Goldman Sachs initiates coverage on Oklo: Leading SMR nuclear power company, numerous benefits but still awaiting implementation, gives a "Neutral rating, target price $117"

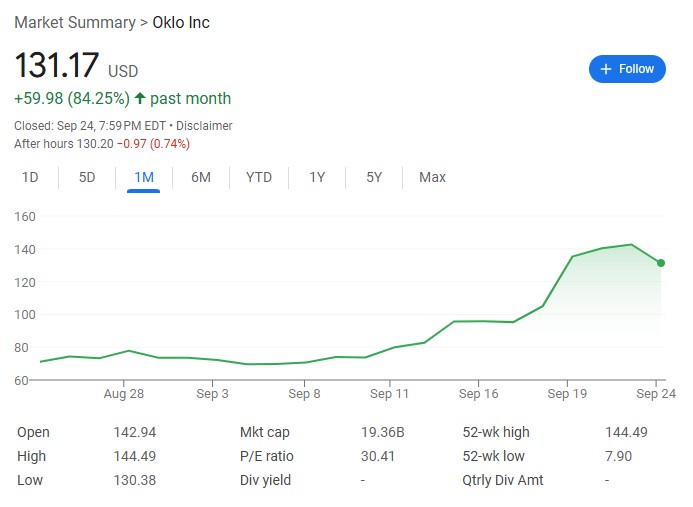

Goldman Sachs initiates coverage on Oklo with a neutral rating and a target price of $117. Despite Oklo's advantages in the nuclear energy revival and AI-driven power demand, along with a large number of intent orders, its stock price has largely priced in expectations. Goldman Sachs pointed out that Oklo faces challenges such as high valuation, funding needs, fuel supply bottlenecks, and uncertainties in licensing approvals. Although the stock price has risen by 84%, there is still 11% downside potential

Goldman Sachs believes that although Oklo's stock price may remain high in the short term driven by catalysts, the uncertainty in its fundamentals makes its current valuation appear "rich," and it recommends a neutral wait-and-see approach.

According to news from the Trend Trading Desk, on September 24, Goldman Sachs' equity team released its first research report on Oklo, a leading company in small modular reactors (SMR) nuclear power. The report pointed out that Oklo is positioned in the golden track of nuclear energy revival and AI-driven power demand explosion, holding the largest number of intention orders in the industry, while the future is filled with potential positive catalysts.

However, its stock price currently seems to have "fully digested" these expectations. Goldman Sachs believes that high valuations, enormous capital requirements, supply bottlenecks of key fuels, and pending operational licenses are four major mountains hanging over its head. Specifically:

- High orders have not yet been converted into "real money": Although the customer reserve scale is impressive, they are all non-binding intentions, and the company has not signed any legally binding power purchase agreements (PPAs) to date.

- The huge financial black hole of the "self-sustaining" model: The company's "hold and operate" heavy asset model, while strong in control, is expected to require raising up to $14 billion in capital before the mid-2040s, posing extremely high financial risks.

- Key fuel bottlenecks: Its advanced reactors rely on high-assay low-enriched uranium (HALEU) as fuel, and currently, the global supply chain for high-assay low-enriched uranium is extremely tight, which is not only Oklo's issue but also the "Achilles' heel" of the entire advanced nuclear energy industry.

- Uncertainty in license approval: Although the company plans to submit a combined license application in the fourth quarter of 2025 and expects the approval process to be shortened, this remains a critical juncture that takes 2 to 3 years with an unknown outcome.

Therefore, Goldman Sachs has given a "neutral" rating and a target price of $117. Over the past month, the company's stock price has risen over 84% to $131.17, indicating about an 11% downside potential compared to Goldman Sachs' target price.

A leader in the industry windfall, but commitments have yet to be fulfilled

Goldman Sachs first affirmed the opportunities that Oklo is positioned to seize.

Against the backdrop of global energy transition and surging power demand from data centers, nuclear energy, as a reliable and carbon-free baseload power source, is experiencing a revival.

From the U.S. "ADVANCE Act" in 2024 to the executive order in May 2025 aimed at revitalizing the U.S. nuclear industry, policy measures (including expedited approvals and cost reductions) have paved the way for the development of nuclear power companies.

As a leading domestic company in the U.S., Oklo will undoubtedly benefit deeply from its sodium-cooled fast neutron reactor technology "Aurora Powerhouse." Goldman Sachs emphasizes that Oklo has accumulated over 14 gigawatts of potential customer orders, a scale that is far ahead of its nuclear power peers, with clients spanning multiple fields including data centers and oil and gas.

