Caterpillar - The Hidden "AI Power Supply" Concept Stock?

According to a report from Bank of America, Caterpillar is being viewed as a potential beneficiary of the AI boom. Its wholly-owned subsidiary, Solar Turbines, produces industrial gas turbines that, due to advantages such as fast delivery and modularity, have become an ideal power solution for AI data centers under constrained grid capacity. Its next cycle's peak EPS is expected to reach $41-45, significantly higher than current market expectations

Caterpillar, the industrial giant known for its heavy machinery, is being viewed as an unexpected beneficiary of the artificial intelligence boom.

According to a research report from Bank of America Securities on the 22nd, the market generally sees Caterpillar as a manufacturer of excavators and mining trucks, but seriously underestimates its "hidden gem" in the Energy and Transportation (E&T) sector—the wholly-owned subsidiary Solar Turbines.

The report states that against the backdrop of limited grid capacity, Caterpillar's turbines and reciprocating engines are increasingly being used by data centers as backup or even primary power solutions, with their smaller, modular turbines having shorter delivery times and better meeting urgent market demands. Based on this, Bank of America reiterated its "Buy" rating on Caterpillar, raising its target price from $495 to $517. In pre-market trading, Caterpillar's stock price was $472.1 per share, indicating an upside potential of about 4.9% to 9.5% to the target price.

For investors, a key recent catalyst is the company's upcoming Investor Day on November 4. At that time, the new CEO Joseph E. Creed is expected to provide more details on this growth opportunity. Bank of America believes that the growth potential of this power generation business has not yet been fully digested by the market, with its analysis showing that this single business could bring Caterpillar an incremental earnings per share (EPS) of $6 to $8 in the coming years.

The "Hidden Gem" in the Spotlight: Solar Turbines

For a long time, investors' perception of Caterpillar has mainly focused on its construction and mining equipment. However, Bank of America's report points out that the company's next earnings growth cycle may be driven by the Energy and Transportation (E&T) sector, which is precisely the part that investors understand the least. At the core of this sector is Solar Turbines, a wholly-owned subsidiary of Caterpillar.

Although not disclosed separately in financial statements, Bank of America believes that Solar Turbines is Caterpillar's highest-margin product line, and its business is at the intersection of power, energy, and data centers. Currently, the power generation business accounts for about 15% of Caterpillar's total sales, but its compound annual growth rate is as high as approximately 25%. According to public documents, several well-known projects, including xAI, Meta, and AI infrastructure developer Crusoe Energy, have begun to adopt Solar Turbines' products.

