JPMorgan Chase is firmly optimistic about Chinese bank stocks: The "high dividend narrative" is far from over!

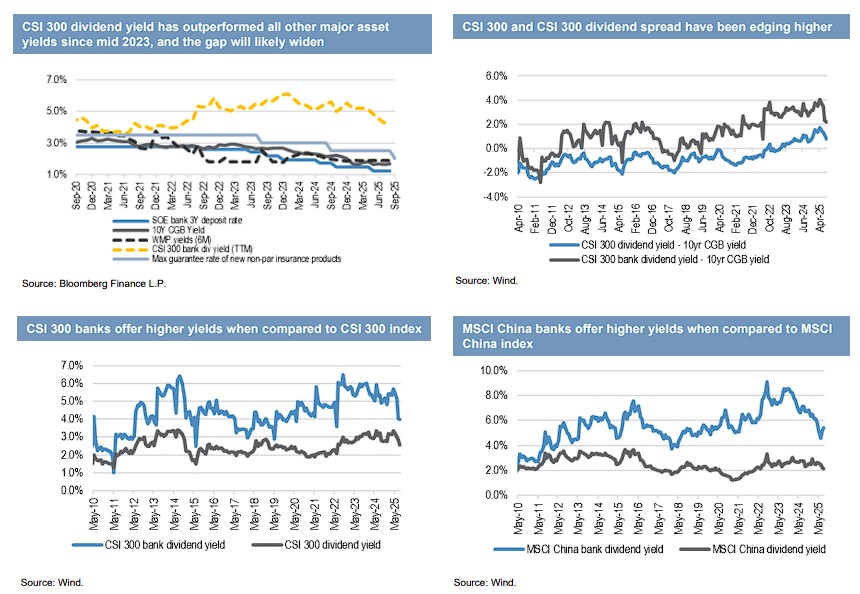

JP Morgan stated that the 4.3% dividend yield of the CSI 300 bank stocks significantly surpasses the 1.8% yield of ten-year government bonds, creating a clear advantage. Even in extreme stress scenarios, bank stocks can still provide a 4%-4.5% dividend yield. It is expected that an incremental capital inflow of 14 trillion yuan into the stock market over the next three years will make high-dividend sectors the main beneficiaries. With net interest margins stabilizing and intermediary business income recovering, the continuous improvement of the banking industry's fundamentals supports the sustainability of dividends

A month later, JP Morgan released another research report firmly bullish on Chinese bank stocks, believing that the "high dividend narrative" is far from over.

According to an article from Jianwen on August 19, JP Morgan analyst Katherine Lei stated in a research report that thanks to stable net interest margins, growth in fee income, and high dividend returns, the A-share banking sector is expected to rise by up to 15% in the second half of the year, while H-share bank stocks are likely to climb by 8%.

On September 19, according to news from the Chasing Wind Trading Desk, JP Morgan released its latest research report stating that in the current interest rate environment, Chinese bank stocks still possess significant investment value due to their stable dividend yields and strong performance. The "high dividend narrative" of Chinese banking is far from over.

The report noted that the 4.3% dividend yield of the CSI 300 bank stocks significantly outperforms the 1.8% yield of ten-year government bonds, as well as the 1.25% bank deposit rate and 1.9% wealth management product yields, and emphasized that even under the pressure of escalating trade frictions, Chinese bank stocks can still provide a dividend yield of about 4% to 4.5%.

JP Morgan believes that the revenue and profit growth of the banking sector will improve quarter-on-quarter in the second half of the year, mainly due to the improvement in net interest margins and a moderate recovery in intermediary business income. The bank expects the interest rate cut cycle to be nearing its end, and the stabilization of net interest margins will provide important support for bank performance.

