S&P 500 dividend derivatives trading volume surged by 40%, with the divergence in the dividend curves of Europe and the United States hiding arbitrage opportunities

The urgent demand for returns from American investors has driven the rapid expansion of the S&P 500 index dividend futures and options market, with trading volume surging by 40% year-on-year. The growth of this market reflects new trends in global capital allocation. U.S. corporate dividend policies are more sustainable, while the European market is more susceptible to geopolitical influences. The rise of dividend derivatives provides investors with more refined risk management tools, although market volatility still requires attention

According to Zhitong Finance APP, the urgent demand for returns from American investors is driving the rapid expansion of the S&P 500 index dividend futures and options market, a sector that was once considered a niche market in the derivatives field and has long been overshadowed by the European market. Now, this niche market is experiencing explosive growth, reflecting new trends in global capital allocation.

As a core platform for global derivatives trading, data from the Chicago Mercantile Exchange (CME) confirms this trend: in the first half of 2025, its dividend futures trading volume surged by 40% year-on-year. Although the base is relatively low, the total open interest in S&P 500 index dividend options has more than doubled.

Nabil Hussein, Managing Director of London brokerage Vantage Capital Markets, observed that since CME launched related products, the trading volume of S&P dividend options has shown a daily increasing trend. He specifically pointed out that while the growth of dividends from American companies is gradual, market participants prefer to position themselves through call options and spread strategies, although the strike prices are set relatively conservatively, unlike the aggressive pricing commonly seen in the European market.

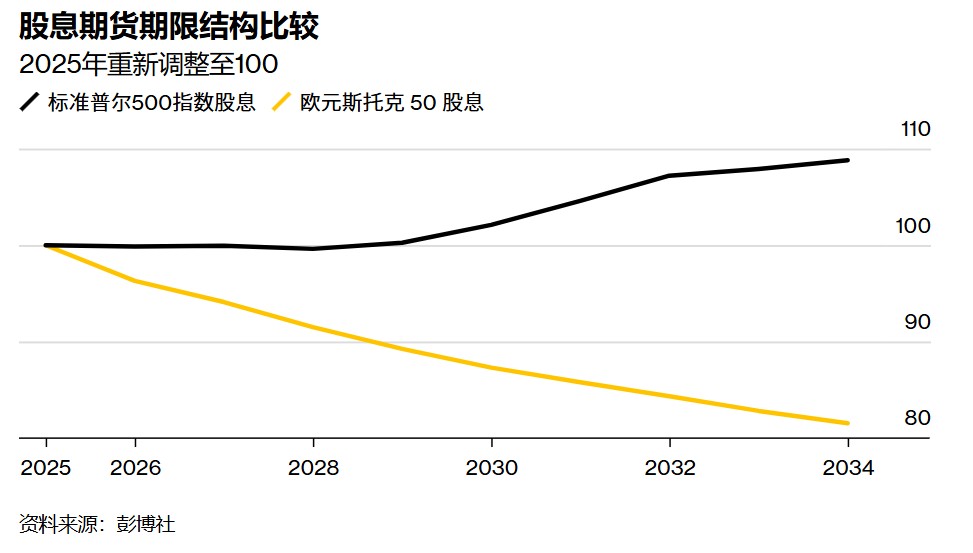

The structural differences between the US and European markets are evident in the shape of the derivatives curve: long-term dividend contracts in the US are valued higher, while European futures prices gradually decline with longer maturities. Maxwell Grinakov, Head of US Equity Derivatives Research at UBS Group, believes this divergence stems from fundamental differences in corporate payment culture; US companies have more sustainable dividend policies, while the European market is more susceptible to geopolitical and economic shocks, leading to more decisive corporate decisions to cut dividends.

Additionally, the expectation that American tech giants like Amazon (AMZN.US) may initiate dividends further enhances the attractiveness of the S&P 500 index dividend curve. In contrast, the European Stoxx 50 index is more significantly affected by changes in dividends from individual companies due to its smaller number of constituent stocks.

