From a 30% plunge to a 50% surge! The new iPhone serves as a strong stimulant, driving a major reversal in Apple's stock price

Apple's stock price rose 4.3% on Monday, with a cumulative increase of 2.3% for the year, just one step away from its historical high. Since a decline of over 30% in April due to tariff uncertainties, the stock price has increased by nearly 50%. Analysts point out that strong demand for the iPhone 17 series has driven this rebound, with Wedbush raising its target price from $270 to $310 while maintaining an "outperform" rating. Despite the rebound, Apple's stock price still lags behind other major tech companies

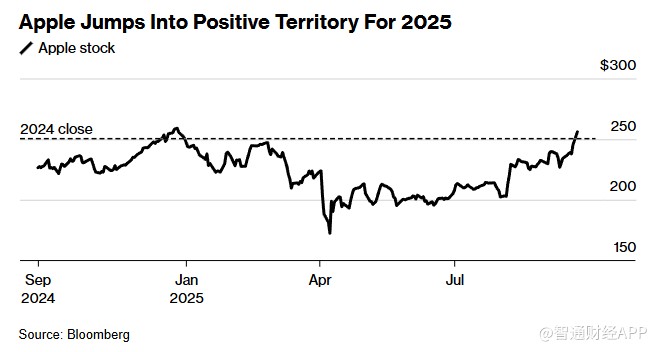

According to Zhitong Finance APP, Apple (AAPL.US) achieved a price increase this year on Monday, just one step away from reaching an all-time high. The stock rose 4.3% to $256.10, with a cumulative increase of 2.3% for the year. Apple's stock price fell to a low in April due to tariff uncertainties, at which point it had dropped over 30% for the year, but since then, the stock has risen nearly 50%.

Recently, the strength of Apple's stock price is attributed to the gradual easing of tariff concerns, and the market is increasingly optimistic that strong demand for the latest iPhone (especially the higher-priced models) will support its growth.

Apple's stock price turns upward this year

It is reported that driven by strong demand signals for the iPhone 17 series, Wedbush raised Apple's target price from $270 to $310. The firm noted that the iPhone 17 series is driving Apple into a genuine upgrade cycle and maintained an "outperform" rating on Apple.

The analyst team led by Daniel Ives stated, "With the iPhone 17 officially launched last weekend, its demand trajectory has exceeded our expectations—so far, sales are 10%-15% higher than the iPhone 16 series year-on-year."

Bill Stone, Chief Investment Officer of Glenview Trust Company, stated, "Clearly, the demand for the new products is stronger than expected, which helps drive buying in the stock. I think previous expectations were low, so the strong demand is a surprise, and any positive surprises will obviously support the stock." Glenview Trust Company manages approximately $15.7 billion in assets and holds Apple shares.

Despite the rebound in Apple's stock price, its performance still lags behind other large tech companies, especially those with more influence in the artificial intelligence sector. The Nasdaq 100 index has risen 18% year-to-date, with stocks like NVIDIA (NVDA.US), Alphabet (GOOGL.US), and Meta Platforms (META.US) all rising over 30%. Microsoft (MSFT.US) has increased over 20% this year. Apple's stock price is still 1.1% lower than its historical closing price