Liquidity alarm sounded! U.S. banking reserves have fallen for seven consecutive weeks, breaching the $3 trillion mark

The reserves of the U.S. banking industry have declined for seven consecutive weeks, falling below $3 trillion to $2.9997 trillion, the lowest level since January. This reduction in liquidity is related to the U.S. Treasury's increased bond issuance, which has impacted the Federal Reserve's balance sheet decisions. Federal Reserve Chairman Jerome Powell stated that reserves remain ample, but changes in liquidity may force the Fed to end its balance sheet reduction process earlier. The effective federal funds rate has slightly risen to 4.09%, indicating a tightening financial environment

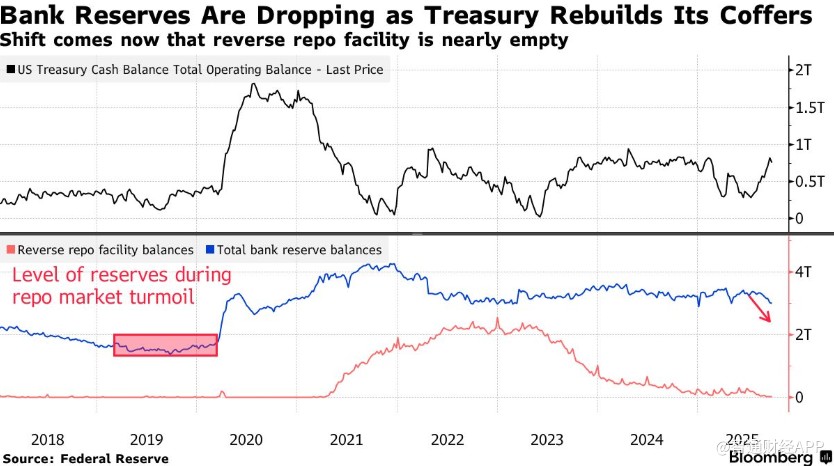

According to Zhitong Finance APP, due to the continuous outflow of liquidity from the financial system, the reserves of the U.S. banking system have significantly declined for the seventh consecutive week, falling below $3 trillion. Bank reserves are a key factor concerning the Federal Reserve's decision to continue reducing its balance sheet.

According to data released by the Federal Reserve on Thursday, as of the week ending September 24, bank reserves decreased by approximately $21 billion to $2.9997 trillion. This is the lowest level since the week of January 1.

U.S. bank reserves are decreasing.

This decline comes as the U.S. Treasury has increased bond issuance to rebuild cash balances after raising the debt ceiling in July. This has drained liquidity from other liabilities on the Federal Reserve's balance sheet, such as the overnight reverse repurchase agreements (RRP) and bank reserves.

However, as the so-called RRP approaches exhaustion, the reserves held by commercial banks at the Federal Reserve have been declining. The cash assets of foreign banks are decreasing even faster than those of U.S. banks.

As the Federal Reserve continues to reduce its balance sheet (known as quantitative tightening, or QT), changes in cash flow can impact the daily operations of the financial system. Due to the potential for QT to exacerbate liquidity constraints and lead to market turmoil, the Federal Reserve slowed the pace of balance sheet reduction earlier this year.

Federal Reserve Chairman Jerome Powell stated last week that bank reserve balances remain ample. However, signs in the financial system suggest that bank reserves may be approaching a critical level, which could force the Federal Reserve to end the balance sheet reduction process earlier than expected.

Affected by changes in liquidity, the Federal Reserve's policy target—the effective federal funds rate—slightly increased within the range this week, indicating that financial conditions may be tightening. Data released by the New York Fed on Tuesday showed that the rate rose one basis point from the previous trading day's 4.08% to 4.09%. The rate remains within the target range of 4% to 4.25% set by the Federal Open Market Committee (FOMC) after last week's rate cut. Over the past two years, this rate has consistently hovered near the lower end of the target range, and the current upward trend marks a significant change.

Lou Crandall, a senior economist at Wrightson ICAP, stated that the trading volume behind the federal funds rate has shrunk due to a reduction in excess funds available for market deployment by non-U.S. institutions. Additionally, the tightening of liquidity has triggered a restructuring of the weighted distribution of unsecured financing rates.

Dallas Fed President Lorie Logan stated on Thursday that the Federal Reserve should abandon the federal funds rate as a benchmark for implementing monetary policy and instead consider adopting an overnight rate linked to a more robust U.S. Treasury-backed loan market.

Logan believes that the federal funds rate target is outdated, and the connections between the rarely used interbank market and the overnight money market are very fragile and could suddenly break. She stated that updating the mechanism by which the Federal Reserve implements monetary policy will be part of achieving efficient and effective central banking functions