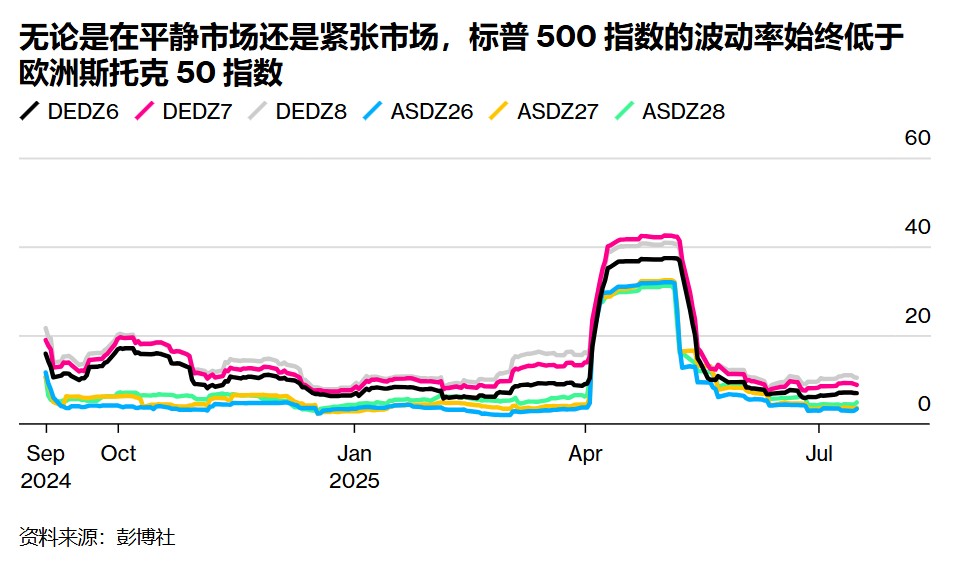

The rise of dividend derivatives provides investors with more refined risk management tools. Although there is a long-term optimistic outlook on the growth of dividends from American companies, market volatility cannot be underestimated: in April of this year, due to concerns about a market crash, S&P 500 dividend contracts expiring in December 2026 plummeted by 11% within a few days, highlighting the uncertainty of the path.

Hussein pointed out that external factors such as tariff policies could create a volatile environment, attracting more diversified trading counterparts. UBS strategist Kieran Diamond warned that the volatility of US dividends far exceeds historical actual levels, leading to higher risks for leveraged investors in defensive positions, which directly drove a significant rise in put option prices after April, with the market's bets on dividend reductions significantly increasing From the perspective of the term structure, the focus of the European and American markets is shifting towards 2027. Currently, the futures price for 2026 is only slightly above the forecast value of institutional brokers, reflecting the market's cautious attitude towards mid-term dividend growth. In terms of strategy application, European hedge funds often obtain dividend upside through call ratio options, while Grinakov suggests that the U.S. market can draw on similar ideas.

It is noteworthy that Europe's large structured products market has given rise to unique linkage effects: local banks often use Euro Stoxx 50 dividend contracts to hedge the risks of callable bonds. If these products trigger stock price thresholds, they will pay high coupons, forcing traders to hold large long dividend positions and hedge by selling long-term contracts, indirectly suppressing prices at the far end of the curve.

Differences in regulatory environments further shape market characteristics. The U.S. Securities and Exchange Commission (SEC) has strengthened over-the-counter derivatives regulation through the Dodd-Frank Act, requiring standardized contracts to be cleared through central counterparties and imposing higher margin requirements (initial margin ratios of 1%-15%) on non-centrally cleared trades. In contrast, the regulatory environment in Europe is more relaxed, attracting U.S. financial institutions to shift some over-the-counter business to places like London, but the nominal amount of global financial derivatives is still dominated by U.S. giants.

Despite a price correction in April, the degree of dividend misalignment in the S&P 500 is expected to be weaker than in the European market. The reason is that U.S. automatic redemption bonds are usually linked to a "worst-performing" basket of stocks, with their dividend sensitivity concentrated on a single underlying asset, while the recent performance of S&P 500 constituent stocks has been balanced overall, making the risks of such structured products relatively controllable. JPMorgan strategists warned in a June report that if the market experiences a sell-off, the technical liquidation of hedgers of automatic redemption products could have a moderate impact on S&P 500 dividends.

CME's Global Head of Equities, Foreign Exchange, and Alternative Products, Tim McCourt, emphasized that the maturity of the dividend options market has significantly improved the accuracy of the futures curve, with the daily interplay between hedgers and speculators more clearly reflecting the market's consensus on future dividend paths. He pointed out: "If all participants have completely consistent expectations for S&P dividends, this market would lose its pricing function." This dynamic balance mechanism is driving the global dividend derivatives market towards a new era of more efficient pricing