The U.S. stock earnings season is trapped in a "zero tolerance" dilemma: meeting expectations is only considered passing, and high valuations have become Wall Street's "tightening spell."

The earnings season for U.S. stocks is underway, and Wall Street's expectations for companies have increased; merely performing well is no longer sufficient. Despite large banks like JPMorgan Chase and Bank of America reporting solid results, their stock price gains have been limited. Netflix's performance exceeded expectations, yet its stock price still fell by 5%. Analysts point out that concerns about high valuations are intensifying, and the risks companies face stem from overvaluation. Although 83% of S&P 500 companies exceeded expectations, earnings growth remains weak

The Zhitong Finance APP noted that the earnings season is in full swing, and Wall Street has conveyed a clear message to companies: merely "performing well" is no longer enough. This week's market trends have reinforced this increasingly evident viewpoint.

Despite large banks like JPMorgan Chase (JPM.US) and Bank of America (BAC.US) reporting robust results and conveying messages of consumer resilience, their stock prices saw limited gains by the end of the week.

Netflix (NFLX.US), currently trading at a price-to-earnings ratio of about 40 times, faced a more severe market reaction. Although the streaming giant reported revenue and profits that exceeded expectations and raised its full-year guidance, its stock price still fell by 5% on Friday.

William Blair analyst Ralph Schackart wrote in his comments on Netflix's earnings report: "Overall 'good' performance and guidance are not good enough for already elevated expectations."

This disconnect between performance and stock price reaction is not an isolated case. As the earnings season progresses, the overall market is facing high valuation issues, and there is an increasing awareness that even strong performance may not be sufficient to justify current stock price levels.

Brian Jacobson, chief economist at Annex Wealth Management, stated: "The biggest risk right now is valuation. When we look at the fundamentals, I think they will improve. But the question is, how much premium are you paying for those fundamentals?"

As companies entered this earnings season, market expectations had already lowered due to increased uncertainty regarding tariffs, policies, and interest rate paths.

