U.S. stocks' "new favorite" suddenly changes: "once unpopular" hard drives and memory stand on the AI windfall, with established storage manufacturers' performance and stock prices soaring

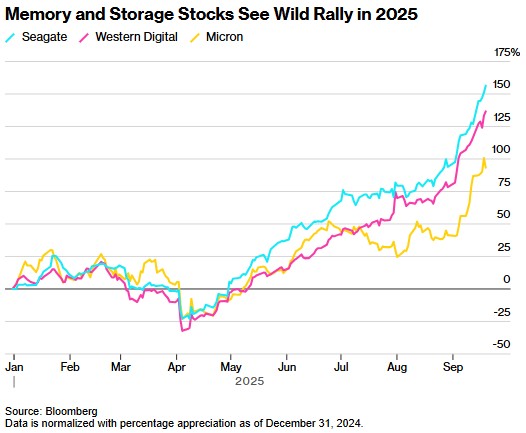

The popular sectors in the US stock market have quietly shifted towards established storage manufacturers, such as Seagate Tech and Western Digital, with their stock prices soaring. Seagate Tech's stock price skyrocketed by 156%, making it the best-performing stock in the S&P 500 index. Micron Tech also set a record for consecutive gains, with a stock price increase of 93%. Analysts point out that this phenomenon may indicate that the market is in a bubble stage, with investors turning to secondary and tertiary concept stocks. The continuous growth of AI infrastructure investment has driven unexpected benefits in this "niche sector."

According to the Zhitong Finance APP, previously, U.S. stocks were soaring in a frenzy over the limitless imagination of the high-tech artificial intelligence (AI) future. Now, the market's "hot track" has quietly shifted to a rather "retro" field within the technology industry, with established tech companies like Seagate Tech (STX.US) and Western Digital (WDC.US) emerging prominently and sparking market discussions.

Established storage manufacturers lead U.S. stocks with stunning gains

Seagate Tech, which produces hard disk drives (HDD), has seen its stock price soar by 156% this year, making it the best-performing stock in the S&P 500 index. Its competitor, Western Digital, follows closely with a 137% increase, ranking third. Meanwhile, Micron Tech (MU.US), the largest memory chip manufacturer in the U.S., has achieved a 93% increase in stock price since 2025 after setting a record of 12 consecutive trading days of gains, placing it among the top five in the index.

Most of these companies have a long history and have traditionally operated "low-key" in the market; they were established long before Mark Zuckerberg (founder of Facebook) and Sam Altman (CEO of OpenAI) were born. Now, with their stock prices soaring, bullish investors see this as a strong indication of robust demand for AI computing devices benefiting a broader range of businesses. However, bearish investors view this as the latest signal that the stock market has entered a bubble and is destined to burst.

"This market performance is a typical characteristic of a bubble period," said Michael O'Rourke, chief market strategist at Jonestrading. He served as a trader during the internet bubble era and is well-versed in such market patterns: "When the leading sectors have valuations that are prohibitively high, and investors begin to turn to secondary and tertiary concept stocks, it indicates to me that the market is in the late stages of a cycle."

Explosive demand for AI infrastructure, unexpected benefits for "cold tracks"

Since the advent of ChatGPT nearly three years ago, which sparked a global AI craze, investments in the infrastructure supporting this technology have continued to pour in. Tech giants like Microsoft (MSFT.US) and Alphabet (GOOGL.US) spend hundreds of billions of dollars each year on semiconductor and networking equipment, providing power support for data centers that run AI workloads and train large language models (LLM).

This massive investment has propelled the rise of chip manufacturers like Nvidia (NVDA.US) and TSMC (TSM.US)—their market capitalizations have now surpassed one trillion dollars, attracting the attention of global investors. Meanwhile, companies like Seagate and Western Digital, although part of the AI boom, belong to the least "noticeable" category.

The history of hard disk drives dates back to the 1950s: the products of that time could only store 5 megabytes of data but weighed over 2000 pounds (about 907 kilograms); today, hard drives in personal computers can hold up to 2 terabytes and weigh only 1.5 pounds (about 0.68 kilograms) or even lessDespite the iteration of product forms, the core direction of these manufacturers has always been the research and development of storage solutions — which has become key to training large language models: the training process of such models requires handling massive amounts of data.

The situation in the memory chip sector is similar. The high-bandwidth DRAM memory produced by Micron is an indispensable component in AI computing, but for ordinary investors, this company is hard to generate "excitement." "Every time I talk about these companies on the phone, I can imagine the other person's eyes glazing over," admitted Kim Forrest, founder of Bokeh Capital Partners. "People prefer to talk about cool topics like flying cars and robotic dogs."

