Warning signals flash! The effective federal funds rate in the United States rises, and market liquidity tightens

The U.S. federal funds rate has risen to 4.09%, triggering warning signals of tightening market liquidity. This change has led to a sell-off in the futures market, indicating that the reduction in banks' excess reserves is occurring faster than expected. Analysts at TD Securities point out that the rise in rates may be an early sign of pressure, and attention should be paid to the Federal Reserve's policy adjustments

According to Zhitong Finance APP, on Monday, the effective value of the U.S. federal funds rate rose slightly. This rare change triggered a sell-off in the futures market related to this benchmark interest rate, which may indicate that the future financial environment will become tighter.

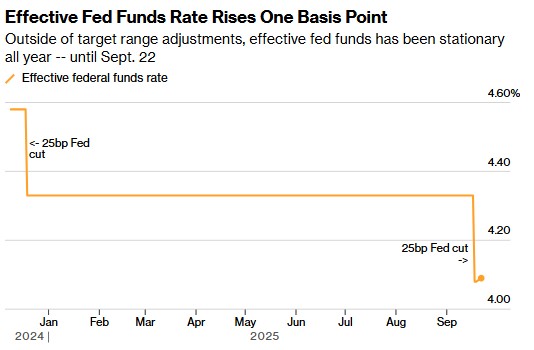

Data released by the New York Federal Reserve on Tuesday showed that the rate increased by 1 basis point from the previous trading day, rising from 4.08% to 4.09%. The rate remains within the range set by the Federal Open Market Committee of 4% to 4.25%, a range established when policymakers lowered borrowing costs last week. Over the past two years, this indicator has hovered near the lower end of that range.

Before the rise on Monday, several companies, including Wrightson ICAP LLC and Citigroup, had indicated that it might increase, suggesting that the pace at which banks' excess reserves (including reserves held by foreign institutions) are decreasing is faster than expected, leading to a decline in liquidity. Reports indicated that on Tuesday, due to the rise in actual interest rates, the price of September federal funds futures fell, with trading volume for that contract approaching 300,000 lots on that day.

Gennadiy Goldberg, head of U.S. interest rate strategy at TD Securities, stated, "This is the first increase in the federal funds rate in this cycle, indicating that there may be some early signs of pressure at the front end of the yield curve."

"We do not believe this indicates a shortage of reserve resources, but the front-end rates are becoming more susceptible to the types of pressures that typically arise, suggesting that the Federal Reserve will need to pay closer attention to this issue going forward."

The trading volume in the federal funds market (which is primarily participated in by Federal Home Loan Banks and foreign enterprises) is much smaller than before, as most commercial banks previously deposited funds directly with the Federal Reserve. Now, the focus is on the effective rate—this is a weighted calculation of all overnight transactions conducted daily. Meanwhile, banks' reserve balances are declining, a result of the Federal Reserve's ongoing balance sheet reduction and the increase in Treasury issuance since July.

In recent months, commercial banks' reserves at the Federal Reserve have continued to decrease, while cash assets held by foreign banks have seen a more rapid decline. At the same time, demand for the Federal Reserve's overnight reverse repurchase mechanism (which is typically seen as an indicator of excess liquidity in the money market) has fallen to its lowest point in four years.

John Canavan, chief analyst at Oxford Economics, pointed out, "The current effective value of the federal funds rate is 4.09%, which has not yet reached a level that would concern the Federal Reserve, but it highlights the significant rise in repo rates over the past few months. Although the central bank has other adjustable rates to control short-term borrowing costs, this further demonstrates the necessity for the Federal Open Market Committee to end quantitative tightening by the end of this year or early next year."