How to understand the rise of Hong Kong stocks? "Extreme" structural market under abundant funds + asset scarcity

The Hong Kong stock market has remained active since the beginning of 2025 due to the emergence of new narratives, with an average daily trading volume reaching HKD 240.6 billion and an average daily inflow of southbound funds of HKD 6.15 billion, approaching last year's total level. Despite the overall economic downturn, structural trends remain active, with popular sectors experiencing crowded trades and more companies listing in Hong Kong, with 51 IPOs this year raising over HKD 100 billion

Hong Kong Stock Market and Liquidity: "Extreme" Structural Market under Capital Abundance + Asset Scarcity

Since the beginning of 2025, thanks to the continuous emergence of new narratives such as DeepSeek, new consumption, and innovative drugs, the Hong Kong stock market has remained active, even leading the global market at one point. Despite the increase in external tariff challenges and a renewed weakening of domestic growth and credit cycles since the second quarter, leading to overall index fluctuations around 24,000 and underperforming globally, the structural market remains vibrant. The active liquidity in the Hong Kong stock market is specifically reflected in: 1) The average daily trading volume reached HKD 240.6 billion, an increase of over 80% compared to the average daily trading volume of HKD 131.8 billion in 2024, setting a historical high; 2) Southbound funds continue to be active, with an average daily inflow of HKD 6.15 billion, nearly double the average daily inflow of HKD 3.47 billion in 2024, with a cumulative inflow of HKD 787.7 billion to date, approaching last year's total of HKD 807.9 billion.

Chart: Average daily trading volume of Hong Kong stocks from early 2025 to present has increased by about 80% compared to last year.

Source: Wind, CICC Research Department

The continuously active liquidity directly explains several "unusual" phenomena we have observed in the recent Hong Kong stock market:

1) Structurally active market that is insensitive to macro factors: Although the overall fundamentals in China are weakening and external disturbances are constant, the structural market remains active, with sectors rising and falling in turn, such as several rounds of main lines like AI, new consumption, and innovative drugs since the beginning of the year;

Chart: Rotation situation of various industries

Source: FactSet, CICC Research Department

2) Easy formation of popular sectors with crowding and crowded trading: Stocks and sectors favored by capital tend to experience short-term expectations and valuation overshoot. By measuring "crowding" with trading volume share and market capitalization share, we can clearly identify the degree of crowding and rotation among different industries since the beginning of the year;

