The devastating impact of Japan's ruling coalition's defeat: Uncertainty leads to heightened bearish sentiment on the yen, changes in interest rate hike prospects, and potential risks to trade negotiations?

Despite safe-haven buying temporarily boosting the yen, several investment bank strategists are pessimistic about the yen's outlook, with HSBC warning that the yen will fall to 152. Coinciding with the critical deadline for U.S.-Japan trade negotiations on August 1, political weakness may undermine Japan's negotiating power. The market is concerned that if Shōji Nakanishi resigns, it could trigger a chain reaction of foreign capital selling, leading to greater turmoil for Japanese assets

The historic defeat of Japan's ruling coalition in the House of Councillors election is triggering a new round of market turbulence, with analysts generally believing that political uncertainty will lead to increased volatility in the yen and Japanese stocks. The combination of political uncertainty and the approaching deadline of August 1 for US-Japan trade negotiations is testing investors' confidence in Japanese assets.

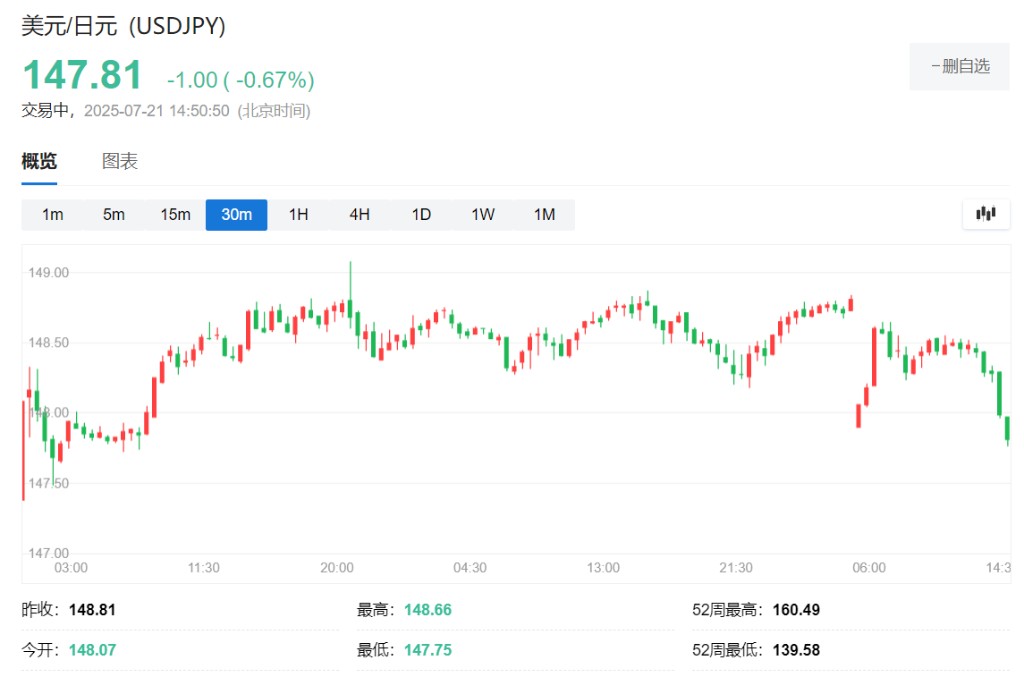

On Monday, the Japanese stock market was closed for a holiday, while the yen initially rose 0.7% against the US dollar, reaching a high of 147.79, but then retraced some gains to 148.48, before rising again to around 147.80. Analysts believe that the yen's pullback after initial safe-haven buying indicates that the market had anticipated the election results, and subsequent safe-haven buying pushed the yen higher again.

This also reflects the turbulent impact of political uncertainty on the yen's movements. Despite the yen's rise, several investment bank strategists are pessimistic about its trajectory, with HSBC warning that the yen could fall to 152.

