Goldman Sachs macro traders discuss U.S. stocks: Last week may have been the peak of the rebound, and this week will show slight signs of reversal

In the view of Goldman Sachs senior trader Bobby Molavi, the current market presents a contradictory state: on one hand, there is an exuberant sentiment at the index level, while on the other hand, client positions do not fully align with this apparent prosperity. The current market is no longer trading on fundamentals but is trading on liquidity, positioning, and trends. This state often signals that the market may face greater volatility, and investors need to be prepared for potential directional changes

The "most exciting moment" of the current rebound in U.S. stocks may have already passed.

Recently, U.S. stocks have experienced a sustained rebound. The Nasdaq index has risen for three consecutive weeks, with 11 out of the 13 trading days before this week closing higher.

According to Bobby Molavi, a senior trader at Goldman Sachs, the current market presents a contradictory state: on one hand, there is an exuberant sentiment at the index level, while on the other hand, client positions do not fully align with this apparent prosperity. Molavi warns that various signs indicate last week may have been the peak of this rebound, and there are signs of a market correction this week. In other words, the most exciting moment of the short-term party may have passed, and it is time to consider risks.

Risks Behind the Tech Stock Frenzy

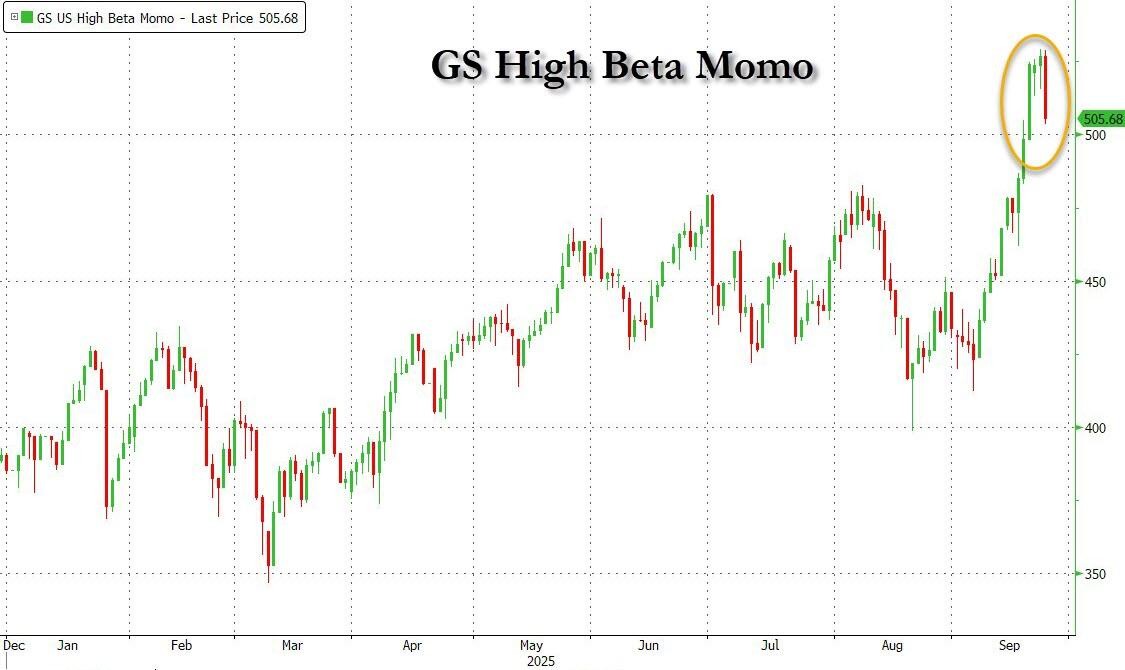

The performance of U.S. tech stocks last week can be described as "crazy": unprofitable tech stocks rose by 8%, the most popular shorted stocks rose by 6.7%, quantum-themed stocks rose by 30%, and nuclear energy concepts rose by 10%, all within five days. Meanwhile, the Nasdaq index has risen for three consecutive weeks, with 11 out of the 13 days before this week showing gains.

Despite the strong recent market performance, investment returns have actually become more challenging. While the index party is in full swing, last week marked the first negative alpha for fundamental investors in six weeks, with systematic funds down 1.3%. Compared to the most popular shorted stocks, core targets for hedge funds fell by 5.9%, and large tech stocks underperformed unprofitable stocks by 5.7%.

Molavi believes it is difficult to determine whether we are currently in a tech bubble. The Nasdaq has risen in 16 out of the past 17 years, with a cumulative return of about 2250%. Moreover, the PE ratio of the top five companies is 28 times, which is still some distance from the historical peaks of 40 times (2021) and 50 times (2000).

However, the market has also shown some worrying signs: the primary market is beginning to show signs of "bubbling" again, with some companies raising funds at valuations close to or exceeding 100 times their annual recurring revenue, while in the secondary market, companies like Palantir are trading at valuations of 70 times revenue.

Market Positioning Analysis: Hidden Concerns Beneath the Surface Prosperity

In the macro realm, the market seems to be pricing in a rather optimistic outlook: no imminent economic recession, benefits of falling interest rates, the onset of a Federal Reserve rate-cutting cycle, dividends from AI, and stable corporate profits and profit margins.

One intuitive reflection of this optimism is that the U.S. market now has four companies with a market capitalization exceeding $3 trillion, with the largest five companies accounting for 20% of the global stock market value. Even more impressively, nine of the top ten companies in the U.S. are actually AI concept stocks, with even Oracle knocking on the door to enter the top ten.

However, Molavi sharply points out a key contradiction: despite various concerns—political, fiscal, deficit, geopolitical, dollar, tariff impacts, re-inflation, labor market issues—seemingly being artificially segmented and ignored, clients' actual positioning does not match the exuberant sentiment of the headline indices:

Investors anxiously hold long positions... while hoping to hold more positions.

Confusion in Market Cycle Judgment

Against the backdrop of the AI boom, Molavi raised a key question: At what stage of the cycle are investors currently?

Molavi pointed out that since the global financial crisis, the U.S. stock market has experienced a 16-year expansion cycle. Compared to history, economic recessions have been brief and severe. Each fluctuation has been resolved more quickly and effectively, allowing new "cycles" to begin.

This raises a critical question: Are we at the end of a cycle or the beginning of a new one? A new cycle characterized by deregulation, transformative technology, lower interest rates and capital costs, high employment and savings rates, along with a surge in corporate activity and government spending? Is the market heading towards the bubble burst period of 2000/01, or is it in the eve of a full-blown frenzy like in 1998?

In Molavi's view, the market may be undergoing a transition from euphoria to calm. Last week may have marked the peak of this round of rebound, and signs of a pullback have emerged this week.

From the perspective of investor positioning, the overcrowded trading of technology stocks, the comprehensive long stance of retail investors, and the complex hedging strategies of institutional investors all point to a possible turning point.

More importantly, the current market is no longer trading on fundamentals but on liquidity, positioning, and trends. This state often signals that the market may face greater volatility, and investors need to be prepared for potential directional changes.