Chart: Crowding situation of various industries

Source: Wind, CICC Research Department

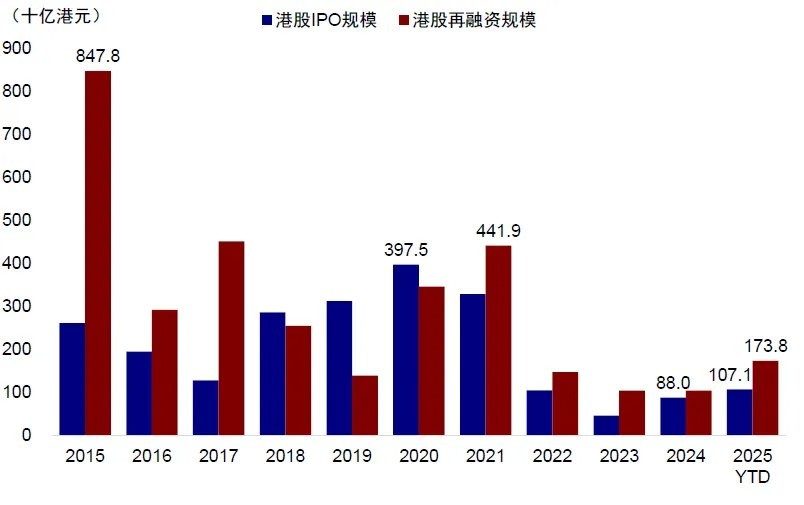

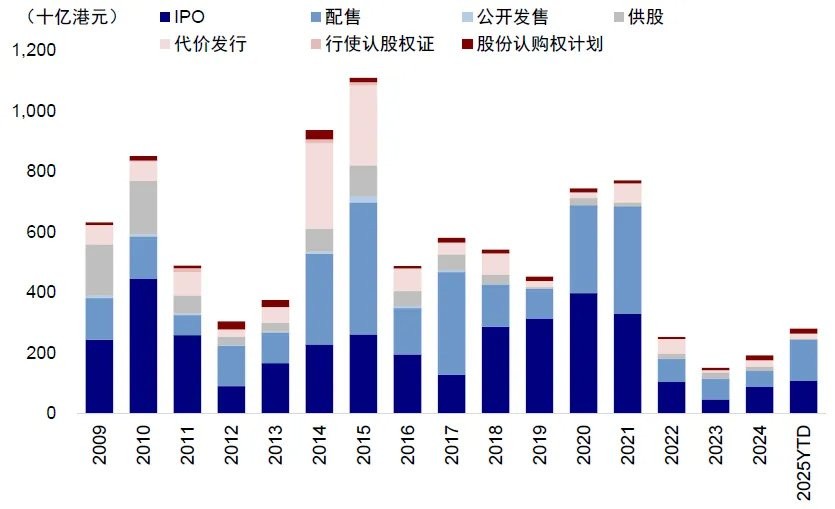

3) More companies are listing in Hong Kong, including A to H companies; refinancing is also increasing. Since the beginning of the year, there have been 51 IPOs in the Hong Kong stock market, raising over HKD 100 billion, exceeding the total scale of 2024, among which 10 companies have transitioned from A-shares to Hong Kong listings, accounting for 70% of the fundraising (《How Significant is the Impact of the A to H Listing Wave?》). Additionally, nearly 50 A-share companies plan to list in Hong Kong, with 195 companies queued for the second half of the year The scale of refinancing through placements and other means has also significantly increased, with the scale of Hong Kong stock refinancing exceeding HKD 170 billion in the first half of 2025, a year-on-year increase of 227%.

Chart: Hong Kong stock IPOs and refinancing remain active this year

Source: Wind, CICC Research Department

Note: Data as of June 30, 2025

4) "New share trading" has also become significantly active. We have conducted a detailed analysis of the returns from Hong Kong stock IPOs in our "Hong Kong Stock New Share Guide," concluding that due to the fully market-oriented inquiry mechanism, the long-term average positive return win rate for Hong Kong stock new shares is only 51% and decreases over time, indicating that there are no stable institutional arbitrage opportunities. However, temporary liquidity and exuberant sentiment will undoubtedly boost enthusiasm;

Chart: The probability of first-day price drop for Hong Kong stocks since 2015 is 51%

Source: Wind, CICC Research Department

5) The AH premium has narrowed, and some individual stocks continue to trade at a premium, such as CATL and Heng Rui Medicine, which were trading at premiums of 26% and 14% respectively as of July 18; the overall weighted average AH premium has also narrowed to 126%. We analyzed in "How Significant is the Impact of the A to H Listing Wave?" that individual stocks that align with industry trends and foreign investment aesthetics can indeed trade at a premium in Hong Kong stocks, such as Conch Cement from 2016-2019, but this pattern cannot be extrapolated indefinitely. In the short term, the overall AH premium remains constrained by the "implicit bottom" of 125% parity under the dividend tax arrangement, which is why it converged through declines in Hong Kong stocks and increases in A-shares after reaching this level in late March and late June.

Chart: Overall AH premium narrows to 126%

Source: Wind, CICC Research Department

The macro background causing this liquidity-rich environment in the Hong Kong stock market is what we mentioned in "Hong Kong Stock Outlook for the Second Half of 2025: Abundance of Funds and Scarcity of Assets," the combination of "plenty of money" (abundance of funds) and "few returns" (scarcity of assets). Abundant liquidity and limited quality assets inevitably lead to a concentration of funds, and the assets that meet the definition of quality returns are mostly found in Hong Kong stocks (such as AI internet, new consumption, and innovative drugs).

