Wall Street is hotly discussing "AI closed loop": Bulls say "suppress ASIC, NVIDIA has a long bull market," while bears say "give loans to customers, just like Cisco back in the day."

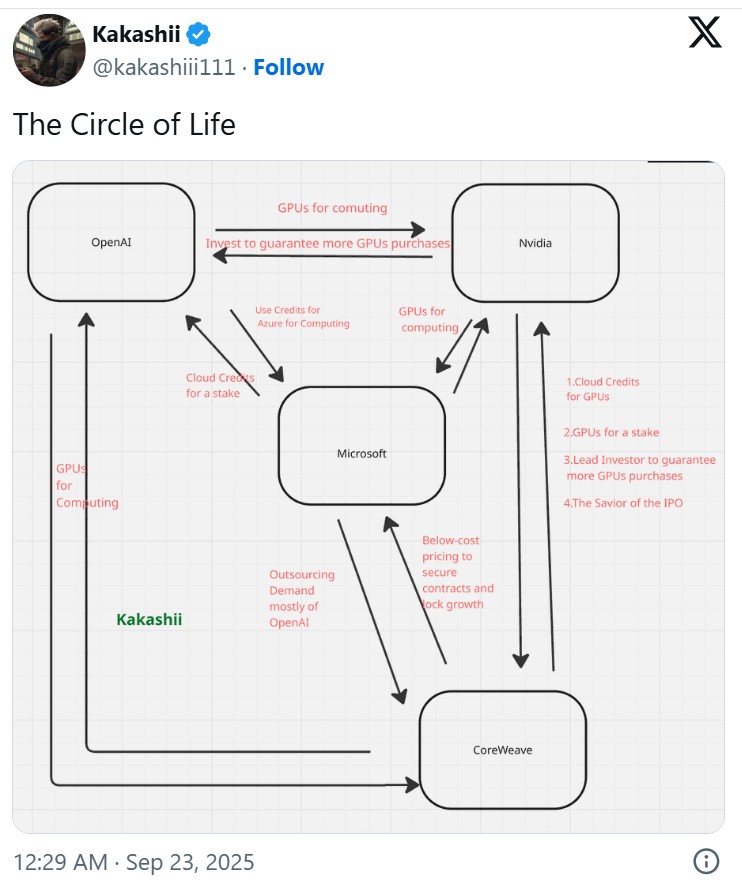

NVIDIA plans to invest $100 billion in OpenAI, which will "use this money" to buy chips from the former. This model of "giving money to customers, who then buy their own products" has raised concerns on Wall Street about a potential repeat of the internet bubble, "lending to customers, just like Cisco did back in the day." However, bullish investors believe this is NVIDIA's strategic move to consolidate its dominance in the GPU market and suppress ASIC competition

NVIDIA's $100 billion investment agreement with OpenAI is stirring intense debate on Wall Street.

On September 24, details reported by Reuters revealed that the structure of the deal involves NVIDIA investing up to $100 billion in exchange for non-voting shares, while the latter will "use this money" to purchase chips from the former and plans to deploy at least 10 GW of NVIDIA systems.

This "supplier financing" model of "giving money to customers, who then buy their own products" has not only driven the AI sector's stock prices soaring but has also made some seasoned market participants uneasy.

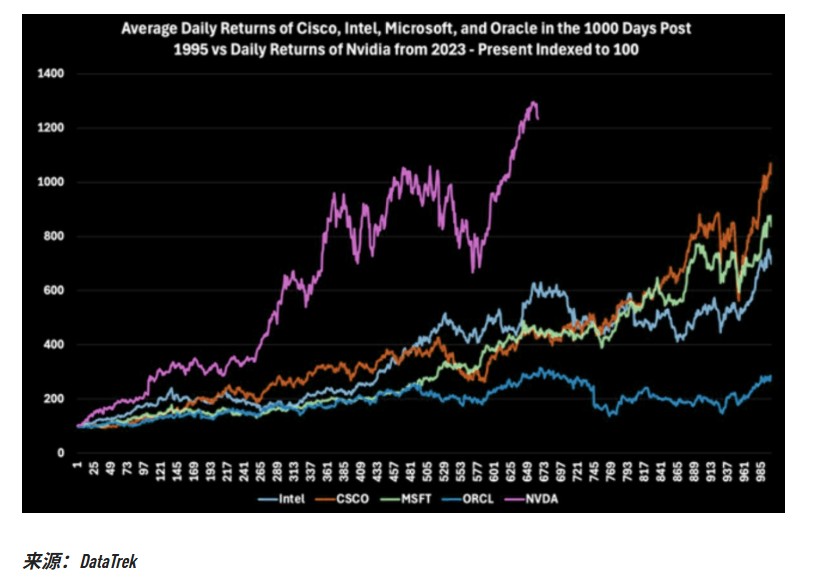

They warn that this model resembles the practices of some companies before the tech bubble burst in 2000, stating, "loaning to customers, just like Cisco back then," could hide significant risks.

However, bullish investors believe this is NVIDIA's strategic move to consolidate its dominance in the GPU market and suppress competition from ASICs (Application-Specific Integrated Circuits).

Echoes of History: Repeating Cisco's "Supplier Financing"?

For bears, NVIDIA's deal is filled with historical déjà vu. Rich Privorotsky, head of Goldman Sachs Delta One trading, referred to this deal as a "circular reference?" in his morning report, bluntly stating that it is a hallmark of the tech bubble era.

He recalled that at that time, telecom equipment manufacturers like Cisco and Lucent provided loans or equity investments to their customers, who then used those funds to repurchase equipment. History has shown that the outcome of this model was "not good for anyone involved."

"……Supplier financing was a characteristic of that (dot-com bubble) era, when telecom equipment manufacturers (Cisco, Lucent, Nortel, etc.) provided loans, equity investments, or credit guarantees to customers, who then repurchased equipment with cash/credit... It can be said that there were no good outcomes for anyone."

JP Morgan's technology trader Meyer expressed a similar viewpoint, noting, "When a company pays for customers to buy its own products, it is usually not a good sign." The Australian Financial Review also commented that "this is quite concerning":

A company invests $100 billion in another company so that it can purchase $100 billion worth of chips produced by the "benefactor." Welcome to the circular economy of artificial intelligence.

Critics argue that this is akin to accounting magic, and while the severity is not on par with the Enron incident, as attention increases, the market may be approaching a critical point.

Strategic Layout: Long-term Narrative for Consolidating GPU Dominance

Despite ongoing skepticism, the bullish side of the market has provided a distinctly different interpretation from a strategic perspective. They believe that this is not merely a financial maneuver, but a crucial step for NVIDIA to solidify its market dominance.

Meyer from JP Morgan articulated the bullish viewpoint, stating that this move is fundamentally no different from NVIDIA's previous investments in companies like CRWV/Lambda. This transaction sends a strong signal to the market: If you want to obtain chips, you must place your order now, or you may not be able to secure supply.

A deeper interpretation is that this transaction is seen as OpenAI publicly aligning with the GPU technology route. Bulls believe that this means OpenAI will reduce or abandon the use of customized ASIC chips, thereby solidifying the "winner" status of GPUs in the AI race, adding a strong footnote to NVIDIA's long-term growth narrative.

Staggering Energy Bill: One Project Requires Ten Nuclear Reactors

In addition to the transaction structure itself, the enormous scale of the project has also shocked the market. According to the plan, OpenAI will deploy at least 10 gigawatts (GW) of NVIDIA systems.

Behind this figure is an astonishing energy consumption. Analyst Lawrence McDonald pointed out that the average capacity of U.S. nuclear power plant units is about 1 gigawatt, with a total capacity of 97 gigawatts from 94 reactors.

This means that the electricity required for just this one project is equivalent to the total generating capacity of ten nuclear reactors