The US dollar has entered a "bear market mechanism"! Morgan Stanley: Shorting costs will significantly decrease, the Federal Reserve is key, and a government shutdown is a "potential negative factor."

Morgan Stanley stated that after Federal Reserve Chairman Jerome Powell's speech at Jackson Hole, the policy shift prioritizes protecting the job market over strict inflation control, providing momentum for a dollar bear market. Market pricing indicates that the dollar's interest rate advantage will decrease by nearly 100 basis points within 12 months, significantly lowering the cost of shorting the dollar. The rising risk of a U.S. government shutdown poses a potential bearish factor, which may increase the dollar's risk premium

The US dollar may face sustained and widespread selling, according to the latest judgment from Morgan Stanley, which believes that a government shutdown is a "potential bearish" factor for the dollar.

On September 23, according to news from the Wind Trading Desk, Morgan Stanley stated in its latest research report that the dollar has entered a "bear market mechanism," and this state is expected to last longer, leading to widespread selling pressure on the dollar.

Morgan Stanley strategist David S. Adams believes that the Federal Reserve has clearly shifted to prioritize protecting the job market after Powell's speech in Jackson Hole, even at the cost of tolerating inflation above the target. This policy shift provides sustained momentum for the dollar bear market.

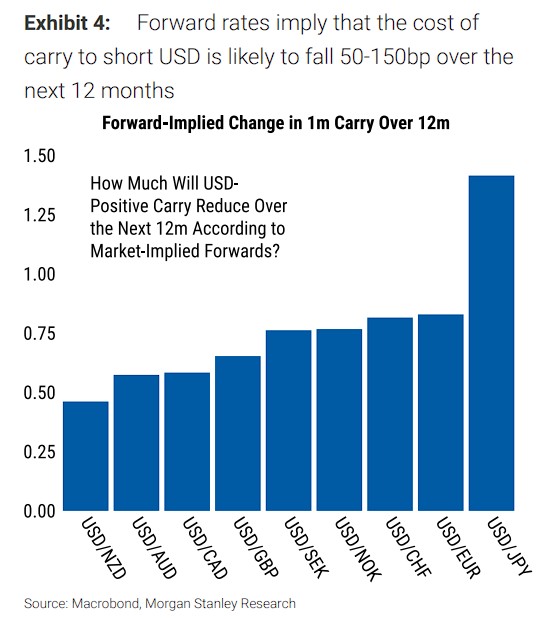

Morgan Stanley pointed out that the key is that market pricing shows the dollar's interest rate advantage is expected to decline by nearly 100 basis points over the next 12 months, significantly reducing the cost of shorting the dollar.

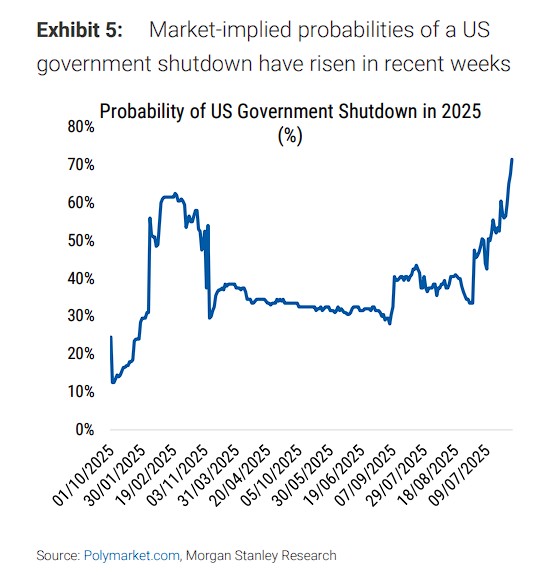

The risk of a US government shutdown is rising, and Morgan Stanley believes this poses a potential bearish risk to the dollar. Polymarket market data shows that the probability of a government shutdown has recently increased significantly, which may further increase the risk premium for the dollar.

Federal Reserve Policy Shift Triggers Dollar Bear Market Mechanism

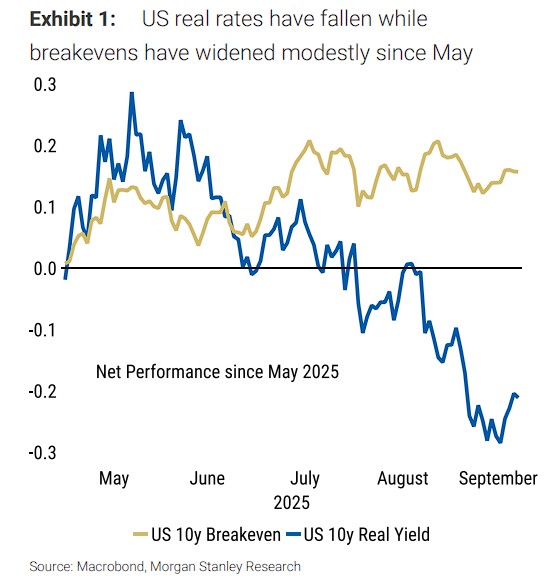

Morgan Stanley had predicted in its mid-year outlook that the dollar would continue to weaken, but at that time, the most likely market mechanism was the "defensive mechanism," where both real interest rates and the breakeven point decline simultaneously.

However, the actual situation since May has been different: real interest rates have indeed fallen, but the breakeven point has expanded. This dynamic is precisely what the bank's four-mechanism framework shows as the "dollar bear market mechanism."

