September Tokyo CPI unexpectedly remained flat, supporting the cautious stance of the Bank of Japan

In September, Tokyo's Consumer Price Index (CPI) unexpectedly remained flat, influenced by temporary subsidy policies, with the core CPI rising 2.5% year-on-year, lower than the expected 2.8%. This data supports the Bank of Japan's cautious stance on interest rate hikes but does not alter its rate hike path. Analysts point out that government subsidy policies have a significant impact on inflation data, and the rise in energy prices partially supports the inflation index. Overall, a single data point will not hinder the Bank of Japan's considerations for interest rate hikes

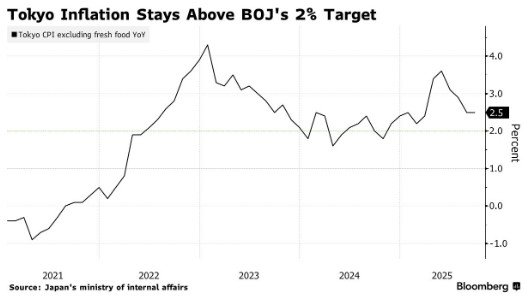

According to Zhitong Finance APP, Tokyo's consumer inflation rate unexpectedly remained stable due to the impact of temporary subsidy policies. This data supports the Bank of Japan's (BOJ) cautious stance on interest rate hikes and does not deviate from the overall upward path of rate increases. Data released by Japan's Ministry of Internal Affairs and Communications on Friday showed that the core consumer price index (excluding fresh food) in Tokyo rose 2.5% year-on-year in September, lower than the median expectation of 2.8% from economists surveyed by Bloomberg.

The unexpected stability of this core inflation indicator serves as a reminder to the market that the government's subsidy policies aimed at alleviating rising living costs can significantly distort data, leading to fluctuations in inflation trends. Therefore, a single data point is unlikely to change the BOJ's trajectory for interest rate hikes.

Yoshiki Shinke, a senior economist at Dai-ichi Life Research Institute, stated: "Today's data, aside from special one-time factors, showed no significant changes, so I believe this will not hinder the BOJ's consideration of rate hikes. This data will neither accelerate the central bank's actions nor cause hesitation—after all, the influencing factors are very clear."

Energy prices provide some support to the inflation index, partly due to the year-on-year data being amplified by last year's utility subsidy policies. In September 2024, utility subsidies had lowered overall inflation by 0.5 percentage points, while this year's subsidies have narrowed the drag to 0.3 percentage points. As a result, energy prices saw their first year-on-year increase in three months.

On the other hand, the Tokyo Metropolitan Government has expanded the coverage of free childcare services starting this month, which has contributed a 0.3 percentage point drag on the inflation index; at the same time, a reduction in water fees has further suppressed inflation growth.

Shinke pointed out: "The expansion of free childcare services is the core reason for this CPI being far below market consensus. The base effect from last year's utility subsidies supports it, while the drag from the decline in childcare fees offsets it. Aside from this, there were no other surprises in the data."

The "super core" inflation indicator, which excludes energy and fresh food (reflecting underlying price pressures), rose 2.5% year-on-year, also lower than economists' expectation of 2.9%; the overall inflation rate recorded 2.5%. Since Tokyo's CPI is often seen as a leading indicator of nationwide inflation trends in Japan, it attracts significant attention from economists.

Taro Kimura from Bloomberg Economics stated: "The mild performance of Tokyo's CPI in September will not lead the BOJ off its established path. The unexpected weakness in this data mainly reflects the impact of local policies in Tokyo, rather than a waning of inflation momentum. Essentially, price pressures remain sticky—wage increases continue to push up prices in labor-intensive service industries."

Food prices remain a focal point for consumers. In September, the price of processed foods rose 6.9% year-on-year, although this was a slowdown from 7.4% in August, and it exerted some drag on the CPI, but food inflation pressures are expected to persist. According to a report by Teikoku Databank, major food and beverage companies in Japan plan to raise prices on over 3,000 products in October, marking the largest price increase wave since April As a key category driving up the cost of living this year, rice prices rose 46.8% year-on-year in September. Although this is a significant narrowing from the 67.9% increase in August (marking the fifth consecutive month of slowdown), it remains unclear whether the increase can further decline to a level satisfactory to consumers in the coming months.

Japanese Prime Minister Shigeru Ishiba announced his resignation earlier this month. Since taking office about a year ago, Ishiba has faced defeats in multiple elections and lost support within the party, with public dissatisfaction over rising living costs being a key factor in his electoral losses.

Currently, there are five candidates vying for the presidency of the ruling Liberal Democratic Party (LDP), all of whom have pledged to take countermeasures in various ways to alleviate the cost pressures faced by households. The LDP presidential election is scheduled for October 4.

At last Friday's monetary policy meeting, Bank of Japan board members Naoki Tamura and Hajime Takata voted against the decision to maintain the policy interest rate at 0.5%. This divergence has led the market to adjust its expectations for policy outlook: traders currently estimate the probability of a rate hike at the October 30 meeting to be around 50%, doubling from the probability at the beginning of this month.

Former Bank of Japan board member Makoto Sakurai stated that the current sticky inflation environment gives the central bank the conditions to raise interest rates at any time, with the core issue being how much the authorities wish to wait and assess the data feedback on the impact of U.S. tariff policies.

In addition, the Tokyo real estate market is also showing a surge in prices. A report from Tokyo Kantei indicates that the average price of family-type second-hand apartments in the core areas of Tokyo's 23 wards rose 38% year-on-year in August, reaching 107 million yen (approximately 719,700 USD)