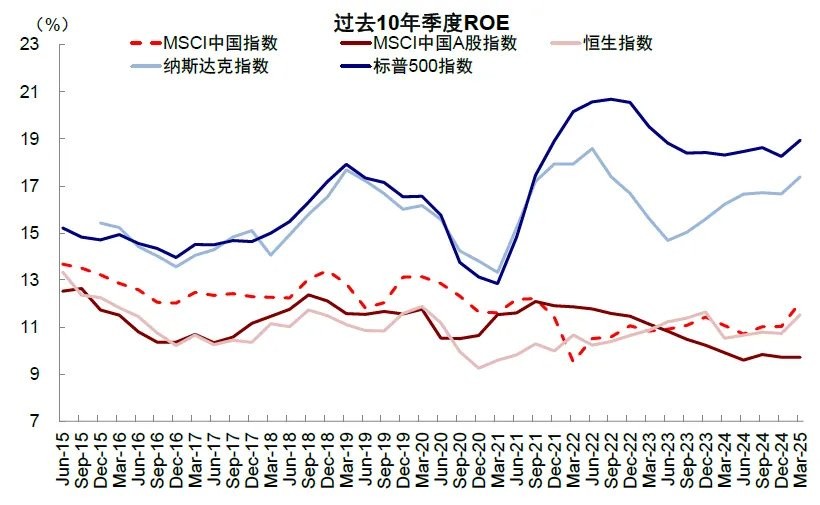

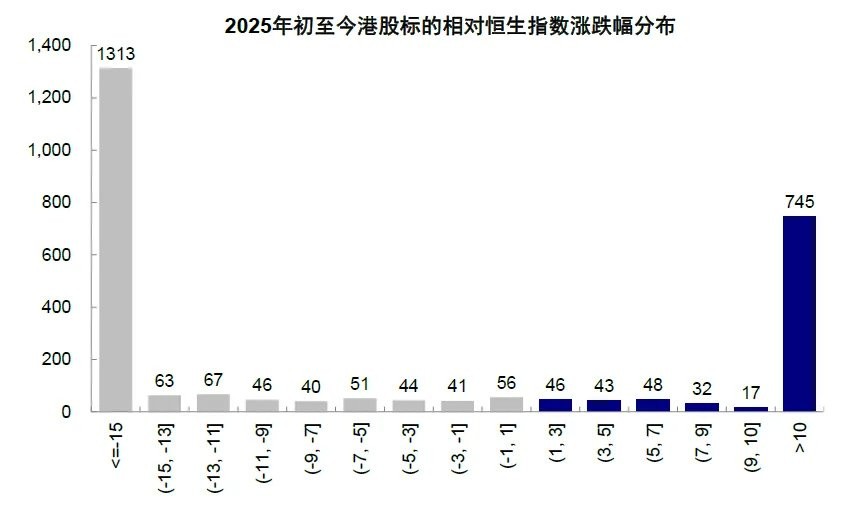

From the perspective of ROE, the overall market's ROE has escaped the continuous decline of previous years but has only barely stabilized (indicating that the Chinese credit cycle has stabilized but has not expanded significantly), while some improving industries are precisely the outperforming sectors (such as insurance and brokerage in finance); In the cycle of non-ferrous metals; media and entertainment, software, consumer services, and new consumption, this is also the fundamental reason why Hong Kong stocks outperform A-shares, dominated by structural market conditions (even within Hong Kong stocks, the differentiation between outperforming and underperforming the index is particularly significant, with only 35% of the stocks in the Shanghai-Hong Kong Stock Connect sample outperforming the Hang Seng Index since the beginning of the year).

Chart: ROE ends continuous decline but barely stabilizes

Source: Wind, CICC Research Department

Chart: Significant differentiation between outperforming and underperforming stocks in Hong Kong

Source: Wind, CICC Research Department

Note: The vertical axis represents the number of stocks

Undoubtedly, the active primary and secondary markets of Hong Kong stocks this year are closely related to the active liquidity. Moreover, as a typical offshore market, liquidity plays a far more important role in Hong Kong stocks than in the A-share market.

So, how to analyze the supply and demand situation of funds in Hong Kong stocks? How will it evolve in the future, and what factors are key? We provide a panoramic analysis in this article.

Liquidity Landscape of Hong Kong Stocks: Macroeconomic "asset shortage," Hong Kong dollar and US dollar liquidity; Microeconomic southbound and overseas funds vs. IPOs, placements, and repurchases

Since the beginning of this year, the liquidity in the Hong Kong stock market has been generally loose, which can be understood from two major dimensions of macro and micro market fund supply and demand, and there is a certain correlation between the two. For example, it is precisely because of the macro-level lack of growth and asset shortage that southbound funds continue to flow in and more companies are listing in Hong Kong.

► Macroeconomic Dimension: This includes three levels, with three factors working together to form the basic pattern of liquidity in Hong Kong stocks in the first half of the year. 1) Domestic liquidity: abundant funds (funds are plentiful) but lacking quality assets (asset shortage), driving continuous inflow of southbound funds. As of June, China's M2 reached 330 trillion yuan, 2.4 times GDP, not only is the scale a historical high, but the gap with GDP is also a historical high, and nominal savings in the household sector are continuously increasing. However, under the situation of inverted returns and costs, the credit contraction in the private sector continues, and the economy has not fully recovered, with limited assets that can provide new growth points or certain returns. Against this backdrop, domestic funds need to seek effective allocation opportunities, whether it is stable return dividend assets or growth-oriented new economy sectors, Hong Kong stocks have comparative advantages, thus attracting accelerated inflow of southbound funds.

