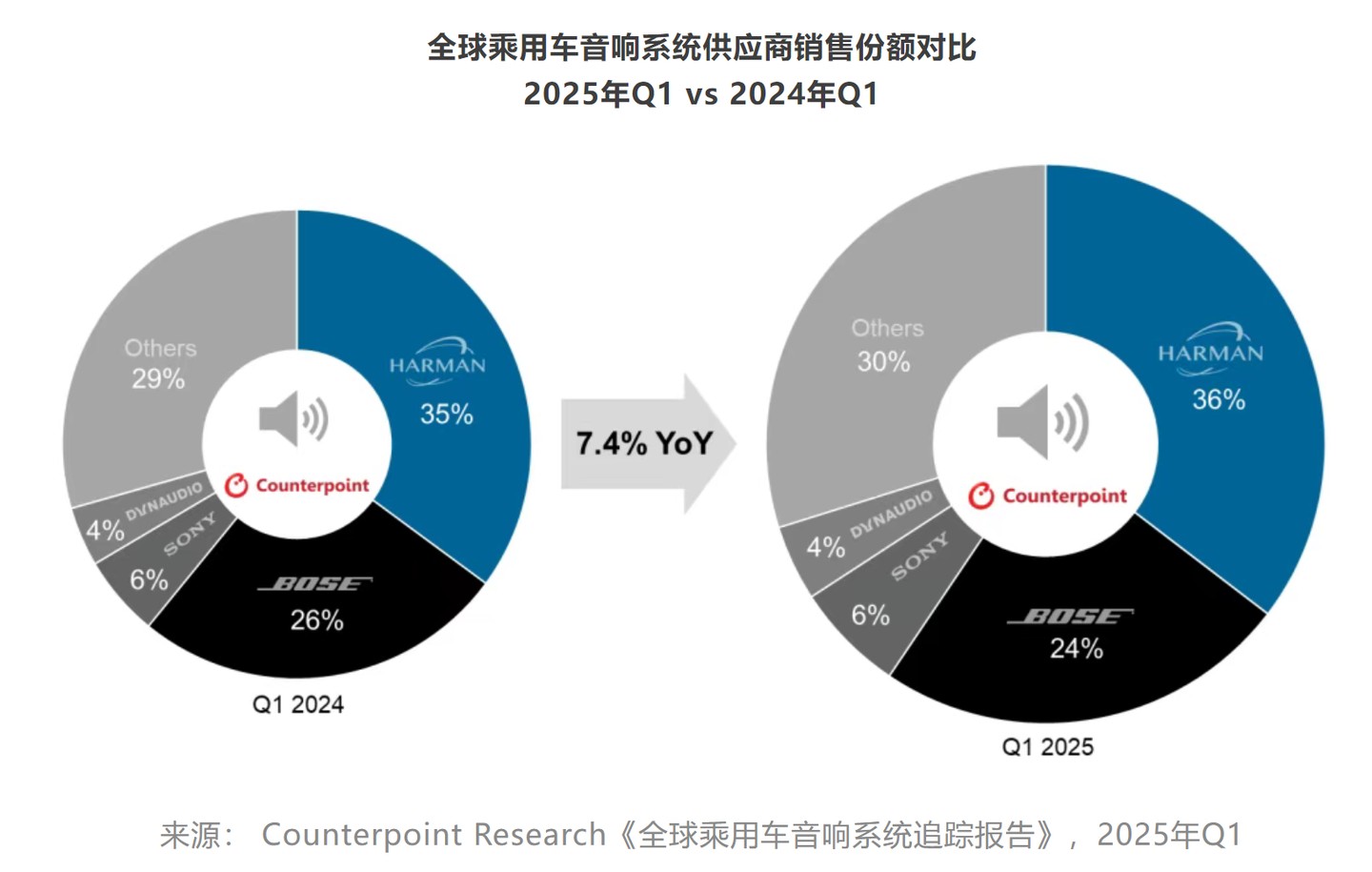

Counterpoint: The global passenger car audio system market is dominated by Harman and Bose, with the two companies contributing nearly 60% of total sales

According to the latest report released by Counterpoint, the global passenger car audio system market is dominated by Harman and Bose, which together contribute nearly 60% of sales. AAC Technologies is the only Chinese company among the top ten suppliers. With the rise of Chinese automotive brands, companies like SONAVOX are rapidly developing. Chinese automakers such as XPeng and Geely are beginning to independently develop audio systems and increase the speaker configurations of high-end models while launching cost-effective electric vehicle models. The increase in software-defined audio features is also changing the competitive landscape of the market

According to the latest "Global Passenger Car Audio System Tracking Report" released by Counterpoint, the global passenger car audio system market is currently dominated by Harman and Bose, with the two companies contributing nearly 60% of total sales. AAC Technologies is the only Chinese company listed among the top ten suppliers. Although this market has traditionally been led by American, Japanese, and European companies such as Harman, Bose, Sony, and Dynaudio, Chinese automotive brands are rapidly gaining influence globally, with companies like Sonavox, WANOS, Nobo Automotive, and ADS Audio emerging quickly.

To enhance supply chain control and create a more differentiated product experience, Chinese automakers such as XPeng, Leapmotor, and Geely have begun to independently develop in-car audio systems and engage in deep collaboration with ecosystem partners.

A noteworthy trend is that Chinese automakers are actively increasing the number of speakers in the high-end market. Several Chinese automotive brands, including Nio, ZEEKR, and BYD, have launched models equipped with more than 20 speakers, such as the Nio ET7, ZEEKR 01, and BYD Tang. Despite the high number of speakers in premium models, Chinese automotive brands are also focusing on launching more cost-effective electric vehicle models with fewer speakers, thereby reducing the average maximum number of speakers in the market.

In addition to the competition in the number of speakers, the continuous increase in software-defined audio features by automotive brands is profoundly changing the competitive landscape of the in-car audio system market. Thanks to OTA remote upgrade capabilities, automotive brands provide users with personalized audio experiences. Several models, including Tesla Model 3, Nio ET7, Cadillac Optiq, and Lucid Air, support OTA updates, which can continuously enhance user experience and introduce new features over time. The popularization of spatial audio and immersive audio technology in high-end models brings users a 360-degree sound field experience. For example, in the U.S. market, General Motors will offer Dolby Atmos experience in all-electric Cadillac models by 2026.

Overall, advanced in-car audio systems are becoming a core differentiating factor in consumers' purchasing decisions, especially in China, a technology frontier market, where consumers are increasingly willing to pay a premium for top-notch audio experiences