The July LPR quotation is out! Both the one-year and five-year LPR remain unchanged

Continue to remain inactive, with the one-year and five-year LPR maintained at 3% and 3.5% respectively. Analysis suggests that there is still considerable room for the implementation of financial policies. If policy rates and deposit rates continue to decrease, and the cost of bank funds continues to decline, there is still a possibility for LPR to decrease

The July LPR quotation is out, with both the 5-year and 1-year rates remaining unchanged.

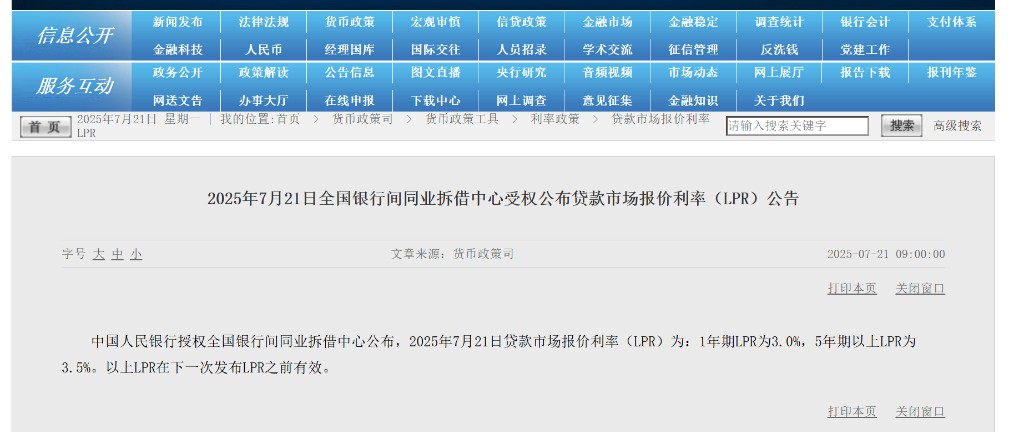

On July 21, the People's Bank of China authorized the National Interbank Funding Center to announce that the Loan Prime Rate (LPR) on July 21, 2025, is: the 1-year LPR is 3.0%, and the 5-year LPR is 3.5%.

In June of this year, the central bank of China announced that the 1-year LPR is 3.0%, and the 5-year LPR is 3.5%, both unchanged from the previous values.

Is there still room for LPR to be lowered in the second half of the year?

Wang Qing, chief macro analyst at Dongfang Jincheng, pointed out, "Looking ahead, the external environment in the second half of the year still faces great uncertainty. In the process of vigorously boosting domestic demand and 'promoting the stabilization of the real estate market with greater efforts,' there is still room for LPR quotations to be lowered."

Recently, the Monetary Policy Committee of the People's Bank of China held its second quarter meeting for 2025. In terms of policy orientation, this meeting reiterated the need to implement a moderately loose monetary policy, strengthen counter-cyclical adjustments, and better utilize the dual functions of monetary policy tools in terms of both quantity and structure. At the same time, it is suggested to increase the intensity of monetary policy regulation in the next phase, enhancing the foresight, targeting, and effectiveness of monetary policy regulation, and flexibly grasping the strength and pace of policy implementation based on domestic and international economic and financial conditions and the operation of financial markets.

Analyst Wang Qing stated that the main tone of "moderately loose" monetary policy has not changed at all, and the central bank will continue to adhere to a supportive monetary policy stance.

"There is still considerable room for the implementation of financial policies in the next steps." Dong Ximiao, chief researcher at ZhaoLian, believes that on one hand, as the policy framework continues to improve, the "implicit lower limit" of the reserve requirement ratio may be broken, and the policy regulation function of the reserve requirement tool will be fully utilized. On the other hand, if policy interest rates and deposit rates continue to decline, the cost of bank funds will continue to decrease, and there is still a possibility for the Loan Prime Rate (LPR) to decline. However, the market should not have overly high expectations for the pace and extent of declines in LPR and other interest rates; the changes in LPR in the next phase need to maintain a dynamic balance among multiple goals such as stabilizing growth, stabilizing interest rate spreads, and stabilizing exchange rates