Chart: Abundant money supply, but poor transmission

Data Source: Wind, China International Capital Corporation Research Department

Data Source: Wind, China International Capital Corporation Research Department

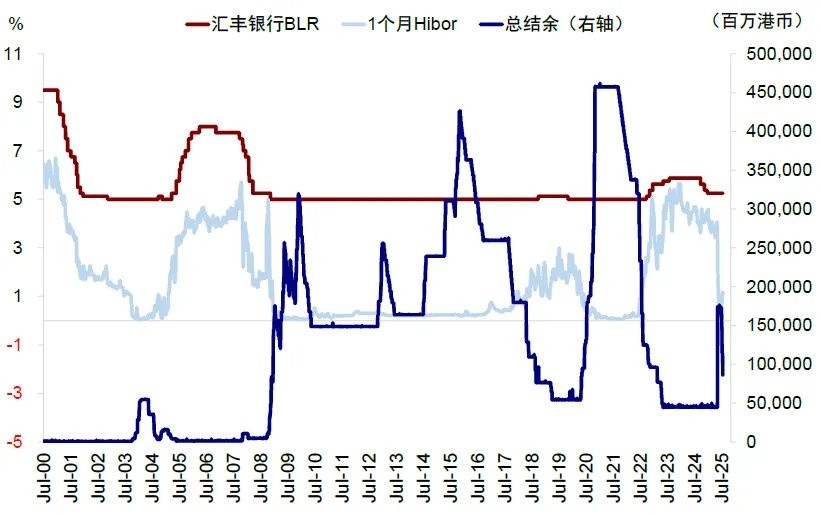

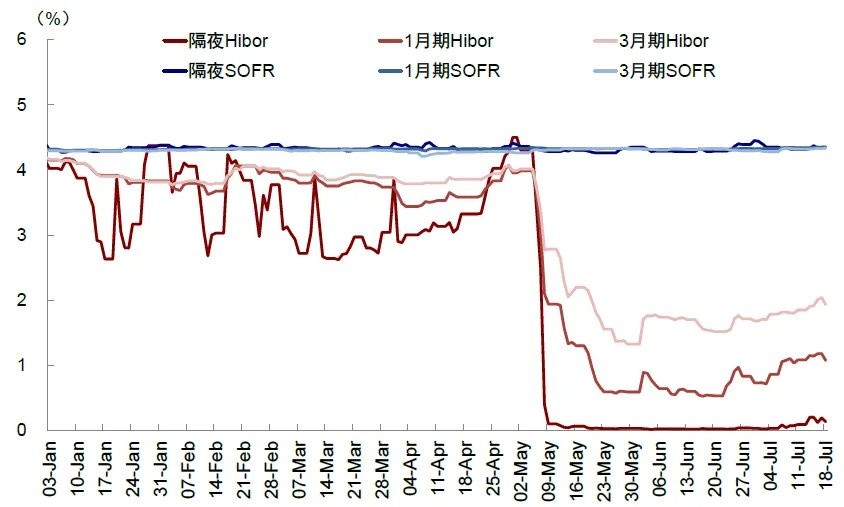

2) Hong Kong Liquidity: The Hong Kong Monetary Authority's large injection of liquidity has led to an unusually loose liquidity environment for the Hong Kong dollar. At the beginning of May, the Hong Kong dollar reached the strong-side convertibility guarantee, and the Hong Kong Monetary Authority unexpectedly injected a large amount of liquidity, resulting in a significant increase in the banking system's surplus and Hibor plummeting to near zero, leading to extremely ample market liquidity.

Chart: The Hong Kong Monetary Authority injected liquidity in early May, recently withdrawing Hong Kong dollars

Data Source: Bloomberg, China International Capital Corporation Research Department

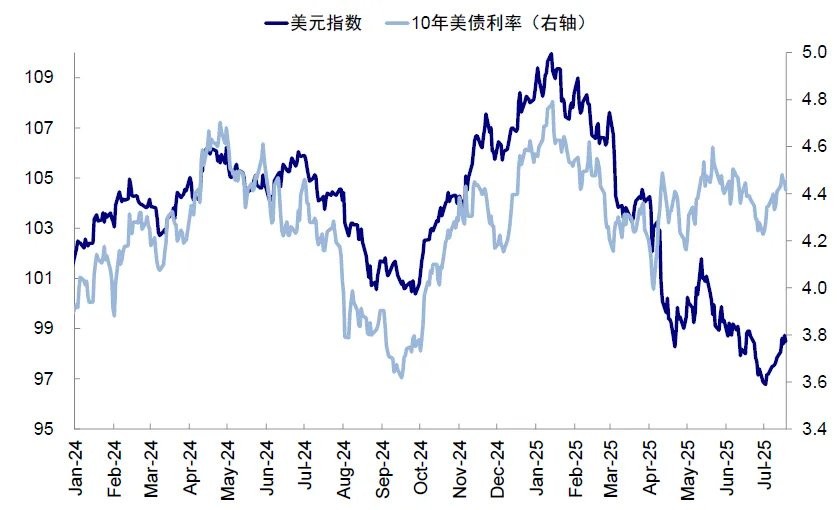

3) External USD Liquidity: Similarly loose in the second quarter. Since April, whether due to the narrative of "de-dollarization" or concerns about the safety of USD assets, the USD index and US Treasury yields have continued to weaken, with some funds withdrawing from the US and "returning home," indirectly benefiting Hong Kong stocks.