The election results not only alter the policy path of the Bank of Japan but also affect US-Japan trade negotiations. Analysts point out that with the August 1 deadline for tariff negotiations approaching, political turmoil could severely impact the negotiation process. Analysts warn that if Shigeru Ishiba ultimately resigns, it could trigger a chain reaction of foreign investors selling Japanese stocks and the yen.

According to Jianwen article, the ruling coalition in Japan faced a historic defeat in the House of Councillors election, and Prime Minister Shigeru Ishiba's political future has become increasingly uncertain, while the rise of the populist right-wing "Reform Party" is changing the political landscape in Japan. This series of changes could severely impact the imminent US-Japan trade negotiations.

Safe-haven buying briefly boosts the yen, but analysts are generally bearish

The election results mark a significant shift in Japan's political landscape.

According to Xinhua News Agency, in the 27th House of Councillors election held on the 20th, the ruling coalition formed by the Liberal Democratic Party and Komeito lost its majority in the House of Councillors. This is the first time since the Liberal Democratic Party was established in 1955 that it has failed to secure a majority in both houses of Congress.

Hebe Chen, an analyst at Vantage Markets, pointed out, "The Japanese House of Councillors election has reignited political uncertainty, adding another layer of instability to an already fragile backdrop since the turmoil last October."

Regarding the yen's initial rise followed by a decline, Akira Moroga, Chief Market Strategist at Aozora Bank, noted:

Some investors had prepared for a larger defeat for the ruling coalition or even Shigeru Ishiba's resignation, and the unwinding of these positions provided initial support for the yen.

Meanwhile, Nick Twidale, Chief Analyst at ATFX Global Markets, stated:

"We have seen initial safe-haven buying, followed by a pullback, as this is in line with expectations. Overall, I believe the yen may weaken due to uncertainty."

He also added that many investors are concerned that Shigeru Ishiba may still lose his position, "if that happens, we will see further declines in the yen."

HSBC issued a shocking warning, stating that due to political and Bank of Japan risks, USD/JPY may break 152, and this is just the beginning for the Japanese yen.

Changing Outlook on Central Bank Policy

Political uncertainty is altering market expectations for the Bank of Japan's monetary policy. Several analysts believe that the central bank will maintain a wait-and-see attitude in the short term until the future policy direction becomes clearer.

Hiroshi Namioka, Chief Strategist at T&D Asset Management, indicated that the prospects for a rate hike by the central bank now face more uncertainty, which may delay any tightening policy actions.

Rodrigo Catril, currency strategist at National Australia Bank, stated:

"The prospects for a rate hike by the Bank of Japan may now be delayed for a longer time. Overall, the election results are not good news for Japanese assets."

Hui Shi Yeo, portfolio manager at iFast Financial, warned:

"As Shigeru Ishiba vows to continue governing after setbacks, and doubts about the government's ability to push forward key policies grow, both the yen and the stock market may become more sensitive to news headlines."

According to CCTV News, on the 21st local time, Japanese Prime Minister and Liberal Democratic Party President Shigeru Ishiba held a press conference at the LDP headquarters, accepting the severe election results and expressing his intention to remain as Prime Minister Commonwealth Bank of Australia currency strategist Carol Kong also stated:

"It is currently unclear whether Shigeru Ishiba can truly continue to serve as Prime Minister, and what this means for the Japan-U.S. trade negotiations. Ongoing political uncertainty will have a negative impact on Japanese assets, including the yen."

New Challenges in Trade Negotiations

The political turmoil comes at a critical time for Japan-U.S. trade negotiations, with the August 1 tariff implementation deadline approaching.

According to media reports, U.S. Secretary of Commerce Howard Lutnick stated last Sunday that August 1 is a hard deadline for the tariffs to take effect. Japan is striving to reach an agreement with the United States before this deadline to avoid facing higher tariffs.

KCM Trade Chief Market Analyst Tim Waterer stated:

"The election results have weakened Ishiba's political influence, which in turn diminishes Japan's negotiating power at the table with the United States. Any agreement now may not be as favorable for Japan as what could have been achieved if Ishiba's position had been more stable at the highest level."