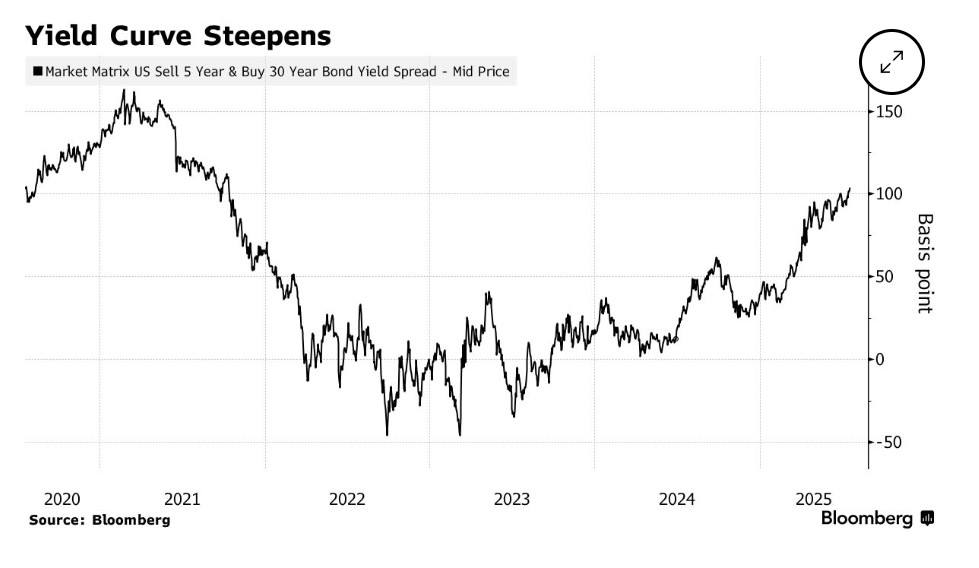

Mark Dowding, Chief Investment Officer of BlueBay Fixed Income at Royal Bank of Canada Global Asset Management, pointed out: "In the past, we believed that the Federal Reserve would not be subject to political interference, but this consensus is now wavering." Investors from institutions including Dowding, Allspring Global Investments, and Invesco have incorporated considerations of "Powell hedging" into their positioning strategies, ranging from bearish bets on the dollar to "steepening trades" (betting on the widening yield spread between short and long-term bonds). These operations are supported by economic fundamentals (such as expectations of slowing U.S. economic growth and expanding debt deficits) and view the political pressure Powell faces as an additional favorable factor.

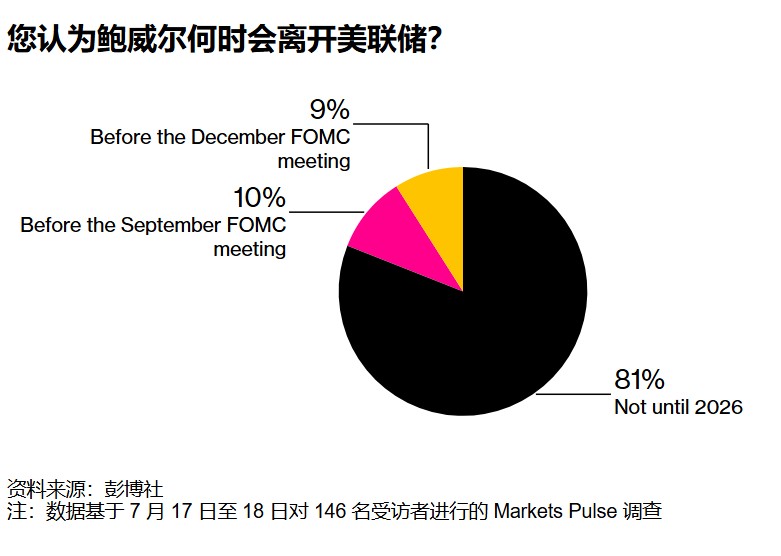

Recently, Trump's attacks on Powell and his allies have noticeably escalated, continuously pressuring him to resign under the pretext of cost overruns in the renovation of the Federal Reserve headquarters. Powell responded by stating that if it weren't for Trump's tariff policies increasing economic uncertainty, the Federal Reserve could have initiated rate cuts earlier this year. Although most Wall Street professionals believe that Trump faces legal obstacles to "fire Powell for cause" (the betting market Polymarket shows a 22% probability of his departure in 2025, a slight increase from 18% last week), surveys indicate that most respondents still expect Powell to complete his term until May next year.