Chart: Overall USD liquidity has been loose since April

Data Source: Bloomberg, China International Capital Corporation Research Department

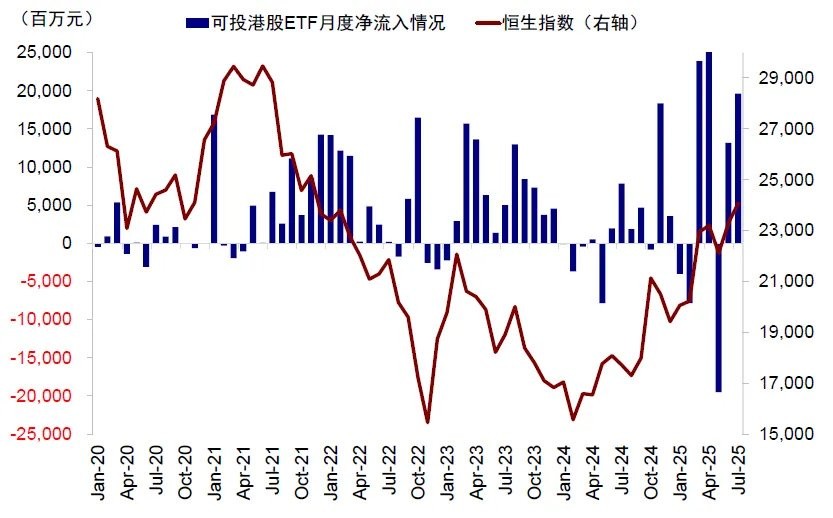

► Micro Dimension: 1) Southbound: Strong inflow, the current inflow scale is close to last year's total, with the pricing power of southbound trading continuously improving both marginally and structurally, currently accounting for 35% of southbound trading volume. Among these, individual investors (ETFs) and trading funds have contributed a large amount of excess increment, with a net inflow of 37.5 billion yuan into mainland investable Hong Kong stock ETFs in the first half of the year, a 10% increase quarter-on-quarter, while insurance funds are also steadily increasing their allocation.

Chart: Large net inflow scale of investable Hong Kong stock ETFs in the first half of the year

Data Source: Wind, China International Capital Corporation Research Department

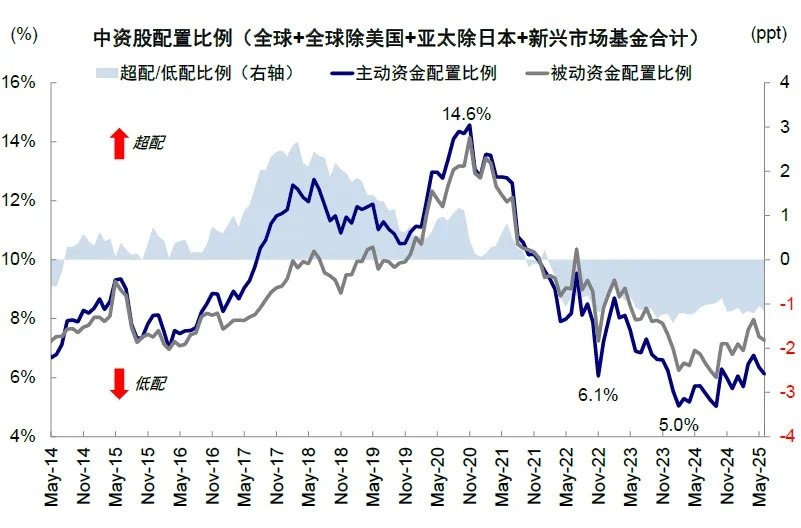

2) Foreign Capital: Long-term foreign capital has not yet returned, but there is structural inflow from regional and trading funds. This year, active foreign capital has cumulatively exited the Hong Kong stock market by 7.78 billion USD (vs. 8.58 billion USD outflow in the same period of 2024), while passive foreign capital has cumulatively inflowed 12.92 billion USD (vs. 7.58 billion USD inflow in the same period of 2024).

3) Corporate Behavior: The surge in IPOs and placements has brought certain supply pressure, with the amount raised from IPOs in the first half of the year being nearly six times that of the same period in 2024, and the amount raised from placements reaching 135.8 billion Hong Kong dollars, exceeding the total of 2023 and 2024 combined. However, under the overall ample liquidity, it has not had a significant negative impact on liquidity Looking ahead, analyzing the future trends of Hong Kong stock liquidity can also start from the above driving factors. In terms of rhythm, we expect that in the third quarter, Hong Kong stocks will face multiple pressures of marginal tightening in liquidity; in terms of scale, the demand for funds in the second half of the year may continue or even accelerate (with IPOs and placements exceeding HKD 300 billion), but whether the speed of fund supply can accelerate still depends on the "wealth effect" (southbound, foreign capital, and repurchases may be around HKD 300 billion).

