"U.S. economic growth + Federal Reserve interest rate cuts" = Risk assets "rise rise rise"?

"The best is yet to come." HSBC strategists believe that the combination of the U.S. economic recovery and expectations of Federal Reserve interest rate cuts will provide strong upward momentum for risk assets. Although there are risks such as a weak labor market and rising default rates in the U.S., they believe these issues are concentrated among low-income groups, and are not sufficient to trigger an overall economic recession, as high-income households contribute the vast majority of consumption

The feast of risk assets may be far from over.

According to news from the Chasing Wind Trading Desk, HSBC's research report titled "Up, Up, and Up" released on September 22 pointed out that signs of renewed acceleration in U.S. economic data, along with the Federal Reserve's interest rate cuts, constitute a "strong catalyst" that will continue to drive risk assets higher.

Prices of various assets are showing a general upward trend. We believe the best is yet to come.

The team led by the bank's Chief Multi-Asset Strategist Max Kettner analyzed that despite market disagreements regarding the U.S. economic outlook, risks such as a weak labor market and rising default rates exist. However, a series of indicators show that the economy is regaining momentum. Meanwhile, the Federal Reserve's easing stance has injected critical liquidity expectations into the market. The S&P 500 index has reached a historic high, while the spreads of emerging markets and high-yield bonds have narrowed to cyclical lows.

The report emphasizes that the current "K-shaped recovery" in the U.S. not only does not pose a risk but rather reinforces its bullish stance. On one hand, the wealth growth of high-income groups and stable real wage levels support overall consumption and economic data; on the other hand, the inflation pressures, wage slowdowns, and rising default rates faced by low-income groups have become key reasons for the Federal Reserve to implement interest rate cuts. This combination of "high growth + loose monetary policy" provides a favorable environment for risk assets akin to "Goldilocks."

Signals of U.S. Economic Recovery

This report lists several pieces of evidence supporting the judgment of renewed acceleration in the U.S. economy.

From a top-down macro data perspective, U.S. weekly retail sales and composite growth indicators have shown improvement since the end of June. Even labor market data, such as overtime hours in the private sector, have begun to display some early-cycle characteristics.

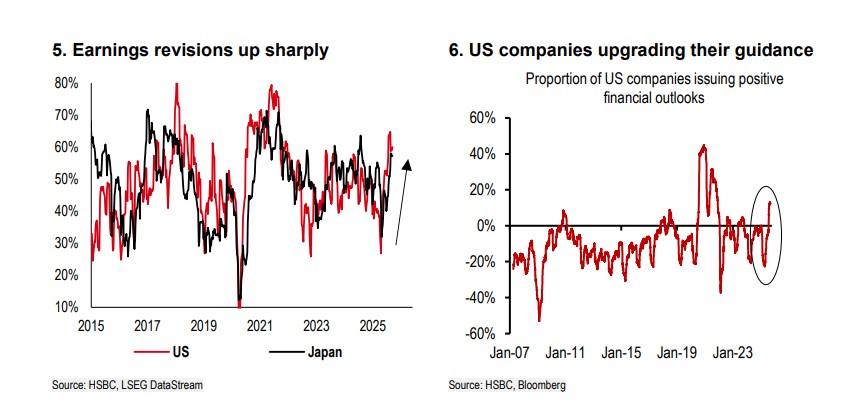

From a bottom-up micro perspective, the signals are even clearer. The report shows that earnings expectations for major stock indices have been significantly revised upward in the past three months, a magnitude typically seen only in the early stages of an economic cycle. At the same time, U.S. listed companies are also net raising their earnings guidance.

In addition, capital market activities are warming up, with the U.S. mergers and acquisitions (M&A) and initial public offering (IPO) markets recovering. The report emphasizes that all these improvements are occurring against the backdrop of a rebound in global broad money supply.

Interest Rate Cut Catalyst: Multiple Pressures on Low-Income Families

It is not difficult to paint a bleak growth picture: the U.S. labor market is weak, default rates are rising, and tariffs along with inflation in certain parts of the world are also increasing. However, the report states, "Especially the ongoing K-shaped economic recovery in the U.S. is not a risk in our view, but rather makes us more optimistic." The report explains that the reason the Federal Reserve tends to lower interest rates even when economic data seems to be improving is that the weak parts of the economy are struggling. Data shows that low-income households are facing multiple pressures:

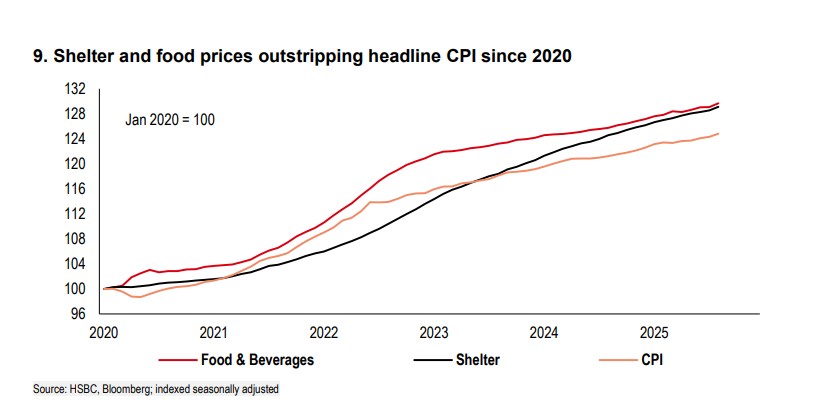

- Inflation Pressure: The inflation rate of "non-discretionary" items such as food, beverages, and housing far exceeds the overall CPI.