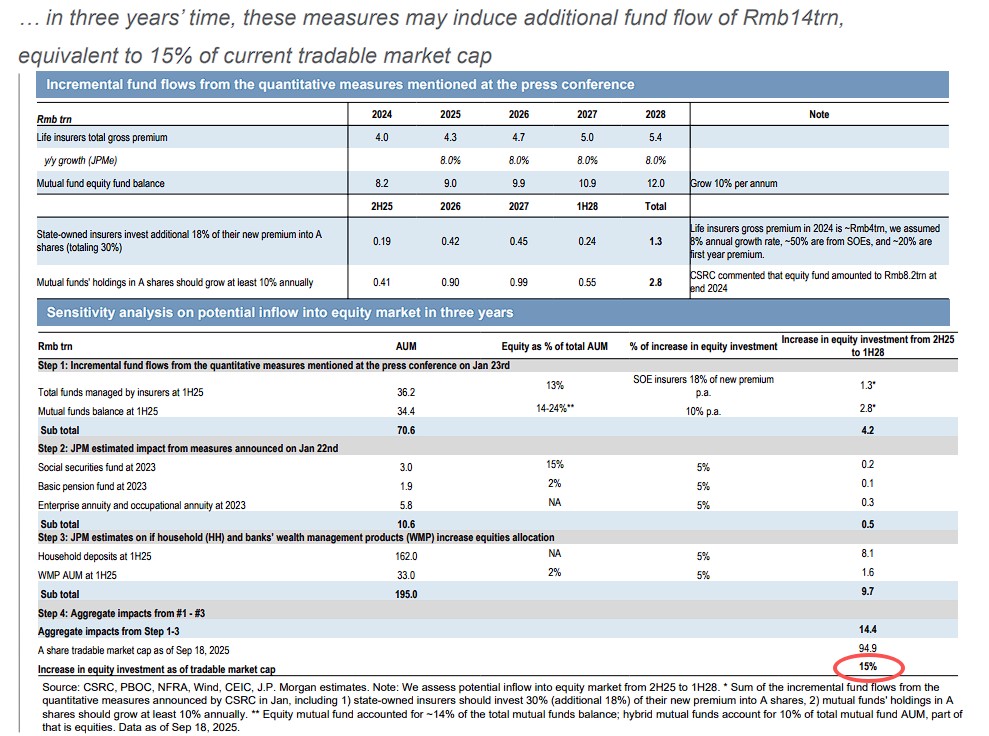

Meanwhile, Morgan Stanley expects that in the next three years, capital inflows into the stock market could reach 14 trillion yuan, equivalent to 15% of the A-share circulating market value, with high dividend sectors becoming the main beneficiaries.

"High Dividend Narrative" Continues to Ferment

In the August research report, analyst Katherine Lei pointed out that ample liquidity and a weak macro backdrop will continue to favor capital flowing into high dividend stocks, with the average dividend yield forecast for A-share bank stocks covered by her being about 4.3% this year, which appears extremely attractive in the current environment of generally declining yields.

JP Morgan's latest research report emphasizes that the dividend theme is far from over, believing that the CSI 300 bank index's 4.3% dividend yield significantly surpasses the ten-year government bond yield (about 1.8%), the three-year bank deposit rate (1.25%), and the wealth management product yield (1.9%), forming a clear yield advantage.

JP Morgan data shows that MSCI China bank stocks and CSI 300 bank stocks provide dividend yields of 5.4% and 4.3%, respectively, with the dividend yield spread relative to ten-year government bonds reaching 360 and 250 basis points, respectively.

JP Morgan emphasizes that even in the context of escalating trade frictions, Chinese bank stocks can still provide a dividend yield of about 4% to 4.5%. The bank's calculations show that under extreme assumptions of a 20% non-performing loan rate for manufacturing export-related loans, a 20% decline in transaction banking fees, and a 20 basis point reduction in LPR and time deposit rates, the dividend yields of A-shares and H-shares of banks can still maintain at 3.8% and 4.5% respectively.

JPMorgan also pointed out that this dividend advantage not only benefits A-share investors, but the increase in southbound funds holding H-share bank stocks also provides strong support for stock prices. Data shows:

Since the beginning of this year, the proportion of southbound funds has significantly increased, with Ping An Group's increased holdings in ICBC H-shares, ABC H-shares, CMB H-shares, and PSBC H-shares contributing over 50% of the southbound fund inflow.

The bank noted that if the dividend spread narrows to 200 basis points, JPMorgan estimates that A-share bank stocks still have an average upside of 27%, while H-share bank stocks have an average upside of 42%. This forecast is based on the current level of government bond yields and the valuation status of bank stocks.

Expectations of Fundamental Improvement Support Valuation Recovery

JPMorgan expects the fundamentals of the banking industry to continue improving.

Second-quarter performance data shows that the banking industry's revenue, pre-tax profit, and net profit growth rates have all turned positive, reaching 2%, 3%, and 3% respectively, a significant improvement from the -3%, -3%, and -2% in the first quarter. This improvement is mainly driven by non-interest net income, with fee income achieving a 6% year-on-year growth in the second quarter, compared to zero growth in the first quarter.