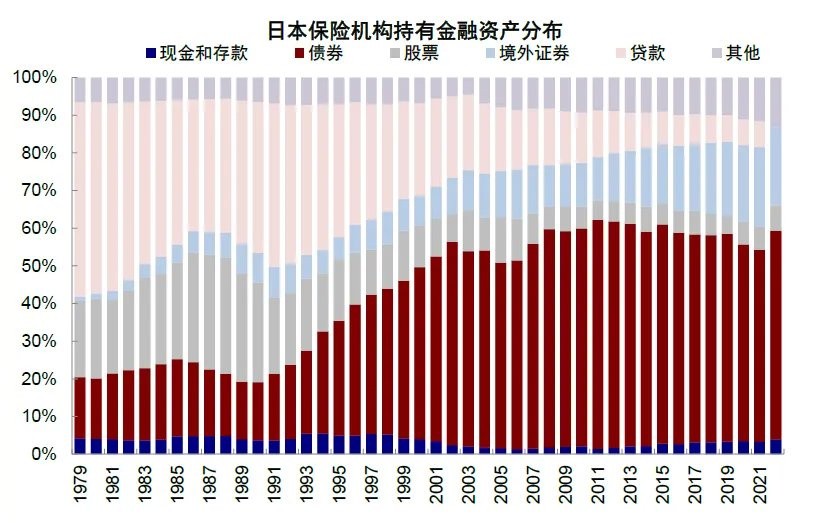

► Macroeconomic Dimension: 1) The situation of abundant mainland funds + asset scarcity may continue, but attention should be paid to whether the marginal attractiveness of A-shares increases. From the perspective of the credit cycle, the "limited efforts" of policies and the "partial pull" of technology and new consumption have prevented the credit cycle from contracting again, but it is also difficult to transform into a global recovery. Investors need to continue to seek structural opportunities that can provide returns, and the trend of long-term funds such as insurance allocating to Hong Kong stocks may continue. In addition to seeking new growth points, some investors are concerned that the decline in dividend yields may make stable return dividend assets difficult to sustain. However, the attractiveness of dividend assets does not end with a fixed time or specific dividend yield. Japanese insurance funds have continuously increased bond asset allocation for over ten years during the interest rate decline phase, and the previous three consecutive years of dividend assets outperforming the average are examples. However, short-term dividend assets may experience fluctuations due to valuation exhaustion. Currently, the dividend yield of bank stocks is declining rapidly, and the AH premium has significantly narrowed to below 20%.

Chart: Japanese insurance institutions continuously increased bond allocation in the 1990s

Source: Haver, CICC Research Department

Chart: The AH premium of the banking sector has fallen below 20%

Source: Wind, CICC Research Department

2) Marginal tightening of Hong Kong dollar liquidity in the third quarter. The previous sharp drop in Hibor has caused the Hong Kong dollar to depreciate rapidly to the weak side, triggering the Monetary Authority's intervention mechanism continuously. From late June to now, the Monetary Authority has cumulatively withdrawn HKD 87.2 billion, accounting for 70% of the previous injection scale, with the balance reduced to HKD 86.4 billion. Although the relatively moderate operations of the Monetary Authority have not tightened liquidity too quickly (the overnight and one-month Hibor are 0.13% and 1.13%, respectively, still at low levels, "How does Hibor affect Hong Kong stocks?"), the exchange rate of the US dollar against the Hong Kong dollar is still around the weak side of 7.85, making the direction of the Monetary Authority's withdrawal of Hong Kong dollars relatively clear, and it is difficult for Hong Kong dollar liquidity to be more relaxed.

Chart: Recent overall rise in Hibor rates

Data source: Wind, China International Capital Corporation Research Department

3) Dollar liquidity faces supply pressure in the third quarter. On one hand, after the passage of the "Great Beauty" Act, there will be a peak supply of about one trillion dollars in government bonds in the third quarter, which will push up U.S. Treasury yields (see "U.S. Treasuries, U.S. Stocks, and Liquidity After the 'Great Beauty' Act"); on the other hand, accelerated technology investment, fiscal stimulus, and new highs in U.S. stocks have significantly dispelled concerns about "de-dollarization" and "triple kill of stocks, bonds, and currencies" in mid-April, also supporting the stabilization and even rise of the dollar. This is also a core indication in our outlook for the second half of the year that differs from market consensus (see "Global Market Outlook for the Second Half of 2025: Consensus on 'De-dollarization'", "The Relationship Between U.S. Stocks and the Dollar").

► Micro Dimension: 1) Southbound Funds: The relatively certain southbound increment for the year is about HKD 200-300 billion, with total inflow for the year possibly exceeding HKD 1 trillion, but the inflow speed may slow in the second half. For southbound investors, the long-term allocation value of the Hong Kong stock market still exists, but there will also be fluctuations after short-term overdrafts. In addition, the "bullets" of institutions such as public funds and insurance may not be as plentiful as expected. As of the first quarter, the domestic actively managed equity funds' holdings in Hong Kong stocks were 30.8%, and even at the highest of 50%, it could only add about HKD 250 billion (total stock holdings of HKD 1.47 trillion). We estimate that the relatively certain southbound increment for the rest of the year is about HKD 200-300 billion (public funds about HKD 100 billion + insurance about HKD 200 billion), with total inflow for the year possibly exceeding HKD 1 trillion. In contrast, the inflow and speed of private equity and individual investors are significantly influenced by market performance itself. Assuming that the aforementioned types of funds increase their current allocation ratio in Hong Kong stocks by 5%, we estimate that the total inflow for the year may reach HKD 900-1,100 billion.

