Under the shadow of the trade war, foreign capital aggressively buys U.S. stocks, with purchases reaching a historic high of $290.7 billion in the second quarter

In the second quarter of this year, foreign investors purchased $290.7 billion worth of U.S. stocks, setting a new historical high and pushing their share in foreign investors' U.S. asset allocation to nearly 32%. Despite trade wars and tariffs leading to foreign consumers boycotting American products, the appeal of the U.S. stock market remains strong, particularly with outstanding performance from technology stocks. It is expected that the scale of U.S. stocks held by foreign investors will increase to $18 trillion, accounting for 30% of the U.S. stock market

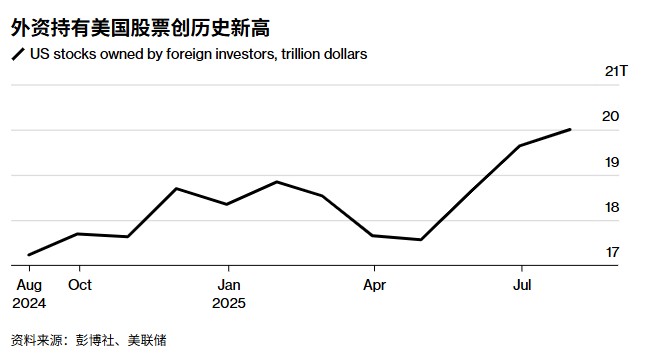

According to Zhitong Finance APP, in spring, Donald Trump intensified global anti-American sentiment with actions such as launching a trade war and considering the annexation of Canada, raising concerns that foreign buyers might boycott American financial products. However, the situation in the U.S. stock market is quite the opposite. Data from the Federal Reserve shows that in the second quarter of this year, foreign investors purchased $290.7 billion worth of U.S. stocks, setting a historical high and pushing the share of stocks in foreign investors' U.S. asset allocation to nearly 32%, breaking the highest record since 1968.

Although data indicates a decrease in foreign travel to the U.S. and a decline in purchases of American products, the allure of the U.S. stock market remains hard to resist. This is largely driven by the strong performance of technology stocks propelled by the wave of artificial intelligence—companies like Nvidia (NVDA.US), Microsoft (MSFT.US), and Google (GOOGL.US) have seen their stock prices continuously rise.

Rob Anderson, an industry strategist at Ned Davis Research, pointed out that despite tariffs leading many foreign consumers to boycott American products, the demand for U.S. stocks remains robust. For instance, Canadians are avoiding American products while still continuously buying U.S. stocks.

Elias Galou, head of global investment strategy at Bank of America, cited data from the Treasury International Capital (TIC) and the Federal Reserve as of July to further support this: based on current trends, the scale of U.S. stocks held by foreign investors is expected to increase by $2.8 trillion this year, bringing the total holdings to about $18 trillion, which accounts for 30% of the nearly $60 trillion U.S. stock market, reaching the highest level since 1945.

Although the proportion of foreign holdings has increased, its dollar value mainly grows with rising asset prices. Galou emphasized that "international investors are still purchasing U.S. stocks at a very strong pace."

However, in terms of index returns, while the U.S. stock market's return rate is stable for 2025, the performance of the S&P 500 index lags behind the benchmark indices of major markets such as Canada, Mexico, Brazil, Japan, and China—both in local currency and in dollars.

The MSCI Global Index has risen 15% this year, likely outperforming the S&P 500 index for the first time since 2017; meanwhile, the MSCI All Country World Index, excluding U.S. stocks, has performed even better, rising 22%, far exceeding the S&P 500 index's 13% increase.

CFRA Chief Investment Strategist Sam Stovall found this behavior of overseas investors "surprising," but believes it is not politically motivated. He analyzed, "When foreign investors' own markets have reached historical highs, why do they still choose the U.S.?" and pointed out that a weak dollar may be a drag on returns. His hypothesis is that foreign capital is selectively focusing on artificial intelligence-themed stocks and large U.S. tech companies—these firms hold a unique weight in the U.S. stock market, with the tech sector having set 26 historical highs this year.

In fact, this wave of bets is not bad: since hitting a bottom on April 8, the U.S. stock market has continued to soar, with the latest round of increases triggered by the Federal Reserve's first interest rate cut in a year Capital flow data shows that this buying frenzy continued into the third quarter—EPFR data indicates that international investors increased their holdings in U.S. stock funds at the fastest pace since March over the past three months.

Brian Jacobsen, Chief Economist at Annex Wealth Management, explains from a more fundamental perspective: many foreign investors holding U.S. assets but unwilling to hold U.S. Treasury bonds realize that "the complaints of foreign investors are directed at the government, not the companies." This calm judgment of the financial market may be the core logic behind the continuous influx of foreign capital into U.S. stocks