The Federal Reserve's interest rate cut clears obstacles, and the US stock IPO market welcomes a "busy October."

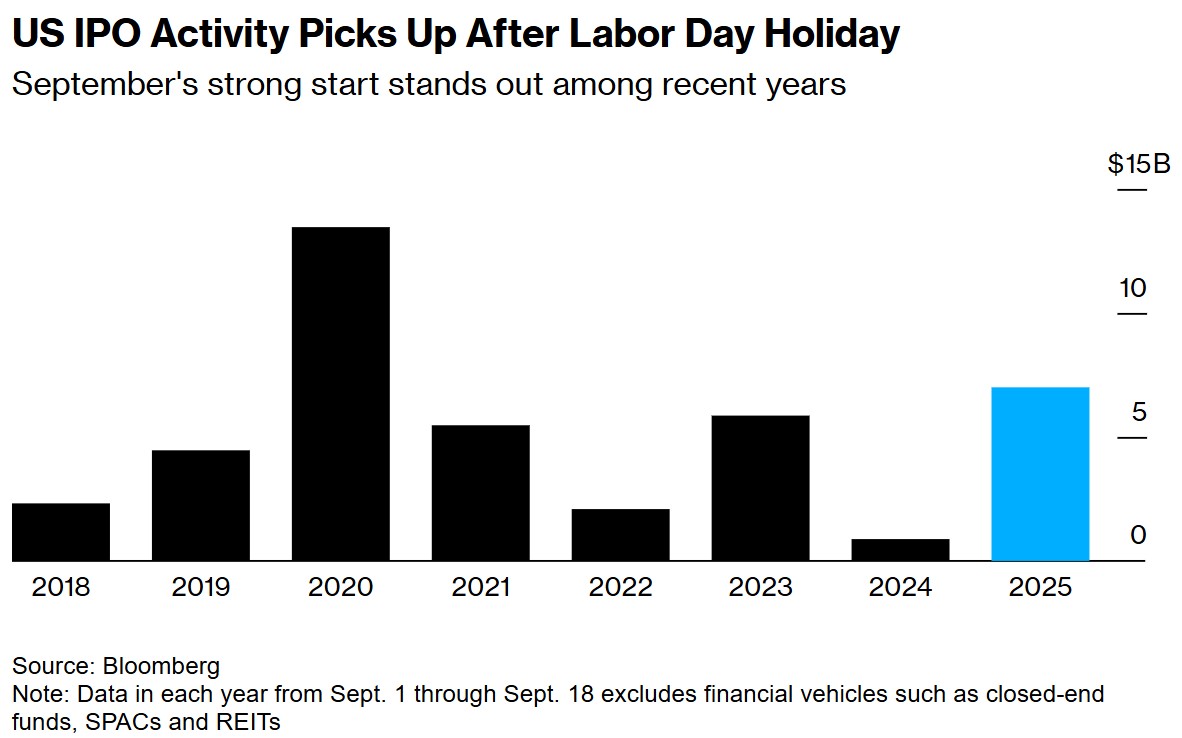

The Federal Reserve's interest rate cuts have a positive impact on the U.S. IPO market, with companies in the technology and services sectors expected to submit IPO applications or launch marketing activities in the coming days and weeks. As market conditions improve, more companies plan to go public in October, potentially exceeding the number of transactions this month. A total of 14 companies have raised $7 billion through IPOs this month, marking the highest level since 2020

According to the Zhitong Finance APP, the Federal Reserve's interest rate cut has cleared the way for private companies waiting for the green light to jump into the U.S. IPO market.

Industry observers expect companies from the technology sector to the service industry to publicly submit IPO applications or initiate marketing activities for such transactions in the days and weeks following the rate cut on Wednesday. Many companies considering going public in the fall have been waiting for this decision while also monitoring the performance of newly listed companies, which has been mixed.

West Riggs, head of equity capital markets at Truist Securities, stated, "There are definitely companies waiting to get through this hurdle, just to ensure there are no surprises. The schedule for October is expected to be very full."

A number of companies, including Neptune Insurance Holdings and the owner of the University of Phoenix, have publicly submitted documents to U.S. regulators and may begin roadshows in the coming days after the mandatory 15-day waiting period. Bankers expect more companies to go public as the U.S. stock market benchmark approaches historical highs, and volatility indicators show relative calm—conditions considered favorable for initial public offerings.

According to data compiled by Bloomberg, 14 companies have raised $7 billion through U.S. IPOs so far this month, excluding SPACs, REITs, and closed-end funds, marking the highest level for the first 18 days of September since 2020. Riggs noted that if the market remains strong, the number of significant deals in October could exceed that of this month.

U.S. IPO activity warms up after Labor Day holiday

The beginning of the Federal Reserve's easing cycle may create an opportunity for the backlog of companies seeking to go public. Companies hoping to go public in October need to submit applications in the coming weeks, or they may have to delay their IPO plans until 2026 to avoid the typical lull around the holiday season.

Will Brautigam, head of U.S. capital markets transactions at Deloitte, stated that several issuers are expected to update the market on their listing plans, including details such as "timing, pricing, and scheduling." The Federal Reserve's decision should prompt companies to take these actions, as it represents "a piece on the board that helps us understand how to price for the market, meaning it will drive demand for more IPOs in the coming weeks."

Last week, the autumn window opened, with the number of companies raising $250 million or more in IPO financing reaching the highest level since October 2021. However, compared to the summer's stunning gains, the performance of such companies has been more subdued, with the median stock price of companies going public this month rising 8.7% as of Wednesday's close.

In terms of performance, StubHub Holdings and Gemini Space Station have seen their stock prices fall below their offering prices, while Figure Technologies Solutions and BlackRock Coffee Bar have seen their stock prices rise by over 35% However, newly listed companies need to trade well to encourage investors to welcome new entrants with open arms. Bloudekham stated that seeing more recent IPOs' stock prices fall below their offering prices may force the market to reassess trading.

He said: "There are some good news and warning factors, namely that this tool must continue to bring returns to investors."