2) Foreign Capital: It is unrealistic to expect a significant return of long-term foreign capital from Europe and the U.S., but the space for large outflows is also limited. Based on data since 2022, we expect that in the second half of the year, under the EPFR standard, active foreign capital may continue to flow out by USD 7 billion, while passive foreign capital is expected to continue inflowing by USD 10 billion. The return of active foreign capital is a lagging indicator of fundamental improvement. Under the baseline assumption, the credit cycle is difficult to transform into a global recovery, and subsequent risks from tariff disturbances and potential confrontations in the financial sector between China and the U.S. may also increase the difficulty of foreign capital returning to the Chinese market, such as restrictions on individual stocks being included in lists, cancellation of capital gains tax exemptions, or exclusion from overseas benchmark indices and ETFs. However, after the tariff turmoil, foreign capital's further underweighting of the Chinese market, the current allocation ratio is already very low, and it is underweight by more than 1 percentage point compared to the benchmark, so the possibility of significant outflows in the future is relatively limited, while some trading funds and regional funds still have allocation intentions for quality stocks and structural highlights in Hong Kong stocks, which are expected to attract some funds Chart: Currently, active foreign capital allocation to Chinese stocks is underweight by 1 ppt compared to the benchmark

Source: EPFR, China International Capital Corporation Research Department

3) IPOs, Placements, and Buybacks: In the second half of the year, new IPO fundraising is expected to reach HKD 120 billion, placements may continue the trend from the first half with an additional HKD 150-200 billion, and buybacks may add around HKD 100 billion. Regarding IPOs, since 2013, data from the Hong Kong Stock Exchange shows that 63% of companies that submitted applications successfully listed. However, only 60% of companies can pass the hearing within the effective period after the first submission, with most needing to undergo two or more submissions. If we refer to this ratio and assume that the Hong Kong Stock Exchange proceeds with IPO applications at the previous pace, combined with the number of listing applications currently being processed (195), it is estimated that about 80 more companies may list in Hong Kong this year. Since 2015, the average fundraising scale for each IPO in Hong Kong has been HKD 1.5 billion, and we estimate that HKD 120 billion may be needed in the second half of the year. Regarding placements, the timing and scale of companies initiating refinancing depend not only on their specific expansion needs but also on market conditions. In the first half of 2025, the refinancing scale in Hong Kong reached HKD 173.8 billion. Under the baseline assumption, the fundraising scale for listed companies in Hong Kong may continue at previous levels, with an expected additional fundraising of HKD 150-200 billion in the second half. Regarding buybacks, the Hong Kong Stock Exchange will implement a treasury stock reform in June 2024, allowing listed companies to hold repurchased shares as treasury stock instead of mandatory cancellation, enhancing corporate enthusiasm and buyback efficiency. Since 2025, buybacks in Hong Kong have continued to heat up, with a cumulative 209 companies participating in buybacks, amounting to HKD 103.2 billion. It is expected that the buyback amount in the second half will remain roughly the same as in the first half, around HKD 100 billion.

Chart: Refinancing scale in the first half of 2025 exceeds HKD 170 billion

Source: Wind, China International Capital Corporation Research Department

Note: Data as of June 30, 2025

Market and Allocation Suggestions: A significant breakthrough at the index level requires additional catalysts; it is still recommended to focus on structure, with a phased "new dumbbell" allocation

Looking ahead, the long-term macro factors supporting the capital situation in Hong Kong stocks have not changed; the situation of ample funds but limited quality assets may continue. However, in terms of rhythm, the third quarter faces pressure from multiple aspects of tightening liquidity, including the Hong Kong Monetary Authority possibly continuing to withdraw liquidity, tightening external dollar conditions, and ongoing supply pressure from IPOs/placements, which may cause some disturbances. At the same time, growth is slowing, policy efforts are easing, and there are uncertainties in tariff negotiations. Nevertheless, we still suggest that if volatility can provide better re-entry opportunities, "actively intervening during downturns and moderately taking profits during exuberance" remains an effective strategy. **

Chart: The Hong Kong stock market's liquidity was relatively loose in the first half of the year, boosting market performance.