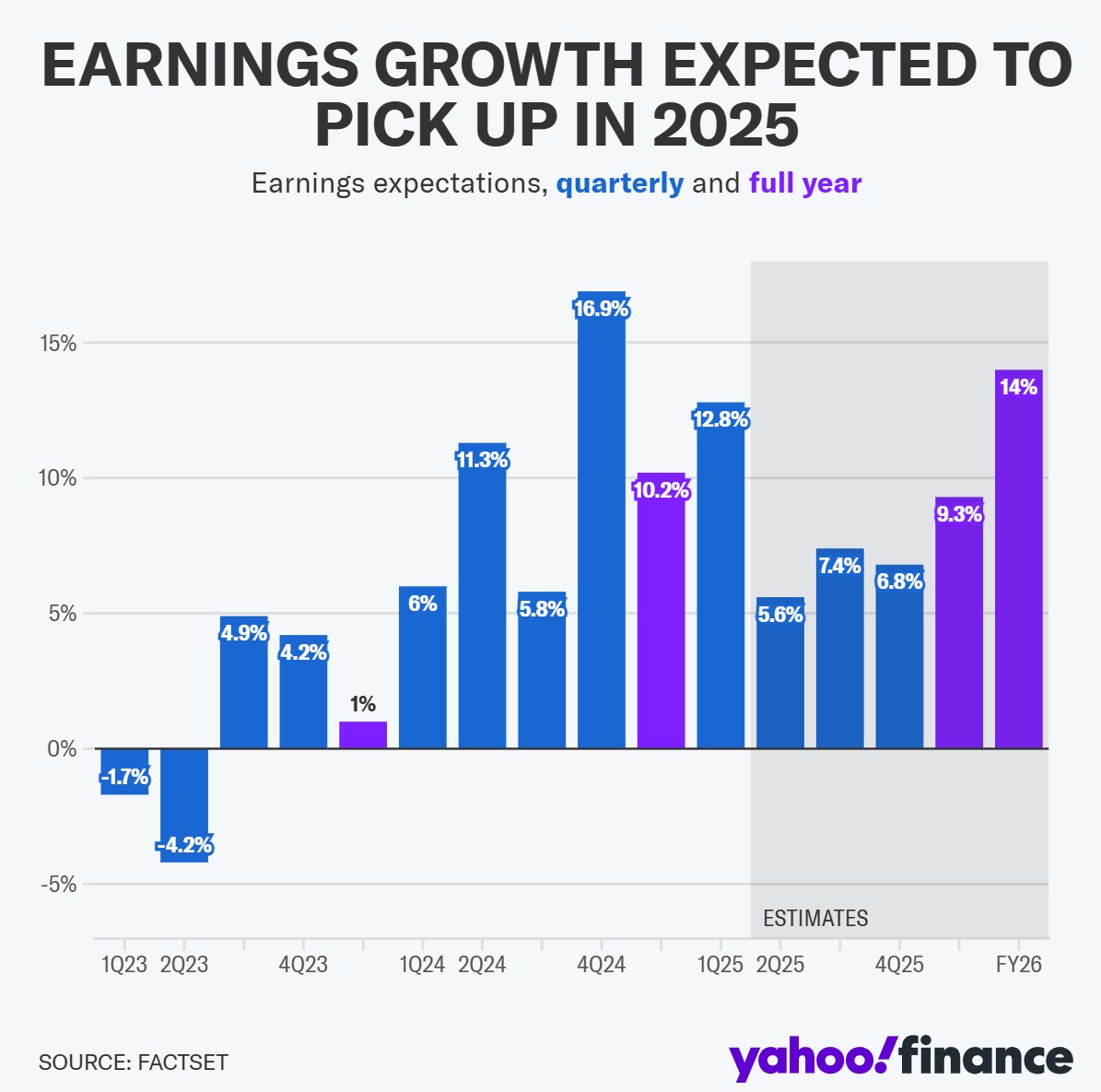

According to FactSet data, analysts initially expected the S&P 500 index to see earnings growth of just under 5% in the second quarter. As more companies reported better-than-expected results, this expectation rose to 5.6% on Friday. If this figure holds, it would still represent the slowest earnings growth since the fourth quarter of 2023.

So far, 83% of the S&P 500 companies that have reported earnings exceeded expectations for second-quarter earnings per share, above the five-year average of 78%. However, the average earnings beat of 7.9% remains below the five-year average of 9.1%.

Faced with this relatively easy hurdle, strategists warn that investors lack patience for any missteps. Jacobson stated: "I expect we will see a lot of volatility. Underperformance will be punished more harshly than usual. I think investors do not have the patience to deal with companies that fail to meet expectations."

After the "Liberation Day" tariff threat proposed by Trump in April triggered a brief sell-off, the stock market has rebounded from its lows and set new historical highs. At that time, Trump vowed to impose tariffs on some of America's largest trading partners. The White House later softened its stance, first granting a 90-day grace period and then pushing the deadline to August 1 This concession has sparked a familiar saying on Wall Street—the so-called TACO trade, which stands for "Trump Always Chickens Out."

This phrase reflects the belief among some investors that the president often takes a tough stance on tariffs but rarely follows through with action. This assumption has provided support to the market in recent months, as traders increasingly bet that policies will shift at the last moment.

However, even as the market rises on hopes of policy shifts, the underlying uncertainty has not disappeared.

Mark Malik, Chief Investment Officer at Siebert Financial, stated that as the earnings season continues, investors will gain a clearer understanding of how tariff-sensitive industries are performing in the current environment.

"All signals currently point in the right direction," he emphasized, noting the uncertainty surrounding the upcoming earnings reports. "We know that (tariff-related inflation) will be a headwind. It will either impact corporate profits or be directly passed on to consumers. The market is trying to digest all of this, and so far it has done well. But I think another shoe will drop soon."