Earnings Report Preview | Is the price increase strategy unsustainable? Can Coca Cola turn to marketing strategy investment for a turning point?

Coca Cola will announce its second-quarter results before the US stock market opens on July 22, with market expectations for earnings per share of $0.83, a year-on-year decline of 1.2%. Revenue is expected to be $12.59 billion, showing weak growth, primarily relying on price increase strategies. Although the first quarter performed slightly better, overall revenue growth has slowed for three consecutive years, and the net profit margin is also on a downward trend. Coca Cola faces exchange rate fluctuations and political uncertainties, and it remains to be seen whether it can achieve a turning point through marketing strategy investments in the future

According to Zhitong Finance APP, Coca-Cola (KO.US) will announce its second-quarter results before the US stock market opens on July 22. The market expects that the world's largest beverage manufacturer will report earnings per share of $0.83, a year-on-year decrease of 1.2%. Revenue is expected to be $12.59 billion, an increase of 1.9% compared to the same period last year.

Weak Growth and High Valuation

Earlier, its main competitor PepsiCo (PEP.US) just delivered an impressive quarterly report, with the company exceeding expectations in both revenue and profit for Q2, thanks to continued growth in international markets.

Similarly, Coca-Cola's adjusted earnings per share for the first quarter were $0.73, with revenue of $11.22 billion, slightly above the market expectations of $0.72 earnings per share and $11.17 billion in revenue.

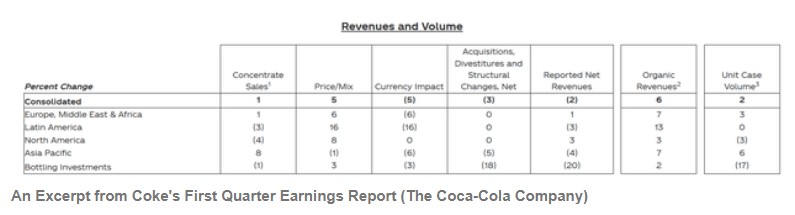

However, unlike its competitor, Coca-Cola has consistently relied on unsustainable price increase strategies to drive slow growth. In the first quarter, although the company achieved slight sales growth in the European market, price increases remained the main driver of revenue growth in key markets such as North America and the Europe, Africa, and Middle East regions. The sales price of concentrates in North America was raised by 4%, which became the main driving force for revenue growth in the first quarter. In 2024, the average price of Coca-Cola products is expected to rise by 5.8%.

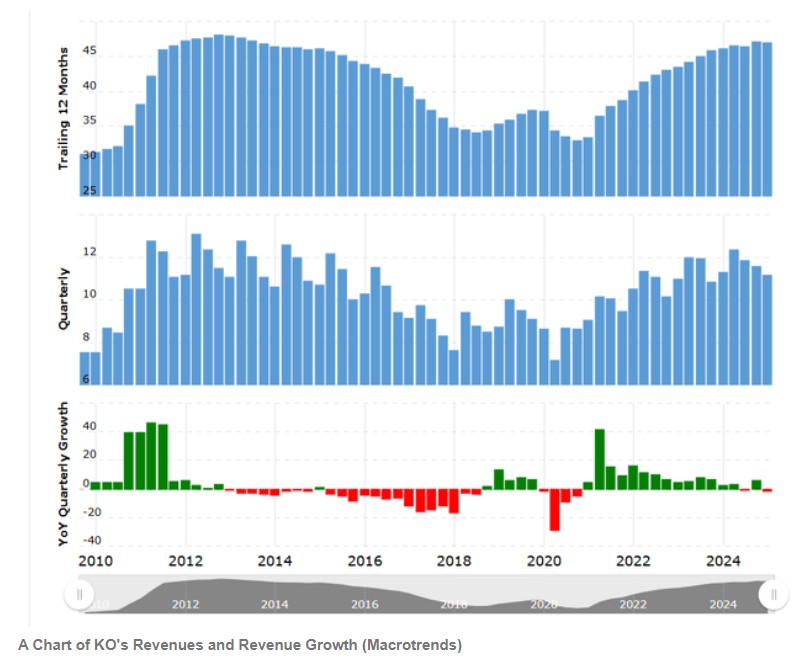

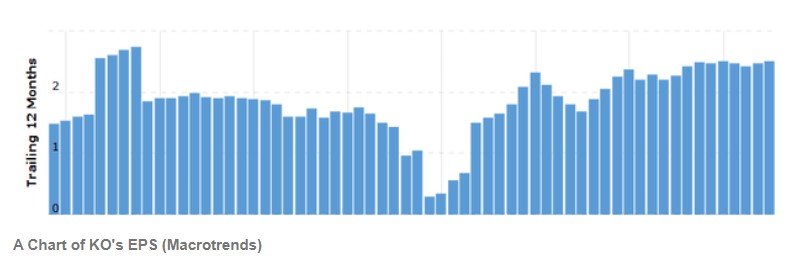

Since March 2022, Coca-Cola's quarterly revenue growth rate has been declining, and the annual revenue growth rate has slowed for three consecutive years. From the end of 2022 to now, the company's revenue has only increased from $43 billion to $47 billion. The growth of earnings per share over the past three years has also been weak; despite spending nearly $5 billion on stock buybacks during this period, the rolling earnings per share have only slightly increased from $2.37 in March 2022 to the current $2.49.

The company's net profit margin has also shown a downward trend since the end of 2022, decreasing from 25.69% in the first quarter of 2022 to the current 23%. Although the revenue growth rate remains in the mid-single digits, and the core business continues to face political uncertainties brought by exchange rate fluctuations and tariff policies, Coca-Cola's current forward P/E ratio based on GAAP remains as high as 24 times.

Due to 65% of revenue coming from markets outside the United States, even slight fluctuations in exchange rates can have a significant impact on the company's core business. Analysts predict that the earnings per share growth rate over the next three years will only be 6-8%, and considering the uncertainty of the current economic environment, this expectation may still be overly optimistic.

Due to 65% of revenue coming from markets outside the United States, even slight fluctuations in exchange rates can have a significant impact on the company's core business. Analysts predict that the earnings per share growth rate over the next three years will only be 6-8%, and considering the uncertainty of the current economic environment, this expectation may still be overly optimistic.

Increased Marketing Investment

However, some analysts believe that Coca-Cola's expected revenue growth in the second quarter will mainly benefit from the company's strategic focus on low-calorie and nutritional beverages. The company's marketing expenditure this year has increased to 11% of sales (the five-year average is 10%), which is expected to strengthen brand recognition and consumer interaction. Despite potential global trade fluctuations, Wall Street remains cautiously optimistic, expecting an organic revenue growth rate of 5-6% for the year and earnings per share growth of 2-3%.

According to analysis, Coca-Cola is increasing its marketing investment. This strategic move aims to strengthen the product matrix centered on low-calorie nutritional beverages, and its emphasis on innovation reflects agility in responding to changes in consumer trends. The marketing investment has increased by 1 percentage point compared to the five-year average, demonstrating its determination to maintain market leadership. Analysts are closely monitoring the potential impact of these initiatives on the competitive landscape and financial performance in subsequent quarters.

Combined with relatively stable revenue and profit growth, these factors support Coca-Cola's strong financial fundamentals. Strategic marketing investments and innovations in healthy beverages create growth opportunities for the company. Although global trade uncertainty poses risks, with robust performance and market adaptability, the overall outlook remains cautiously optimistic. Wall Street analysts maintain a "neutral" rating, expecting organic revenue and earnings per share to grow steadily. With the continuous optimization of the product matrix and market expansion, Coca-Cola has a solid foundation to address future challenges and seize emerging consumer trends