Allspring Senior Portfolio Manager Noah Weiss bluntly stated: "The actual benefits of firing Powell now are limited."

Last week's market reaction vividly demonstrated the impact of this risk: within less than an hour from the "firing rumor" to Trump's denial, the yield on U.S. 30-year Treasury bonds surged by 0.11 percentage points, and the difference between it and the 5-year Treasury bond yield widened to the highest level since 2021; The euro fell more than 1% against the dollar, and the stock market also saw a significant decline.

However, Megan Swiber, a rate strategist at Bank of America, believes that the hedging effect of "steepening trades" may be limited, as the Treasury may suppress rising yields by controlling the issuance of long-term bonds (the next quarterly refinancing plan will be announced on July 30). She recommends the "breakeven rate" strategy (the difference between the yields of ordinary government bonds and inflation-protected securities), considering it a "cleaner" hedging tool that can effectively capture the potential risks of a dovish Federal Reserve policy pushing up inflation. Currently, the 10-year breakeven rate, which reflects market inflation expectations, has risen to 2.42%, close to the highest level since February, indicating that investors are pricing in the risks to the independence of the Federal Reserve.

Federal Reserve Governor Waller is one of the popular candidates for the next chair. He stated on Friday that if a majority of his colleagues support keeping rates unchanged at the policy meeting at the end of July, he will vote against it and advocate for a rate cut to support the job market. Surveys show that 33% of respondents support Waller taking over, followed by Treasury Secretary Yellen. Some investors view Powell's risks as part of multiple challenges: Ed Hossaini, a global rate strategist at Columbia Threadneedle, pointed out that "the worst-case scenario is the Federal Reserve losing its independence, tariffs causing significant inflation, and fiscal policy further stimulating before the midterm elections, all happening simultaneously." He is betting on options that interest rate volatility will rebound from a three-year low.

Bloomberg macro strategist Edward Harrison analyzed that if the Federal Reserve ultimately adopts Waller's rate cut suggestion, long-term yields are more likely to rise against the backdrop of warming inflation expectations. Historically, after the Federal Reserve's first rate cut last year, long-term rates only stopped rising when the Fed ceased lowering the federal funds rate. If the Federal Reserve maintains rates unchanged amid internal dissent, uncertainty will push up term premiums, ultimately leading to rising long-term rates, which may exacerbate Trump's pressure on the Federal Reserve to cut rates, creating a "vicious cycle."

It is noteworthy that Van Gelderen's "steepening trade" strategy is not a new proposal. As early as March 2024, he suggested clients position for related trades based on the expectation that "Trump might be elected and fire Powell." At that time, he pointed out, "It sounds crazy, but it could totally happen." Although he temporarily exited due to high holding costs, he now believes that the "timing for acceleration" has arrived Economic data that the market needs to pay attention to in the future includes: Regarding the Federal Reserve, the period from July 19 to 31 is a communication blackout period. On July 22, Jerome Powell will attend a meeting to deliver a speech, and on the same day, Federal Reserve Vice Chair for Supervision Michael Barr will have a dialogue with OpenAI CEO Sam Altman. In terms of bond auctions, 13-week and 26-week Treasury bills will be issued on July 21, 6-week Treasury bills will be issued on July 22, 17-week Treasury bills will be issued on July 23 along with the resumption of 20-year bond issuance, and 4-week, 8-week Treasury bills and 10-year Treasury Inflation-Protected Securities will be issued on July 24