Source: Wind, EPFR, iFind, CICC Research Department

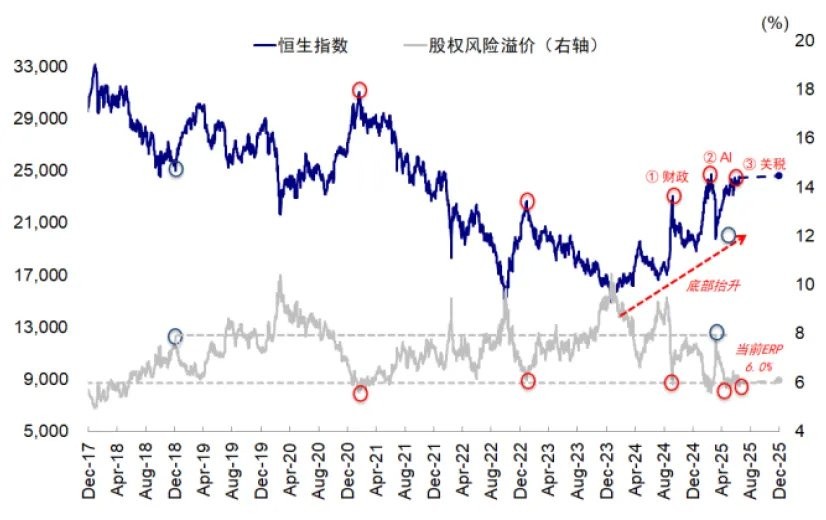

From a point of view, the current dynamic weighted Hang Seng Index risk premium has fallen to 6%, slightly lower than the level at the beginning of October last year. Whether it is the DeepSeek asset revaluation, last year's "924" market, or the market sentiment during the early 2023 pandemic reopening period, a risk premium of 6% for the Hang Seng Index seems to be an important threshold. The space for short-term sentiment recovery may be limited, and further valuation expansion requires more catalysts. Therefore, 1) In the baseline scenario, if earnings are not downgraded but there is also no temporary boost from the technology sector, the Hang Seng Index may fluctuate around 24,000 points;

Chart: The Hang Seng Index fluctuates around 24,000 points in the baseline scenario.

Source: Bloomberg, CICC Research Department

2) In an optimistic scenario, breaking down the sector calculations, the current risk premium for the new consumption + innovative drug sectors is 0.6%, close to the level during the optimization of epidemic prevention at the end of 2022; the risk premium for traditional economic sectors such as banks is 8.3%, which is lower than the 9.1% during the economic cycle and housing price peak in 2021; the risk premium for other new economy sectors (such as the internet) is 3.0%, still higher than the low point of 2.2% during the AI market in late March this year. If we assume that the risk premium for the technology sector falls back to the low point in late March this year, and the sentiment for new consumption/innovative drugs and the banking sector remains unchanged, the Hang Seng Index corresponds to around 26,000 points.

Chart: The optimistic scenario reaches 26,000, but more catalysts are needed.

Source: FactSet, CICC Research Department

But can the market effectively break through? In our report "Outlook for Hong Kong Stocks in the Second Half of 2025: Abundance of Funds and Scarcity of Assets," we mentioned that the key factors determining the direction of China's credit cycle are tariffs, fiscal policy, and AI. Therefore, we need to observe the relative changes of these three factors compared to previous peaks: 1) Fiscal Policy: The reduction of tariffs has lessened the urgency for fiscal stimulus; even if there is a subsequent escalation, it may not occur until the end of the third quarter when the exemption expires on August 12; 2) Tariffs: Whether they can improve beyond the current 10% is worth observing; otherwise, transshipment becomes unnecessary, especially with regard to whether some Southeast Asian countries impose additional transshipment restrictions; 3) AI: Recently, the sentiment in e-commerce and the internet has recovered, but it may only contribute structurally. Meanwhile, the current sentiment is significantly "calmer" compared to the excitement after the Spring Festival, and future breakthroughs may depend on leapfrog model iterations or groundbreaking applications to catalyze growth Therefore, the effective breakthrough of the index and the continued expansion of valuations require more catalysts that exceed the previous "high base." We still recommend a focus on structural market conditions. The barbell allocation of stable returns (dividends) + growth returns (growth) remains the optimal strategy before the credit cycle stabilizes but is difficult to expand significantly. However, there can be a slight rotation at both ends of the barbell based on the degree of sector overextension, termed the "new barbell." The core principle is to buy long-term correct sectors at reasonable positions.

► Dividends: Long-term logic is solid, but the banking sector is short-term overvalued, and some moderate switching to insurance, etc., is advisable. In the context of declining growth and overall market investment returns, and a lack of clear industrial main lines, stable returns or value-preserving assets still have long-term allocation value, especially as a hedging tool during phases of decline when the overall market growth space has not yet opened up. However, after a significant rise in the banking sector, short-term valuations are overstretched, with AH premiums narrowing to below 20%, leading to decreased attractiveness and facing pressure. It may be considered to rotate some banking positions into the insurance sector, which also benefits from high dividend logic and still has attractive dividend yields.

► Growth: New consumption is overextended in the short term, while AI applications, robotics, and innovative pharmaceuticals show promise. In the short term, new consumption is notably overstretched. The rise in innovative pharmaceuticals is considerable, with clear long-term logic, and the rhythm can be grasped in the short term. In contrast, the expectations for AI applications and robotics-related sectors are not as exuberant as before, making it a better choice to lay out positions in advance. Specific directions include: 1) AI applications, covering sub-directions such as gaming, short video generation, software, education, etc.; 2) Robotics industry chain, especially focusing on core component fields.

Authors: Liu Gang, Wang Muyao, Source: CICC Insight, Original Title: "CICC: Who is Leading the Hong Kong Stock Market? — The Liquidity Landscape of Hong Kong Stocks"

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account individual users' specific investment goals, financial conditions, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk