The weak dollar cycle begins, and the hedging window for emerging markets in Asia quietly opens

The cost of protecting against dollar risk exposure in Asia has fallen to its lowest level since April, providing investors with hedging opportunities. The Federal Reserve is expected to continue cutting interest rates, while the easing cycle of various Asian central banks is nearing its end, which may further reduce currency protection costs. Goldman Sachs strategists point out that low hedging costs will enhance attractiveness, especially for capital-exporting economies in North Asia. As expectations of a weaker dollar rise, investors are beginning to protect dollar assets, with inflows into dollar-hedged ETFs surpassing those into non-hedged ETFs for the first time

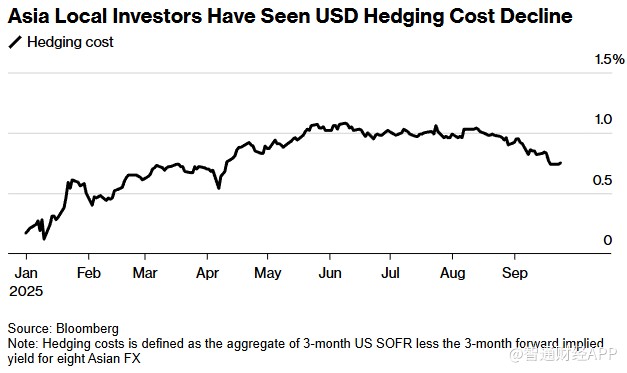

According to the Zhitong Finance APP, the cost of hedging against dollar risk exposure in Asia has fallen to its lowest level since April, with a further downward trend, providing opportunities for investors who need to hedge risks.

Data compiled by Bloomberg shows that the hedging costs for eight major Asian currencies have dropped to an average of 0.7%. As the market expects the Federal Reserve to continue cutting interest rates, while the easing cycle of Asian central banks is nearing its end, the cost of currency protection may decline further. Goldman Sachs strategists stated that this low cost will enhance the attractiveness of hedging.

Desmond Soon, a portfolio manager at Western Asset Management, noted that due to concerns about a potential weakening of the dollar in the future, "the demand for hedging dollar investments will certainly increase, especially for capital-exporting economies in Northeast Asia."

The dollar hedging costs for local Asian investors are decreasing.

As expectations for Federal Reserve interest rate cuts rise, the likelihood of a weaker dollar increases, prompting more investors to protect their dollar assets. Given that Asian investors hold trillions of dollars in U.S. investments, this demand could be substantial.

The Federal Reserve has cut rates by 25 basis points this month and hinted at further easing in the future. In contrast, the easing cycles of the Reserve Bank of India, the Bangko Sentral ng Pilipinas, and the Monetary Authority of Singapore are expected to be nearing their end. The Bank Negara Malaysia is expected to maintain interest rates unchanged for an extended period.

The Bloomberg Dollar Spot Index has fallen about 8% year-to-date, and institutions including Goldman Sachs and Manulife Investment Management believe the dollar will continue to decline.

Mercer Consulting previously warned that Trump’s policies are prompting some investors to pull assets out of the U.S., which could weaken the demand for hedging over time.

Hedging demand is becoming evident. A report released by Deutsche Bank last week showed that the inflow of funds into dollar hedging ETFs has exceeded that of non-hedged ETFs for the first time in a decade.

Goldman Sachs strategists Danny Suwanapruti and Andrew Tilton wrote in a report on Sunday: "As the Federal Reserve's rate cuts lower the cost of hedging dollar assets, the dollar hedging theme should rise again in the fourth quarter."