Low-income households spend a larger portion of their income. Tariffs may impose additional upward pressure on food and other consumer goods. This could hit low-income households harder.

- Wage Slowdown: Wage growth for low-income and low-skilled groups is slowing down much faster than for high-income and high-skilled groups.

Not only are the prices of such consumer goods rising faster, but wage growth for low-income consumers and low-skilled groups has also begun to slow down more rapidly, while wage growth for high-income and high-skilled groups remains relatively stable.

- Rising Defaults: The default rates on credit cards and auto loans have significantly increased since 2021.

It must be acknowledged that the overall level of credit defaults has not yet reached a level of excessive concern.

It is the plight of this part of the economy that provides ample justification for the Federal Reserve's interest rate cuts.

Risks Are Controllable, High-Income Households Support Consumption

Although risks are acknowledged, the bank believes these issues are unlikely to trigger a full-blown economic recession. The report analyzes that, firstly, although the default rates on credit cards and auto loans are rising, their absolute levels have not reached a "worryingly excessive degree."

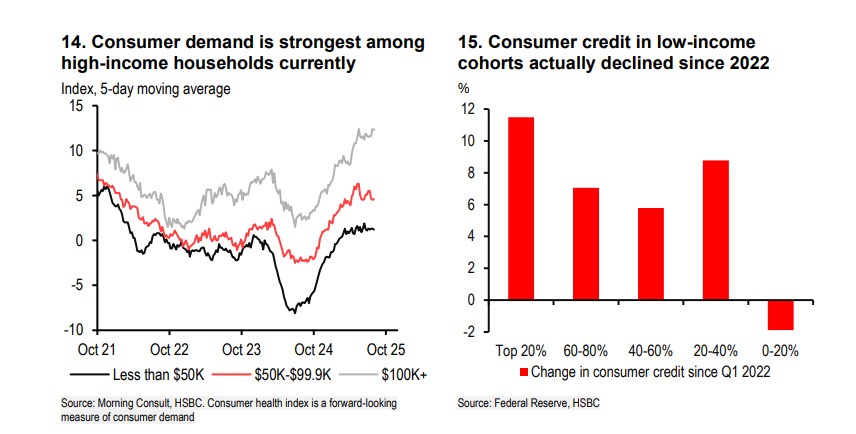

Secondly, and most critically, high-income households are currently in good overall condition and are the strongest group driving consumer demand.

Given that the top 10% of households contribute about 50% of overall consumption, their strong spending is sufficient to support overall macro data, which is what market participants are most concerned about. Therefore, while the pressures on low-income groups are real, their drag on the overall economy is relatively limited.

It should come as no surprise that current consumer demand is strongest among high-income households. Given that they drive the vast majority of overall consumption, they also drive the overall growth data that market participants care about most.

The report concludes:

While low-income households face some pressures, it may not be severe enough to trigger an economic downturn: 1) Their contribution to overall consumption is too low (for example, the top tenth of households drives about 50% of consumption); 2) While a large portion of household assets is held by high-income households, low-income households have actually experienced the highest proportion of growth since 2022. The consumer credit of low-income households has even declined since then.

Risk Assets Up, up & up more

Based on the above analysis, the report believes that the current environment supports increasing holdings in risk assets and is optimistic about the outperformance potential of cyclical sectors in the stock market, with financial stocks also favored due to the interest rate environment.

Due to ongoing concerns about the potential sustainability of the U.S. dollar's status as a reserve currency and its debt, the rebound potential of the dollar is limited, which in turn benefits emerging markets. Therefore, the report maintains an "overweight" rating on emerging market stocks and local currency bonds.

Conversely, the bank maintains an "underweight" stance on U.S. Treasuries, U.K. Gilts, and Japanese Government Bonds in its tactical asset allocation. The report concludes that U.S. Treasury yields need to rise a long way before reaching the "danger zone" that would harm the valuation of risk assets, indicating that the attractiveness of bonds relative to stocks remains weak in the foreseeable future.

The above exciting content comes from [Chasing Wind Trading Platform](https://mp.weixin.qq.com/s/uua05g5qk-N2J7h91pyqxQ).

For more detailed interpretations, including real-time analysis and frontline research, please join the【 [Chasing Wind Trading Platform ▪ Annual Membership](https://wallstreetcn.com/shop/item/1000309)】

[](https://wallstreetcn.com/shop/item/1000309)