In terms of net interest margin, JPMorgan believed in last month's research report that the interest rate cut cycle is nearing its end, and expects one or two additional rate cuts in the second half of the year or in 2026.

The bank's analysis suggests that the combined impact of a 50 basis point reduction in mortgage loan rates, symmetrical reductions in LPR and deposit rates, and a 75 basis point reduction in the reserve requirement ratio is basically neutral for banks' net interest margins.

State-owned banks performed better than joint-stock banks in terms of revenue growth, achieving a revenue growth of 5%, while joint-stock banks' revenue growth remained flat. All six state-owned banks achieved positive growth in the second quarter, with an average increase of 2%, but there was significant differentiation among joint-stock banks.

In terms of asset quality, JPMorgan pointed out that the overall non-performing loan ratio and the proportion of loans under scrutiny in the banking industry remain stable. In the second quarter, the provision coverage ratio for loans under scrutiny in the banking industry increased by 1 percentage point quarter-on-quarter, while the proportion of special mention loans decreased by 2 basis points quarter-on-quarter, indicating that risks are controllable.

Policy Dividends Continue to Be Released, 14 Trillion Yuan Incremental Funds Expected

In its latest research report, JPMorgan stated that since the end of 2023, Chinese regulators have launched the "China Value Enhancement" initiative, encouraging listed companies to enhance investor returns through a series of policy measures.

JPMorgan has found that the relevant policies cover multiple dimensions such as market value management, share buybacks, cash dividends, and corporate governance, creating a favorable policy environment for high-dividend targets such as bank stocks.

JPMorgan expects that under policy guidance, approximately 14 trillion yuan of incremental funds will flow into the stock market over the next three years, equivalent to 15% of the circulating market value of A-shares.

This forecast is based on multiple factors:

This forecast is based on multiple factors:

Household assets are shifting 5 percentage points from deposits to stocks, bank wealth management and insurance assets are increasing stock allocations by 5 percentage points, and the allocation of long-term funds (mainly insurance funds and social security funds) is increasing.

Specifically, state-owned insurance companies will invest 18% of new premiums into A-shares, totaling 1.3 trillion yuan; the scale of public fund holdings will grow at a rate of at least 10% per year, contributing 2.8 trillion yuan; and 5% of household deposits and wealth management products will be transferred to the stock market, contributing 8.1 trillion yuan and 1.6 trillion yuan, respectively.

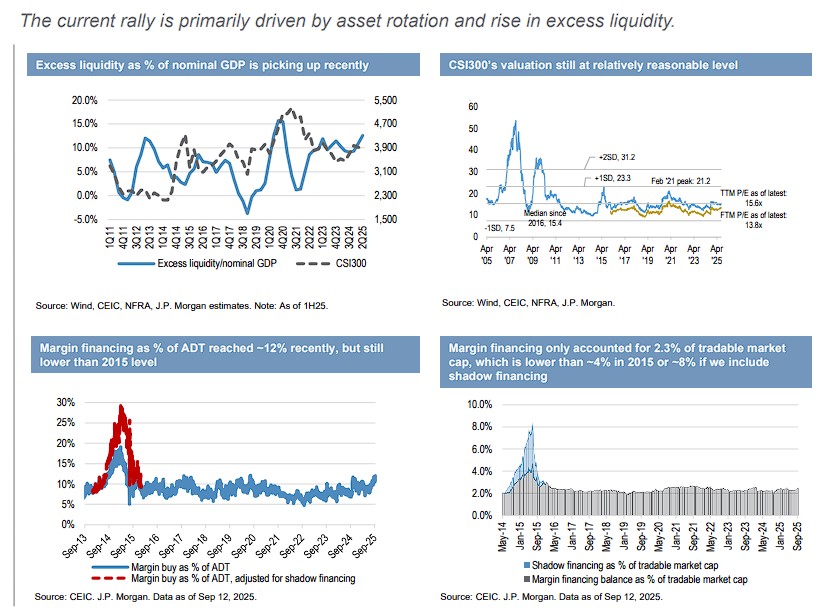

It is worth noting that for this round of stock market rise, JP Morgan's analysis shows that the current market rebound is mainly driven by asset rotation and an increase in excess liquidity. The balance of margin financing and securities lending accounts for 2.3% of the tradable market value, lower than the approximately 4% level in 2015, indicating that the current rise is sustainable.