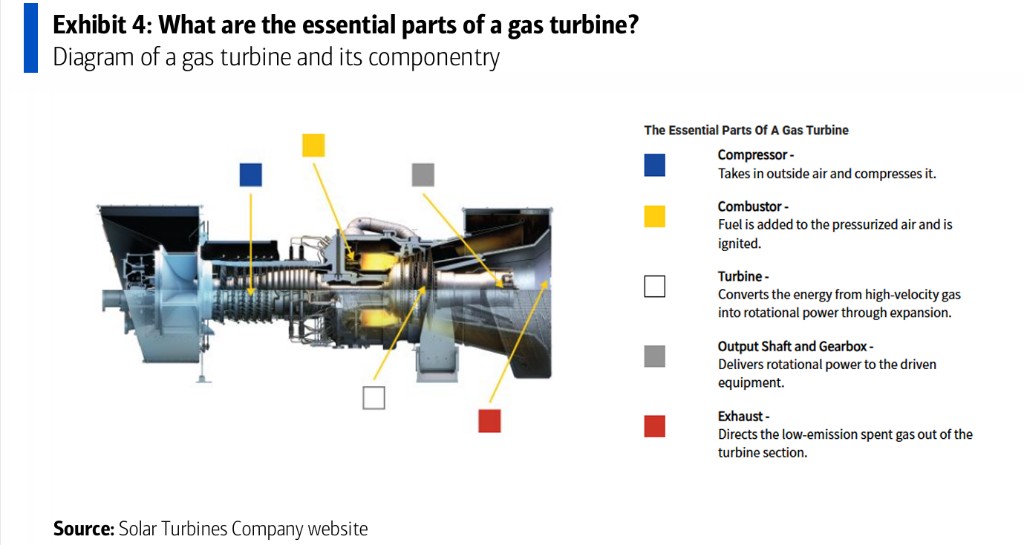

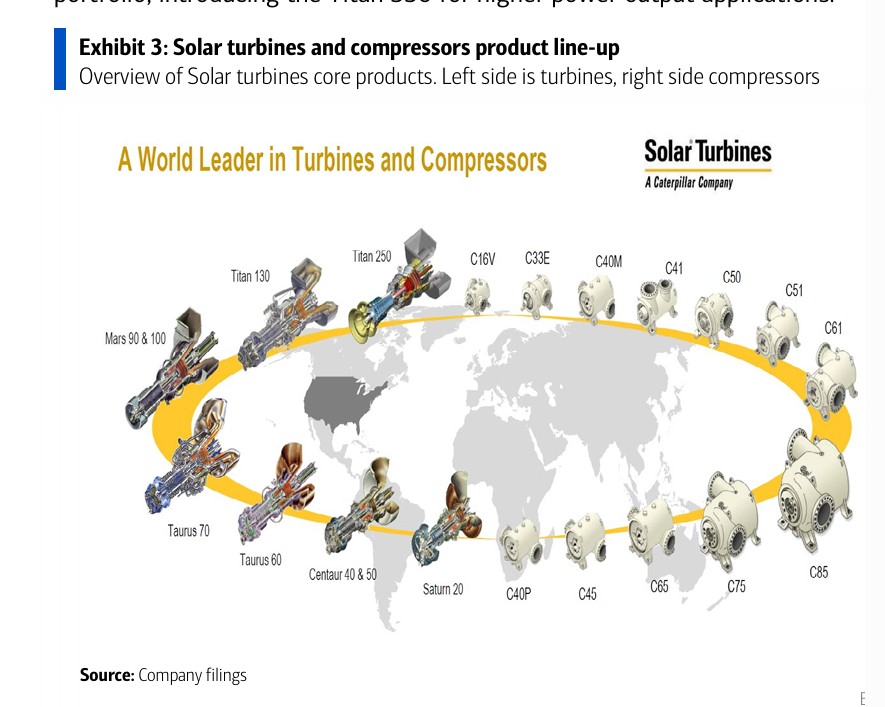

Solar Turbines primarily produces industrial gas turbines with power ranges from 1 to 39 megawatts (MW) and has a large after-sales service business Bank of America analysts pointed out based on historical data that this business has extremely high profit margins and robust profitability. In 2009 and 2010, its profit margins exceeded 20%, and it demonstrated strong resilience during economic downturns.

Why are small turbines favored?

The "power anxiety" of AI data centers is reshaping the energy solutions market, making small turbines a preferred choice. According to Bank of America's report, this trend is primarily driven by several factors:

- Long grid connection times: The approval and construction process for new projects to connect to the grid can take more than five years, while data center developers hope to be operational within 18 to 36 months. This has transformed on-site generation from a "transitional solution" to a "necessary solution."

- Delayed delivery of large equipment: The delivery cycle for large turbines has extended from a few years ago to five to seven years, failing to meet the rapid deployment needs of data centers. In contrast, the waiting time for small turbines like those from Solar Turbines is only 18 to 24 months.

- Modular advantages: Small turbines can be "stacked" for use, allowing for phased increases as the data center scales up to meet gradually growing power demands. This deployment method also incorporates redundancy, serving as both the main power source and backup power.

Specific projects cited in the report confirm this trend. According to tomshardware-tech industry, Elon Musk's AI startup xAI deployed products from Solar Turbines at its Memphis campus to avoid the lengthy grid connection queue. Additionally, Solar Turbines has appeared in Meta's Socrates data center, Crusoe Energy's AI campus developed for Oracle and OpenAI, and Caterpillar's collaboration agreements with Joule Capital Partners and Hunt Energy. Notably, the newly launched Titan 350 (38 megawatts) turbine from Solar Turbines is in high demand due to its higher power output, although orders have not yet fully opened.

New engine for profit growth and potential valuation reassessment

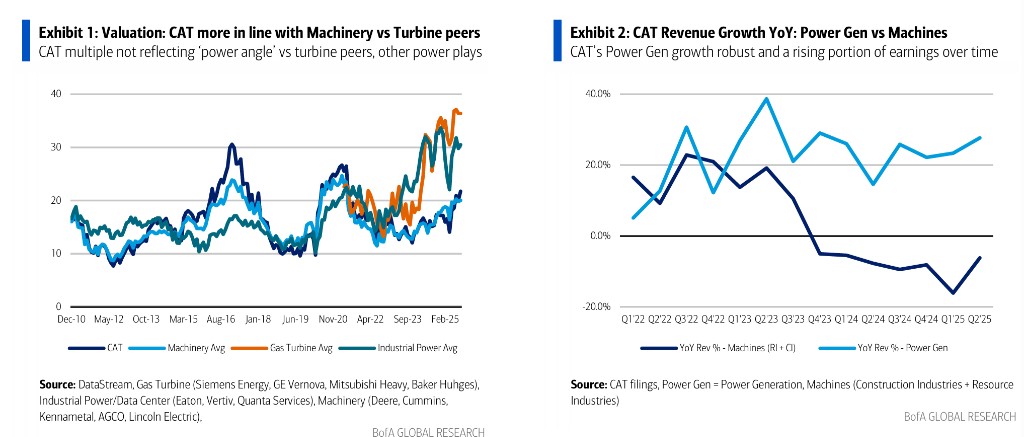

Bank of America's report emphasizes that the market's valuation of Caterpillar is still primarily based on its traditional machinery business and has not fully reflected its growth potential in the power generation sector. The report shows that Caterpillar's price-to-earnings ratio is roughly in line with its machinery peers (such as Deere and Cummins) but is significantly lower than industrial companies benefiting from power and data center themes (such as Eaton and Vertiv) and gas turbine peers (such as GE Vernova and Siemens Energy) Analysts believe that as the proportion of the power generation business in the company's profits continues to rise, Caterpillar's valuation has reason to be reassessed. Solar Turbines, as Caterpillar's internal business with the highest profit margins and a large aftermarket, should have its earnings stream valued at a higher multiple.

In scenario analysis, Bank of America estimates that the data center and power generation themes alone could bring Caterpillar an incremental sales of $10 billion, translating to an additional earnings per share of $6 to $8. The report further projects that considering the growth potential of its various business segments, Caterpillar's peak EPS in the next cycle could reach $41 to $45, far exceeding current market expectations.

Caterpillar will hold its first investor day in years on November 4, which is seen by the market as a key catalyst. At that time, the new CEO Joseph E. Creed will formally present the company's strategy to investors for the first time. Notably, Mr. Creed has long served as the Chief Financial Officer of Caterpillar's Energy and Transportation segment, giving him a deep understanding of this business