The company even maintains a good relationship with the well-known artificial intelligence company OpenAI, which provides room for future collaboration.

However, Goldman Sachs points out that there is a key flaw behind this impressive track record: all agreements are letters of intent (LOI) or non-binding agreements.

The only substantial progress comes from a $25 million advance payment from Equinix, but in Goldman Sachs' view, this amount may not even cover 10% of the cost of a 75-megawatt reactor. Until any final power purchase agreement (PPA) is obtained, the value of these 14 gigawatts of orders remains on paper.

Huge Financing Pressure Under Heavy Asset Model

Unlike many peers that only provide technology and design, Oklo has chosen a "hold and operate" business model.

This means the company will be fully responsible for all aspects from technical design, licensing application, construction, to final operation and maintenance. Although this model can bring stronger operational control, it also comes with huge financial risks and capital intensity.

Goldman Sachs estimates that by the mid-2040s, Oklo will need to raise approximately $14 billion to support its operations and expansion, during which it will continue to "burn cash," heavily relying on capital markets.

This large sum will be gradually filled through various channels such as equity, corporate bonds, government loans, and project financing. In contrast, NuScale, which only exports technology and does not hold heavy assets, has much smaller funding needs.

Additionally, to meet the massive capital expenditures, Goldman Sachs expects Oklo will need to raise about $4.2 billion in equity financing, which means existing shareholders will face ongoing equity dilution risks.

Supply Bottleneck of High-Assay Low-Enriched Uranium Fuel

Goldman Sachs believes that fuel supply is the weakest link in Oklo's grand blueprint.

According to Goldman Sachs' calculations, based on Oklo's deployment plan, by 2035, its demand for high-assay low-enriched uranium will be equivalent to 3% of the current global supply of natural uranium. By 2050, this ratio will soar to 12%.

This means that if Oklo and other nuclear power companies relying on high-assay low-enriched uranium want to achieve commercial deployment, the current fuel supply system is completely unable to meet the demand and must undergo large-scale investment and expansion.

Although Oklo is actively promoting a "three-pronged" fuel strategy—including the construction of a $1.7 billion fuel recovery facility—using newly enriched high-assay low-enriched uranium fuel, weapon-grade nuclear material downblending, or recovered nuclear waste.

But these will take years to materialize, also increasing its capital burden and the execution risks of vertical integration, as historically, the cost-effectiveness of nuclear fuel recovery has been highly controversial

The Long Path to Licensing and Uncertain Commercialization Timeline

Although Oklo is at the forefront in technology and partnerships, its commercialization still needs to cross the most critical threshold: obtaining a license from the U.S. Nuclear Regulatory Commission (NRC).

The company plans to submit a combined operating license application for its 75 MW Aurora Powerhouse in the fourth quarter of 2025.

Goldman Sachs believes this is a key catalyst, as Oklo's choice of a customized combined operating license application path theoretically could shorten the approval time from several years in the traditional path to 24-36 months.

However, Goldman Sachs emphasizes that this is only an expected timeframe and there is no guarantee of timely approval, with even the risk of rejection. The company had previously faced a rejection from the NRC in 2022 due to insufficient information.

The company's goal is to achieve commercial operation of its first reactor (located at Idaho National Laboratory) by the end of 2027 or early 2028. This timeline is closely dependent on the approval process of the U.S. Nuclear Regulatory Commission, and any delays will push back its revenue-generating timeline.

Goldman Sachs Valuation

Goldman Sachs ultimately gives a neutral rating and a target price of $117, based on a weighted average of 50% from both the EV/EBITDA valuation method and the discounted cash flow valuation method.

It is noteworthy that since Oklo will have no revenue before 2027, Goldman Sachs' valuation model is heavily reliant on long-term forecasts. Specifically:

- The EV/EBITDA method uses a 50x valuation multiple for 2035 EBITDA, then discounts it over 9 years at an approximate 15% weighted average cost of capital.

- The discounted cash flow valuation method extends to 25 years, reaching 2050. This indicates that the current stock price support comes from very distant future expectations.

In short, Oklo's story is full of imaginative potential, but the road from dream to reality is fraught with obstacles that require substantial funding, technological validation, and policy approvals to overcome.

Goldman Sachs believes that until these significant uncertainties are clarified, the current valuation appears "rich."

The above content is from the Wind Trading Platform.

For more detailed interpretations, including real-time analysis and frontline research, please join the【**Wind Trading Platform ▪ Annual Membership**】

Risk Warning and Disclaimer

The market has risks, and investment requires caution. This article does not constitute personal investment advice and does not take into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, views, or conclusions in this article align with their specific circumstances. Investment based on this is at one's own risk