The research report states that the noticeable shift in the Federal Reserve's monetary policy committee's reaction function—initially evident in Chairman Powell's speech in Jackson Hole and confirmed at last week's FOMC meeting—prioritizes protecting the labor market over strictly controlling inflation above the target.

Morgan Stanley stated that this shift has led its economists to significantly revise their Federal Reserve forecasts, expecting faster rate cuts to the terminal rate.

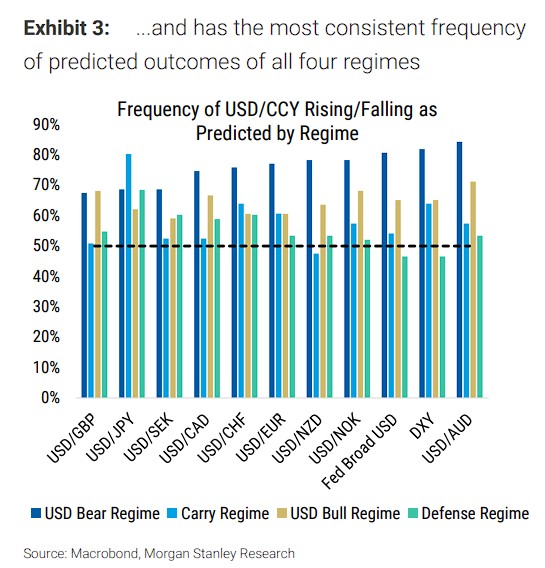

Historical data shows that under the dollar bear market mechanism, the frequency of other currencies appreciating against the dollar reaches 67-84%, with substantial average gains. The dollar bear market mechanism is notable not only for the breadth and magnitude of the dollar's weakness but also for its consistency.

Morgan Stanley believes that the perceived shift in the Federal Reserve's reaction function increases the likelihood of remaining in a dollar bear market mechanism: As data changes, investors may believe that weakness in the labor market will trigger a larger-than-expected response from the FOMC, while unexpected inflation increases may be viewed as less concerning. Based on this judgment, Morgan Stanley has expanded its dollar "short list" to include the Australian dollar and the Canadian dollar. Previously, the bank had recommended long positions in the euro against the dollar and short positions in the dollar against the yen. Morgan Stanley's reasoning is as follows:

The Australian dollar against the US dollar benefits from the Reserve Bank of Australia's lower risk of rate cuts, the expected positive hedge of the Australian dollar against liquidity, and a relatively low risk premium compared to similar currencies.

The US dollar against the Canadian dollar benefits from its high sensitivity to interest rate differentials, the market's overestimation of the Bank of Canada's terminal rate, and the underestimation of productivity gains from the removal of trade barriers.

The cost of shorting the dollar will significantly decrease

Investors generally reflect that the punitive interest rate differentials faced when shorting the dollar are a challenge for positions. Morgan Stanley emphasizes that "interest rate relief" is on the way.

Forward rates indicate that for most currencies, the "cost" of shorting the dollar position will decrease by 50-75 basis points at some point, and for the dollar/yen, it is close to 150 basis points.

The research report states that the interest rate differential gained by dollar bulls, or paid by dollar bears, will decrease by nearly 100 basis points over the next 12 months. The bank believes that this means the key resistance for dollar bears will gradually disappear.

If the market's pricing of the Federal Reserve's rate cut cycle and the actual rate cuts by the Fed accelerate further (likely driven by further weakness in the labor market), this interest rate dynamic may come faster than expected.

Increased risk of government shutdown adds pressure to the dollar

The rising probability of a government shutdown adds new downside risks to the dollar.

Research from Morgan Stanley's economist team shows that the growth slowdown caused by a government shutdown typically has a negative impact on the dollar, and a prolonged shutdown may further increase the dollar's risk premium.

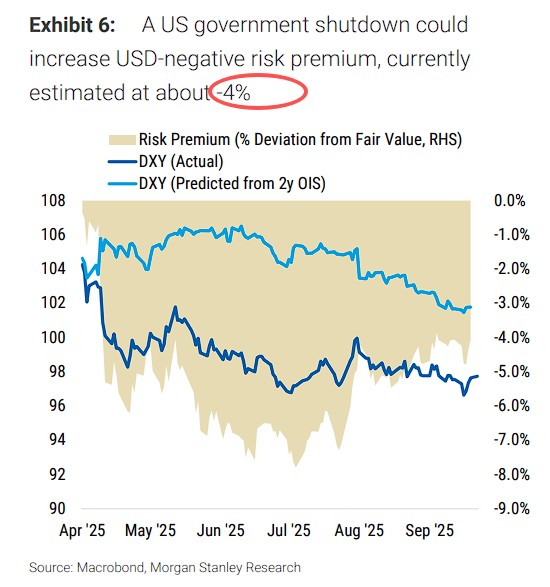

The current negative risk premium for the dollar is about -4%, and a government shutdown could push this value higher. More importantly, a shutdown means a pause in government data releases, which will reduce the economic data available to the Fed before the October 29 meeting.

“How the market interprets the Fed's policy decisions in the absence of data, and the Fed's actual response, may lead the market to derive new judgments about the data sensitivity of the Fed's reaction function. If the reaction function is seen as disconnected from the data, it may further raise the dollar's risk premium.”