Is AI Overhyped? More "Obscure Sectors" Are Being Ignited

Forrest, a former software engineer with twenty years of asset management experience, stated that she holds Micron stock because of its competitive advantage in the memory market; however, from a broader perspective, she believes that AI is currently "overhyped" — similar to the development path of the internet, the time required for the application scenarios of this technology to materialize will far exceed most people's expectations.

"If the targets investors buy are entirely dependent on AI or data centers, and they bet that their performance will 'grow linearly,' then such investments are bound to become 'warning cases,'" Forrest cautioned.

The AI boom has also sparked interest in other previously "quiet" sectors in the stock market. Power producer Vistra Energy (VST.US) saw its stock price rise 66% in 2023, soar 258% in 2024, and increase 53% so far in 2025; chip manufacturer Broadcom (AVGO.US) experienced approximately 100% growth in both 2023 and 2024, with a 49% increase in 2025, and its market capitalization has now reached $1.6 trillion; digital storage and memory manufacturer Sandisk Corp (SNDK.US) has seen a "crazy" performance this month, with its stock price rising over 100% since September 2.

Additionally, Oracle (ORCL.US), a veteran software company known for its slow-growing database business, has now become the tenth largest company by market capitalization in the S&P 500 index, thanks to the surge in demand for cloud computing services. On September 9, the day after Oracle released its earnings report, its stock price skyrocketed 36% in a single day, raising its valuation to the highest level since the internet bubble era, further igniting debates about whether there is a "bubble" in the market.

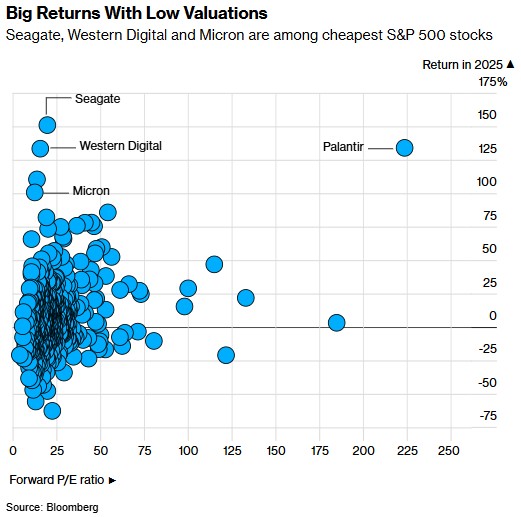

In contrast, Seagate, Western Digital, and Micron, due to their cyclical business and relatively low attention in the investment community, have historically been among the lowest-valued stocks in the S&P 500 index. Currently, all three companies are profitable, but over the past three years, each has reported annual losses according to Generally Accepted Accounting Principles (GAAP).

At the beginning of 2025, Western Digital's expected price-to-earnings ratio (P/E ratio) was less than 6 times, while Seagate and Micron were only about 10 times. Although their valuations have since risen, the current P/E ratios of all three are still below the S&P 500 index (with a forward 12-month expected P/E ratio of 23 times)

Among them, Seagate has the highest valuation, with an expected price-to-earnings ratio of 20 times. However, Benchmark Co. analyst Mark Miller believes that considering the strong demand outlook for its products, this valuation remains highly attractive. Last week, he raised Seagate's target price to Wall Street's highest level—$250, which implies more than a 13% upside compared to last Friday's closing price of $221.

"We expect the prices and profit margins of Seagate hard drives to continue to rise, which will support a further increase in its valuation relative to historical levels," Miller wrote in a research report last week.

Data compiled by Bloomberg shows that Seagate's revenue for fiscal year 2026 (ending June of the following year) is expected to grow by 16%, down from a 39% increase in fiscal year 2025; Western Digital, which aligns with Seagate's reporting cycle, is expected to see a 27% decline in sales for fiscal year 2025, with current fiscal year revenue expected to grow by 16%; among the three, Micron has the strongest sales outlook, with revenue expected to grow by 48% this year and a projected increase of 33% next year.

Wall Street's Divided Attitude: Is it Time to Take Profits, or Is There Still Room to Grow?

Wall Street generally holds an optimistic view on Seagate, Western Digital, and Micron, but due to the rapid rise in these stocks, analysts have not had time to adjust their target prices accordingly. Currently, Seagate's stock price is more than 20% above the average target price set by analysts, Western Digital is over 10% higher, and Micron is also slightly above the average expectation.

Some Wall Street professionals believe these signals may indicate that it is time for investors to take profits from these stocks.

"Historically, for any cyclical company, its valuation is usually low at the peak of performance and hits bottom during losses," explained O'Rourke from Jonestreet Trading. "Therefore, the buying opportunity should be when the industry cycle reverses and the company is in losses; conversely, when valuations appear 'healthy,' it often signals a selling opportunity."